Water Storage Systems Market Analysis & Overview:

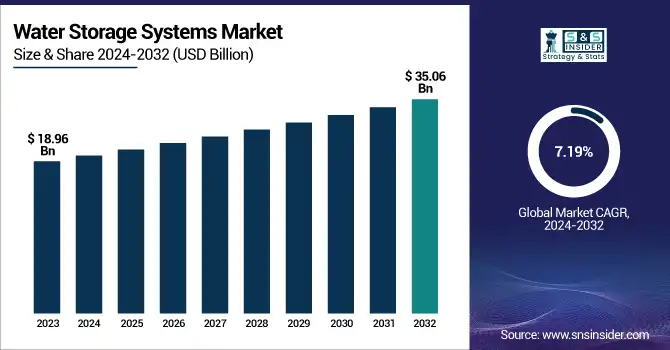

The Water Storage Systems Market Size was valued at USD 18.96 Billion in 2023 and is expected to reach USD 35.06 Billion by 2032 and grow at a CAGR of 7.19% over the forecast period 2024-2032.

To Get more information on Water Storage Systems Market - Request Free Sample Report

The Water Storage Systems Market is witnessing consistent growth with increasing water scarcity issues, urbanization, and growing industrial demand. These systems are essential for municipal water supply, agriculture, industrial processing, and disaster preparedness. Major drivers of market growth include innovation in storage materials, government policies for water conservation, and the growing use of rainwater harvesting.

The U.S. Water Storage Systems Market was valued at USD 3.57 Billion in 2023 and is expected to reach USD 7.16 Billion by 2032, growing at a CAGR of 8.16% from 2024 to 2032. The U.S. Water Storage Systems Market is stimulated by aging infrastructure, expanding water conservation efforts, and surging demand across residential, municipal, and industrial segments. Growth in the market is supported by government initiatives such as infrastructure investment and sustainability rules. Smart water management and environmentally friendly materials are key drivers for future industry trends.

Water Storage Systems Market Dynamics

Key Drivers:

-

Rising Water Scarcity and Government Initiatives for Sustainable Water Management Propel the Water Storage Systems Market Growth

Increasing global water scarcity has fueled the demand for effective water storage technologies, especially in areas experiencing severe drought. Compliance with government policies and regulations supporting sustainable water management, such as wastewater recycling and rainwater harvesting, is also pushing market demand. The Infrastructure Investment and Jobs Act in the U.S. is one of the efforts fueling investments in new water storage facilities. Furthermore, markets and cities increasingly implement smart storage of water and IoT-based monitoring to make maximum use of available water. Growth in the requirements for long-term water security will likely fuel ever-increasing research and development advancements in water storage system technologies.

Restraint:

-

High Initial Investment and Maintenance Costs Limit the Adoption of Water Storage Systems Across Various Sectors

In spite of the increased demand for cost-effective water storage facilities, the high initial investment needed to build and maintain large storage facilities is a major impediment. Steel, concrete, and fiberglass materials, for instance, are capital-intensive and thus become less affordable to small-scale industries and household users. Regular upkeep, such as cleaning, reinforcement, and compliance with regulatory guidelines, also increases the overall expenditure. Most end-users procrastinate adoption due to these monetary limitations, so they use lower-cost options. The challenge is especially evident in developing countries where water infrastructure funds are still inadequate.

Opportunity:

-

Advancements in Smart Water Storage Technologies Drive Innovation and Efficiency in Water Management Systems

The growing use of smart technologies in water storage facilities is offering enormous growth prospects for the market. AI-driven predictive maintenance, IoT-integrated sensors, and remote monitoring systems are revolutionizing the efficiency and sustainability of water storage facilities. These technologies allow real-time monitoring of water levels, leak detection, and automated distribution systems, enhancing overall water conservation. Sectors like municipal utilities, agriculture, and data centers are putting money into such technologies in order to make efficient use of resources and reduce operation expenses. Increasing digital water management awareness, globally, will result in increasing demand for smart water storage solutions.

Challenge:

-

Climate Change and Unpredictable Weather Patterns Disrupt Water Availability and Storage System Efficiency

The growing uncertainty of climate change presents a major challenge to the Water Storage Systems Market. Severe weather patterns, such as extended droughts and excessive rainfall, impact water supply and storage needs. In arid areas, low rainfall restricts water replenishment, making conventional storage systems less effective. On the other hand, heavy rainfall and flooding can cause system overflows, contamination, and damage to infrastructure. These uncertainties complicate it for industries and municipalities to plan and develop long-term storage systems. These challenges can be addressed by using innovative, climate-resilient technologies and adaptive water management approaches to provide secure and sustainable water storage.

