Cartoning Machines Market Report Scope & Overview:

To get more information on Cartoning Machines Market - Request Free Sample Report

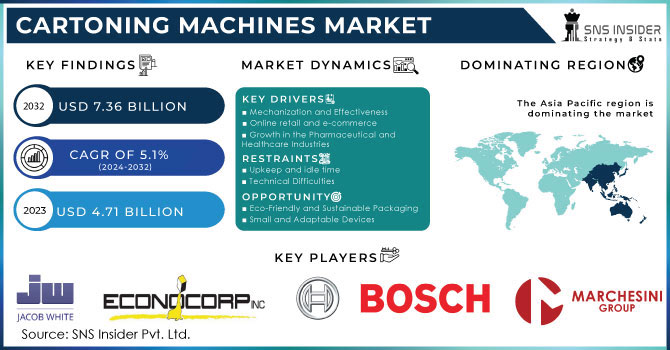

The Cartoning Machines Market size was estimated at USD 3.95 billion in 2023 and is expected to reach USD 5.83 billion By 2032 at a CAGR of 4.42% during the forecast period of 2024-2032. This report includes the automation of carton forming, filling, and sealing by retail, commercial, and industrial use of food, pharmaceutical, and other consumer goods. Market growth is being propelled forward by rising mechanization, expanding e-commerce, sustainability pressures, and regulatory compliance, particularly with initiatives like the EU Green Deal. Organizations are investing in machines that consume less energy and also packaging solutions that will be biodegradable. This connectedness through advanced technologies like robotics, AI, IoT, and digital twins, improves the performance of machinery. Continuous R&D is aimed at more versatile, high-speed, and eco-friendly cartoning solutions to cater to the ever-evolving needs of the industry.

MARKET DYNAMICS

DRIVERS

Packaged goods are gaining traction across sectors such as food, pharmaceuticals, and consumer goods, which is a key driving force for cartoning machines.

Packaging is the key to securely transporting or storing product without contamination or damage. Additionally, it plays an important role in branding as eye-catching, useful packaging can also attract consumers and enhance the visibility of products in highly sought after environments. Packaging is also important in controlling freshness and shelf life to meet regulatory requirements and consumer expectations, which is especially critical for food and pharmaceuticals. Consumers are turning to convenience and ready-to-use options, leaving packaged goods to take center stage. The increase in demand for products sold in different types of packaging has created a need for high-speed cartoning machines that can run at much greater speeds to meet increasing production demands, thus propelling the market growth.

RESTRAINT

The cost of purchase and installation of high-end cartoning machines is very high causing a major hurdle for businesses to invest in cartoning machines, especially, small and medium-scale enterprises (SMEs).

These machines have advanced technology and precision as well as the automation of the production process, which is why they have a high purchase price. This cost can, however, prove prohibitory to SMEs who usually operate with tighter budgets and less capital to invest in such equipment. Moreover, the setup and integration of such machines in existing production lines can entail more costs in terms of the cost of training workers, upgrading existing facilities, and compliance with industry standards. The bigger companies can bear the costs, but the latter will probably not be able to justify the expense without the prospect of speedy payback. This high introductory investment therefore discourages the uptake of cartoning machines and subsequently the operational automation and growth by numerous packaging sector businesses.

OPPORTUNITY

The increasing industrialization and urbanization in emerging economies are fueling the growth of the global automated cartoning machines market

In regions such as Asia-Pacific, Latin America, and parts of Africa, emerging markets are often experiencing rapid industrialization and urbanization. An ongoing transition you can see from all sectors including food and beverages, pharmaceuticals, and consumer product goods is transforming to power up the demand for packaged goods at a fast pace. With the modernization of several industries in these regions, the demand for cost-effective and efficient packing solutions is continuously expanding. A cartoning machine is an automatic carton-forming device that can create cartons for packages, goods, or products; cartoning machines provide many benefits, including increased productivity, and higher output rates, repeatability, and lower labor costs may also be achieved, making automated cartoning machines be more attractive for some businesses needing to increase turnover. Besides, the increasing adoption of automation follows the accomplishment of advanced manufacturing technology. Thus, increasing consumer demand coupled with efficient operations creates considerable growth opportunities for the cartoning machine sector in emerging market space.

