Centrifugal Pump Market Report Scope & Overview:

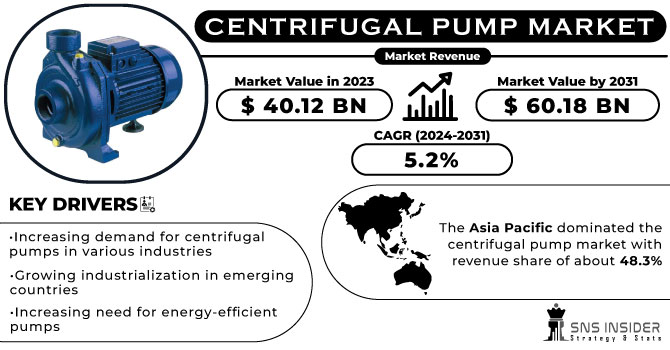

Centrifugal Pump Market size was valued at USD 40.12 billion in 2023 and is expected to grow to USD 60.18 billion by 2031 and grow at a CAGR of 5.2% over the forecast period of 2024-2031.

The centrifugal pump is a device that uses centrifugal force to move fluids. It consists of an impeller, which rotates at high speeds, creating a flow of fluid through the pump. The fluid enters the pump through the suction inlet and is then accelerated by the impeller. As the fluid moves through the impeller, it gains kinetic energy, which is then converted into pressure energy as it exits the pump through the discharge outlet.

Get More Information on Centrifugal Pump Market - Request Sample Report

They are preferred over other types of pumps because of their simplicity, reliability, and ease of maintenance. However, they do have some limitations, such as their inability to handle high-viscosity fluids and their susceptibility to cavitation. To ensure optimal performance, it is important to select the right type of centrifugal pump for the specific application. Factors to consider include the flow rate, head pressure, fluid viscosity, and temperature. Regular maintenance and monitoring of the pump's performance are also essential to prevent breakdowns and ensure efficient operation.

These centrifugal pumps are widely used in various industries, including oil and gas, water treatment, chemical processing, and power generation. The demand for centrifugal pumps has been increasing due to the growing need for efficient fluid handling systems. The market is expected to continue to grow in the coming years, driven by factors such as the increasing demand for energy-efficient pumps, the rise in industrialization, and the growing need for water and wastewater treatment.

Market Dynamics

Drivers

-

Increasing demand for centrifugal pumps in various industries

-

Growing industrialization in emerging countries

-

Increasing need for energy-efficient pumps

The centrifugal pump market is being propelled by a growing demand for energy-efficient pumps. This is due to the fact that energy consumption is a major concern for many industries, and the use of energy-efficient pumps can significantly reduce energy costs. Furthermore, the need for sustainable and environmentally friendly solutions has become increasingly important in recent years. Centrifugal pumps are able to operate with minimal environmental impact, making them an attractive option for companies looking to reduce their carbon footprint. In addition, the versatility of centrifugal pumps makes them suitable for a wide range of applications, including water treatment, chemical processing, and oil and gas production. This has further contributed to their popularity in the market.

Restraints

-

High cost associated with centrifugal pumps

-

Availability of alternative pumping technologies

The availability of alternative pumping technologies poses a significant challenge for the centrifugal pump market. This means that there are other types of pumps such as solar water pumps that are competing with centrifugal pumps in the market. These alternative technologies may offer better performance, efficiency, or cost-effectiveness, which can make it difficult for centrifugal pumps to remain competitive.

Opportunities

-

Growing trend of smart pumps

-

Increasing demand for pumps in the Asia-Pacific region

Challenges

-

Need for regular maintenance

-

Increasing competition from the local unorganized manufacturing sector

Impact of Russia-Ukraine War:

The Russian invasion of Ukraine impacted the centrifugal market significantly. One of the main factors contributing to the impact of the war on the centrifugal pump market is the disruption of supply chains. Many manufacturers of centrifugal pumps rely on materials and components from both Russia and Ukraine, and the conflict has made it difficult to obtain these resources. This has led to delays in production and increased costs for manufacturers, which in turn has affected the availability and pricing of centrifugal pumps. A more detailed analysis is included in the final report.

Impact of Recession

The global recession impacted the centrifugal pump market significantly. As businesses and industries struggle to stay afloat, the demand for centrifugal pumps has decreased. This has resulted in a decrease in production and sales for manufacturers of these pumps. Furthermore, the recession has caused a shift in the types of centrifugal pumps that are in demand. Customers are now looking for more cost-effective and energy-efficient pumps, which has led to an increase in the production of these types of pumps. A more detailed analysis is included in the final report.

