Wireless Health Market Report Scope & Overview:

Get more information on Wireless Health Market - Request Sample Report

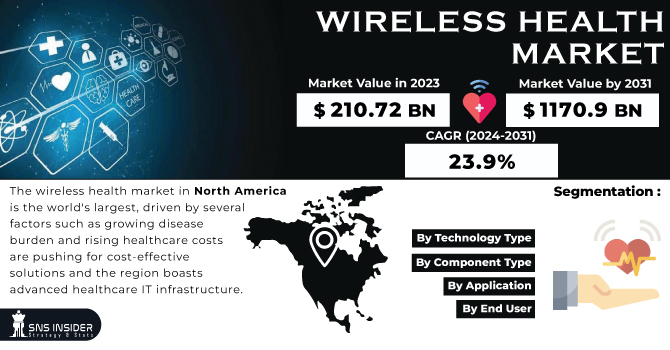

The Wireless Health Market Size was valued at USD 198.7 Billion in 2023 and is expected to reach USD 896.3 Billion by 2032, growing at a CAGR of 18.2% over the forecast period 2024-2032.

The wireless health market report provides key statistics and trends on wireless health adoption, including remote patient monitoring (RPM), telehealth, and wearable wireless technologies. The report analyzes wireless medical device shipments and 5G, IoT, and Cloud integration trends with wireless medical devices. It addresses RPM for chronic disease management expansion, evaluates regulations (HIPAA, GDPR, FDA), and identifies cybersecurity risks. In addition, it discusses trends in market revenue rates and spending, with an eye toward investments in hospitals, and other public and private sector spending. These insights provide a fact-based perspective on wireless healthcare innovation, growth and regulatory dynamics. High growth in the wireless health market is attributed to the growing digital health solutions infrastructure supported by several government initiatives and investments.

Market Dynamics

Driver

-

Advancements in wireless communication technology, Innovations in wireless tech enhance healthcare delivery and patient monitoring.

Advancements in wireless communication technology are significantly transforming healthcare delivery, enhancing patient monitoring, and streamlining operations. The healthcare sector saw significant impact from the adoption of 5G technologies, to enable seamless real-time data flow. It enhances remote patient monitoring, telehealth consultation, and hospital emergency management, driving a greater demand for 5G- enabled healthcare products. WPAN technologies have become increasingly popular due to low-cost, ease-to-use short-range connectivity such as Bluetooth and RFID. Widespread acceptance of wireless communication technologies in health care have led to higher levels of patient care, more efficient clinical workflows, and improved operational efficacy. They are foundational technologies used in electronic health record (EHR) systems, telemedicine, asset tracking, patient monitoring and medical device interoperability. Wireless communication technologies are revolutionizing the healthcare sector by facilitating the exchange of data and information, which lays the foundation for more personalized, effective, and affordable healthcare delivery.

Restraints:

-

Data Security and Privacy Concerns, transmitting sensitive patient data wirelessly raises security and privacy issues.

The rapid adoption of wireless health technologies has heightened concerns over data security and privacy. A 2023 survey revealed that 65% of respondents were hesitant to use wireless health devices due to privacy concerns. This apprehension is not unfounded 2021, data breaches impacting the healthcare industry impacted more than 45 million peoples, demonstrating just how vulnerable are these systems. Also, 67% of smartphone users are concerned with data security and privacy on data on their smartphone and 48% of smartwatch/fitness tracker users have the same concern according to their 2023 survey. Such figures underscore the urgent necessity of strong data protection mechanisms in wireless health devices to build and maintain user trust.

Opportunities:

-

Integration of Artificial Intelligence, combining AI with wireless health systems offers personalized care and predictive analytics.

The integration of Artificial Intelligence (AI) into wireless health systems presents significant opportunities for enhancing patient care and diagnostic accuracy. Recent breakthroughs show how AI can shift healthcare delivery. An example is the Google Health Acoustic Representations (HeAR) model, model analyzes sounds like coughs via smartphone microphones to detect diseases such as tuberculosis. The AI-based method, trained on 300 million sound clips including 100 million cough sounds, aims to provide fast and accurate diagnoses, especially in areas with limited access to health care.

