VRF Systems Market Report Scope & Overview:

Get more information on VRF Systems Market - Request Sample Report

The VRF Systems Market Size was valued at USD 25.19 billion in 2023 and is expected to reach USD 73.88 billion by 2032 and grow at a CAGR of 12.7% over the forecast period 2024-2032.

The variable refrigerant flow systems market is expanding at an accelerating rate due to the increasing need for energy-efficient HVAC technologies and the wider use of clean energy solutions. Similar to SEP implemented by the US Department of Energy, VRF gains benefits from the government backing the energy program. VRF systems are known for their ability to correctly manage the flow of refrigerant, which leads to significant energy and operational cost savings, thus accounting for a large portion of the market for commercial buildings, schools, and healthcare facilities. Technological advances such as the use of the Internet of Things and AI-based controls also increase market growth rates by enhancing system performance and improving user experience. VRF is also recognized by state energy programs and local governments in the context of the current emphasis on sustainable construction practices. Therefore, VRF is now a critical element of energy-efficient building projects in the U.S. and around the world, which supports local economic growth and job creation, leading to a faster reduction in pollution reasoning similarly to the impact of SEP on state energy programs.

As the VRF system market emerges, it is set to participate in global changes towards more energy-efficient and low-carbon buildings similarly to the BTO part of the US DOE that currently pushes for a decrease of carbon emissions in the building industry. VRF systems help to construct and renovate better, more energy-efficient, and flexible buildings that work well. Consequently, as more buildings require their installations, the similar market will simultaneously assist with reaching the overall goal of the country to cut building greenhouse gas emissions by 65% by 2035 and 90% by 2050, in comparison with 2005 levels. Moreover, the implementation of VRF systems supports equity, affordability, and resilience goals improving the HVAC offerings with more energy-efficient capacities for underserved communities, therefore, reducing energy expenditures and increasing building robustness to withstand environmental pressures.

At present, VRF systems will play a crucial role in making dramatic reductions in greenhouse gas emissions in the building industry, as it currently comprises more than one-third of the whole U.S. emissions. The main reason behind it is that VRF technology offers the options for precise temperature control of residential properties and energy efficiency of diverse appliances in many commercial properties. Nevertheless, VRF systems can better increase its position in transforming the grid edge and decreasing life cycle emissions with its combination with smart cooling and heating technologies such as on-site solar panels or battery storage and EV charging. As a result, the growth of the VRF systems market that is currently coupled with overall climate goals of the world will encompass numerous advantages ranging from cost savings to improved building standards and creation of well-paid HVAC jobs.

MARKET DYNAMICS:

Drivers

-

Growth in VRF System Market Driven by Regulatory Changes

The VRF system market is being greatly impacted by the recent regulatory changes made by the EPA, including the one-year extension for installing VRF systems with high-GWP HFCs. The suggested regulation delays the deadline for installation of new VRF systems with HFCs GWP of 700+ until January 1, 2027, to manage unsold inventory concerns and support environmental goals while maintaining market stability. This expansion is crucial for enabling manufacturers and suppliers to adapt to the changing regulatory environment without experiencing immediate financial pressure due to unsold inventory. The 2023 Technology Transitions Rule, starting in 2023, sought to eliminate high-GWP refrigerants by January 2026, creating potential stockpile problems for existing components and systems in the supply chain. By extending this deadline, the EPA is giving the industry time to adjust and avoiding market disruptions that may have hindered the adoption of new, lower-GWP technologies. This flexibility in regulations helps the VRF system market grow by allowing stakeholders extra time to switch to more eco-friendly refrigerants, while still using current high-GWP stock. Moreover, it also strengthens the market's ability to withstand abrupt policy changes, thereby creating a steady atmosphere for technological advancement and investment in energy-efficient HVAC solutions. As the sector moves towards adopting more environmentally friendly refrigerants and cutting-edge technologies, these regulations will play a key role in boosting market expansion and easing the shift towards low-carbon options.

