Pet Grooming Services Market Size & Growth Forecast

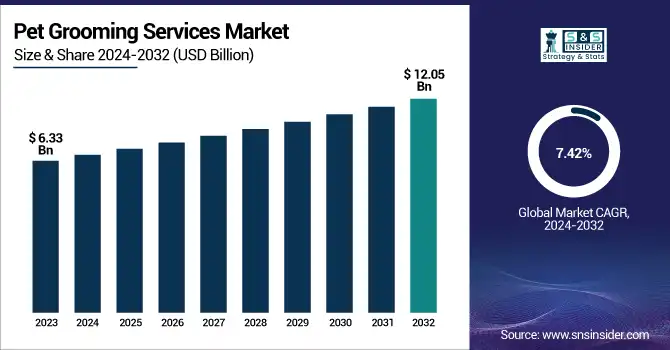

The global pet grooming services market size was USD 6.33 Billion in 2023 and is expected to reach USD 12.05 Billion by 2032, growing at a CAGR of 7.42% over the forecast period 2024-2032.

This report highlights the key statistics and trends in the Pet Grooming Services Market, including market size and growth forecasts, as well as pet ownership trends by species and region. It reviews service demand and frequency, with data on consumer preferences and spending habits among salons, mobile grooming, and at-home services. The report explores technology adoption, including digital booking platforms and AI-powered grooming tools, while also addressing regulatory and safety compliance in different markets. It also offers insights into pricing trends and consumer spending behaviours, providing a well-rounded perspective on the evolving landscape of the pet grooming market. This kind of knowledge is instrumental to the stakeholders to assess market dynamics, discover emerging trends, and explore potential opportunities in this booming sector.

To Get more information on Pet Grooming Services Market - Request Free Sample Report

The pet grooming services market is gaining traction due to increasing pet ownership and spending. Recent U.S. government statistics show that the pet is booming. According to the American Pet Products Association (APPA), this trend underscores pets increasing humanization, as more owners consider them family rather than mere companions. The U.S. pet grooming market size was estimated at USD 2.00 billion in 2023 and will grow at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2032. This increase follows pet ownership growth, increased consumer spending on pet grooming services, and technological improvements in the pet grooming sector. With premium services and mobile grooming solutions, the market is set for new boundaries. Other factors contributing to market growth include increased disposable income and the effects of social media.

Pet Grooming Services Market Dynamics

Key Growth Drivers

-

The increasing humanization of pets has led owners to invest more in grooming services to ensure their pets' well-being and appearance.

The growing humanization of pets has been an important driver of the pet grooming services market. Pet owners treat their animals like family, doing more than ever before to care for their health, appearance, and overall well being. This trend has led to higher spending on premium pet foods and services, including grooming. For example, global pet care sales increased into 2024 by 5.9%, to USD 197.6 billion, led by a phenomenon known as pet humanization and demand for known quality products. In the United States, this trend is most evident. Pet owners increasingly are spending on premium pet care services, as evidenced by companies like Freshpet that reached almost $1 billion in revenue in 2024 selling fresh, refrigerated pet food. Additionally, a survey of 2,000 American dog owners revealed that 76% consider food as their "love language" for their pets, with more than half feeding their dogs better than they do themselves, highlighting the deep emotional connection between pet owners and their animals.

Pet humanization has led to significant growth in the pet care market in Thailand. In 2024, the market reached a value of over 40 billion baht (approx. USD 1.1 billion) and is estimated to hit 60 billion (USD 1.8 billion) in the next 3 years. This growth is attributed to factors such as an increasing number of single-person households and the use of pets for companionship among the elderly. These examples show the growing global demand for professional grooming services as cats and dogs enter human life.

Market Restraints

-

The availability of do-it-yourself (DIY) grooming solutions allows pet owners to groom their pets at home, reducing the demand for professional services.

One of the most prominent factors hindering the growth of the professional pet grooming services market is the growing preference amongst pet owners for the availability of do-it-yourself (DIY) grooming facilities. The volatile economic environment we're in, it led many people to search for lower-cost substitutes for professional pet grooming, including bathing their furry friends on their own. For instance, a survey in the United Kingdom revealed that 24% of dog owners have turned to home grooming to mitigate expenses associated with pet care. In the United States, the trend toward DIY grooming is also significant. According to a 2024 study, 47% of pet owners did grooming tasks at home, 5% higher than in 2018. The shift is underscored further by the increasing investment in home grooming tools, with 81% of dog owners and 76% of cat owners quoting they own grooming equipment.

