Crane and Hoist Market Report Scope & Overview:

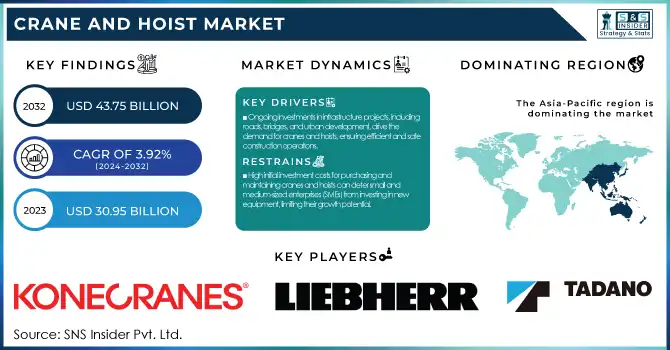

The Crane and Hoist Market size was estimated at USD 30.95 billion in 2023 and is expected to reach USD 43.75 billion by 2032 at a CAGR of 3.92% during the forecast period of 2024-2032.

To get more information on Crane and Hoist Market - Request Free Sample Report

The crane and hoist market are experiencing significant growth, driven by increased construction activities, rapid urbanization, and advancements in infrastructure development. The construction industry's reliance on efficient lifting and movement of heavy materials has led to a sustained demand for cranes and hoists. For instance, India's construction sector is projected to reach USD 1.4 trillion by 2025, propelled by initiatives like the Smart City Mission and the development of industrial corridors.

The Technological innovations are significantly enhancing the capabilities of cranes and hoists. The integration of the Internet of Things (IoT) and automation is transforming crane operations by enabling real-time monitoring, predictive maintenance, and greater safety. These technologies help reduce downtime, enhance efficiency, and lower operational costs, making cranes and hoists more effective. Additionally, the growing e-commerce sector, particularly in regions like Southeast Asia, is increasing the demand for efficient material handling solutions in warehousing and intralogistics, further boosting the market for cranes and hoists. Despite this promising outlook, the crane and hoist industry face several challenges. High manufacturing and maintenance costs remain a barrier, as cranes are complex machines that require regular inspections and upkeep to ensure safe operation. Moreover, there is a shortage of skilled crane operators, which can limit operational efficiency. However, with ongoing infrastructure projects and an ever-expanding need for efficient material handling solutions, the market is expected to continue its positive trajectory. By addressing these challenges, the crane and hoist market is well-positioned for long-term growth.

Crane and Hoist Market Dynamics

DRIVERS

-

Ongoing investments in infrastructure projects, including roads, bridges, and urban development, drive the demand for cranes and hoists, ensuring efficient and safe construction operations.

Ongoing investments in infrastructure development are a key driver for the crane and hoist market. Major infrastructure projects such as roads, bridges, airports, and urban development demand advanced lifting equipment to facilitate efficient and safe construction processes. As countries modernize and expand their infrastructure, cranes and hoists play a crucial role in material handling, lifting heavy loads, and ensuring smooth operations at construction sites. This trend is particularly evident in developing economies, where governments are investing heavily in large-scale infrastructure projects. The demand for cranes is expected to grow as cities become more urbanized and industrialized, with cranes facilitating tasks such as building high-rise structures, bridges, and public transportation systems. Additionally, technological advancements in cranes, such as automation and remote control, are driving their adoption. As a result, the infrastructure sector remains a primary driver, shaping the market dynamics and ensuring the continued demand for crane and hoist solutions in construction.

RESTRAINT

-

High initial investment costs for purchasing and maintaining cranes and hoists can deter small and medium-sized enterprises (SMEs) from investing in new equipment, limiting their growth potential.

High initial investment costs pose a significant challenge for businesses looking to purchase and maintain cranes and hoists. The cost of acquiring these machines, coupled with the expenses related to installation, training, and maintenance, can be prohibitively expensive for small and medium-sized enterprises (SMEs). SMEs often face budget constraints, making it difficult to allocate substantial capital for heavy equipment. As a result, many may delay or opt for renting cranes and hoists rather than making outright purchases. Furthermore, maintenance costs for these machines, including repairs, inspections, and replacement of parts, can add to the overall financial burden. This can limit the ability of smaller companies to compete with larger firms that have more resources. The high upfront and ongoing costs may also deter potential buyers from adopting newer, technologically advanced models, hindering their ability to improve operational efficiency and safety.

