Water Quality Monitoring Systems Market Size & Overview:

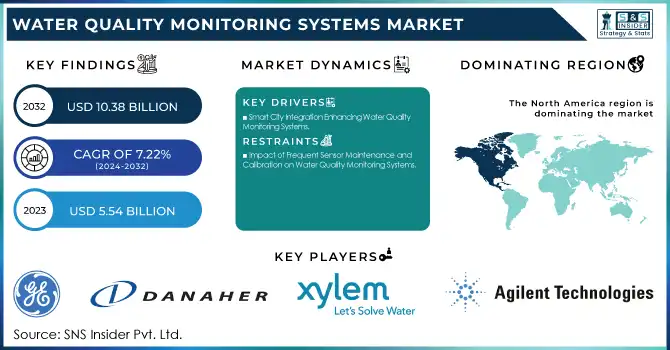

The Water Quality Monitoring Systems Market Size was valued at USD 5.54 billion in 2023 and is expected to reach USD 10.38 billion by 2032 and grow at a CAGR of 7.22% over the forecast period 2024-2032. These systems are mainly employed to monitor the quality of the water in advance to avoid the risk of using polluted water because of an illness caused by using unhealthy water. Moreover, technological advancements that include the incorporation of artificial intelligence, Internet of Things, and smart sensors have stepped up the monitoring process.

To Get more information on Water Quality Monitoring Systems Market - Request Free Sample Report

Another major boost for adoption in this industry is the focus on social responsibility and sustainability, considering that many companies have made commitments to reducing their environmental impact, while also improving water conservation. Regional advancements in technology and rising awareness about water quality issues are also contributing to market growth, particularly in emerging economies.

Water Quality Monitoring Market Dynamics

Drivers:

-

Smart City Integration Enhancing Water Quality Monitoring Systems

Growing smart city initiatives with emphasis on integrated infrastructure coupled with sustainable urban management is propelling the demand of advanced water quality monitoring system. Smart water management is the way forward and IoT systems, real-time data collection, predictive analytics and better decision making are some of the key highlights in managing smart urban water resources. As cities become smart ecosystems, it has become more than imperative to ensure efficient, scalable, and eco-friendly solutions to monitor water quality. IoT, AI, and sensor technologies are revolutionizing water conservation, quality assurance, and regulatory compliance across sprawling cities. With 840,000 miles of digital network infrastructure, companies such as Spectrum Enterprise are uniquely placed to drive these smart city initiatives forward. Spectrum, in addition, pledged to spend USD 25 billion to increase its capacity in five years, which should facilitate the deployment of water quality monitoring systems. This growth in smart city infrastructure is a key factor accelerating the global demand for advanced water monitoring solutions.

Restraints:

-

Impact of Frequent Sensor Maintenance and Calibration on Water Quality Monitoring Systems

Frequent maintenance and calibration of sensors in water quality monitoring systems are critical to ensuring their accuracy and reliability. Over time, sensors can drift or become less responsive, necessitating regular recalibration to maintain precision in measuring key water quality parameters such as pH, turbidity, and chemical concentrations. Additionally, these systems often require periodic maintenance to replace worn-out or malfunctioning components, which can result in operational downtime. Depending on the sensor, downtime could account for additional costs such as sensor replacement, labor, and system diagnostics apart from disrupting the constant monitoring process. For municipalities or industries who depend on real-time data, these problems can hinder water quality monitoring initiatives, resulting in delayed corrective actions as well as increased total cost of ownership (TCO).

Opportunities:

-

Revolutionizing Water Quality Monitoring through IoT and AI Advancements.

Advancements in IoT (Internet of Things) and AI (Artificial Intelligence) are transforming the water quality monitoring systems market by enabling more efficient, precise, and cost-effective solutions. Devices that involve smart sensors or connected monitoring stations that record real-time measurements of different water quality parameters, including pH, turbidity, chemical concentrations or temperature. The data is sent wirelessly to the central systems to be monitored on an ongoing basis. This process is enhanced with AI by analyzing the vast amounts of data created through the process and detecting patterns, trends, and anomalies with machine-learning algorithms. Therefore, AI helps in predicting incoming problems like contamination events, and equipment failure before they happen, which facilitates pre-emptive interventions. One promising, AI-powered method for such water testing takes advantage of the power of a smartphone camera to capture color changes in the water as it reacts; these changes are then interpreted. The model created by the technique produced remarkable accuracy, with R² values of 0.868 for freshwater samples and 0.978 for saltwater samples. Additionally, the method achieves low root-mean-square-error values, underscoring its precision. This technological integration reduces the reliance on manual testing, lowers labor costs, and improves resource management, contributing to more sustainable water management practices.

