Aluminum Oxide Moisture Sensors Market Size Analysis:

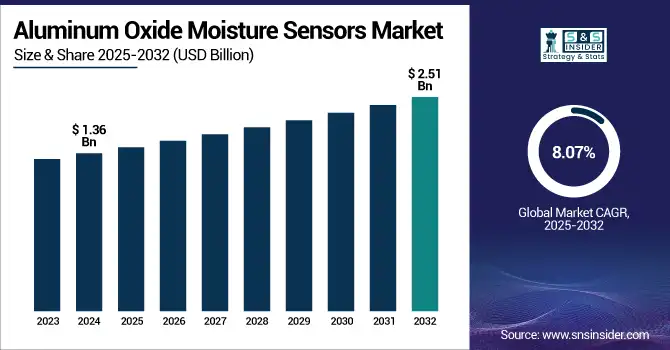

The Aluminum Oxide Moisture Sensors Market Size was valued at USD 1.36 billion in 2024 and is expected to reach USD 2.51 billion by 2032 and grow at a CAGR of 8.07% over the forecast period 2025-2032.

To Get more information on Aluminum Oxide Moisture Sensors Market - Request Free Sample Report

The worldwide aluminum oxide moisture sensors market is fueled by increasing demand for accurate humidity measurement in industries like oil & gas, pharmaceuticals, food processing, and chemicals. Technological innovation, rising automation, and regulatory compliance needs are fueling adoption. Growing industrial infrastructure in developing economies also drives market growth, while sensor miniaturization innovation improves integration across various applications.

According to research, in May 2025, aluminum oxide moisture sensors achieved a wide dew point detection range from –100 °C to +20 °C, corresponding to 0.0015 ppm to 0.2% by volume of water vapor. They offered high selectivity for moisture, low hysteresis, and operated independently of gas flow, with rapid response times due to their capacitive gold-aluminum oxide design.

The U.S. Aluminum Oxide Moisture Sensors Market size was USD 0.25 billion in 2024 and is expected to reach USD 0.39 billion by 2032, growing at a CAGR of 5.77% over the forecast period of 2025–2032.

The U.S. market for aluminum oxide moisture sensors is growing with greater focus on process efficiency, safety, and regulatory compliance in key industries. Adoption is fueled by the increasing demand for real-time moisture monitoring in sophisticated industrial environments. Improved sensor reliability and integration with digital control systems also fuel demand, with moisture detection becoming an essential part of contemporary industrial operations.

Aluminum Oxide Moisture Sensors Market Dynamics

Key Drivers:

-

Increasing Industrial Automation Across Sectors Drives Adoption of Aluminum Oxide Moisture Sensors for Real-Time Process Monitoring and Efficiency.

The increasing adoption of automation in the oil & gas, pharmaceuticals, and food processing industries is largely fueling the need for aluminum oxide moisture sensors. Such sensors provide precise, real-time moisture levels, enabling optimized process control, minimized downtime, and product quality assurance. As businesses compete for more efficiency and compliance, the installation of trusted moisture monitoring solutions is becoming imperative, driving aluminum oxide moisture sensors market growth worldwide.

Restrain:

-

Integration Complexity with Legacy Industrial Systems Limits the Deployment of Aluminum Oxide Moisture Sensors Across Established Facilities.

Most older industrial plants run using legacy control systems that are not readily compatible with contemporary aluminum oxide moisture sensors. Adopting these sensors tends to mean further investment in infrastructure upgrade, interface modules, or bespoke setup, which tends to deter deployment. This technology barrier, particularly in price-sensitive industries, inhibits the rollout rate and limits the full utilization of advanced moisture monitoring in mature industrial processes.

Opportunities:

-

Expanding Applications in Emerging Economies Provide Lucrative Growth Opportunities for Aluminum Oxide Moisture Sensors Across New Industrial Infrastructures.

Fast industrialization of Asia Pacific, Latin America, and Middle East would offer new backgrounds for the aluminum oxide moisture sensors market. These areas are pursuing manufacturing, energy and food production, all of which demand sophisticated moisture sensing. With increasing focus on quality control, regulation compliance, and modernisation, this creates opportunities for sensor vendors to increase and grow their presence in the market and in turn their revenues.

Challenges:

-

Sensor Performance Can Be Compromised by Harsh Environmental Conditions in Industrial Applications, Posing a Major Market Challenge.

Under harsh conditions like petrochemical facilities or offshore oil platforms, aluminum oxide moisture sensors could be challenged by exposure to contaminants, high temperatures, and corrosive gases. Such exposures can impact sensor accuracy and lifetime, resulting in increased maintenance or early failure. Maintaining sensor reliability and integrity in those harsh environments is a technical and operational challenge that manufacturers continually need to meet through innovation.

