Oncology Nutrition Market Size Analysis:

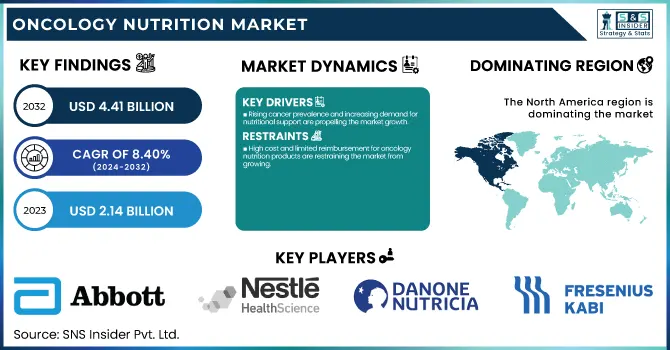

The Oncology Nutrition Market Size was valued at USD 2.14 billion in 2023 and is expected to reach USD 4.41 billion by 2032, growing at a CAGR of 8.40% from 2024 to 2032.

This report provides an in-depth statistical overview of the Oncology Nutrition Market, with a focus on cancer incidence and prevalence trends in major regions in 2023. It identifies prescription and consumption trends, with regional differences in the use of oral, enteral, and parenteral nutrition. It also presents product volume trends, examining the rising demand for liquid and powder forms. One of the major differentiators is the breakdown of healthcare expenditure by government, commercial, private, and out-of-pocket sources, providing a view into financial access. The data-driven strategy ensures that there is a comprehensive view of oncology nutrition dynamics rather than generic market growth intelligence.

To Get more information on Oncology Nutrition Market - Request Free Sample Report

Oncology Nutrition Market Dynamics

Drivers

-

Rising cancer prevalence and increasing demand for nutritional support are propelling the market growth.

The increasing global cancer burden is one of the major drivers for the oncology nutrition market. The World Health Organization (WHO) estimated that 20 million new cancer cases were diagnosed globally in 2023, and the projected number is expected to increase to 30 million by 2040. Malnutrition among cancer patients is common, occurring in 30-80% of patients receiving treatment, which can result in compromised immunity, muscle wasting, and adverse treatment outcomes. It has fueled the need for cancer-specific nutrition solutions that work to keep patients strong and enhance recovery. Recent trends include Danone's collaboration with Resilience in January 2024 to further develop digital nutritional care for cancer patients. In addition, advancements in personalized nutrition, including immunonutrition products such as AbbVie's Juven, are assisting cancer patients in managing the impact of chemotherapy and radiation therapy better.

-

Advances in clinical nutrition and customized diets for cancer patients are contributing enormously to the oncology nutrition market.

Research suggests that targeted nutritional care can improve response rates to treatment by as much as 30% and lower chemotherapy-induced complications. Recent research centers on the use of immunonutrition, ketogenic diets, and gut microbiome-based nutrition in cancer treatment. Players like Fresenius Kabi and Nestlé Health Science are investing in precision nutrition and providing solutions ranging from high-protein to omega-3-enhanced formulas. In January 2024, Kate Farms unveiled Peptide+ 1.5, which is a plant-based, peptide-based formula that serves the needs of cancer patients experiencing gastrointestinal upset in January 2024. AI-based nutrition planning is also making inroads as companies embed digital technology in coming up with bespoke diet plans through analyzing metabolic responses and treatment as per the individual patients, yet again fueling the growth in the market.

Restraint

-

High cost and limited reimbursement for oncology nutrition products are restraining the market from growing.

One of the primary constraints on the oncology nutrition market is the prohibitive expense of customized nutritional products and limited reimbursement support from healthcare systems and insurance carriers. Oncology nutrition products like immunonutrition and high-protein enteral formulas may be costly, ranging from USD 300 to USD 1,000 monthly per patient, depending on form and type. Most insurance companies classify these products as supplements, not as necessary treatments, and charge patients out-of-pocket. This is a disproportionate burden on low- and middle-income groups, restricting access to necessary nutritional care. Reimbursement policies also differ geographically, with developing nations having no standardized coverage for oncology nutrition. Even with continued efforts by advocacy organizations to enhance reimbursement models, the cost remains a primary deterrent, hindering market uptake, particularly in cost-conscious healthcare settings.

