Welding Materials Market Report Scope & Overview:

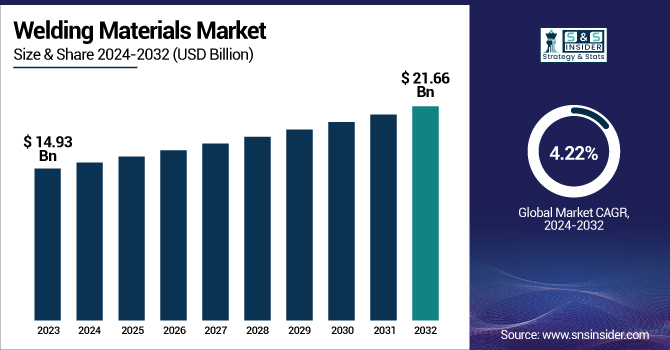

The Welding Materials Market was valued at USD 14.93 billion in 2023 and is expected to reach USD 21.66 billion by 2032, with a growing CAGR of 4.22% over the forecast period 2024-2032.

To Get more information on Welding Materials Market - Request Free Sample Report

This report offers a unique perspective on the Welding Materials Market by focusing on operational efficiency, sustainability, and innovation trends. It explores shifting consumption patterns and regional capacity utilization, alongside insights into supply chain resilience and disruption levels. The analysis also highlights the pace of technological adoption, particularly in automation and advanced welding solutions. Environmental compliance is assessed to reflect the industry's move toward greener practices. A notable addition is the Digital Integration Index, tracking the adoption of smart technologies in welding processes.

The U.S. welding materials market is projected to grow steadily from USD 2.43 billion in 2023 to USD 3.64 billion by 2032, reflecting a CAGR of 4.59%. This growth is driven by rising demand across construction, automotive, and manufacturing sectors. Continuous advancements in welding technologies and infrastructure development are further boosting market expansion.

Welding Materials Market Dynamics

Drivers

-

Rapid urbanization and infrastructure development, especially in emerging economies, are driving strong demand for welding materials in construction and related sectors.

The rising demand from the construction and infrastructure sectors is a significant driver of the welding materials market. This will generate massive investment opportunities in major infrastructure projects, including bridges, railways, pipelines, commercial and industrial buildings, particularly in developing countries such as India, China, and Brazil, where rapid urbanization and industrialization is witnessed. The second reason is the specific types of welding materials you use. As the trend of spending on smart cities, transportation networks, and energy infrastructure by governments accelerates, the consumption of welding electrodes, wires and gases continues to expand. The use of advanced welding techniques for complex structures is also positively influencing the high-performance materials demand. Also in large construction, robotic welding and automated welding are gaining preference, which underlines the need to improve efficiency and cost in labor. Over the next decade, the construction business is expected to grow steadily, which is driving new trends in this field, and optimal development of the welding materials market.

Restraint

-

Volatility in raw material prices disrupts cost stability and squeezes profit margins for welding material manufacturers.

Volatility in raw material prices poses a significant challenge to the welding materials market. Central inputs like steel, aluminum, copper and flux constituents can experience wild swings in prices owing to the disruption of supply chains, geopolitical concerns, trade policies and overall variation in global demand. As these raw materials constitute the basis for welding consumables including electrodes, wires, and rods, any variation in their cost bears a direct influence on the overall producers' production cost. This uncertainty creates challenges with long-term planning and pricing, making it hard for businesses to keep their profit margins steady. Smaller manufacturers, in particular, are under added pressure, since they lack the financial drag to absorb steep cost increases or bargain for better rates. Additionally, sudden increases in raw material prices can increase product prices and decrease customer demand, affecting competitiveness. As a result, volatility in raw material costs continue to be a major area of focus for stakeholders across the welding materials value chain.

Opportunities

-

Innovation in eco-friendly and high-strength welding materials is driven by the demand for sustainable, efficient, and high-performance solutions across industries.

The growing emphasis on sustainability and performance in industrial applications is driving innovation in eco-friendly and high-strength welding materials. The manufacturers are focusing more on the development of low-hydrogen electrodes and flux-cored wires to bring down harmful emissions and improve the quality of welds. Not only do these materials grow mechanical strength and coffee resistance, they reduced porosity and hydrogen give up affecting structural welding. Consumable electrodes, include tungsten electrodes in TIG welding, are growing in popularity due to their efficiency, minimal waste generation, and precision, particularly in high-spec sectors, such as aerospace and automotive. Moreover, greener options will become a fixture in the industry as regulations against environmental disdain and labor mismanagement become more increasingly enforced. Due to the requirements of end-users for more longevity, sustainability, and green, welding material producers are investing in R&D and creating products that comply with environmental goals while meeting the high-performance criteria. In the competitive welding materials market, this trend thus offers attractive avenues for innovation and differentiation.

