Copper Tubes Market Report Scope & Overview:

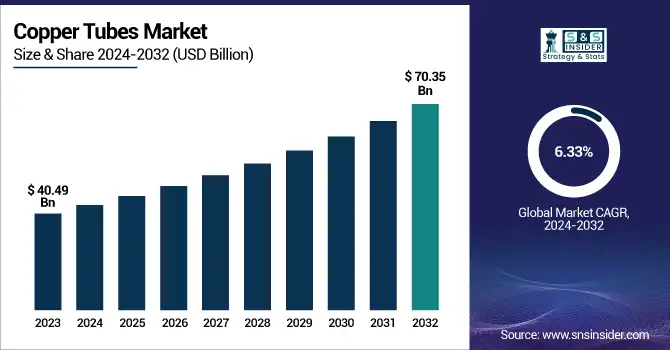

The Copper Tubes Market was estimated at USD 40.49 billion in 2023 and is expected to reach USD 70.35 billion by 2032, with a growing CAGR of 6.33% over the forecast period 2024-2032.

To Get more information on Copper Tubes Market - Request Free Sample Report

This report offers a unique perspective on the Copper Tubes Market by emphasizing regional trends in production volume and capacity utilization, showcasing shifts in industrial output and operational efficiency. It delves into supply chain disruptions and downtime metrics, highlighting improvements in logistical stability and manufacturing continuity. Technological advancements, including automation and smart alloying, are tracked alongside regional adoption patterns, with certain areas emerging as innovation hubs. A comprehensive trade flow analysis reveals evolving import-export dynamics and cross-border supply shifts. Additionally, the report explores the rising influence of sustainability-driven innovations such as recyclable copper tube systems.

The U.S. copper tubes market is projected to grow from USD 6.41 billion in 2023 to USD 11.37 billion by 2032, reflecting a CAGR of 6.57%. This steady growth is driven by rising demand across HVAC, plumbing, and industrial applications. The market is expected to gain momentum due to infrastructure upgrades and increased construction activity nationwide.

Copper Tubes Market Dynamics

Drivers

-

Rising demand for energy-efficient HVAC and refrigeration systems is driving the growth of copper tubes due to their superior thermal conductivity and corrosion resistance.

The rising demand in HVAC and refrigeration systems is a key driver propelling the growth of the copper tubes market. This involves providing copper tubing for refrigerated systems since copper provides better thermal and fire resistance and is easily formable for heat exchange and refrigerant flow. The HVAC industry is experiencing rapid growth—especially in emerging regions like Asia-Pacific and the Middle East—as global temperatures rise and the need for energy-conscious cooling systems grows. Furthermore, the growing trend towards green buildings and the use of sustainable technologies is also promoting the application of recyclable and long-lasting materials such as copper. The shift toward miniaturized and high-efficiency HVAC units is also increasing the demand for high-performance copper tubing. The market is poised to develop at a consistent rate in the coming years, driven by urbanization, infrastructure development, as well as technological advances in cooling systems, according to industry estimates. This trend emphasizes copper's critical role in provided sustainable and efficient HVAC solutions.

Restraint

-

Volatility in copper prices due to global supply-demand imbalances and geopolitical factors hampers profitability and disrupts production planning.

Volatility in raw material prices, particularly copper, poses a significant challenge for manufacturers in the copper tubes market. The prices of copper are incredibly dependent on global market conditions and can be influenced by myriad factors, such as geopolitical tensions, trade limits, mining regulations, and supply chain bottlenecks. Events such as political turmoil in major copper-producing countries or sanctions impacting trade routes can constrain supply, leading to higher prices. On the other hand, decreased demand from important sectors such as construction or electronics can result in price falls. This volatility presents challenges for manufacturers looking to establish consistent pricing plans or continuous production schedules. Costs can't be passed on to end-users through a price increase if/when it is the only solution, causing companies to suffer a loss in profit margin. In addition, because of market instability, procurement teams have to continuously revise sourcing strategies, leading to greater operational complexity. Thus, fluctuations in raw material prices continue to be a key restraint in the copper tubes industry.

Opportunities

-

Rising investments in green buildings and energy-efficient systems are boosting demand for copper tubes due to their superior thermal performance and sustainability.

Increased investments in green building technologies and energy-efficient systems are significantly driving the demand for copper tubes, particularly in eco-friendly HVAC and water supply applications. With green construction kicking off across the world, copper's genial inherent features, such as beautiful thermal conductivity, corrosion resistance and lengthy service life, allow it to be a most well-liked metal in green building initiatives. Copper tubes help provide energy efficiency by enabling superior HVAC systems for lower energy consumption and fewer greenhouse gas emissions. Furthermore, consistent with the tenets of sustainable development and the circular economy, their recyclability makes them a perfect candidate for sustainable designs. Policy support and certification initiatives like LEED (Leadership in Energy and Environmental Design) are also driving the use of copper-based systems in buildings, both residential and commercial. This trend is especially strong in developed regions and fast-growing economies where rapid urbanization and rising environmental awareness are driving the transition to energy-efficient infrastructure and building practices.