Opportunities

-

The expansion of Personalized and AI-driven nutrition Plans presents a significant growth opportunity in the oncology nutrition market.

Growing attention to customized nutrition and combining artificial intelligence-driven food solutions provides substantial growth prospects within the oncology nutrition market. Cancer patients need different kinds of nutrition based on tumor characteristics, stage of treatment, and metabolism response, for which solutions on a "one-size-fits-all" model are not efficient. Implementing precision nutrition assisted by artificial intelligence and machine learning enables customizing the diet for every patient, maximally promoting desired outcomes. Players such as Nestlé Health Science and Danone are investing in AI-based platforms to offer personalized meal plans and nutritional advice. Also, digital health companies are embedding oncology nutrition modules into patient management systems to enhance compliance and track outcomes. With more studies on gut microbiome-based nutrition and metabolomics, the market is set for innovation in precision dietary interventions, fueling growth and increasing product lines.

Challenges

-

Integration into cancer treatment protocols remains limited due to low awareness among healthcare providers and patients.

Although oncology nutrition has been shown to have benefits, its implementation in standard cancer treatment pathways has been low because of low awareness and understanding among healthcare professionals and patients. Research has shown that just 40-50% of oncologists refer patients to nutritionists as a standard practice, meaning many cancer patients do not receive the necessary nutrition. In addition, most oncology centers and hospitals do not have specially designed nutritional counseling services, and clinical standards for integrating specialized nutrition into cancer treatment are region-specific. The challenge is also added by the conventional emphasis on drug therapies at the expense of nutrition as a secondary option for treatment. The resolution of this problem needs more advocacy, improved training of oncology clinicians, and partnership between pharmaceutical and food companies to establish oncology nutrition as a core component of cancer treatment.

Oncology Nutrition Market Segment Analysis

By Cancer Type

The stomach and Gastrointestinal (GI) Cancer segment dominated the market and accounted for around 25.16% of the market share in the oncology nutrition market in 2023 because of the high incidence of GI cancers and the importance of nutritional care in the management of the patient. Gastric and colorectal cancers are two of the five most prevalent cancers globally, with more than 1.9 million new cases of colorectal cancer in 2023, as reported by the World Health Organization (WHO). Stomach and GI cancer patients frequently experience malabsorption, significant weight loss, and cachexia, which require specialized oncology nutrition to preserve energy, avoid muscle wasting, and ensure tolerance to treatment. Enteral and parenteral nutrition products are highly advised for GI cancer patients who are undergoing chemotherapy, radiation, or surgery, propelling high demand for customized nutritional products.

Strong clinical guidelines in favor of medical nutrition interventions among GI cancer patients have also increased market growth. Organizations such as the European Society for Clinical Nutrition and Metabolism (ESPEN) and the American Society for Parenteral and Enteral Nutrition (ASPEN) highlight the significance of enteral nutrition in the management of GI cancer-associated malnutrition. Major nutrition corporations, such as Nestlé Health Science and Fresenius Kabi, have developed their product portfolios to feature high-protein, low-viscosity, and immune-stimulating formulations that are specifically designed for GI cancer patients. As oncologists became increasingly aware and the GI cancer burden grew, the segment dominated the oncology nutrition market in 2023.

By Product Type

The proteins segment dominated the market and accounted for the maximum share of the oncology nutrition market at 30.25% in 2023 due to its crucial function in the muscle mass, immune system, and overall cancer recovery of a patient. Cachexia or muscle loss associated with cancer affects cancer patients and, therefore, demands high-protein nutrition to prevent muscle loss and withstand treatment. Clinical trials demonstrate that protein supplementation, especially whey, casein, and plant proteins, enables greater muscle retention, immune function, and post-treatment recovery. Since malnutrition is very common in cancer patients, oncologists and nutritionists highly suggest protein-containing formulas as part of the oncology nutrition routine. Abbott Laboratories, Nestlé Health Science, and Fresenius Kabi are some of the leading firms that manufacture specialized high-protein nutritional products, including Boost High Protein and Ensure High Protein, because of the growing demand.