Water Storage Systems Market Segments Analysis

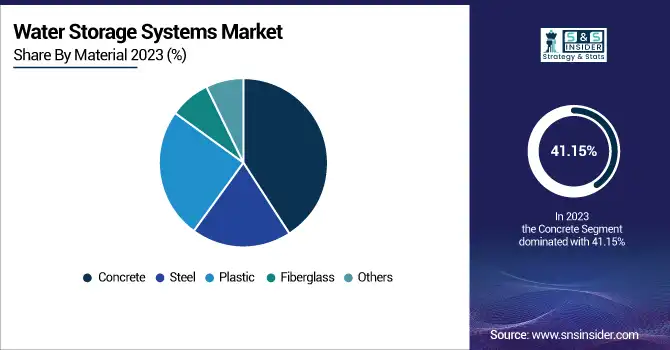

By Material

The Concrete Segment led the Water Storage Systems Market in 2023 with the highest revenue share of 41.15%, attributed to its longevity, affordability, and common usage for municipal and industrial purposes. Concrete tanks are used for large-scale water storage, wastewater treatment, and fire suppression systems because of their high structural integrity and long lifespan. Preload LLC launched state-of-the-art pre-stressed concrete water storage tanks for use in big municipal projects, boosting their market position. CST Industries further extended its product range with hybrid concrete-steel storage products to address the rising need for environmentally friendly infrastructure. The sector's growth is a reflection of growing investments in city water infrastructure and conservation efforts initiated by governments.

The Plastic industry is expected to expand at the highest CAGR of 10.11% over the forecast period, due to increasing demand for lightweight, corrosion-resistant, and affordable storage solutions. Plastic tanks are widely used in domestic, agricultural, and industrial applications for the storage of potable water, rainwater collection, and chemical storage. In 2023, Norwesco, Inc. introduced a new series of UV-resistant polyethylene water tanks, responding to growing sustainability needs. Enduraplas also launched reinforced plastic tanks with intelligent monitoring systems for greater efficiency.

By Application

The Onsite Water and Wastewater Collection segment dominated the Water Storage Systems Market in 2023 with a 30.68% share in terms of revenue, owing to stringent wastewater regulation and a growing need for decentralized treatment facilities. Advanced storage and treatment systems have been rolled out by companies such as Veolia Water Technologies and Xylem Inc. to enhance water reuse efficiency. In 2023, SUEZ Group unveiled an innovative system to store wastewater underground in an effort to improve municipal and industrial water management. Such innovations are in line with increasing efforts towards sustainability, guaranteeing safe storage of water and collection of wastewater.

The Potable Water Storage System segment is expected to expand at the highest CAGR of 8.65% due to increasing demand for safe drinking water and the development of corrosion-resistant storage materials. In 2023, CST Industries introduced an upgraded glass-fused-to-steel potable water storage tank with enhanced durability and resistance to contamination. Likewise, Tank Connection introduced a bolted RTP (Rolled, Tapered Panel) water storage system to address growing municipal demand. Governments are investing in intelligent water storage technologies, incorporating IoT for real-time monitoring.

By End-User

The Municipal segment led the Water Storage Systems Market in 2023, fueled by rising urbanization, aging infrastructure, and government investments in water conservation initiatives. Municipal governments are upgrading water storage tanks to provide a stable supply for drinking, sanitation, and emergency stockpiles. In 2023, CST Industries introduced advanced bolted steel tanks for large-scale municipal water storage with improved durability and corrosion resistance. ZCL | Xerxes diversified its fiberglass tank product offerings, offering leak-proof solutions for wastewater treatment. These developments go in tandem with increasing regulatory norms and sustainability initiatives, further adding to the dominance of the municipal sector in water infrastructure projects.

The Residential market will account for the highest CAGR owing to the growing concern of consumers toward water conservation, rainwater harvesting, and emergency storage technologies. The need for space-saving, affordable, and eco-friendly water storage is fueling innovations in the industry. Modular rainwater harvesting tanks were launched by Bushman USA in 2023 for urban residents who are looking for environmentally friendly solutions. Norwesco also broadened its polyethylene water tank product line, featuring UV-resistant tanks for long-term household storage. As climate change becomes a greater issue, residential water storage systems adoption is rising rapidly, becoming one of the leading drivers in the changing Water Storage Systems Market.

