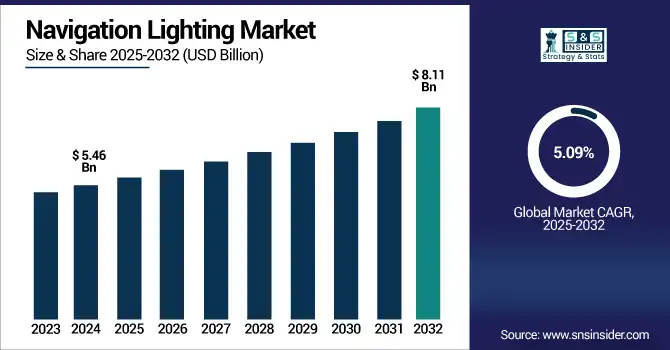

Navigation Lighting Market Size & Growth:

The Navigation Lighting Market Size was valued at USD 5.46 billion in 2024 and is expected to reach USD 8.11 billion by 2032 and grow at a CAGR of 5.09% over the forecast period 2025-2032.

To Get more information on Navigation Lighting Market - Request Free Sample Report

The Global Market includes detailed analysis across various segments by type, technology, installation type, end-user, and region. Demand for maritime and aviation safety, growing global trade, and technological developments in LEDs and solar lights are expected to drive this adoption. Navigation Lighting Market analysis reveals increasing integration of smart lighting technologies globally. Moreover, regulatory mandates are driving deployment across new and reconditioned vessels and aircraft. With the improvement of safety and operational standards, the requirement for various navigation lighting systems is increasing across both developed and emerging economies.

For instance, LED navigation lights consume up to 80% less power than traditional incandescent lamps and last over 50,000 hours, reducing maintenance frequency.

The U.S. Navigation Lighting Market size was USD 1.20 billion in 2024 and is expected to reach USD 1.74 billion by 2032, growing at a CAGR of 4.78% over the forecast period of 2025–2032.

The U.S. Market is largely propelled by its active marine and aviation industries, aided by stringent federal regulations on safety and visibility. The drive toward modernization of commercial and defense fleets is accelerating advanced lighting systems requirements. Moreover, the growing investment in energy-efficient, smart navigation lighting is helping drive demand in coastal regions and inland waterways, maintaining the country as a global leader in high-performance navigation lighting technologies.

For instance, more than 70% of newly built the U.S. vessels now integrate smart navigation lighting systems with diagnostics and automated control features.

Navigation Lighting Market Dynamics:

Key Drivers:

-

Rising Global Maritime Trade and Seaborne Transportation Volumes Push Demand for Reliable Navigation Lighting Systems Across Commercial Shipping Routes

Increased international trade and an increasing trend of container traffic across major ports are fueling the development of navigation lights for the safety and compliance of vessels. Growing activities in shipbuilding and cruise lines and offshore operations also demand night visibility and route signaling, which drives demand for a safe and powerful lighting solution. They are part of the strict illumination standards set by global marine organizations, and thereby are widely adopted. Smart lighting and LED based systems are embedded for more reliable and fuel-efficient driving, which is driving this long-term market.

For instance, approximately 65% of new commercial vessels include smart lighting systems capable of self-diagnosis and remote operation.

Restraints:

-

High Installation and Maintenance Costs of Navigation Lighting Systems Hinder Adoption in Small-Scale Commercial and Defense Fleets

While technology has advanced in many areas of navigation lighting systems, the price of entry for the initial components can still be daunting, especially when it comes to modern LED or solar-based systems. Costs associated with the wiring, integration process into existing systems, and testing for environmental robustness push smaller fleet operators away. These already place a considerable burden on the transport sector, especially in developing countries, and maintenance adds to the burden when operating in harsh marine or high-altitude environments. Non-premium segments witness slow adoption owing to stiff budgets for small shipping companies and regional airports, thereby restraining comprehensive market penetration across end-users.

Opportunities:

-

Increasing Adoption of LED and Solar-Based Navigation Lights to Enhance Energy Efficiency and Reduce Operational Costs

The sustainability and energy-saving technologies are creating a shift toward the adoption of LED and solar-powered lighting systems for navigation. Such systems save more than 50% on energy consumption, have a longer life cycle and require less maintenance than conventional incandescent or halogen systems. Ports, airport, and naval fleets are also gradually switching from traditional lighting to LED equivalents. This trend is further boosted by the various incentives and subsidies offered by countries globally for the adoption of green technologies. Navigation Lighting Market growth is increasingly driven by global energy efficiency goals, leading this market to grow at a significant rate for energy-efficient lighting manufacturers.

For instance, over 60% of major international ports and airports had begun retrofitting traditional lighting systems with LED-based alternatives.