This global trend is reflected in the Indian market as well. According to an estimation, the pet grooming market of India will expand at a significant CAGR (Compound annual growth rate) from 2024-2032. A result of this growth is growing demand for grooming products and services, especially in densely populated urban areas where pet ownership levels are high. The growing trend of at-home grooming provides pet owners with a more pandemic-friendly way to save money on pet grooming, but it's a challenge for grooming pros. Such demand can lead to another problem because home grooming services are usually fairly cost-effective which can pose a threat to pet groomers that need to remain effective with their prices, and then there are also markets to be explored beyond professional grooming.

Market Opportunities

-

The expansion of mobile grooming services offers convenience to pet owners by providing on-demand grooming at their preferred locations, catering to busy lifestyles.

The pet grooming services market is experiencing a significant shift towards mobile grooming solutions, driven by the increasing demand for convenient and personalized pet care. Mobile grooming services offer pet owners the flexibility of professional grooming at their doorstep, catering to busy lifestyles and the growing humanization of pets. Recent numbers illustrate the trend. In 2024, about 9% of dog owners reported using mobile grooming services, highlighting a significant preference for these of these convenient options. Moreover, 30% of dog owners chose grooming parlors, highlighting a significant demand for professional grooming services. In addition, an impressive 84% of pet owners prioritized their dog's hygiene by bringing them at least once per year for a grooming session.

The rise in mobile grooming services can also be seen in the number of mobile pet care providers. In the United States, companies like Pooch Mobile, My Pet Mobile Vet, and Hollywood Mobile Grooming have emerged, delivering well-equipped mobile grooming and veterinary care facilities. This increase is driven by the rise in pet adoption numbers and the need for ease in pet care services. These are some of the major factors providing opportunities for the pet grooming services market. As pet owners increasingly prioritize convenience and individualized care, mobile grooming services are set to address this demand and continue thriving in the pet grooming industry.

Market Challenges

-

Economic uncertainties can lead pet owners to reduce spending on non-essential services like grooming, affecting market growth.

The rapidly evolving state of economics introduces hurdles for the pet grooming services market, impacting not only consumer spending patterns but also operational frameworks. During periods of economic downturn, pet owners often reassess discretionary expenses, leading to reduced spending on non-essential services like professional pet grooming. This shift can result in decreased appointment bookings and revenue for grooming businesses. The increasing number of people opting for DIY grooming solutions. The use of various home grooming kits and online resources has also allowed pet owners to do grooming services in-house, thus decreasing the demand for expensive services. This analytics was especially seen among price-sensitive customers looking for affordable options.

Additionally, the pet grooming industry is experiencing rising operational costs, including increased labour expenses and higher prices for grooming products. These cost pressures can lead businesses to raise service prices, which may deter budget-conscious customers. For example, major pet retailers in the UK are reporting lukewarm demand for accessories and treats, saying consumers are squeezing their budgets in a tough economy. Indeed, the consolidation of vet practices through private equity has been correlated with rising costs in the services provided for our pets. Such consolidation has the potential to reduce competition, which translates to higher prices for consumers, potentially impacting consumers’ willingness to spend on ancillary services, such as grooming.

Pet Grooming Services Market Segmentation Analysis

By Service Type

In 2023, the Massage/Spa & Others segment held the largest market share in the global pet grooming services market. That dominance can also be ascribed to the growing awareness of pet wellness and the benefits spa treatments provide to pets. Government figures reveal a trend towards premium pet services as owners shell out on treatments designed to improve pet's circulation and alleviate stress. The Massage/Spa segment's popularity is also driven by its ability to provide relaxation and health benefits, similar to those experienced by humans. With pet owners being better educated about the benefits of these services, demand is ongoing. This segment is also aided by the incorporation of e-commerce platforms, which enable pet owners to quickly schedule and manage grooming appointments online. This convenience, combined with the perceived health benefits, has solidified the Massage/Spa segment's position as a leader in the market.