Water Storage Systems Market Regional Outlook

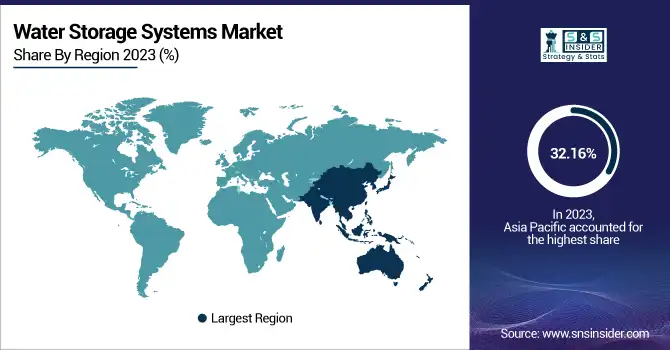

The Asia Pacific led the Water Storage Systems Market in 2023, with a revenue share of 32.16%, fueled by high urbanization, industrialization, and government investments in water infrastructure. Economies such as China, India, and Japan are actively employing large-scale water storage solutions to meet growing water demand. In 2023, Sintex Plastics Technology diversified its high-capacity plastic water tanks portfolio, meeting residential and industrial demands. Additionally, Hitachi’s smart water management solutions are enhancing municipal water storage efficiency. With increasing adoption of rainwater harvesting and wastewater recycling initiatives, the region is expected to sustain its market leadership.

North America is seeing the highest growth rate of 8.34% in the Water Storage Systems Market, which is fueled by the replacement of aging infrastructure, stricter water conservation legislation, and rising demand from applications such as data centers, agriculture, and municipal utilities. Products like those by ZCL Composites (Shawcor Ltd.) feature leading-edge fiberglass water tanks, featuring corrosion resistance and extended lifespan. In 2023, CST Industries introduced large-capacity bolted steel tanks, serving industrial and emergency water storage requirements. The U.S. and Canada are also adopting IoT-based smart water storage solutions, in line with sustainability objectives and fueling consistent market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

AGI - Ag Growth International - (Water Storage Silos, Liquid Storage Tanks)

-

CST Industries, Inc. - (Aquastore Glass-Fused-to-Steel Tanks, HydroTec Epoxy Coated Tanks)

-

Containment Solutions - (Underground Fiberglass Water Tanks, Aboveground Water Storage Tanks)

-

DN Tanks - (Pre-Stressed Concrete Water Tanks, Circular Prestressed Tanks)

-

Balmoral Tanks - (GRP Water Storage Tanks, Epoxy Coated Steel Tanks)

-

Caldwell Tanks - (Composite Elevated Water Tanks, Standpipe Water Storage Tanks)

-

Superior Tank Co., Inc. - (Bolted Steel Water Tanks, Welded Water Storage Tanks)

-

Tianjin Anson International Co., Ltd. - (Galvanized Steel Water Tanks, Stainless Steel Water Tanks)

-

Wolf Systembau Gesellschaft m.b.H. - (Reinforced Concrete Water Tanks, Agricultural Water Storage Tanks)

-

McDermott - (CB&I Water Storage Tanks, Elevated Water Storage Tanks)

-

ZCL Composites, Inc. - (Fiberglass Underground Water Tanks, Aboveground Fiberglass Water Tanks)

-

Synalloy Corporation - (Stainless Steel Water Tanks, Industrial Water Storage Tanks)

-

Grupo Rotoplas S.A.B. De C.V. - (Plastic Water Storage Tanks, Modular Water Tanks)

-

BH Tank - (Corrugated Steel Water Tanks, Bolted Steel Water Storage Tanks)

Recent Trends

-

January 2024– CST Industries introduced an advanced Epoxy Coated Bolted Steel Tank designed for high-capacity water storage in municipal and industrial applications. The new system features an upgraded Glass-Fused-to-Steel coating for enhanced durability and corrosion resistance.

-

February 2024 – Caldwell Tanks developed a Hybrid Elevated Storage Tank (HEST), which combines pre-stressed concrete and steel to increase water storage capacity while reducing overall construction costs by 15%.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 18.96 Billion |

| Market Size by 2032 | US$ 35.06 Billion |

| CAGR | CAGR of 7.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material - (Concrete, Steel, Plastic, Fiberglass, Others) • By Application - (Hydraulic Fracture Storage And Collection, Onsite Water And Wastewater Collection, Potable Water Storage System, Fire Suppression Reserve & Storage, Rainwater Harvesting & Collection, Others) • By End-User - (Municipal, LNG, Upstream, Midstream, Downstream/Petrochem, Hydrogen, Ammonia, Biofuels, Nuclear, Aerospace, Agriculture, Residential, Data Center, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AGI - Ag Growth International, CST Industries, Inc., Containment Solutions, DN Tanks, Balmoral Tanks, Caldwell Tanks, Superior Tank Co., Inc., Tianjin Anson International Co., Ltd., Wolf Systembau Gesellschaft m.b.H., McDermott, ZCL Composites, Inc., Synalloy Corporation, Grupo Rotoplas S.A.B. De C.V., BH Tank |