CHALLENGES

Supply chain disruptions and fluctuating demand can lead to shortages of raw materials, causing delays in cartoning machine production and longer lead times.

Long lead times between one supplier and another could take away from the production of cartoning machines, as the availability of raw materials and important components is vital in the production of cartoning machines. The shortage of microchips and raw materials like metals, plastics, or electronic components that could paralyze the manufacturing process, postpone production, and expand lead times. There are a multitude of reasons, from supply chain disruptions to global trade uncertainty to demand for specific materials. This hampers the ability of manufacturers to meet the demand of the customer leading to a production bottleneck and stuck deliveries. This has a direct effect on the financial performance of the manufacturers along with the growth of the market. Companies may respond to longer lead times and limited material availability by increasing prices, leading to an erosion in their competitive position.

SEGMENT ANALYSIS

By Type

The Vertical/Top-Load Cartoning Machines segment captured over 62% of the market share in 2023 due to their ubiquity across food and beverage, pharmaceutical, and cosmetic segments. They are quite popular due to their effectiveness in managing products of different dimensions and shapes. These machines are most commonly used in rapid packaging on high-production lines. Top Load type arrangement makes for easy in-system production integration and is best suited for a top-load loading-based product running environment. This multi-purpose and fast efficiency make vertical/top-load cartoning machines highly conceiving for those businesses that are in pursuit of dependable, high-performance packaging solutions, thus and their stronghold in the market.

By End-Use Industry

The Food & Beverage segment captured over 34% of the market share in 2023. This market share is driven largely due to the increasing demand for automated packaging solutions to boost production capacities in the segment. The growing consumer inclination for easy handling and good quality is influencing food and beverage manufacturers to fulfill their needs through automated cartoning machines, which assure quicker packaging, quality, and safety. Additionally, the increased emphasis on hygiene and sustainability in food packaging is facilitating the use of sophisticated technology that minimizes wastage and enhances shelf life while complying with stringent regulatory standards.

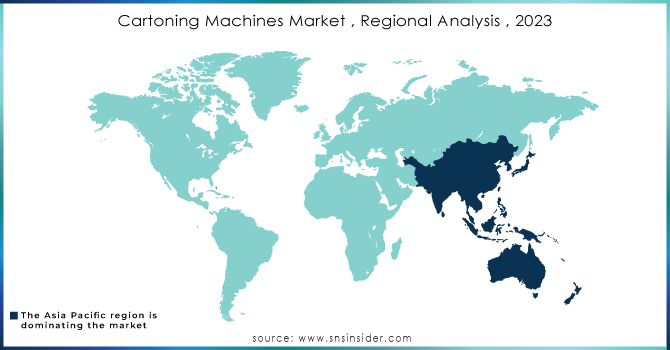

KEY REGIONAL ANALYSIS

The Asia-Pacific region dominated with a market share of over 42% in 2023, driven by rooted manufacturing infrastructure and the presence of many leading packaging companies. The high industrial base of the region and high growth of the key industries such as food & beverages, pharmaceuticals, and consumer goods in the region have augmented the demand for automated packaging solutions. The demand for high-speed and advanced cartoning machines is growing as the company focuses on improving efficiency while reducing labor costs and fulfilling the needs of consumer demand. The grounds for this growing demand encompass the fact that countries such as China, Japan, and India are a cornerstone of this growth as they utilize cheaper production and are home to a vast consumer market.

North America is growing as a result of expanding the new-age packaged technology. As more companies seek ways to reduce their environmental impact, the adoption of advanced cartoning machines that feature sustainable designs has become a priority as well, leading to innovations during the cartoning process. Regional stakeholders are innovating along the technology front to meet consumer demand for more flexible and tailor-made packaging. The volume of shipments has increased, driven by e-commerce surging and, with this demand for fast, high-speed packaging solutions. Such factors coupled with the presence of prominent manufacturers have made North America a driving point for the growth of the cartoning machine sector on account of the growing investments in automation and technological updates.