Challenges:

-

Ensuring Sensor Accuracy and Overcoming Maintenance Challenges in Water Quality Monitoring

Ensuring the accuracy and reliability of sensors in water quality monitoring is crucial for obtaining precise data. Over time, sensors may degrade, causing them to lose sensitivity of key metrics such as pH and turbidity. They need to be calibrated and maintained periodically to ensure reliable operation, which translates into operational downtime and extra costs incurred in repairs and replacements. Maintaining these sensors has been a significant hurdle for this continuous process, decreasing the efficacy of overall water quality management systems.

Water Quality Monitoring Systems Market Segment Analysis:

By Type

The sensors segment held the dominant share of around 55% in the Water Quality Monitoring Systems market in 2023, Due to the increasing adoption of advanced sensor technologies for the real-time monitoring of different water quality parameters such as pH, conductivity, turbidity, dissolved oxygen, and chemical concentrations. These sensors offer high accuracy, ease of installation, and cost-effectiveness, making them indispensable in both industrial and municipal water quality management. Their ability to provide continuous data allows for early detection of contamination and more efficient resource management. With the increasing demand for automation and smart water management systems, sensor technologies are becoming integral to ensuring reliable, real-time water quality monitoring, further propelling market growth in this segment.

The Data Acquisition Systems (DAS) segment is expected to be the fastest-growing in the Water Quality Monitoring Systems market over the forecast period (2024-2032). This growth can be described to the rising demand for real-time collection, storage, and analysis of water quality parameters. DAS combines sensors, communication networks, and analytic tools to facilitate real-time monitoring that promotes more efficient water use. The ability of DAS to aggregate voluminous data into predictive analytics for decision-making capabilities is driving rapid adoption of DAS technologies, and as industries and municipalities alike turn toward increasingly reliable, automated systems for water quality monitoring, the market continues to see an upwards growth trajectory.

By Application

In 2023, the Utility segment accounted for the largest revenue share of around 43% in the Water Quality Monitoring Systems market. This dominance is fueled by the growing need from municipalities and utility companies for reliable, real-time quality monitoring of water during its journey through distribution networks and treatment plants. In terms of meeting regulations, utilities are pouring money into new water quality monitoring systems that help them not only guarantee safe to drink water, but also ensure compliance and detect possible contamination events. Furthermore, the increasing emphasis on sustainable water management and the need for optimized resource utilization have also led to the widespread acceptance of such systems. As urbanization and water scarcity concerns rise, the utility sector's reliance on water quality monitoring technology is expected to continue driving market growth.

The Residential segment is expected to be the fastest-growing in the Water Quality Monitoring Systems market over the forecast period from 2024 to 2032. To continue as consumers become more informed on water quality and the demand for safe, clean water rises in households. Due to the increasing awareness among homeowners regarding drinking water contaminants, water quality monitoring systems are also being adopted to target health and safety of families until 2023. Furthermore, the growing trend towards smart house technologies and evolving IoT-based systems are anticipated to make water quality monitoring systems affordable and accessible for residential consumers. This trend is expected to fuel the market's expansion in the coming years.

Water Quality Monitoring Systems Market Regional Landscape:

In 2023, North America dominated the Water Quality Monitoring Systems market, holding a significant revenue share of around 45%, due to significant demand by industries, municipalities, and governments for sophisticated water management systems to address increasing concerns on water pollution and resources management. One of the benefits of the region is that it has established infrastructure, much higher technology adaptation and a growing focus on environmental sustainability. A major driver of market growth is the regulatory policies in the U.S. and the significant financial contributions made to water quality monitoring technologies. Moreover, Canada’s dedication to sustainable management of water reinforces the region’s excellence within the global market. As smart city initiatives and stricter environmental regulations take hold, North America is expected to maintain its dominant position in the coming years.

