Weight Management Services Market Report Scope & Overview:

Get more information on Weight Management Services Market - Request Free Sample Report

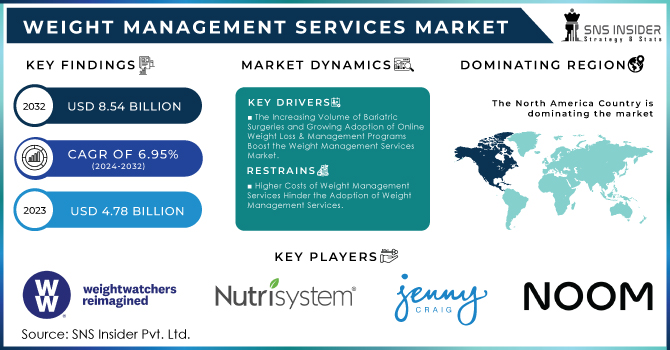

The Weight Management Services Market Size was valued at USD 4.78 Billion in 2023, and is expected to reach USD 8.54 Billion by 2032, and grow at a CAGR of 6.95% over the forecast period 2024-2032.

The rising popularity of online weight loss and management programs, along with the raising number of bariatric surgeries is propelling growth in the market for weight management services. In the United States, there has been a significant increase in surgical interventions for severe obesity with upwards of 250,000 bariatric surgeries performed by the year 2023 according to data from our historical atlas compiled using Centers for Disease Control and Prevention (CDC) estimates. This increase in bariatric procedures speaks to the fact that people are acknowledging a desire for complete systems to effectively combat their weight problems, such as those led by medical professionals rather than gimmick-peddling entrepreneurs.

The demand for online weight loss and management programs is also recognized as it extends beyond surgical solutions. According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), more than one in five U.S. adults now use digital platforms for weight management purposes. A rise in digital health tools, such as personalized meal and fitness plans plus tracking features, also contributed to these numbers. This rise in digital engagement aligns with data from the Federal Trade Commission (FTC) which reported that online weight loss services had a substantial increase as well, with over 15 million new subscribers throughout just 2023. The surge in the number of bariatric surgeries performed and the popularity of online programs have contributed to boosting market growth.

MARKET DYNAMICS:

KEY DRIVERS:

-

The Increasing Volume of Bariatric Surgeries and Growing Adoption of Online Weight Loss & Management Programs Boost the Weight Management Services Market.

-

The Increasing Popularity of Fitness Centers and Diet Plans Among Developing Nations Supports the Growth of the Weight Management Services Market.

RESTRAINTS:

-

Higher Costs of Weight Management Services Hinder the Adoption of Weight Management Services

-

Stringent Regulatory Requirements and Compliance Issues Can Impact the Development of Weight Management Services Products and Services

OPPORTUNITY:

-

Growing Awareness about Healthy Lifestyles is offering Lucrative Growth opportunities fueling the Weight Management Services Market.

-

Preventive Health and Technological Advancements Provide Opportunities for Weight Management Services Market Expansion.

KEY MARKET SEGMENTATION:

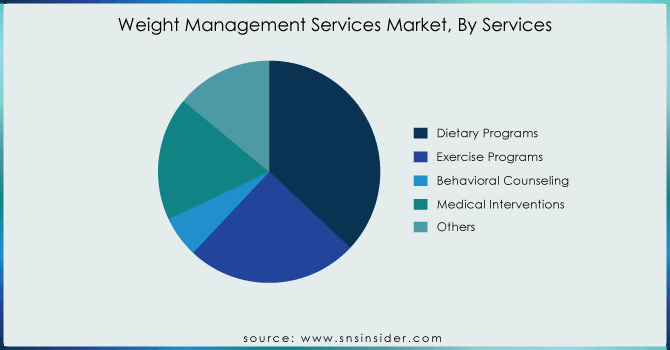

By Services

In 2023, dietary programs accounted for the largest share of 37%. Nutrition is more essential given its role in weight management, and hence the dominance of Nutritionists. These food plans can be designed according to the specific needs of an individual. According to the National Institutes of Health (NIH), approximately 60% of adults who are trying to manage their body weight utilize dietary programs more than other solutions. Because dietary intervention has a more rapid and tangible effect on weight loss, it is the notion that underlies this preference. Moreover, diet programs frequently coalesce with all-in combined weight management forts utilizing trainer and behavioral components to rescue acceptance to their core role. As important and rapidly growing sectors, like exercise programs, behavioral counseling, or medical interventions are to support people in losing weight there is no doubt that dietary products remain the most widely used because of their direct impact on achieving sustained healthy weight.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Delivery Mode

The largest category was online services with 36% in 2023. This is largely attributed to the ease and availability that digital platforms provide. Online weight management programs are becoming increasingly personalized and user-friendly, which makes them very enticing for those who would like to benefit from customized meal plans or workouts on-the-go in today's fast-paced digital world. According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), more than 25% of adults in the nation are pivoting from weight management to online platforms, a rise compared with previous years. That trend could be due to the increasing transparency and user-friendliness of online services through technology advancements. Virtual coaching, interactive tools, and complete apps will help both users.