Challenges

-

Technological disruption in welding demands constant innovation and investment, pressuring companies to upgrade materials and processes to remain competitive.

The welding materials market is significantly impacted by technological disruption, which necessitates continuous upgradation by industry players. Given that welding technology are evolving so fast, including laser welding, friction stir welding, and robotic automation, enterprises need to keep investing on the R&D to be competitive. These methods require high-performance welding materials that ensure greater precision, strength, and reliability. Consequently, manufacturers are compelled to innovate and diversify their product portfolio to address evolving requirements from end-use sectors, such as automotive, aerospace, and energy. In addition, the use of advanced technologies like AI, IoT and sensors in welding processes further deepens the necessity of having a digital transformation. Businesses that can't keep up with these developments will fall behind and lose market share to more adaptive rivals. The financial burden of this continuous cycle of innovation and adaptation is more felt by small and medium enterprises, which makes technological disruption a bane as well as a boon for the welding materials market.

Welding Materials Market Segmentation Analysis

By Type

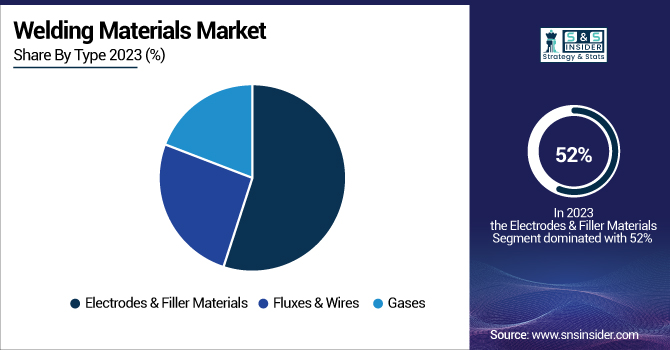

The electrodes & filler materials segment dominated with a market share of over 52% in 2023. This continues mainly because they have wide applications in major heavy industries such as construction, automotive, and shipbuilding. These materials are fundamental consumables in several welding processes, as they are the central element in forming robust metal joints. It is due to their ability to provide durability, reliability, and compatibility with a range of welding methods, be it manual or automated, that they find indispensable usage in the industrial and commercial applications. Further, adoption of numerous metals remains the key demand driver across multiple sectors, owing to versatility of metals. With industries also contributing to the high demand for these things as they invest in infrastructure and manufacturing, their number one position in the space remains cemented.

By Technology

The Arc welding segment dominated with a market share of over 38% in 2023, owing to its versatility, low cost, and high efficiency of working with different types and thicknesses of metals. By generating a highly focused heat through a high-intensity electric arc, it allows for deeper weld penetration and improved processing times. This is why arc welding is the best option for industries like construction, automotive, shipbuilding, and heavy equipment manufacturing. Its versatility to be used with manual or automated systems also enhances its attraction, allowing for variety in welding requirements. The adaptability of arc welding with various methods, such as MIG, TIG, and stick welding, also makes it useful in many applications. These benefits together have made arc welding the most dominant and dependable technology in the world's welding materials sector.

By End-Use Industry

The heavy industries segment dominated with a market share of over 42% in 2023, due to the wide and constant demand across major sectors including shipbuilding, oil & gas, power generation, and general manufacturing. Industries with high reliance on welding materials for large-scale fabrication, structural assembly, and maintenance of massive infrastructure. Due to the high complexity and operational scale, there is the real need for premium and long-lasting welding consumables that can survive harsh conditions while also providing structural integrity. In addition, demand is further inflamed by activities of renewing the old infrastructure, retrofitting of partially used facilities and creating new industrial buildings.

Welding Materials Market Regional Outlook

Asia-Pacific region dominated with a market share of over 42% in 2023, due to its strong industrial base and rapid urbanization. This economy is growing rapidly in countries like China, India, Japan, and South Korea through the construction, infrastructure and shipbuilding, and automotive manufacturing. The region's growing manufacturing sector and government initiatives promoting industrialization result in substantial demand for welding materials. Moreover, the region's dominance is further backed by the presence of low-cost labor, raw materials availability, and technological developments in welding processes. The competitive edge of this industry is furthermore strengthened due to the increasing number of global as well as local welding material manufacturers. These factors contribute to Asia-Pacific being the largest region in the welding materials market.