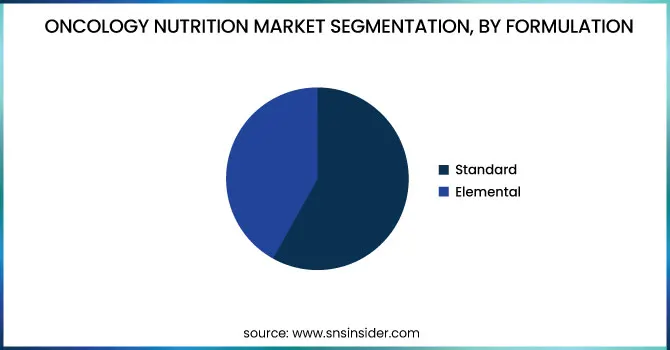

By Formulation

The Standard formulation segment dominated the oncology nutrition market with a 66.03% market share in 2023 due to its prevalence, cost-effectiveness, and applicability to different kinds of cancers. Standard formulations are designed to provide balanced macronutrients (fats, carbohydrates, and proteins), vitamins, and minerals and hence suitable for the majority of cancer patients requiring nutritional intervention. Compared to elemental formulations, pre-digested and typically restricted to patients suffering from severe malabsorption or gastrointestinal problems, regular formulations have a preference in most clinical and homecare environments due to the ease of their administration, relative affordability, and compatibility with enteral and oral feeding. Further, hospitals, clinics, and healthcare practitioners order standard oncology nutrition products frequently as the first-line dietary management, stabilizing their market leadership.

By Route of Administration

The Oral segment dominated the oncology nutrition market with approximately 58.12% market share in 2023 because it is easy to consume, less expensive compared to other forms, and most preferred by the patients. Oral nutritional supplements (ONS) can be easily administered to cancer patients, and these are frequently prescribed in managing malnutrition, weight loss, and anticancer treatment-related side effects. Oral nutrition products, including high-caloric shakes, protein-enriched drinks, and immune-enhanced formulas, are used to maintain energy levels, muscle strength, and overall well-being during cancer treatment. By clinical recommendations established by ASPEN (American Society for Parenteral and Enteral Nutrition) and ESPEN (European Society for Clinical Nutrition and Metabolism), oral nutrition is the first cancer treatment regimen before enteral or parenteral nutrition. This widespread applicability has contributed to fueling the dominance of the oral formulation segment in 2023.

By Dosage Type

The Liquid segment dominated the market with a 41.23% market share in the oncology nutrition market in 2023 due to the convenience of consumption, higher absorption rate, and acceptance by swallowing- or digesting-impaired patients. Treatments for cancer, such as chemotherapy, radiation, and surgery, can produce severe dysphagia, nausea, and anorexia, which lead to a choice of liquid products to deliver the required nutrients. Liquid oncology nutritional supplements such as high-protein beverages, immune-fortifying beverages, and high-calorie drinks are typically recommended to prevent malnutrition, maintain muscle strength, and improve energy for cancer patients. Liquid form was placed in their highest ratings as the superior and best-tolerated nutrition intervention by ASPEN (American Society for Parenteral and Enteral Nutrition) clinical guidelines and ESPEN (European Society for Clinical Nutrition and Metabolism), reinforcing its dominance in the marketplace.

By End-use

The Hospitals segment dominated the oncology nutrition market during 2023 with approximately 34.16% market share due to greater patient volume, availability of expert cancer care, and intense attention on clinical nutrition management. Hospitals are primary hubs for cancer treatment, cancer diagnosis, and care after cancer therapy, thus being the biggest consumers of oncology nutrition products. Patients undergoing chemotherapy, radiation therapy, and surgery require nutritional support to prevent malnutrition, manage treatment side effects, and improve recovery outcomes. Holistic nutritional care in the form of parenteral, enteral, and oral nutrition is provided by hospitals under the supervision of oncologists, dietitians, and clinical nutritionists to provide optimal patient care. In addition, hospital settings permit the provision of advanced oncology nutrition products, such as immunonutrition and metabolic-targeted therapies, which are significant in critically ill cancer patients.

Oncology Nutrition Market Regional Insights

In 2023, North America dominated the market and accounted for the highest market share of about 38.20% in the oncology nutrition market, mainly because of its well-established healthcare infrastructure, high incidence of cancer, and high adoption of clinical nutrition products. The area also suffers from an unusually high cancer rate, with the American Cancer Society estimating 2 million new diagnoses of cancer in the United States alone in 2023. Innovative use of oncology nutrition products Because of more advanced healthcare facilities and the newer generation oncologists and nutritionists, oncology nutrition products are being used extensively. Furthermore, U.S. and Canadian reimbursement policies that favor access to medical nutrition therapies also drive market demand (Please see the "Reimbursement Scenario" section). Market leaders in the Oncology Nutrition RNA Market are Abbott Laboratories, Nestlé Health Science, Danone Nutricia, and others, who are continuously investing in clinical trials and product innovation to enhance oncology patient care, thus creating their milestones for the North American region.