Aluminum Oxide Moisture Sensors Market Segment Analysis:

By Product Type

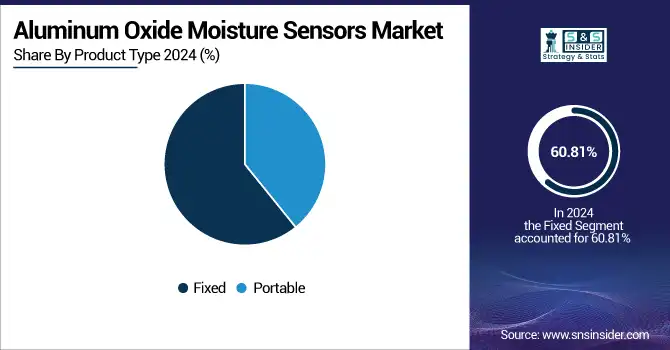

The fixed segment of aluminum oxide moisture sensors dominated the largest market share in revenue with 39.20% in 2024. These sensors provide long-term, consistent moisture measurement for industrial processes like oil & gas and pharmaceuticals. Honeywell and Yokogawa have introduced sophisticated fixed moisture sensors with increased accuracy and reliability.The dominance of the fixed segment is fuelled by need for uninterrupted, real-time measurement in critical situations, creating stability and regulatory support in industrial processes.

The portable segment will witness the fastest CAGR of 8.71% from 2025 to 2032, led by mounting demand for on-site, flexible moisture measurement instruments. New product innovations like handheld sensors from Testo and Emerson offer convenience to industries like food processing and monitoring the environment. Portability offers ease of conducting moisture tests in different locations, and this encourages usage in those industries that prioritize mobility and flexibility, pushing the aluminum oxide moisture sensors market ahead.

By Application

Industrial segment is the highest contributor to the aluminum oxide moisture sensors market, which accounted for 38.89 percent of market share in 2024. This segment covers high-growth industries such as oil & gas, food processing, and chemicals in which immaculate moisture control is vital for quality and security. Industrial-grade moisture sensors with improved accuracy and reliability have been developed by aluminum oxide moisture sensors market companies such as Siemens and Emerson. The demand for high-performance sensors from the industrial sector is keeping the growth of aluminum oxide moisture sensors in check, providing operational efficiency and regulatory compliance.

The environmental segment will witness the fastest CAGR of 9.65% during the forecast period of 2025-2032 due to growing awareness of environmental monitoring and climate change. Players such as Lufft and GE Measurement & Control have introduced rugged and portable moisture sensors that are particularly suited for environmental applications like air quality and soil moisture monitoring. The increasing need for environmental monitoring solutions, along with the advancements in sensor technology, is strongly driving the aluminum oxide moisture sensors market in this segment.

By End-User

The oil and gas segment dominated the market for aluminum oxide moisture sensors in terms of highest revenue share of 32.73% in 2024. The requirement for accurate detection of moisture in this industry stems from the requirement to avoid corrosion of pipelines, ensure equipment efficiency, and meet strict environmental standards. However, there is a need to continuously monitor any moisture content to keep downtime at a minimum and ensure that the process equipment is running at its best in severe environments, which drives the market growth of aluminum oxide moisture sensors in this sector.

The pharmaceuticals segment will grow at the fastest CAGR of 9.63% during the forecast period of 2025 to 2032. Accurate control of moisture is critical for maintaining the stability and quality of pharmaceutical products. As there is growing emphasis on strict regulatory guidelines and quality control in drug production, the demand for sophisticated moisture sensors is increasing. As the pharmaceutical industry continues to emphasize product integrity and safety, the adoption of aluminum oxide moisture sensors is expected to grow rapidly in this segment.

By Distribution Channel

The distributors segment dominated the aluminum oxide moisture sensors marketshare of 53.92% in 2024. Distributors are essential to provide these sensors to industries at large scale by connecting manufacturers and buyers. This channel facilitates extensive availability and after-sales support, which increases market penetration. As industrial applications more and more need precise moisture monitoring solutions, the distributor segment remains at the forefront of the market by making sure the mass distribution of aluminum oxide moisture sensors.

The online industry is expanding with the fastest CAGR of 8.95% during 2025-2032 based on the rise in e-commerce and digitalization in industrial business. The online platforms are more and more used by customers to buy sensors based on their easy availability, favorable prices, and product comparison capabilities. With e-commerce solutions increasingly provided by other companies for acquiring sensors, market growth is accelerating further through rising demand for aluminum oxide moisture sensors through online markets.