-

Regulatory Change Leading to Innovation in VRF Systems Due to Low-GWP Refrigerants

The first pivotal driver of growth and innovation in the VRF System market is the necessary shift that has to be made according to the American Innovation and Manufacturing Act of 2020. The operation with high-GWP refrigerants is phased out, and the HVAC equipment has to be redesigned and changed to conform to the new, low-GWP options, which, for a new type of the A2L-class refrigerant, have to be done according to strict deadlines set by the U.S. Environmental Protection Agency. Firstly, all residential and light commercial air conditioning and heating equipment has to be switched to these new low-GWP refrigerants on 1 January 2025, and by 1 January 2026, it cannot be replaced with the equipment that was produced before the deadline, be it manufactured or installed. This change in regulations is the central driver of growth and innovation in the VRF and other systems, as it centers on the integration and innovation towards A2L refrigerants in the system market. These refrigerants are low-flammable, which is an improvement over their predecessors, yet are still classified as absolutely nontoxic, which emphasizes the low hazards of the new products. Manufacturers are reacting and altering their equipment accordingly, in order to handle new refrigerants, and improve technical aspects, like safety features, installation processes, which is also rippling through the VRF System advancement. This innovation is necessary to conform to the rigorous environmental demands and global climate goals. The secondary factors are prospective issues with the supply chain and liaised redesign grievances during the transformation, hence the new VRF Systems have to be efficient and environmentally sound. The focus on the adoption of low-GWP refrigerants speeds up the acceptance of the advanced VRF Systems and prepares the HVAC sector for future demands in the context of environmental effects. Approximately, the VRF System market is going to expect massive growth as a direct consequence of regulatory changes and the industry’s adaptation of more environmentally sound refrigerant technologies.

RESTRAINTS:

-

Challenges in the Vrf system market related to regulations and technology

The VRF systems market is constrained by regulatory changes and challenges in technological adaptation. The U.S. Department of Energy (DOE) is actively leading the shift to ultra-low Global Warming Potential (GWP) refrigerants as a key part of its overall plan to reduce carbon emissions in buildings. This shift, required by the 2020 American Innovation and Manufacturing Act, seeks to replace high-GWP refrigerants with more eco-friendly alternatives. Nevertheless, this change in regulations brings about complications for the market of VRF systems. The DOE has recently invited HVAC&R stakeholders to join working groups in order to continue efforts in creating codes and standards for the new refrigerants. These endeavors involve assessing the effectiveness and safety of refrigerants such as CO2 and propane, which are growing in popularity but need new designs and training for successful use (DOE).Adopting new refrigerants like A2Ls, with reduced GWP but increased flammability, requires substantial modifications to VRF systems, affecting cost and installation difficulty. For example, the need for more safety features and updated handling procedures to deal with the higher flammability of A2L refrigerants can raise the total cost and level of difficulty in VRF system. Furthermore, the postponement of deadlines for specific VRF systems that utilize high-GWP refrigerants until January 1, 2027, indicates continuous market adaptations and possible setbacks in the implementation of new technologies Together, these elements create doubt and may hinder the market's shift towards advanced, low-GWP systems, creating a difficulty for stakeholders aiming to comply with changing regulations while handling higher expenses and technical demands.

-

Challenges in Altering VRF Systems to Protect Against Wildfire Smoke

Incorporating Variable Refrigerant Flow (VRF) systems into buildings encounters notable limitations in adjusting to evolving regulations for wildfire smoke safety. In 2020, the EPA and NIST suggested that ASHRAE create guidelines to protect building occupants from wildfire smoke, leading to the establishment of the GPC44 committee. The temporary advice provided by this committee highlights the importance of improving air filters, using portable air cleaners, and controlling HVAC systems to reduce smoke infiltration (EPA). These changes are essential for enhancing air quality during wildfires but present a difficulty for the VRF systems industry. VRF systems may need significant adjustments to comply with the new standards while aiming to enhance heating and cooling efficiency. The requirement for better filtration and air purification in VRF systems leads to increased expenses and complications. The implementation of advanced filters for capturing fine particulate matter from wildfire smoke may require modifications to current VRF components, leading to higher initial expenses and maintenance needs, as stated by ASHRAE. Furthermore, the temporary guidance emphasizes the significance of having a smoke readiness plan, which increases the operational challenges for building managers who depend on VRF systems (NIST). As VRF installations incorporate filtration and air cleaning technologies, the total cost and complexity of these systems may increase, which could discourage investment despite their efficiency advantages. This adjustment difficulty presents a major obstacle for the VRF market, especially in areas experiencing more frequent wildfires.

