Vulnerability Management Market Report Scope & Overview:

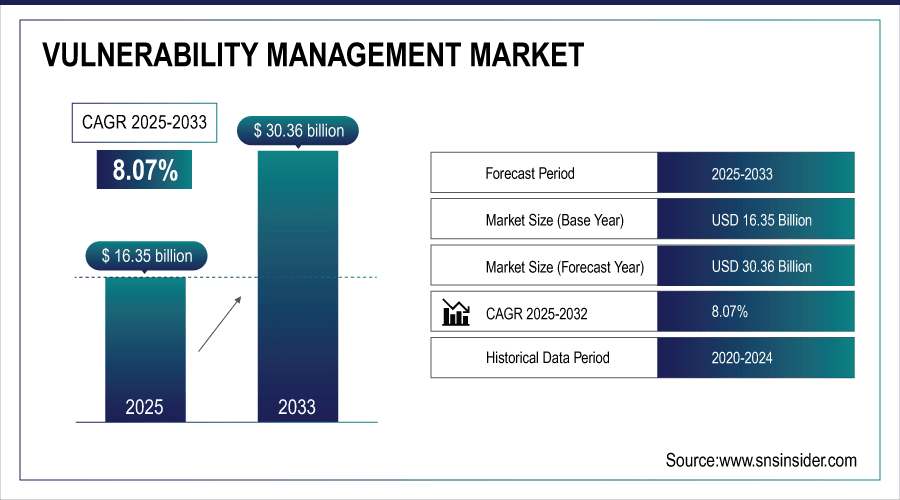

The Vulnerability management market Size was valued at USD 16.35 Billion in 2025E and is expected to reach USD 30.36 Billion by 2033 and grow at a CAGR of 8.07% over the forecast period 2026-2033.

The Vulnerability Management market is primarily driven by the increasing frequency and sophistication of cyberattacks across industries, which has raised the need for organizations to proactively identify and remediate security weaknesses. The growing adoption of digital transformation, cloud computing, and IoT devices has expanded the attack surface, prompting enterprises to invest in advanced vulnerability management solutions. According to study, over 70% of enterprises are investing in cloud and IoT-enabled technologies, expanding the digital footprint and attack surface.

To Get More Information On Vulnerability management market - Request Free Sample Report

Vulnerability Management Market Trends

-

Rising cyberattacks drive organizations to adopt proactive vulnerability management solutions.

-

Digital transformation and IoT expansion increase enterprise attack surfaces globally.

-

Regulatory compliance and industry mandates accelerate vulnerability management adoption worldwide.

-

Cloud-based and managed services simplify deployment for SMEs and enterprises.

-

Automated remediation and threat intelligence improve efficiency in addressing vulnerabilities.

-

Emerging markets and digitalization offer significant growth opportunities for vendors.

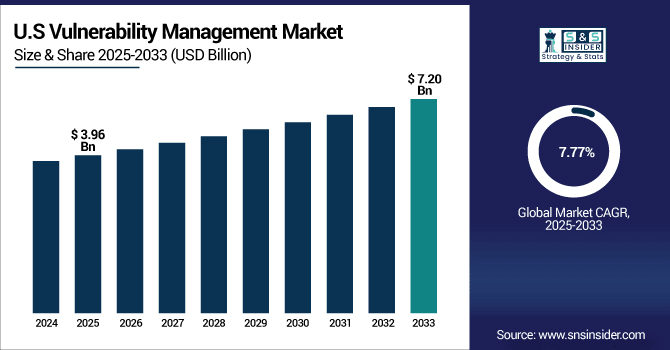

The U.S. Vulnerability management market size was USD 3.96 Billion in 2025E and is expected to reach USD 7.20 Billion by 2033, growing at a CAGR of 7.77% over the forecast period of 2026-2033, driven by the high frequency of cyberattacks, with enterprises facing millions of threats annually, including ransomware and phishing. Rapid adoption of cloud computing, IoT, and digital transformation has expanded attack surfaces, while stringent regulations like HIPAA and CCPA enforce robust cybersecurity measures.