Similarly, Movano's Evie Ring incorporates EvieAI, a chatbot trained on over 100,000 peer-reviewed medical journals. This AI delivers credible health information supported by data from trusted sources such as the Mayo Clinic and Harvard, with a 99% accuracy rate. Without giving specific diagnosis, the chatbot provides guidance which comes to the users with a new set of medical information on monthly basis. In addition, KardiaMobile 6L by AliveCor is the first six-lead personal electrocardiogram (ECG) device with FDA clearance, allowing the recording of medical-grade ECGs with a smartphone. This gadget helps identify atrial fibrillation and normal sinus rhythm with an AI-like Sensor that alerts heart conditions much before time.

Challenges:

-

Interoperability Issues, ensuring seamless data exchange between diverse wireless health devices remains a significant hurdle.

The effectiveness of wireless health devices relies heavily on interoperability, and its challenges are major impediments. A 2021 study revealed that 40% of users faced difficulties syncing data between various health devices and applications, underscoring the fragmentation in data formats and communication protocols. This lack of standardization results in imperfect integration, leading to potential misinterpretations and errors in patient care. In order to solve these problems, the ISO/IEEE 11073 standards family has been introduced, with the goal of ensuring uniform communication protocols for medical devices. However, despite these efforts, achieving universal interoperability remains a significant hurdle necessitating ongoing collaboration among manufacturers, healthcare facilities and regulators to ensure devices can communicate effectively and securely.

Segmentation Analysis

By Product

The wireless health market is led by Wireless Personal Area Networks (WPAN) technologies, which represented 37% of the market in 2023. The large market share can be attributed to the affordable and easy-to-use WPAN solution. WPAN technologies such as Bluetooth and RFID provide seamless connectivity over short distances, which makes them suitable for healthcare environments such as hospitals, clinics, and homecare. Government initiatives further complement the rise of WPAN in wireless health. The Advancing American Kidney Health initiative, introduced by the U.S. Department of Health and Human Services (HHS) in 2024, encourages the use of wearable devices and WPAN technologies for the remote monitoring of kidney patients. The goal of this program is to enhance patient outcomes and lower costs using wireless health solutions.

The rising ease of integration of WPAN into different types of gadgets is additionally expected to propel the WPAN phase through the forecast period. In India, a recent report published by the Indian Ministry of Electronics and Information Technology predicts that the number of IoT devices in Indian healthcare will amount to 50 million by the year 2025, with a significant portion utilizing WPAN technologies for data transmission and device connectivity.

By Component

The software components segment dominated the market in 2023, with 39% market revenue share. The increasing need for complex health care applications, data analytics platforms, and interoperable software solutions that underpin wireless health systems has fuelled this dominance. Wireless health components have benefited extensively from government initiatives. As an illustration, the Digital Europe Programme of the European Commission, which commenced in 2024, had a budget of €7.5 billion to foster advanced digital skills and deployment of digital technologies, particularly healthcare software solutions. This has led to unprecedented investment in innovation like AI for diagnostics and predictive analytics for patient care.

In the United States, the Office of the National Coordinator for Health Information Technology (ONC) reported that as of 2024, 96% of hospitals and 78% of office-based physicians have adopted certified electronic health record (EHR) technology. The sizable portion of this segment can be attributed to the high EHR adoption rate that has created a large ecosystem for software components that augment and link with EHR systems.

By Application

In 2023, patient-specific applications held 54% of the market revenue, highlighting the growing focus on personalized healthcare solutions. The increasing requirement for remote patient monitoring, chronic disease management, and personalized health tracking applications greatly contributes to this substantial market share. This segment has witnessed substantial growth on account of government support for patient-centric healthcare. In 2024 in Canada, Health Canada announced the launch of the "Innovative Solutions Canada" program with CAD 100 million to fund the creation of digital health solutions tailored to patients. It's sparked innovation in things like AI-powered symptom checkers and personalized medication management apps. Additionally, in 2024, CMS broadened reimbursement for remote patient monitoring services, now including patient- or device-specific applications. This change in policy is encouraging healthcare providers to use wireless health solutions customized according to patient needs, thereby driving the segment's dominant position in the market.