Crane and Hoist Market Segmentation Analysis

By Type

The fixed segment dominated with the market share over 58% in 2023. Fixed cranes, which include bridge cranes and gantry cranes, are preferred for their stability and ability to handle heavy loads over long periods. They are typically installed in fixed locations such as warehouses, factories, and ports, where they provide continuous, reliable service. Overhead cranes, a subset of fixed cranes, are widely used in manufacturing and construction industries due to their precision, lifting capacity, and efficiency in moving materials across production floors or work sites. Their dominance is driven by their ability to handle demanding operations in controlled environments, making them an essential part of industrial infrastructure.

By Operation

The hydraulic segment dominated with the market share over 52% in 2023, due to its precision, power, and efficiency in lifting and moving heavy materials. Hydraulic cranes use fluid power to generate lifting force, allowing for smooth and controlled operations even with heavy loads. Their robust design ensures reliability, making them ideal for demanding environments. These cranes are widely used in industries such as construction, manufacturing, and transportation, where heavy lifting is essential. Their versatility and ability to handle large, cumbersome loads make them indispensable in tasks ranging from lifting building materials to loading and unloading cargo. The ability to provide consistent performance in various applications has solidified hydraulic cranes as the preferred choice across many sectors.

By Industry

The construction segment dominated with the market share over 32% in 2023, due to the essential role these machines play in lifting and transporting heavy materials such as concrete, steel beams, and machinery. Cranes and hoists enable the efficient movement of these materials, which is crucial for large-scale construction projects. As the construction sector continues to grow globally, there is an increasing demand for advanced equipment capable of handling larger, heavier loads and speeding up construction timelines. This growth is driven by urbanization, infrastructure development, and the need for faster construction methods, which in turn boosts the demand for cranes and hoists across various construction activities, from residential to commercial and industrial projects.

Crane and Hoist Market Regional Outlook

Asia-Pacific region dominated with the market share over 42% in 2023, due to its rapid urbanization and extensive infrastructure development. Countries like China, India, and Japan are key contributors, where large-scale construction and industrial expansion drive demand for cranes and hoists. The region's growing industrial sectors, including manufacturing and material handling, require advanced lifting equipment for efficiency and safety. Additionally, significant investments in transportation, residential, and commercial projects further boost market growth. Asia-Pacific’s leading position is reinforced by its strong manufacturing base, which produces a variety of cranes and hoists to meet the demands of different industries. This combination of urban development, industrialization, and infrastructure growth ensures Asia-Pacific remains the largest market for cranes and hoists globally.

North America is emerging as the fastest-growing region in the crane and hoist market, driven by a surge in construction activities across the United States and Canada. The growing demand for cranes and hoists is largely attributed to the need for heavy lifting equipment in large-scale infrastructure projects, such as bridges, highways, and urban development. Additionally, North America's emphasis on modernizing its infrastructure and expanding industrial operations has led to a significant increase in the demand for advanced lifting solutions. This demand is further bolstered by technological innovations and the adoption of automated hoist systems, ensuring that the region remains a key player in the global crane and hoist market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players of the Crane and Hoist Market

-

Konecranes: (Overhead cranes, gantry cranes, hoists)

-

Liebherr: (Tower cranes, mobile cranes, crawler cranes)

-

Tadano Ltd.: (Mobile cranes, truck-mounted cranes, rough terrain cranes)

-

The Manitowoc Company, Inc.: (Crawler cranes, tower cranes, mobile cranes)

-

Zoomlion Heavy Industry Science & Technology Co., Ltd.: (Construction cranes, truck cranes, tower cranes)

-

Terex Corporation: (Rough terrain cranes, tower cranes, pick & carry cranes)

-

Ingersoll Rand: (Hoists, winches, material handling systems)

-

PALFINGER AG: (Knuckle boom cranes, truck-mounted cranes, hoists)

-

Columbus McKinnon Corporation: (Hoists, trolleys, lifting systems)

-

KOBE STEEL, LTD.: (Overhead cranes, electric hoists, gantry cranes)

-

XCMG Group: (All-terrain cranes, crawler cranes, tower cranes)

-

Sumitomo Heavy Industries, Ltd.: (Overhead cranes, electric hoists, material handling systems)

-

ABUS Kransysteme GmbH: (Overhead cranes, jib cranes, hoists)