The Asia-Pacific region is the fastest-growing market for Water Quality Monitoring Systems during the forecast period from 2024 to 2032, driven by Increased awareness about the impact of environmental pollution on human health, along with the fast adoption of digital technologies such as Internet of Things (IoT) and Artificial Intelligence (AI), is boosting the need for accurate water quality monitoring solutions. Asia is growing as a hub for smart water management systems with countries like China, India, and Japan investing heavily on smart water management systems. In this dynamic region the demand for better water management practices and regulatory compliance drive market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the Major key Players in Water Quality Monitoring Systems Market along with their product:

-

General Electric Company (USA) [Products: Power generation, water treatment systems, industrial equipment]

-

Danaher Corporation (USA) [Products: Life sciences, diagnostics, water quality, industrial tools]

-

Xylem (USA) [Products: Water treatment solutions, pumps, water quality testing instruments]

-

Agilent Technologies, Inc. (USA) [Products: Analytical instruments, life sciences, diagnostics, chemical analysis]

-

Teledyne Technologies Incorporated (USA) [Products: Electronic instruments, imaging systems, water quality testing]

-

HORIBA, Ltd. (Japan) [Products: Analytical instruments, automotive testing equipment, water quality measurement]

-

Emerson Electric Co. (USA) [Products: Industrial automation, process control systems, environmental solutions]

-

Siemens (Germany) [Products: Automation, industrial control systems, water treatment solutions]

-

Evoqua Water Technologies LLC (USA) [Products: Water filtration, treatment, and wastewater management solutions]

-

Pentair (USA) [Products: Water filtration, fluid management systems, industrial water treatment]

-

Rockwell Automation (USA) [Products: Industrial automation, control systems, software solutions]

-

ABB Ltd. (Switzerland) [Products: Robotics, industrial automation, water treatment systems]

-

Schneider Electric (France) [Products: Energy management, automation, water treatment solutions]

-

IDE Technologies (Israel) [Products: Desalination, water treatment systems, industrial filtration]

-

Veolia (France) [Products: Water management, waste management, energy services, environmental solutions]

-

Trimble (USA) [Products: Water management software, geographic information systems (GIS), remote sensing equipment]

-

Badger Meter (USA) [Products: Water metering systems, flow measurement, remote monitoring solutions]

List of Suppliers who provide raw material and Component in Water Quality Monitoring Systems Market:

-

Honeywell International Inc.

-

Thermo Fisher Scientific Inc.

-

Endress+Hauser

-

Emerson Electric Co.

-

SUEZ Water Technologies & Solutions

-

Xylem Inc.

-

Ruggedcom (Siemens)

-

Ametek Inc.

-

Horiba Ltd.

-

YSI Inc. (A Danaher Company)

Recent Development

-

On January 3, 2024, Badger Meter (NYSE: BMI) acquired remote water monitoring hardware and software from Trimble (NASDAQ: TRMB), including Telog RTUs and Trimble Unity software, enhancing real-time data collection for water and environmental monitoring.

-

On August 23, 2024, Siemens introduced its Water Quality Analytics as a Service (WQAaaS) for UK water utilities, offering real-time water quality data and insights to enhance maintenance and support digital transformation during AMP8, including sensor installation, data connectivity, and analytical insights from treatment works to customer taps.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.54 Billion |

| Market Size by 2032 | USD 10.38 Billion |

| CAGR | CAGR of 7.22 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Sensors [Ph, Dissolved Oxygen Sensors, Temperature Sensors, Turbidity Sensors, Total Organic Carbon (TOC) Analyzer, Conductivity Sensors, Others],Data Acquisition Systems, Data Analysis and Visualization Tools) • By Application(Utility, Industrial, Commercial, Residential, Laboratories, Government Buildings, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | General Electric Company (USA), Danaher Corporation (USA), Xylem (USA), Agilent Technologies, Inc. (USA), Teledyne Technologies Incorporated (USA), HORIBA, Ltd. (Japan), Emerson Electric Co. (USA), Siemens (Germany), Evoqua Water Technologies LLC (USA), Pentair (USA), Rockwell Automation (USA), ABB Ltd. (Switzerland), Schneider Electric (France), IDE Technologies (Israel), Veolia (France),Trimble (USA),Badger Meter (USA) |