Food Packaging Equipment Market Scope & Overview:

The Food Packaging Equipment Market Size was estimated at USD 20.17 billion in 2023 and is expected to arrive at USD 29.82 billion by 2032 with a growing CAGR of 4.44% over the forecast period 2024-2032.

To get more information on Food Packaging Equipment Market - Request Free Sample Report

This report offers unique insights into the Food Packaging Equipment Market by analyzing regional manufacturing output, utilization rates, and maintenance metrics. It highlights trends in technological adoption for automated food packaging across different regions. The report also covers export/import data, providing a global perspective on the movement of packaging equipment. Additionally, it examines downtime metrics and their impact on operational efficiency, revealing emerging trends in automation and sustainability.

In the U.S. Food Packaging Equipment Market, there is a steady growth trend projected from 2023 to 2032. Starting at a value of USD 2.83 in 2023, it is expected to increase to USD 4.17 by 2032, reflecting a compound annual growth rate (CAGR) of 4.39%. This growth highlights a robust expansion driven by technological advancements, sustainability trends, and increasing demand for efficient packaging solutions across various food sectors. The U.S. market remains a key player in North America, contributing significantly to the region’s overall market growth.

Market Dynamics

Drivers

-

The increasing demand for processed and packaged food, driven by busy lifestyles and urbanization, is fueling growth in the food packaging equipment market.

The increasing demand for processed and packaged food is a significant growth driver in the food packaging equipment market. With population growth and the rapid pace of urbanization, there has been a trend towards busy lifestyles, resulting in a greater preference for easy, ready-to-eat, and processed food. This trend is especially prominent in developing areas, driven by increasing disposable income and shifting dietary patterns, fueling demand. Consequently, there is a growing need for food manufacturers to adopt sophisticated packaging solutions to produce the high volumes of goods necessary to satisfy consumer demands. Advanced packaging solutions are increasingly being used to streamline the manufacturing process, reduce costs, and enhance shelf-life, including automation and smart packaging. Furthermore, the surge in demand for healthier and more convenient food choices has increased the need for packaging machinery that offers versatility in terms of materials and portion sizes, providing manufacturers with the opportunity to create more customized and eco-friendly solutions.

Restraint

-

The high initial investment required for advanced packaging equipment can be a financial barrier for small and medium-sized food manufacturers, limiting market growth.

The high initial investment required for advanced food packaging equipment is a significant barrier, particularly for small and medium-sized food manufacturers. These companies typically operate with limited capital and struggle because the costs of acquiring modern machinery, including automated systems, robotics, and specialized technology, can be substantial and require a significant upfront investment. Although such advanced systems can potentially increase efficiency, decrease labor costs, and improve the quality of the product, the capital required to procure such equipment may keep some of the smaller players from entering or growing further into the market. Additionally, the cost of maintaining and operating such systems also increases the economic burden. Many smaller manufacturers face challenges in adopting advanced packaging solutions due to the significant capital expenditure associated with such technologies, which may hinder their competitiveness and inhibit growth and innovation across the food packaging market.

Opportunities

-

The development of automated and robotic packaging solutions enhances efficiency, precision, and speed in food packaging through the integration of robotics, AI, and vision systems.

The development of automated and robotic packaging solutions is transforming the food packaging industry, driven by the growing demand for efficiency and speed. Automated systems can package products quickly and accurately and reduce labor costs, human error, and production time. Packaging machinery has increasingly adopted robotic arms, vision systems, and AI to perform better. Robotic arms perform repetitive work such as sorting, filling, and sealing with great precision, while vision systems maintain alignment and quality control. Machine learning algorithms can analyze historical data and determine when maintenance is required, reducing downtime and optimizing maintenance schedules, which improves operational efficiency and ensures quality remains constant in packaging processes. These innovations allow manufacturers to respond to the growing need for packaged food items quickly and affordably, as well as embrace shorter production runs and personalized packaging. With the industry shifting towards automating solutions, the advancements of robotics and AI in food packaging equipment are a major growth area for manufacturers wanting to remain competitive.

Challenges

-

Supply chain disruptions in the food packaging equipment industry cause delays in component availability, impacting production timelines and increasing costs.