Market segmentation

By Flow

-

Axial Flow

-

Radial Flow

-

Mixed Flow

By Operation Type

-

Hydraulic

-

Electrical

-

Air-Driven

By Stage

-

Single-Stage

-

Multi-Stage

By End-user

-

Commercial

-

Residential

-

Agricultural

-

Industrial

-

Water & Wastewater

-

Oil & Gas

-

Power Generation

-

Mining

-

Chemical

-

Food & Beverage

-

Others

-

Regional Analysis

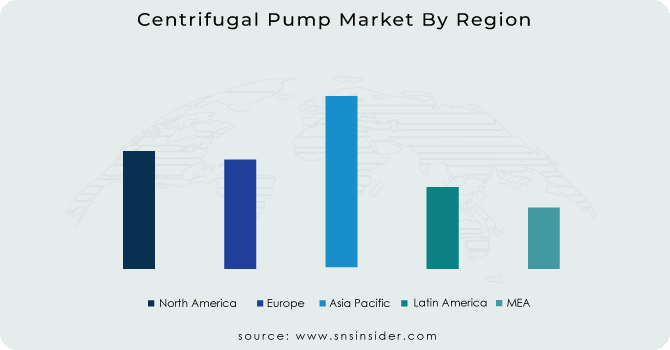

The Asia Pacific dominated the centrifugal pump market with revenue share of about 48.3% and is expected to grow with a significant CAGR during the forecast period. The region’s robust industrial growth, increasing demand for water and wastewater treatment, and rising investments in infrastructure development are some of the driving factors behind this dominance. One of the key drivers of the Asia Pacific centrifugal pump market is the region's thriving industrial sector. With countries like China, India, and Japan leading the way, the region has witnessed significant growth in industries such as oil and gas, chemical, and power generation. These industries require centrifugal pumps for various applications, such as fluid transfer, circulation, and pressure boosting, which has led to a surge in demand for these pumps. Moreover, the Asia Pacific region is facing a growing need for water and wastewater treatment due to rapid urbanization and industrialization. This has resulted in an increased demand for centrifugal pumps in the region's water and wastewater treatment plants. Additionally, the region's governments are investing heavily in infrastructure development, including the construction of new water treatment plants, which is further driving the demand for centrifugal pumps.

North America is projected to experience the highest CAGR in the centrifugal pump market during the forecast period. This is owing to the region's robust industrial sector, increasing demand for energy-efficient pumps, and growing investments in water and wastewater treatment facilities. Additionally, the presence of major market players in the region and favorable government initiatives further contribute to the growth of the centrifugal pump market in North America. As a result, the region is expected to witness significant growth in the coming years, making it a key market for centrifugal pump manufacturers and suppliers.

Need any customization research on Centrifugal Pump Market- Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major key players are Wilo Group, GRUNDFOS, KSB Company, Flowrox, Sulzer, Xylem, The Weir Group PLC, Flowserve Corporation, Ebara Corporation, Kirloskar Brothers Limited, Dover Corporation, ITT Corporation., and other key players mentioned in the final report.

Wilo Group-Company Financial Analysis

Recent Development:

-

In April of 2023, The KSB Group developed a new radial multi-vane impeller with an open design, specifically engineered to handle untreated wastewater.

-

In May 2023, Xylem made a major announcement with the launch of their new International Pump Manufacturing Site in Egypt.

-

Flowrox made waves in the industry with the release of their CF-V centrifugal pump, featuring a vertical cantilever design. This technology is perfectly suited for mining, minerals processing, and other industrial operations, delivering unparalleled performance in sumps and pits.

| Report Attributes | Details |

| Market Size in 2023 | US$ 40.12 Bn |

| Market Size by 2031 | US$ 60.18 Bn |

| CAGR | CAGR of 5.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Flow (Axial Flow, Radial Flow, and Mixed Flow) • By Operation Type (Hydraulic, Electrical, and Air-Driven) • By Stage (Single-Stage and Multi-Stage) • By End-user (Commercial, Residential, Agricultural, Industrial {Water & Wastewater, Oil & Gas, Power Generation, Mining, Chemical, Food & Beverage, and Others}) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Wilo Group, GRUNDFOS, KSB Company, Flowrox, Sulzer, Xylem, The Weir Group PLC, Flowserve Corporation, Ebara Corporation, Kirloskar Brothers Limited, Dover Corporation, ITT Corporation. |

| Key Drivers | • Increasing demand for centrifugal pumps in various industries • Growing industrialization in emerging countries |

| Market Opportunities | • Growing trend of smart pumps • Increasing demand for pumps in the Asia-Pacific region |