Asia Pacific is witnessing the fastest growth throughout the forecast period with 9.52% CAGR. With higher rates of cancer incidence, increased expenditure on healthcare, and growth in awareness for nutritional care utilized during cancer therapy, followed by other regions through all the forecast years. This, combined with population aging and lifestyle transition, is driving over 50% of the world's cancer burden in the region and boosting the need for oncology nutrition in nations such as China, India, and Japan. Across the region, increasing numbers of oncology care centers are being set up by governments and health organizations, and investment is also being made across the region to incorporate medical nutrition into cancer treatment. Additionally, increasing disposable income, urbanization, and expansion of global nutrition firms have led to greater accessibility of oncology-specific nutrition items. Recent expansion trends—such as Nestlé's business development in China and Danone's alliances in Southeast Asia—indicate high growth rates as well as greater penetration of the market in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Oncology Nutrition Market Key Players

-

Abbott Laboratories (Ensure Plus, Glucerna)

-

Nestlé Health Science (Resource Support Plus, Boost)

-

Danone Nutricia (Forticare, Fortisip)

-

Fresenius Kabi (Supportan, Fresubin)

-

B. Braun Melsungen AG (Nutricomp, Nutrilipid)

-

Mead Johnson Nutrition (Enfamil, Sustagen)

-

Hormel Health Labs (ProPass, FiberBasics)

-

Victus, Inc. (Pro-Stat, Uplift)

-

Global Health Products, Inc. (Beneprotein, Benecalorie)

-

Ajinomoto Co., Inc. (Aminosyn, Clinimix)

-

Ventria Bioscience (VEN100, VEN200)

-

Avesthagen Limited (Avdesp, Avent)

-

Jaguar Health, Inc. (Mytesi, Gelclair)

-

Kate Farms (Standard 1.4, Peptide 1.5)

-

Hormel Foods Corporation (Hormel Vital Cuisine, Med Pass 2.0)

-

AbbVie Inc. (Ensure Surgery Immunonutrition Shake, Juven)

-

Victus, Inc. (Pro-Stat Sugar Free, Uplift)

-

Global Health Products, Inc. (Beneprotein, Benecalorie)

-

Meiji Holdings Co., Ltd. (Meiji Mei Balance, Meiji Hohoemi)

Suppliers (These suppliers provide specialized oncology nutrition products, including enteral and parenteral nutrition solutions, to support cancer patients' dietary needs during treatment and recovery. Their offerings range from high-protein, immune-boosting formulas to essential vitamins, minerals, and amino acid-based supplements in the Oncology Nutrition Market

-

Abbott Laboratories

-

Nestlé Health Science

-

Danone Nutricia

-

Fresenius Kabi

-

B. Braun Melsungen AG

-

Hormel Foods Corporation

-

Meiji Holdings Co., Ltd.

-

Pfizer Inc.

-

Baxter International Inc.

-

Victus, Inc.

Recent Development in the Oncology Nutrition Market

-

In January 2024, Danone collaborated with Resilience, a digital oncology firm, to improve nutritional care for cancer patients. The collaboration resulted in creating a new nutrition and oncology module within Resilience's digital healthcare platform.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.14 billion |

| Market Size by 2032 | US$ 4.41 billion |

| CAGR | CAGR of 8.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Cancer Type (Head and Neck Cancer, Stomach and Gastrointestinal Cancer, Esophageal Cancer, Liver Cancer, Breast Cancer, Pancreatic Cancer, Lung Cancer, Other Cancer Types) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Abbott Laboratories, Nestlé Health Science, Danone Nutricia, Fresenius Kabi, B. Braun Melsungen AG, Mead Johnson Nutrition, Hormel Health Labs, Victus, Inc., Global Health Products, Inc., Ajinomoto Co., Inc., Ventria Bioscience, Avesthagen Limited, Jaguar Health, Inc., Kate Farms, Hormel Foods Corporation, AbbVie Inc., Meiji Holdings Co., Ltd., and other players. |