Supply chain disruptions have a significant impact on the food packaging equipment industry, as they can lead to delays in the procurement of essential components and parts required for manufacturing or upgrading packaging machines. Geopolitical events, delays in transportation, economies that disrupt global trade, shortages of raw materials, and many other factors can interfere with the smooth transfer of goods. These disruptions can result in increased production costs, longer lead times to get equipment delivered, and, in some cases, the shutdown of food manufacturers' production lines. Furthermore, disruptions can impact the availability of essential components that are necessary for upkeep or repairs, resulting in potential downtime and diminished operational productivity. Supply chain disruptions could lead to delayed innovation, reduced customer satisfaction, and hindered competitiveness in the food packaging industry since its processes rely on the timely delivery of high-quality materials and components; thus, if companies want to lessen these risks, they should devise strategies.

Segmentation Analysis

By Equipment

The Form-Fill-Seal (FFS) segment dominated with a market share of over 32% in 2023, due to its efficiency, versatility, and ability to handle a wide range of food products. This consists of the automated process of forming, filling, and sealing packaging in one single continuous process, minimizing manual labor and human error. FFS can be applied to a wide range of food types, such as solids, liquids, and powders, thus driving the universal uptake of packaging processes across food sectors. This equipment is also very favored by food manufacturers, as it can maintain high-speed production while ensuring product integrity and shelf life. Moreover, they can handle versatile sizes, shapes, or materials of packaging, which are also key factors in their market ubiquity.

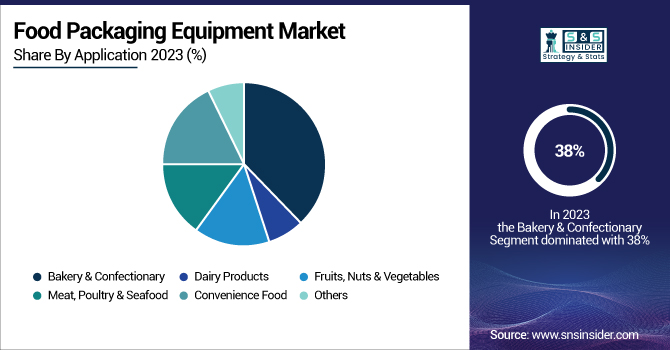

By Application

The Bakery & Confectionery segment dominated with a market share of over 38% in 2023, while the increasing demand for packaged bakery products like bread, cake, pastries, and confectionery is driving the segment. Consumers are looking for on-the-go, ready-to-eat foods more than ever, which amplifies the demand for packaged baked goods. In regions where convenience and on-the-go consumption dominate, this is a growing trend. Moreover, the increasing development of packaging technology that extends the shelf life of bakery products and maintains their freshness is positively influencing the growth of this segment. However, this category continues to lead the pack with demand and growth, largely due to consumer preference for their safe, easy-to-consume, and high-quality bakery products.

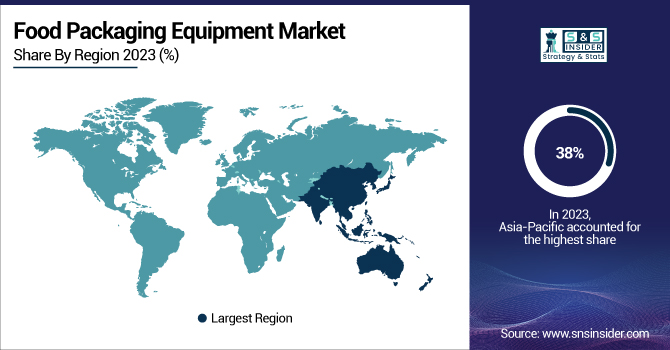

Key Regional Analysis

The Asia-Pacific region dominated with a market share of over 38% in 2023, driven by the substantial presence of food manufacturing and packaging industries across countries like China, India, Japan, and South Korea. These countries are some of the biggest global food producers, with extensive manufacturing capabilities that serve domestic and international tariffs alike. This, added with the growing urbanization, rising disposable incomes of the population, and increase in demand for convenience and pack food, has driven the food processing ingredient market significantly advanced. Moreover, growing e-commerce and increasing demand for food preservation and safety are also contributing to the demand for advanced food packaging solutions in the region.