Vulnerability Management Market Growth Drivers:

-

Rising Cyberattacks Push Organizations to Adopt Vulnerability Management Solutions

The primary driver for the vulnerability management market is the rising number and complexity of cyberattacks across industries. As organizations adopt digital technologies such as cloud computing, IoT, and remote work solutions, the attack surface expands significantly. Enterprises are now facing advanced threats like ransomware, zero-day attacks, and phishing campaigns, which can disrupt operations, compromise sensitive data, and cause financial losses. Vulnerability management solutions help organizations proactively identify, prioritize, and remediate security gaps in their IT infrastructure.

Around 30% of companies report at least one major data breach per year, affecting sensitive customer and corporate data.

Vulnerability Management Market Restraints:

-

High Costs and Complexity Challenge Vulnerability Management Adoption Globally

A major restraint for the market is the complexity and cost of deploying comprehensive vulnerability management solutions. For many organizations, especially SMEs, implementing and integrating these solutions into existing IT infrastructure can require significant financial and technical resources. This includes costs for software licenses, skilled personnel, continuous monitoring, and regular updates. Additionally, advanced solutions often demand integration with other cybersecurity tools, which can increase operational complexity. These challenges may slow adoption among smaller businesses or organizations with limited cybersecurity expertise, even though the need for protection is critical.

Vulnerability Management Market Opportunities:

-

Cloud-Based and Managed Services Open New Growth Opportunities

A significant growth opportunity lies in the rise of cloud-based and managed vulnerability management services. Cloud deployments allow organizations to access scalable, cost-effective security solutions without heavy upfront investment in hardware or infrastructure. Managed services further relieve organizations from the burden of continuous monitoring and maintenance, enabling them to focus on core operations while still ensuring strong security. This trend is particularly beneficial for SMEs and organizations in emerging regions, where cybersecurity expertise and budgets may be limited. By offering subscription-based, automated, and scalable solutions, vendors can tap into a growing market segment and drive adoption across industries undergoing rapid digital transformation.

Organizations deploying automated threat intelligence tools report faster remediation of vulnerabilities by 40–50%.

Vulnerability Management Market Segmentation Analysis:

-

By Component: In 2025, Solution led the market with share 65.20%, while Services are the fastest-growing segment with a CAGR 8.42%.

-

By Organization: In 2025, Large enterprises the market 30.06%, while SME fastest-growing segment with a CAGR 9.17%.

-

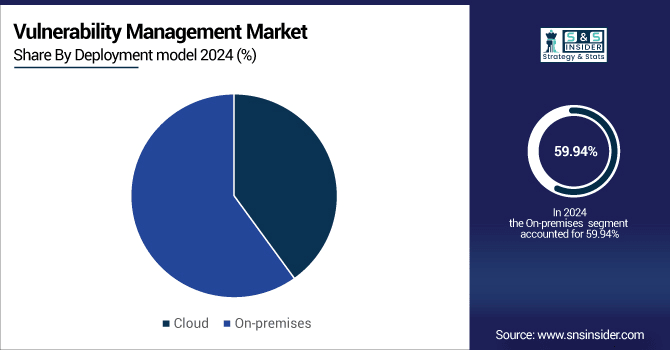

By Deployment model: In 2025, Cloud led the market with share 40.06%, while On-premises the fastest-growing segment with a CAGR 9.24%.

-

By End-user: In 2025, IT & telecom led the market with share 30.06%, while Healthcare is the fastest-growing segment with a CAGR 11.06%.

By Deployment Model, Cloud Lead Market While On-Premises Fastest Growth

In the Vulnerability Management market, the Cloud deployment model leads in 2025, driven by its scalability, ease of deployment, and ability to provide real-time monitoring and updates across distributed IT environments. Cloud solutions are increasingly preferred by enterprises seeking flexible and cost-effective cybersecurity options. Meanwhile, On-Premises deployment is the fastest-growing segment, as large organizations continue to prioritize full control over their security infrastructure, data privacy, and compliance requirements, investing in dedicated on-site solutions for sensitive and mission-critical systems.

By Component, Solution Lead Market While Services Fastest Growth

In the Vulnerability Management market, the Solution segment leads in 2025, accounting for the majority of adoption due to increasing demand for advanced software tools like vulnerability scanners, threat intelligence platforms, and endpoint protection solutions. Solutions provide organizations with comprehensive capabilities to identify, assess, and remediate security gaps effectively. Meanwhile, the Services segment is the fastest-growing, driven by rising adoption of managed vulnerability services, consulting, and support offerings, enabling enterprises, particularly SMEs, to implement robust cybersecurity measures without heavy in-house resources.