Challenges:

-

Compatibility Issues with Older Vessels and Airframes During Lighting System Integration Slow Adoption Rates

Integrating modern navigation lighting systems on older ships and aircraft is a technically challenging task. Due to this, they almost always lead to complete re-wiring or re-structuring due to its lack of compatibility with legacy electrical systems, mounting brackets, and control modules which opens the door for high costs and long downtime. Plus, documentation and standardization are at best patchy for many older fleets, resulting in unpredictable integration. As such, these challenges both slow the time-to-market and dampen the incentive for operators to upgrade their compliance, especially where either compliance or cost pressures are not immediate, which can be a continuing hurdle for market growth.

Navigation Lighting Market Segmentation Analysis:

By Type

Sidelights accounted for the largest share of 28.5% of the market in 2024, on the back of being used as a compulsion for ships under the global maritime law. These lights are necessary to indicate to other vessels whether you are on the port or starboard side, especially at night. There are various certified sidelights offered by Perko Inc. for commercial and defense use. Meeting IMO and USCG standards ensures wide usage, which means the segment will remain entrenched in navigation lighting.

All-Around Lights are expected to register the fastest CAGR of 6.38% during the forecast period owing to their visibility in a 360-degree manner and usage. These are especially common among recreational boats and other small marine vessels. Companies, such as Aqua Signal (a brand of Glamox) are ahead of the game and developing low-profile and rugged designs that are adapted to modern marine applications. They are also more competitively priced and adaptable across classes of vessels, which is gaining more appeal in new maritime market segments.

By Technology

In 2024, LED technology accounted for 46.3% of revenue share in the Navigation Lighting Market and it is also expected to be fastest growing technology with CAGR of 5.77% till 2032. This growth can be attributed to its energy efficiency coupled with a long lifespan and being within the safety standards. High-efficiency LED navigation lights applying the highest level of marine IP protection and durability from companies, such as Hella Marine, led the way. On the other hand, based on its ongoing research and development, Den Haan Rotterdam (DHR) continue innovating intelligent and modular LED solutions for both retrofits and new installations across marine and aviation and will drive widespread adoption while the world remains focused on sustainability and decarbonization efforts.

By Installation Type

Fixed lighting held the largest Navigation Lighting Market share of 52.6% in 2024 owing to its stability and function in commercial vessels, airports and marine terminals. These systems provide permanent infrastructure capable of high-throughput performance and are built to last. Navigation Lighting Market trends highlight growing preference for durable, infrastructure-based lighting solutions. Lopolight is among the leading suppliers of fixed navigation light systems for large-scale provide. In a world of fixed installations, their reliability under the most extreme environmental conditions has seen them emerge as one of the most preferred solutions globally.

Portable lighting is anticipated to witness a CAGR of 6.16% for the forecast period of 2024-2032 due to its portability, ease in usability & deployment and appropriate for emergency & temporary scenarios. Easy to use in military ships, temporary piers, and small boats, these lights are extensively used. Innovative Lighting Inc. has developed a variety of small, battery-operated, and solar-powered navigation lights.

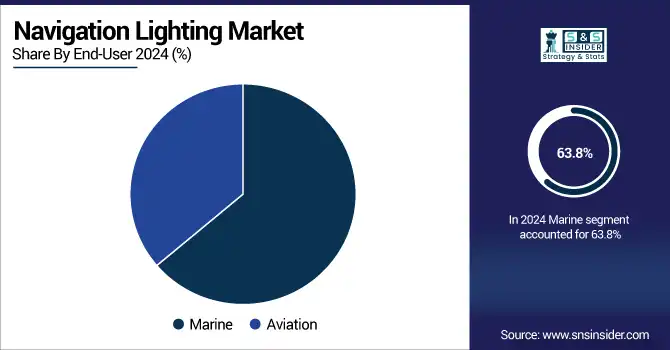

By End-User

Marine segment accounted for the highest share at 63.8% in 2024, owing to large commercial vessels operations, regulations, and high international maritime trade. Navigation lights are the indispensable part of safety, passage identification, and crumple avoidance on the ocean. R.STAHL TRANBERG is one company that focuses on marine-grade navigation lighting systems. This segment leads both commercial shipping and naval fleets, too, their ability to ply an ocean without fail is part of the appeal as they are regarded as faring well in the quality and endurance of such conditions.

Aviation is estimated to expand at a 5.40% CAGR over the period of 2024-2032 led by escalating air traffic globally, airport expansions, and need for advanced airside lighting. Navigation light is very useful in low visibility situations as it ensures the safety of the aircraft. Among the key players, ADB SAFEGATE is a prominent provider for integrated airfield lighting solutions enabling enhanced runway visibility and assistance by lighting. AeroLEDs advanced aviation lighting systems facilitate the global modernization and expansion of infrastructure to meet demand by enhancing the efficiency of air travel.