Europe is the fastest-growing region in the food packaging equipment market, largely due to the increasing emphasis on sustainable packaging solutions. With growing consumer awareness of sustainability, businesses are increasingly using eco-friendly materials and technologies to answer demand for green packaging. In addition, automation is improving efficiency and lowering labour costs, which is a further factor on the growth of the market. With the increasing demand for processed and ready-to-eat products, especially in urban regions, the demand for modern packaging solutions is growing. In addition, European regulations regarding food safety, sustainability, and waste are also driving companies to invest in advanced packaging technologies. Such factors collectively are driving rapid growth and innovation in European food packaging equipment market.

Need any customization research on Food Packaging Equipment Market - Enquiry Now

Some of the major key players in the Food Packaging Equipment Market

-

MULTIVAC (Vacuum packaging machines, thermoforming packaging machines)

-

M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A. (Horizontal flow wrappers, vertical form-fill-seal machines)

-

Krones AG (Bottling and packaging machines, labeling systems)

-

Tetra Pak International S.A. (Processing and packaging systems for liquid foods)

-

Robert Bosch Packaging Technology (Packaging machines, filling machines, blister packaging systems)

-

GEA Group Aktiengesellschaft (Processing equipment, packaging machines for dairy and beverages)

-

Illinois Tool Works Inc. (Packaging equipment, stretch wrapping machines)

-

ARPAC LLC (Shrink wrappers, stretch wrappers, case sealers)

-

Coesia S.p.A. (Filling and packaging solutions, labeling machines)

-

OPTIMA Packaging Group GmbH (Packaging machines for pharmaceutical and food products)

-

Sealed Air Corporation (Automated packaging systems, bubble wrap machines)

-

Mondi Group (Flexible packaging solutions, corrugated packaging systems)

-

Amcor (Flexible and rigid packaging solutions for food products)

-

Ishida Co., Ltd. (Weighing, packing, and inspection systems for food packaging)

-

Fres-co System USA, Inc. (Flexible pouch packaging machines)

-

Sidel (Filling and packaging machines for beverage, dairy, and food products)

-

Universal Pack S.R.L. (Vertical form-fill-seal packaging machines, pouch filling machines)

-

Schubert Group (Robotic packaging solutions, pick-and-place machines)

-

Hallmark Packaging (Custom packaging solutions, thermoform and die-cutting machines)

-

Beumer Group (Conveyor systems, palletizing systems for packaging)

Suppliers for (Innovative food packaging solutions, especially in protective and shrink wrap packaging, as well as vacuum-sealed packaging), Food Packaging Equipment Market

-

Tetra Pak

-

Bosch Packaging Technology

-

Sealed Air Corporation

-

Multivac

-

Sidel

-

Ishida Co., Ltd.

-

Welbon Packaging Systems

-

Coesia Group

-

Sonoco Products Company

-

Yamato Scale Co., Ltd

Recent Development

In January 2025, MULTIVAC's CoolingPacking System received the Sustainable Packaging News Award in the Sustainable Packaging Machinery category for its innovative integration of cooling in the thermoforming packaging process, enhancing the shelf life of bakery products.

| Report Attributes | Details |

| Market Size in 2023 | USD 20.17 Billion |

| Market Size by 2032 | USD 29.82 Billion |

| CAGR | CAGR of 4.44% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment (Form-Fill-Seal, Filling & Dosing, Cartoning, Case Packing, Wrapping & Bundling, Others) • By Application (Bakery & Confectionary, Dairy Products, Fruits, Nuts & Vegetables, Meat, Poultry & Seafood, Convenience Food, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | MULTIVAC, M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A., Krones AG, Tetra Pak International S.A., Robert Bosch Packaging Technology, GEA Group Aktiengesellschaft, Illinois Tool Works Inc., ARPAC LLC, Coesia S.p.A., OPTIMA Packaging Group GmbH, Sealed Air Corporation, Mondi Group, Amcor, Ishida Co., Ltd., Fres-co System USA, Inc., Sidel, Universal Pack S.R.L., Schubert Group, Hallmark Packaging, Beumer Group. |