By Organization, Large Enterprises Lead Market While SME Fastest Growth

In the Vulnerability Management market, Large Enterprises lead in 2025, holding the largest share due to substantial cybersecurity budgets, regulatory compliance requirements, and the adoption of advanced vulnerability management solutions across complex IT infrastructures. These organizations prioritize proactive security to protect sensitive data and ensure business continuity. Meanwhile, SMEs represent the fastest-growing segment, driven by increasing awareness of cyber threats, digital transformation initiatives, and the adoption of cost-effective, managed vulnerability services that enable smaller organizations to strengthen security without significant in-house expertise.

By End-User, IT & Telecom Lead Market While Healthcare Fastest Growth

In the Vulnerability Management market, the IT & Telecom sector leads in 2025, driven by high exposure to cyber threats, rapid digital transformation, and the critical need to protect sensitive data and infrastructure. These enterprises adopt comprehensive vulnerability management solutions to ensure network security and business continuity. Meanwhile, the Healthcare sector is the fastest-growing segment, fueled by increasing digitization of patient records, regulatory compliance requirements, and rising cyberattacks targeting sensitive healthcare data, prompting adoption of advanced vulnerability management solutions.

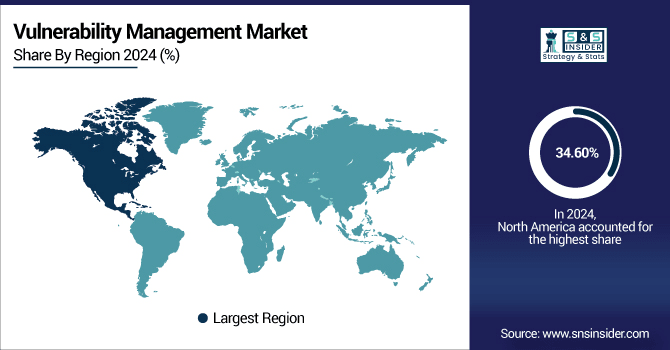

Vulnerability Management Market Region Analysis

North America Vulnerability management market Insights

North America dominated the global Vulnerability management market in 2025E, with over 34.60% revenue share, driven by the high frequency of cyberattacks, stringent regulatory frameworks, and advanced technological infrastructure. Enterprises across BFSI, IT & telecom, and healthcare sectors prioritize proactive cybersecurity to protect sensitive data and ensure compliance with laws such as HIPAA and CCPA. The region’s strong focus on digital transformation, cloud adoption, and threat intelligence solutions further fuels demand for vulnerability management. Leading vendors, including Tenable, Qualys, IBM, and Microsoft, reinforce market growth through innovative solutions and services.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Vulnerability management market with Advanced Technological Adoption

The U.S. leads the Vulnerability Management market due to widespread adoption of advanced cybersecurity technologies, high digital transformation, and stringent regulations like HIPAA and CCPA.

Asia-Pacific Vulnerability management market Insights

The Asia-Pacific region is expected to have the fastest-growing CAGR 9.68%, for the Vulnerability management market, driven by rapid digital transformation, increasing cloud adoption, and rising cyber threats across enterprises. Countries like China, India, and Japan are investing heavily in cybersecurity infrastructure to protect sensitive data and comply with emerging regulations. SMEs and large organizations are increasingly adopting cloud-based and managed vulnerability management solutions. The growing internet penetration, IoT deployment, and government initiatives further accelerate market growth, creating significant opportunities for vendors in the region.

China and India Propel Rapid Growth in Vulnerability management market

China and India are driving the fastest growth in the Vulnerability Management market due to rapid digitalization, increasing cloud and IoT adoption, and rising cyber threats. Government initiatives and growing awareness among enterprises further accelerate the adoption of advanced vulnerability management solutions.

Europe Vulnerability management market Insights

Europe holds a significant share in the Vulnerability Management market, driven by strict data protection regulations such as GDPR and growing cybersecurity awareness among enterprises. Organizations across BFSI, IT, healthcare, and manufacturing sectors are adopting advanced vulnerability management solutions to protect sensitive data and ensure compliance. The region benefits from mature technological infrastructure, high cloud adoption, and increasing investments in threat intelligence and automated security tools, supporting steady market growth and creating opportunities for both established vendors and emerging solution providers.