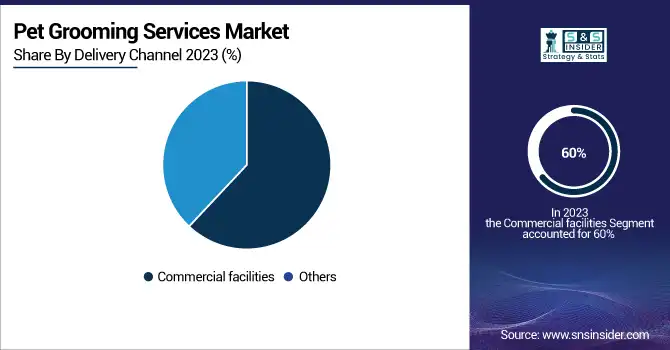

By Delivery Channel

In 2023, Commercial facilities held the largest share of the pet grooming services market because these facilities provided a wide range of services and were skilled and experienced in handling pets. These places are equipped with the necessary equipment and trained staff, providing a wide range of services from basic grooming to specialized treatments. Government data indicates that commercial facilities have seen significant investment in new service locations, contributing to their market dominance. Commercial facilities are also known to have club memberships with discounted pricing, making customers loyal. Their success hinges on the trust and dependency placed on these establishments for quality services. Commercial facilities are also appealing because they serve a wide variety of customer bases where many different services can be rendered. The combination of flexibility with online bookings has made commercial facilities the first choice for many Pet Parents.

By Pet Type

In 2023, dogs accounted for approximately 82% share of the global pet grooming services market. This dominance is largely due to the popularity of dogs as pets and the high demand for dog-specific grooming services such as haircuts, bathing, and nail clipping. Government statistics show dog owners are now willing to spend more on their pets. On the other hand, the dog grooming segment has the largest market share due to the diverse needs of dogs such as long-haired breeds that need regular grooming. Moreover, the increasing availability of things like mobile grooming for dogs helps grow this segment. In addition, dog owners tend to want more control than other types of pet owners, which is part of the reason why pet insurance and mobile grooming services have surged they offer convenience and flexibility for dog owners. As pet owners continue to view their dogs as integral family members, the demand for premium grooming services tailored to dogs is expected to remain high.

Pet Grooming Services Market Regional Insights

North America accounted for the largest share in 2023 within the pet grooming services market. Factors such as a well-established pet grooming industry, high pet expenditure, and rising consumer awareness about pet health and wellness in the region are the key driving forces behind this dominance. The American market especially has been a major driver amid government statistics showing a huge rise in spending on pets. The presence of leading providers of pet grooming service & a widespread penetration of premium pet services has also strengthened North America global market.

The Asia Pacific region is the region that is witnessing the fastest growth, which is attributed to an increase in the number of pet animals and spending on pet animals in countries such as China and Japan. This growth is driven by government initiatives promoting pet care and the growing impact of social media on pet expenditures. As increasing numbers of people in these countries consider pets as family members, the demand for first-class pet grooming services in these countries is also steadily rising. Additionally, the growth of the Asia Pacific region is also bolstered by the growing access of specialized pet grooming services such as mobile grooming services and spa treatments, that can cater to the diverse needs of pet owners across the region. The increase in Asia Pacific is particularly impressive, as the region has a large and growing middle class with greater disposable income available for pet spending. Moreover, the region's online shopping portals are contributing significantly to the accessibility of pet grooming services for customers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Pet Grooming Services Market Key Players

-

Royal Canin

-

KONG Company

-

Bissell Inc.

-

Virbac

-

Furry Land

-

Petco

-

PetSmart

-

The Groom Room (Pets at Home)

-

Earthbath

-

FURminator

-

Andis Company

-

Oster

-

TropiClean

-

Chris Christensen Systems

-

Pet Head

-

JW Pet Company

-

Four Paws

-

Hartz

-

ConairPRO Pet

Recent Developments in the Pet Grooming Services Industry

-

In April 2024, U.S.-based pet grooming service provider, Furry Land, announced the launch of its service in multiple new locations, further driving the personalized grooming services market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.33 Billion |

| Market Size by 2032 | USD 12.05 Billion |

| CAGR | CAGR of 7.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Massage/Spa & Others, Shear & Trimming) • By Pet Type (Dogs, Cats, Others) • By Delivery Channel (Commercial facilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Wahl Clipper Corporation, Royal Canin, KONG Company, Bissell Inc., Virbac, Bob Martin Petcare, Petco, PetSmart, The Groom Room (Pets at Home), Furry Land, Earthbath, FURminator, Andis Company, Oster, TropiClean, Chris Christensen Systems, Pet Head, JW Pet Company, Four Paws, Hartz, ConairPRO Pet. |