North America is the fastest-growing region in the welding materials market, fueled by technological innovation and rising demand from key industries such as construction, automotive, oil & gas, and aerospace. Industry is evolving rapidly due to advanced welding techniques taking place such as robotic and automated welding systems which is upgrading industrial operations and productivity. As infrastructure rehabilitation, renewable energy projects, and modernized manufacturing facilities become more prevalent, more materials will be used. Additionally, the market is gaining traction as the government is investing, and the private sector initiatives are also being undertaken, which enhances the local production capabilities. North America is projected to experience consistent growth in high-performance welding materials in response to the increasing need for efficiency and precision across various industries.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Welding Materials Market:

-

Colfax Corporation (Welding consumables, equipment, and automation solutions)

-

Air Liquide S.A. (Industrial gases for welding and cutting applications)

-

Air Products & Chemicals (Shielding gases, welding gas mixtures)

-

Illinois Tool Works (MIG/TIG welding wires, electrodes, consumables)

-

Linde PLC (Shielding gases, welding accessories, consumables)

-

Lincoln Electric Holdings (Welding electrodes, wires, fluxes, power sources)

-

Tianjin Bridge Welding Materials Group (Welding electrodes, flux-cored wires)

-

Kobe Steel (Covered electrodes, solid wires, flux-cored wires)

-

ESAB (Part of Colfax) (Electrodes, wires, welding fluxes, gas equipment)

-

Fronius International GmbH (Welding wires, filler materials, welding systems)

-

Böhler Welding (voestalpine AG) (Filler metals, TIG/MIG/MAG wires, rods)

-

KISWEL Co., Ltd. (Flux-cored wires, MIG/TIG wires, electrodes)

-

Ador Welding Ltd. (Welding electrodes, MIG/MAG wires, fluxes)

-

WeldWire Company, Inc. (Stainless steel welding wire, TIG/MIG wire)

-

Hyundai Welding Co., Ltd. (SMAW electrodes, GMAW wires, SAW wires & flux)

-

Zika Industries Ltd. (Welding rods, MIG/TIG wires, brazing alloys)

-

Sandvik Materials Technology (Alleima) (Stainless welding wire, strip electrodes)

-

The Harris Products Group (Brazing alloys, welding alloys, fluxes)

-

ITW Welding (Hobart, Miller brands) (Welding wires, power sources, consumables)

-

China Welding Material Company (CWMC) (Welding electrodes, wires, fluxes)

Suppliers for (stick electrodes, MIG wires, flux-cored wires, welding equipment, and automation systems) On Welding Materials Market

-

Lincoln Electric

-

ESAB

-

voestalpine Böhler Welding

-

Kobe Steel, Ltd.

-

Air Liquide

-

Illinois Tool Works Inc. (ITW)

-

Tianjin Golden Bridge Welding Materials Group

-

Hyundai Welding Co., Ltd.

-

Ador Welding Ltd.

-

Nippon Steel Welding & Engineering Co., Ltd.

Recent Developments

-

In August 2023: Lincoln Electric formed a strategic alliance with software company Authentise to incorporate digital solutions that enable real-time tracking and quality assurance in welding operations, enhancing efficiency and transparency for industrial clients.

-

In March 2023: ESAB launched the Rebel EMP 215ic, a versatile and portable multi-process welder engineered for user-friendly operation across both industrial environments and smaller workshops, meeting the demand for flexible, high-performance welding tools.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.93 Billion |

| Market Size by 2032 | USD 21.66 Billion |

| CAGR | CAGR of 4.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Electrodes & Filler Materials, Fluxes & Wires, Gases) •By Technology (Arc Welding, Resistance Welding, Oxy-Fuel Welding, Others) •By End-Use Industry (Transportation, Building & Construction, Heavy Industries, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Colfax Corporation, Air Liquide S.A., Air Products & Chemicals, Illinois Tool Works, Linde PLC, Lincoln Electric Holdings, Tianjin Bridge Welding Materials Group, Kobe Steel, ESAB, Fronius International GmbH, Böhler Welding (voestalpine AG), KISWEL Co., Ltd., Ador Welding Ltd., WeldWire Company, Inc., Hyundai Welding Co., Ltd., Zika Industries Ltd., Sandvik Materials Technology (Alleima), The Harris Products Group, ITW Welding, China Welding Material Company (CWMC). |