By Age Group

In 2023, geriatrics was the largest segment holds 56% of market revenue. This is largely due to the rise of obesity and health issues associated with it among people in their mid-life. As the global population ages, a greater number of older people are turning to weight management programs to tackle health problems such as diabetes, cardiovascular disease, and poor joint function which may be worsened by carrying excess weight.

The report, based on data from the Centers for Disease Control and Prevention (CDC), noted about 42% of those aged at least 65 are obese - indicating a need for weight loss programs targeted to an older population. These services typically include customized dietary programs tailored to the older body, exercise regimens that account for mobility issues, and medical interventions to better control chronic conditions important components in optimizing quality of life within this demographic. This explains its dominance in the weight management services market due to a large and more immediate demand within the geriatric segment.

By Technology

The mobile applications occupied 58% of the weight management services in 2023. This is largely attributed to the growing popularity and accessibility of health & fitness apps (generally) that can be used with smartphones. Mobile apps also come with the ability to track their diet, exercise, and progress along with a little push of personalized recommendations. Mobile apps are a very inexpensive gateway for more users to enter since it is easy to use, cheap, and readily available with instant feedback updates. Chock full of calorie trackers, fitness regimens, and Wearable Tech integration features these apps are top-notch for managing weight day to day. The size of the mobile applications segment is large enough partly because those apps have readymade features with users actively using them.

REGIONAL ANALYSIS:

Several key drivers are expected to keep the Asia-Pacific weight management services market on a rapid growth curve from 2024-2031, with expansion clocking in at more than an 8.5% CAGR over that period. The region's expanding middle class is getting to spend more on healthcare and wellness services. With the growing economic development, the disposable income of consumers is also rising which will allow a larger part of consumers to afford weight management programs and services. Second, growing urbanization in places like China, India, and Indonesia is generating a lifestyle change that supports healthy weight management. Urbanization leads to Fitness centers, dietary programs, and health-related technologies as the cities grow. Moreover, urbanized regions are more populated with health education attentiveness movements that may motivate the acceptance of weight regulatory mechanisms.

The World Health Organization (WHO) reported obesity rates that grow even faster than new GDP superstars, as shown by India and China. The surge in this health problem has amplified the need for weight management products to manage and control maladies that stem from obesity. Finally, the increased prevalence of smartphone technologies and internet access in this region allow for widespread utilization of mobile app technology to deliver mHealth applications as well as online weight management programs. Weight management Tech Services to Be More Accessibilities services are used in weight reduction which also expand the market and make the solutions much easier.

KEY PLAYERS:

The key market players include Weight Watchers International, Inc., Nutrisystem, Inc., Jenny Craig, Inc., Noom, Inc., Medifast, Inc..Herbalife Nutrition Ltd., Atkins Nutritionals, Inc., Slimming World Co., Beachbody, LLC: & other players.

RECENT DEVELOPMENTS

Noom, as of June 2024, has brought a new app, Noom Vibe, to the market. It uses high-incentive and high efficacy to increase the rate at which people pick healthy habits. Simultaneously, it fosters a supportive environment through expert talks and socializing with peers also opting into healthy living. Noom Vibe uses a psychological incentives model of healthy habit promotion to lend its users points, referred to as “Vibes”, which are the apps' free virtual currency for picking life-improving habits. “Vibes” can be cashed out for gift cards and donated to charities.

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 4.78 Billion |

|

Market Size by 2032 |

US$ 8.54 Billion |

|

CAGR |

CAGR of 6.95% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Services (Dietary Program, Exercise Programs, Behavioral Counseling, Medical Interventions & Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Weight Watchers International, Inc., Nutrisystem, Inc., Jenny Craig, Inc., Noom, Inc., Medifast, Inc..Herbalife Nutrition Ltd., Atkins Nutritionals, Inc., Slimming World Co., Beachbody, LLC: & other players |

|

Key Drivers |

•The Increasing Volume of Bariatric Surgeries and Growing Adoption of Online Weight Loss & Management Programs Boost the Weight Management Services Market. |

|

RESTRAINTS |

•Higher Costs of Weight Management Services Hinder the Adoption of Weight Management Services. |