Need any customization research on Cartoning Machines Market - Enquiry Now

Some of the major key players in the Cartoning Machines Market

-

Marchesini Group S.p.A. (Cartoning machines, packaging lines)

-

Jacob White Packaging Ltd. (Cartoners, case packers, end-of-line systems)

-

Robert Bosch LLC (Horizontal cartoning machines, cartoning systems)

-

Econocorp Inc. (Cartoning machines, automated packaging solutions)

-

Langley Holdings PLC (Cartoning and packaging machines)

-

Bivans Corporation (Cartoning systems, automatic carton erectors)

-

PMR Packaging Inc. (Automatic cartoners, packaging equipment)

-

Packaging Equipment Inc. (Cartoning machines, packaging machinery)

-

Mpac Group plc (Cartoning systems, packaging equipment)

-

IWK Verpackungstechnik GmbH (Cartoning machines, filling and sealing systems)

-

Tetra Pak (Cartoning and packaging solutions)

-

Omori Machinery Co., Ltd. (Cartoning machines, packaging equipment)

-

Krones AG (Cartoning systems, packaging machinery)

-

Uflex Limited (Cartoning machines, packaging solutions)

-

Smurfit Kappa (Carton packaging machinery)

-

Sampack India Pvt. Ltd. (Cartoning machines, packaging solutions)

-

ACG Worldwide (Cartoning systems, pharma packaging solutions)

-

ProMach Inc. (Cartoning machines, packaging automation)

-

Fosber Group (Cartoning and corrugated packaging machinery)

-

WestRock Company (Cartoning systems, packaging machinery)

Suppliers for (Cutting-edge technology, including advanced automation, robotics, and AI to improve efficiency, speed, and precision in cartoning processes) on Cartoning Machines Market

-

Marchesini Group S.p.A.

-

Jacob White Packaging Ltd.

-

Robert Bosch LLC

-

Econocorp Inc.

-

Langley Holdings PLC

-

Bivans Corporation

-

PMR Packaging Inc.

-

Packaging Equipment Inc.

-

Mpac Group plc

-

IWK Verpackungstechnik GmbH

RECENT DEVELOPMENT

In October 2024: Econocorp unveiled its newest secondary packaging solution, the Spartan M-Pro carton, at the PACK EXPO International 2024.

In April 2024: IWK Packaging Systems introduced the CH 4, a modular, horizontal cartoning machine designed to meet the growing demand for packaging delicate pharmaceutical items like pre-filled syringes and vials. The high-speed system also reduces energy consumption by over 20%.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 3.95 billion |

|

Market Size by 2032 |

USD 5.83 billion |

|

CAGR |

CAGR of 4.42% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Vertical/Top-Load Cartoning Machine, Horizontal/End-Load Cartoning Machine) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Marchesini Group S.p.A., Jacob White Packaging Ltd., Robert Bosch LLC, Econocorp Inc., Langley Holdings PLC, Bivans Corporation, PMR Packaging Inc., Packaging Equipment Inc., Mpac Group plc, IWK Verpackungstechnik GmbH, Tetra Pak, Omori Machinery Co., Ltd., Krones AG, Uflex Limited, Smurfit Kappa, Sampack India Pvt. Ltd., ACG Worldwide, ProMach Inc., Fosber Group, WestRock Company. |

|

Key Drivers |

• Increasing consumer inclination towards packaged goods in sectors such as food, pharmaceuticals, and consumer products is creating necessity for cartoning machines to ensure product safety, branding, and lifestyle. |

|

RESTRAINTS |

• While large business units are investing their capital in automation processes and increasing the production level, the lack of a high upfront investment in advanced cartoning machines acts as a barrier to investment for SMEs. |