Germany and U.K. Lead Vulnerability management market Expansion Across Europe

Germany and the U.K. are driving market growth in Europe due to strong cybersecurity regulations, advanced IT infrastructure, and high adoption of digital transformation initiatives.

Latin America (LATAM) and Middle East & Africa (MEA) Vulnerability management market Insights

Latin America and Middle East & Africa are emerging regions in the Vulnerability Management market, driven by increasing digital adoption, rising cyber threats, and growing awareness of cybersecurity. Organizations across BFSI, IT, healthcare, and government sectors are investing in advanced vulnerability management solutions to protect sensitive data and comply with evolving regulations. The adoption of cloud-based and managed services.

Vulnerability Management Market Competitive Landscape

Microsoft's Defender Vulnerability Management offers a risk-based approach to discovering, prioritizing, and remediating endpoint vulnerabilities and misconfigurations. The solution provides asset visibility, real-time insights, and automated remediation workflows, seamlessly integrating with other Microsoft security products. This integration enables organizations to manage vulnerabilities across their IT infrastructure effectively, supporting a proactive security strategy.

-

In August 2025, Microsoft released a major Patch Tuesday update addressing 111 security vulnerabilities, including a critical zero-day flaw in Windows Kerberos and a remote access flaw in Azure OpenAI, urging immediate application of the updates to mitigate security risks.

AT&T provides managed vulnerability services through its Managed Vulnerability Program, offering a risk-based approach to vulnerability management. The program delivers comprehensive visibility across on-premises, cloud, web application, and operational technology assets. AT&T's services include threat hunting, vulnerability scanning, and remediation support, tailored to the unique needs of each organization.

-

In March 2024, AT&T experienced a data breach that exposed records of most of its customers' call and text conversations, with the stolen information dating back to 2022 and early 2023.

IBM offers a comprehensive suite of vulnerability management solutions, including IBM Guardium and IBM QRadar Vulnerability Manager. These tools provide organizations with the ability to identify, assess, and remediate vulnerabilities across on-premises and cloud environments. IBM's solutions integrate with its broader security portfolio, enabling centralized visibility and streamlined workflows.

-

In August 2024, IBM issued a security bulletin addressing multiple vulnerabilities in IBM WebSphere Application Server Liberty, including CVE-2024-27268 and CVE-2024-25026, which could lead to denial of service due to specially crafted requests.

Vulnerability Management Market Key Players

Some of the Vulnerability management market Companies are:

-

Tenable, Inc.

-

Qualys, Inc.

-

IBM Corporation

-

Microsoft Corporation

-

Rapid7, Inc.

-

AT&T Inc.

-

Hewlett Packard Enterprise Company

-

Dell Technologies Inc.

-

Broadcom Inc. (Symantec)

-

Cisco Systems, Inc.

-

Oracle Corporation

-

VMware, Inc.

-

McAfee Corp.

-

Trend Micro Incorporated

-

Palo Alto Networks, Inc.

-

Check Point Software Technologies Ltd.

-

CrowdStrike Holdings, Inc.

-

Fortinet, Inc.

-

SonicWall, Inc.

-

Ivanti, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 16.35 Billion |

| Market Size by 2033 | USD 30.36 Billion |

| CAGR | CAGR of 8.07% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Organization (SME, Large Enterprises) • By Deployment Model (On-Premises, Cloud) • By End-User (IT & Telecom, BFSI, Healthcare, Retail, Manufacturing, Energy & Utility, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Tenable, Inc., Qualys, Inc., IBM Corporation, Microsoft Corporation, Rapid7, Inc., AT&T Inc., Hewlett Packard Enterprise Company, Dell Technologies Inc., Broadcom Inc. (Symantec), Cisco Systems, Inc., Oracle Corporation, VMware, Inc., McAfee Corp., Trend Micro Incorporated, Palo Alto Networks, Inc., Check Point Software Technologies Ltd., CrowdStrike Holdings, Inc., Fortinet, Inc., SonicWall, Inc., Ivanti, Inc., and Others. |