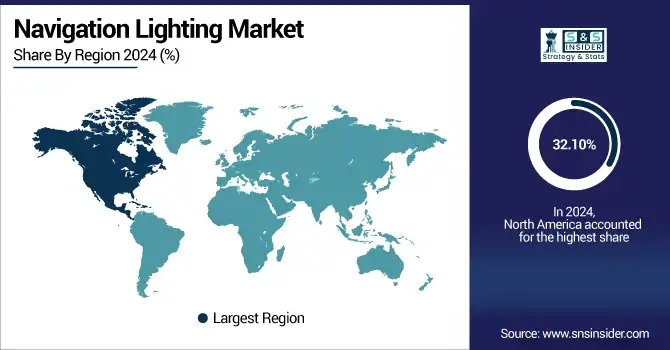

Navigation Lighting Market Regional Insights:

North America dominated the market share holding a 32.10% share in 2024 due to robust marine and aviation infrastructure, and extensive uptake of advanced lighting systems, coupled with regulatory mandates. High penetration of leading manufacturers coupled with retrofitting activities at the U.S. airports and naval bases has fostered dominance. North America dominates the global arena owing to pre-established maritime trade routes and a proactive approach to safety compliance.

-

The U.S. dominates the North American navigation lighting industry due to its advanced maritime and aviation infrastructure, strict safety regulations, and high investment in modernizing naval and airport systems, supported by leading domestic manufacturers and large-scale defense spending.

Asia Pacific is poised to register the fastest CAGR of 5.96% over the forecast period over 2024-2032, due to expanding port infrastructure, shipbuilding hubs, and growing investments into regional aviation. It is metamorphosing into a spook for the powerhouse lookup as China, India and South Korea are growing their sea-going fleet and airport networks in a shooting step. Increasing exports, positive government initiatives, increasing awareness regarding safety standards are driving the adoption of navigation lighting that are boosting the marine and aviation industries.

-

China leads the Asia Pacific market owing to its massive shipbuilding industry, expanding commercial ports, rising seaborne trade, and government-backed infrastructure projects. Its aggressive modernization of marine and aviation sectors further strengthens its dominance in navigation lighting adoption.

Europe accounts for a substantial share owing to the presence of high-value maritime trade routes, strict safety and environmental laws, and an added aviation infrastructure. Germany, the U.K., and Norway are developing energy-efficient lighting technologies. In addition, the shipbuilding industry thriving in the region, combined with increased inclination toward sustainable energy, is driving the uptake of contemporary LED and solar navigation lights.

-

Germany dominates the European Navigation Lighting Market due to its advanced shipbuilding industry, major ports, and strong emphasis on marine safety and energy-efficient technologies. Its leadership in maritime innovation and compliance with strict EU regulations gives it an edge over other countries.

In the Middle East & Africa, the UAE dominates the navigation lighting market due to its advanced port infrastructure, strategic maritime location, and growing aviation hubs. In Latin America, Brazil leads the market with its extensive coastline, major shipping activity, and increasing investments in port modernization and marine safety technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Navigation Lighting Companies are:

Major Key Players in Navigation Lighting Market are Hella Marine, Den Haan Rotterdam (DHR), Perko Inc., TRANBERG (R.STAHL TRANBERG), Aqua Signal (Glamox), Lopolight, Ocean Signal, ADB SAFEGATE, Innovative Lighting Inc. and Daeyang Electric Co., Ltd and others.

Recent Developments:

-

In June 2024, Hella Marine expanded its NaviLED PRO range by introducing a 3 NM Starboard Navigation Lamp. Designed for commercial and recreational vessels, it offers multi-volt compatibility (12/24 V), IP67 protection, and a fully sealed LED system with a five-year warranty.

-

In January 2025, Vega Industries introduced the VLB‑5 LED Beacon, a rebranded and enhanced version of its VLB‑67 model. This solar-powered navigation beacon offers 5 NM visibility and is widely used for marking marine channels, ports, and offshore structures.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.46 Billion |

| Market Size by 2032 | USD 8.11 Billion |

| CAGR | CAGR of 5.09% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Sidelights, Stern Light, All-Around Light, Masthead Light and Others) • By Technology (LED, HID, Incandescent, Halogen and Solar) • By Installation Type (Fixed, Portable and Surface Mount) • By End-User (Marine and Aviation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Hella Marine, Den Haan Rotterdam (DHR), Perko Inc., TRANBERG (R.STAHL TRANBERG), Aqua Signal (Glamox), Lopolight, Ocean Signal, ADB SAFEGATE, Innovative Lighting Inc. and Daeyang Electric Co., Ltd. |