Challenges

-

Stricter environmental regulations and mining restrictions limit copper supply and raise production costs for tube manufacturers.

Stricter environmental regulations and mining restrictions are significantly impacting the copper tubes market by constraining the availability of raw materials and driving up operational costs. Governments worldwide have responded with more restrictive mining regulations to combat ecosystem harm, carbon emissions, and biodiversity loss. Copper mines, particularly in regions with sensitive ecosystems or high levels of pollution, are often affected by this kind of regulation, resulting in less mining or periods of inactivity. The available copper is now limited, leading to price volatility and disruption in the production timelines of copper tube manufacturers. Moreover, if companies adhere to environmental standards, they need to spend money on environmentally friendly technologies and sustainable business practices, increasing the costs even more. Such challenges are especially painful for smaller and mid-sized players in the industry, which may have a hard time swallowing increasing costs. As a result, there is pressure on the sector to deliver resource-efficient innovation in the shadow of a complex web of international environmental regulations.

Copper Tubes Market Segmentation Analysis

By Type

The coils segment dominated with a market share of over 42% in 2023, due to its extensive application in HVAC and refrigeration systems. The cooling systems demand effective heat exchange, and copper coils are unparalleled in this regard with their superior thermal conductivity. The increasing demand for energy-efficient technologies across the globe has also propelled the adoption of copper coils, owing to their property of reducing the consumption of energy and the subsequent cost of operation. They are also popular in residential, commercial, and industrial sectors due to their flexibility and ease of installation. In addition, coils, being an inert metal, have a high corrosion resistance, providing long service life and consistent performance within the development. Such advantages are increasingly driving the growth of the coils segment, contributing to the overall growth of the copper tubes market.

By Thickness

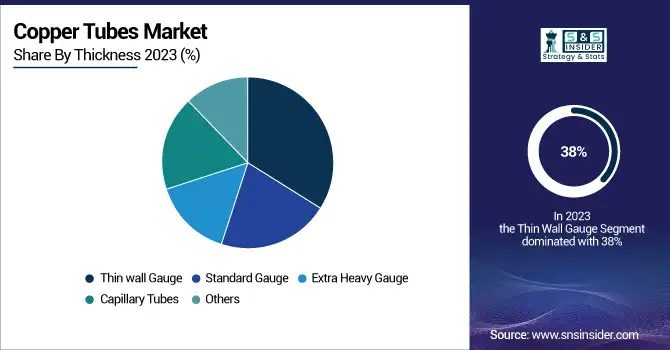

The thin wall gauge segment dominated a market share of over 38% in 2023, driven by its widespread application across various industries. These tubes, in particular is and used due to their high conductivity, durability, and ease of installation and are used in various electrical systems like generators, cables, transformers, busbars, and switchboards. In addition, the low corrosion vulnerability and thermal efficiency elevate their usage for plumbing systems, together with hot and cold-water supply lines. The thin wall design also saves material without sacrificing performance, making them even more attractive for cost-sensitive projects. Consequently, this segment remains a frontrunner in the market, bolstered by continued infrastructure development and increasing demand for efficient electrical and plumbing solutions.

By Application

The HVAC (Heating, Ventilation, and Air Conditioning) segment dominated with a market share of over 32% in 2023, driven by copper’s excellent thermal conductivity, corrosion resistance, and durability. Due to these properties, copper tubes are perfect for heat exchange and fluid transport within HVAC systems, where efficiency and longevity are paramount. Due to its strength in both high and low temperature and pressure ranges, copper is frequently utilized in both domestic and commercial air conditioning and refrigeration systems. Furthermore, rising trends in urbanization, the construction industry, and the need for energy-efficient heating and air conditioning systems will remain the driving forces of the HVAC industry, consolidating the leading position of the HVAC industry in the market. By perusing the others about this makes of sustainable as well as top-quality fabrics accepted, copper nonetheless is kept, monopolizing the HVAC tube in plenty of the full copper bundles marketplace.

Copper Tubes Market Regional Outlook

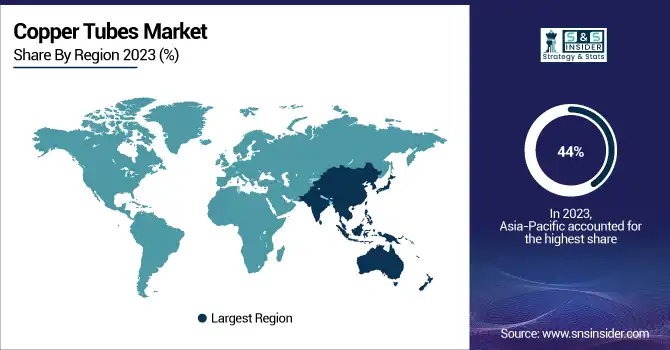

The Asia-Pacific region dominated with a market share of over 44% in 2023, attributed to accelerated urbanization, robust industrial growth, and construction activities in emerging economies, especially China and India. In addition, China's robust automotive sector and ongoing infrastructure projects, which utilize copper tubes in applications such as HVAC systems, plumbing, and refrigeration, keep the pursuit high. Its manufacturing capabilities and low-cost labor have also attracted global players, reinforcing its market position. Asia-Pacific holds the largest share of the copper tubes market and is expected to be the fastest-growing region, owing to the supportive government initiatives and rising investments towards the development of residential and commercial projects.