-

Mammoet: (Heavy lifting cranes, engineered lifting solutions)

-

KATO WORKS CO., LTD.: (Mobile cranes, rough terrain cranes, truck cranes)

-

Sany Group: (Crawler cranes, truck cranes, tower cranes)

-

Hitachi Construction Machinery Co., Ltd.: (Crawler cranes, material handling cranes)

-

Demag Cranes: (Overhead cranes, hoists, gantry cranes)

-

Vulcan Cranes: (Customized cranes, overhead cranes, hoists)

-

GH Cranes & Components: (Bridge cranes, gantry cranes, hoists)

Suppliers for (overhead cranes for heavy industries like steel, power, and construction. Known for large-scale custom solutions) on Crane and Hoist Market

-

Anupam Industries Limited

-

RHS Cranes

-

Globe General Industries

-

Procrane Solutions India Private Limited

-

Jayco Hoist & Cranes Mfg. Co.

-

Hindustan Cranes & Hoist Co.

-

Super Mech Cranes & Components

-

Electromech Material Handling Systems (India) Pvt. Ltd.

-

K2 Cranes & Components Pvt. Ltd.

-

WMI Konecranes India Limited

RECENT DEVELOPMENT

In December 24, 2024: Aydıntaş, a Turkish crane and heavy haulage company, placed an order with Liebherr for two LTM 1450-8.1 mobile cranes. These cranes, capable of lifting up to 132 meters, are equipped with both fixed and luffing jibs. With a capacity of 450 tonnes, they incorporate advanced features like VarioBallast, VarioBase, and ECOmode. The cranes will primarily serve the energy sector. Aydıntaş, a long-time Liebherr customer for 30 years, will add these new machines to its fleet of 50 cranes.

In May 10, 2024: Sumitomo Heavy Industries Construction Cranes Co (HSC) in Japan upgraded its SCX1000A-3 and SCX1800A-3 lattice crawler cranes, with capacities of 100 and 180 tonnes, respectively. The updated models now feature Stage V engines, enhanced safety systems, and a load moment limiter. Both cranes are powered by a 209 kW Cummins B6.7 engine, which complies with EU Stage V emissions standards, offering better fuel efficiency with ECO winch mode and auto idle stop. Other improvements include an upgraded cabin, enhanced hydraulics for hammer and grab applications, and easier machine access.

In June 2023: Konecranes expanded its operations by acquiring the industrial crane service division of Munck Cranes AS, a prominent provider of industrial cranes and crane services in Norway. This acquisition grants Konecranes access to Munck's extensive customer base and a significant number of industrial crane installations in Norway and beyond.

In March 2023: Tadano Ltd. launched two truck crane models, the GT-1200XL-2 and GT-800XL-2, designed for the US and Canadian markets. These models are well-suited for taxi crane services due to their lightweight axles and compact transport dimensions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 30.95 billion |

| Market Size by 2032 | USD 43.75 billion |

| CAGR | CAGR of 3.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Mobile (Crawler Cranes, Rough Terrain Cranes, All-Terrain Cranes, Truck Loader Cranes), (Fixed (Industrial Cranes, Tower Cranes, Ship-to-Shore Cranes)) • By Operation (Hydraulic, Electric, Hybrid) • By Hoist (Type, Operation, Industry, Region) • By Industry (Construction, Shipping & Material Handling, Automotive & Railway, Aerospace & Defense, Energy & Power, Mining, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Konecranes, Liebherr, Tadano Ltd., The Manitowoc Company, Inc., Zoomlion Heavy Industry Science & Technology Co., Ltd., Terex Corporation, Ingersoll Rand, PALFINGER AG, Columbus McKinnon Corporation, KOBE STEEL, LTD., XCMG Group, Sumitomo Heavy Industries, Ltd., ABUS Kransysteme GmbH, Mammoet, KATO WORKS CO., LTD., Sany Group, Hitachi Construction Machinery Co., Ltd., Demag Cranes, Vulcan Cranes, GH Cranes & Components. |

| Key Drivers | • Ongoing investments in infrastructure projects, including roads, bridges, and urban development, drive the demand for cranes and hoists, ensuring efficient and safe construction operations. |

| Restraints | • High initial investment costs for purchasing and maintaining cranes and hoists can deter small and medium-sized enterprises (SMEs) from investing in new equipment, limiting their growth potential. |