MARKET SEGMENTS:

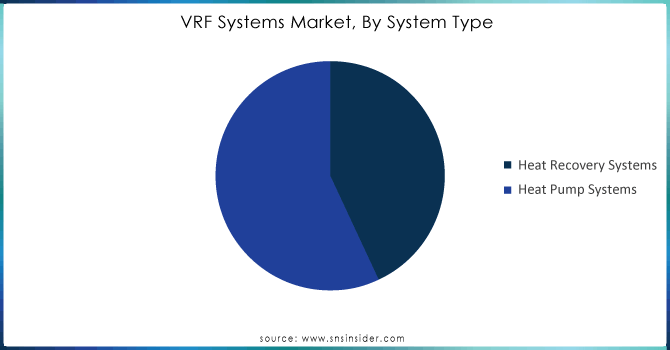

By System Type

Based on System Type, Heat Pump Systems is the largest share in VRF System Market with 58% of share in 2023. This particular section has continuously been the most significant in the VRF industry, demonstrating its widespread use and success in current HVAC systems. Heat pumps are essential to VRF systems because of their versatility and energy efficiency. Heat pumps improve temperature control and decrease energy usage by offering both heating and cooling in one unit, which can be easily reversed. This aligns well with the increasing focus on energy-efficient HVAC systems in building design. Prominent industry players like Daikin, Mitsubishi Electric, and LG have experienced substantial growth thanks to their advanced heat pump technologies, contributing to the continued dominance of the heat pump market segment. For example, Daikin has been increasing its range of heat pumps and putting money into developing new technologies in order to keep up with the growing need for efficient energy solutions (Daikin). Furthermore, Mitsubishi Electric has emphasized the development of heat pump systems, enhancing product characteristics to boost efficiency and performance (Mitsubishi Electric). LG is further solidifying its market presence by incorporating cutting-edge heat pump technology into its VRF systems, which is fueling expansion in this sector. The ongoing focus on energy efficiency and sustainability in building management is driving the expansion of heat pump systems in the VRF System market, providing an attractive solution for residential and commercial use.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

Based on Application, Residential is dominating in VRF Systems market capturing the largest share with 39% of share in 2023. VRF systems, particularly air supply VRFs, are gaining popularity in the residential and commercial sectors of Asia, Europe, and North America. The surge in popularity is in part caused by the effort to fully electrify, aiming to decrease dependence on fossil fuels by substituting conventional gas-powered heating systems with air source heat pumps. This change promotes sustainability objectives and is in line with changing energy policies. Data from the U.S. Census Bureau shows a notable increase in investment in public residential construction, reaching a peak of more than USD 9 billion in 2020, followed by a slight decrease to USD 9 billion in 2021. The rise in residential construction is a result of the growing utilization of energy-saving technologies, such as VRF systems. In order to meet this demand, companies are creating innovative new products. An example is when Carrier China introduced the XCT8 VRF series in February 2022, which aims to achieve high energy efficiency levels and fill gaps seen in earlier models. In the same way, VRF systems are seeing increased market opportunities thanks to government-supported residential projects. Al Hamra's Falcon Island project in the UAE, worth AED 1 billion (USD 272 million), and South Korea's eco-friendly smart city project in Kuwait, valued at USD 4 billion, showcase how government efforts are boosting the housing market and increasing the need for innovative HVAC solutions. The growth prospects of the VRF market are strengthened by higher residential investments and the overall shift towards electrification and sustainability in construction.

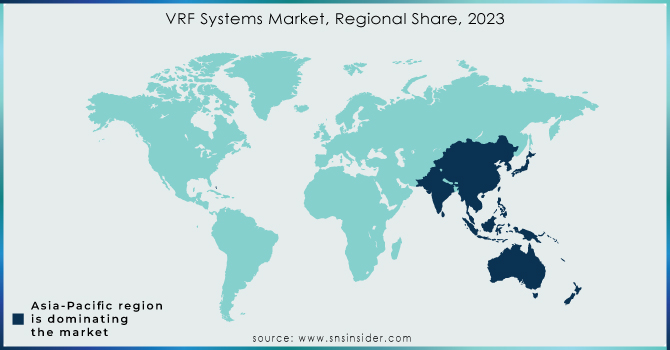

REGIONAL ANALYSIS:

In 2023, the Asia Pacific region is leading in revenue share in the VRF Systems market, holding 32% of the market share. Panasonic Corporation, Daikin Industries, Toshiba Corporation, and Mitsubishi Electric are key companies in the region, playing a major role in its market dominance. For example, Panasonic has been leading in VRF innovation by introducing advanced systems with smart controls and improved energy efficiency features. Panasonic's newest VRF systems aim to offer maximum comfort with minimal energy usage, in line with the area's increasing emphasis on sustainability and cost-effectiveness. Daikin, a top player in HVAC solutions worldwide, is constantly innovating with its VRF technology, such as the latest Daikin VRV X series, providing better performance and versatility for different commercial uses. Daikin's systems are recognized for being energy-efficient and versatile for various building layouts. Toshiba's dedication to innovation is shown through its release of the Toshiba SMMS-e VRF system, which prioritizes high energy efficiency and minimized environmental effects by utilizing advanced inverter technology and improved control choices (Toshiba). Mitsubishi Electric has also played a role in the market by introducing CITY MULTI VRF systems, aimed at providing dependable performance and high efficiency. These systems incorporate advanced technology for better user control and energy conservation (Mitsubishi Electric). Asia Pacific's crucial position in the VRF systems market is emphasized by these developments, as manufacturers are driving expansion by constantly innovating and meeting the rising need for effective and adaptable HVAC solutions in commercial settings.

In 2023, North America holds a substantial 26% portion of the VRF systems market and is the second quickest growing area, fueled by rising need for energy-efficient and simple-to-set-up HVAC options. VRF systems are widely preferred in this area because of their excellent energy efficiency and versatility, making them perfect for a variety of uses, including commercial buildings and large residential developments. Businesses are proactively improving their VRF product lines to align with environmental regulations and customer demands. An example is LG Electronics, who made a significant impact by launching the V5 multi-variable refrigerant flow (VRF) systems in Canada in November 2018. The V5 series, with weights from 6 to 42 tons, includes advanced technology and accommodates various electrical power setups like three-phase 208/230V, 460V, and 575V, making it versatile for different installation situations (LG Electronics). This system includes refrigerants with low global warming potential (GWP), conforming to North America's growing regulatory focus on cutting greenhouse gas emissions and enhancing energy efficiency. Likewise, Daikin Industries has also advanced with its VRV Life series, utilizing cutting-edge refrigerant technology and improved controls to maximize efficiency and save energy (Daikin). Carrier has also played a part in the market by introducing their improved VRF systems that comply with strict energy efficiency requirements and adhere to different environmental laws (Carrier). These advancements highlight North America's transition to sustainable HVAC options, mirroring wider trends in energy efficiency and environmental accountability.

KEY PLAYERS:

The key players in the VRF Systems market are LG Electronics, Daikin Industries, Fujitsu General Corporations, Toshiba Corporation, United Technologies Corporation, Mitsubishi Electrical, Midea Group, Johnson Controls, Lennox International, Ingersoll Rand PLC & Other Players.

RECENT DEVELOPMENT

In April 2022: Samsung India unveiled India's inaugural AI-equipped Variable Refrigerant Flow (VRF) air conditioners, promising enhanced efficiency and rapid cooling capabilities.

In July 2022: DAIKIN made headlines with its decision to broaden its patent non-assertion commitment, specifically for air conditioning units utilizing the low Global Warming Potential (GWP) refrigerant HFC-32.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 25.19 Billion |

| Market Size by 2032 | USD 73.88 Billion |

| CAGR | CAGR of 12.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System Type (Heat Recovery Systems, Heat Pump Systems) • By Component (Outdoor Units, Installation Services, Indoor Units, Control Systems And Accessories) • By Capacity (Up To 10 Tons, 11 To 18 Tons, 19 To 26 Tons, Above 26 Tons) • By Application (Commercial, Residential, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | LG Electronics, Daikin Industries, Fujitsu General Corporations, Toshiba Corporation, United Technologies Corporation, Mitsubishi Electrical, Midea Group, Johnson Controls, Lennox International and Ingersoll Rand PLC. |

| Key Drivers |

• Growth in VRF System Market Driven by Regulatory Changes |

| RESTRAINTS |

• Challenges in the Vrf system market related to regulations and technology |