Aluminum Oxide Moisture Sensors Market Regional Analysis:

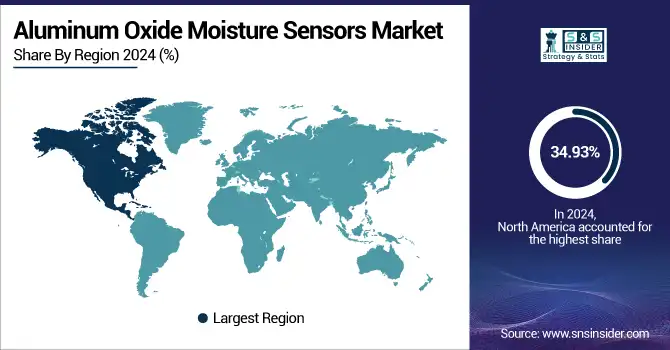

North America dominated the market for aluminum oxide moisture sensors with the highest revenue share of 34.93% in 2024. The region's robust industrial base and strict regulatory norms fuel demand for high-performance moisture sensors across industries such as oil & gas, pharmaceuticals, and food processing. Technology development in automation and environmental monitoring also fuels the market. The region's embracement of advanced moisture sensor technology makes North America a prime leader in the global market.

-

The U.S. is the largest market for aluminum oxide moisture sensors in the North American region on account of the well-established industrial base, high demand for innovative sensor technologies and stringent regulatory framework. Its emphasis on automation, safety and environmental monitoring are leading to a constantly growing market.

The Asia Pacific region is anticipated to expand at the fastest CAGR of 9.39% during the period from 2025 to 2032, fueled by fast-paced industrialization and growing manufacturing hubs. China, India, and Japan are observing huge demand for moisture sensors in industries such as chemicals, food & beverage, and environmental monitoring. Growing emphasis on environmental protection, regulatory compliance, and quality control also accelerates market growth further. The growing use of sophisticated moisture sensing technology is driving the aluminum oxide moisture sensors market in the region.

-

Asia Pacific aluminum oxide moisture sensors market is dominated by China on account of rapid industrialization, growing manufacturing industry and rising demand for advanced technologies in the region. Heavy investments on infrastructure, automation and compliance with regulations are largely driving the adoption of moisture sensing solutions.

The market for European aluminum oxide moisture sensors is growing, with growing industrialization and need for accurate moisture control in the pharmaceutical, automotive and food and beverage processing fields, among others. Innovation and Penetration is driven by key markets such as Germany, France and the UK. Factors such as product quality and quality control regulations and advancements in technology are boosting the market, and environmental sustainability goals are also responsible for the high demand of moisture monitoring solutions in the region.

-

Germany leads the European market for aluminum oxide moisture sensors because of its robust industrial sector, particularly in automotive, manufacturing, and pharmaceuticals, and its emphasis on innovation and the adoption of advanced sensor technology.

The Middle East & Africa market is witnessing growth with high demand from industries in South Africa, Saudi Arabia, and the UAE. Market growth is driven by higher industrialization and technology adoption. Latin America, with Brazil and Argentina at the forefront, is also growing steadily as industries are looking for accurate moisture control systems in various industries.

Get Customized Report as per Your Business Requirement - Enquiry Now

Aluminum Oxide Moisture Sensor Companies are:

Major Key Players in Aluminum Oxide Moisture Sensors Market are General Electric Company, Honeywell International Inc., Siemens AG, Vaisala Oyj, Michell Instruments Ltd., Panametrics, TE Connectivity Ltd., AMETEK Inc., Roscid Technologies, Systech Illinois.

Recent Development:

-

December 2024, The portable Vaisala Indigo80 device offers accurate field measurements for humidity, temperature, dew point, moisture in oil, and other parameters, supporting data analysis, diagnostics, and calibration with Indigo-compatible instruments.

-

November 2024, Avensys launched the 8800 Series Moisture Analyzer, utilizing advanced aluminum oxide (Al₂O₃) sensing technology to detect trace moisture levels, with capacitance variations between aluminum core and gold film ensuring precise measurements.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.36 Billion |

| Market Size by 2032 | USD 2.51 Billion |

| CAGR | CAGR of 8.07% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Portable, Fixed) •By Application (Industrial, Environmental, Automotive, Aerospace, and Others) •By End-User (Oil and Gas, Pharmaceuticals, Food and Beverage, Chemicals, and Others) •By Distribution Channel (Direct Sales, Distributors, Online) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | General Electric Company, Honeywell International Inc., Siemens AG, Vaisala Oyj, Michell Instruments Ltd., Panametrics, TE Connectivity Ltd., AMETEK, Inc., Roscid Technologies, Systech Illinois. |