North America holds a notable share in the copper tubes market, largely supported by its mature construction sector and increasing adoption of energy-efficient solutions. The demand is backed by continuing infrastructure development, refurbishment of aging buildings, and an enhanced focus on green building standards. They are also used in many other applications, including plumbing, HVAC systems, and heating. Market growth in the region is also aided by sustainability initiatives and government regulations promoting energy conservation. With all of that said, though the Asia-Pacific region is still the top-performing area of the world by wide margins in market presence and growth rate, the Africa Middle East region is enjoying heavy growth from both industrial activity and urbanization high demand from populous and emerging economies, headlining China and India, where construction and automotive industries are very prosperous.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Copper Tubes Market

-

Mueller Streamline Co. (Copper Tubing, Line Sets, ACR Tubing)

-

KME Group S.p.A (Sanitary Copper Tubes, Industrial Copper Tubes)

-

Wieland Group (Smooth Tubes, Inner-grooved Tubes, Heat Exchanger Tubes)

-

LUVATA (Copper Tubes for HVAC, Plumbing Tubes, Inner-Grooved Tubes)

-

KOBE STEEL, LTD. (Copper Alloy Tubes, Air Conditioner Tubes)

-

Cambridge – Lee Industries LLC (Plumbing Tubes, ACR Tubes, Industrial Copper Tubes)

-

Shanghai Metal Corporation (Straight Copper Tubes, Pancake Coils, LWC Tubes)

-

Qindao Hongtai Copper Co., LTD (Refrigeration Copper Tubes, Medical Copper Tubes)

-

CERRO Flow Products LLC (Plumbing Tubes, HVACR Tubes, Coils)

-

MM Kembla (Kembla Copper Tube, Kembla Gas Tube, PairCoil)

-

Furukawa Electric Co., Ltd. (Copper Tubes for Refrigeration, Straight Tubes, Coils)

-

Golden Dragon Precise Copper Tube Group (LWC Tubes, Straight Tubes, Inner-Grooved Tubes)

-

Hailiang Group (Copper Water Tubes, Medical Gas Tubes, Inner Grooved Tubes)

-

MetTube Sdn Bhd (Air Conditioning Tubes, Plumbing Tubes)

-

Sam Dong (Copper Tubes for Transformers, Electrical Applications)

-

Mehta Tubes Ltd. (Copper Plumbing Tubes, HVAC Tubes)

-

Tube-Mac Industries (Copper Tubes for Hydraulic Piping Systems)

-

Zhejiang Hailiang Co., Ltd. (Coil Tubes, ACR Tubes, Pancake Coils)

-

Ningbo Jintian Copper (Group) Co., Ltd. (Copper Tubes for HVACR, LWC Tubes)

-

Oriental Copper Co., Ltd. (High Conductivity Copper Tubes for Industrial Use)

Suppliers for (Recognized for a wide range of copper tubing solutions , including line sets, ACR tubes, and plumbing coils) on the Copper Tubes Market

-

Mueller Streamline Co.

-

Cambridge – Lee Industries LLC

-

CERRO Flow Products LLC

-

Shanghai Metal Corporation

-

MM Kembla

-

Golden Dragon Precise Copper Tube Group

-

Hailiang Group

-

Zhejiang Hailiang Co., Ltd.

-

Ningbo Jintian Copper (Group) Co., Ltd.

-

Mehta Tubes Ltd.

Recent Development

In May 2024, Chinese copper producer Zhejiang Hailiang Co. is set to invest USD 288 million in a new manufacturing facility in Morocco, aimed at producing lithium-battery foil for export. The plant will have an annual output capacity of 50,000 tons of alloy, 35,000 tons of pipe, 40,000 tons of rod, and 25,000 tons of foil.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 40.49 Billion |

| Market Size by 2032 | USD 70.35 Billion |

| CAGR | CAGR of 6.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Straight lengths, Coils, Pancake or flattened tubes, U-Bends, Drawn tubes, Others) • By Thickness (Standard gauge, Extra heavy gauge, Thin wall gauge, Capillary tubes, Others) • By Application (Plumbing, HVACR, Industrial, Medical gas system, Fire sprinkler system, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mueller Streamline Co., KME Group S.p.A, Wieland Group, LUVATA, KOBE STEEL, LTD., Cambridge – Lee Industries LLC, Shanghai Metal Corporation, Qindao Hongtai Copper Co., LTD, CERRO Flow Products LLC, MM Kembla, Furukawa Electric Co., Ltd., Golden Dragon Precise Copper Tube Group, Hailiang Group, MetTube Sdn Bhd, Sam Dong, Mehta Tubes Ltd., Tube-Mac Industries, Zhejiang Hailiang Co., Ltd., Ningbo Jintian Copper (Group) Co., Ltd., Oriental Copper Co., Ltd. |