By End Use

The wireless health market was dominated by the patients/individuals end use segment in 2023, due to the rising trend towards consumer-oriented healthcare and increasing usage of personal health measurement devices. This is reinforced by governmental policies advocating for patient empowerment and active self-management of health14. In the UK, National Health Service (NHS) has released its "Digital First" strategy investing £4.5 billion in 2024 to develop and fund the use of digital health tools for patients. As a result, the number of people using health apps and wearable devices has increased, increasing the market share of this segment. For example, the Australian Digital Health Agency reports that by 2024, more than 90% of Australians have a My Health Record, a digital health record system that provides access to and management of health information for individuals. The high adoption rate could be attributed to the growing trend of patients opting for an active role in their healthcare decision making, thus fuelling the dominance of the patients/individuals end use segment.

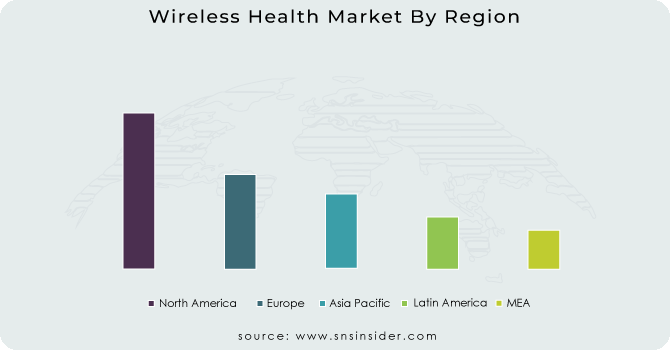

Regional Analysis

The wireless health market in North America accounted for about 36% of the global market share in 2023. The region's leadership in this area is a result of its sophisticated healthcare infrastructure, widespread acceptance of digital health technologies, and supportive government policies. According to the U.S. Department of Health and Human Services, the percentage of hospitals in the country that had implemented telehealth solutions for more than a year increased to 76% in 2024 from 61% in 2023. This rapid adoption has been further accelerated by the FCC's USD 198 million investment in the Connected Care Pilot Program, which aims to expand telehealth services across the nation.

On the other hand, Asia-Pacific region is growing at highest CAGR in forecast period of 2024 to 2032. The rapid growth of world health apps is propelled by increased smartphone penetration, improving internet infrastructure, and government initiatives for the digitization of healthcare systems. In India, the National Digital Health Mission, launched in 2024, aims to create a comprehensive digital health ecosystem, with a target of connecting 500,000 health centers by 2025. Similarly, China's "Internet Plus Healthcare" initiative has resulted in the rapid proliferation of wireless health solutions in China, with 72% of public hospitals reporting online consultation services, according to the Chinese National Health Commission, by the end of 2024.

Need any customization research on Wireless Health Market - Enquiry Now

Key Players

Key Service Providers/Manufacturers

-

Oura Health: Oura Ring 3, Oura Ring 4

-

Withings: BPM Core, U-Scan

-

Polar Electro: Polar Grit X Pro, Polar Vantage V3

-

Cadi Scientific: ThermoSensor, Cadi SmartSense RFID Infant Safety System

-

HealthHero: Virtual GP Service, Disease Risk Evaluation Tool

-

Fitbit (Google LLC): Fitbit Charge 5, Fitbit Sense 2

-

Apple Inc.: Apple Watch Series 8, Apple Watch SE

-

Garmin Ltd.: Garmin Forerunner 955, Garmin Venu 2 Plus

-

Samsung Electronics Co., Ltd.: Samsung Galaxy Watch 5, Samsung Galaxy Fit 2

-

Xiaomi Corporation: Mi Smart Band 7, Mi Watch Revolve Active

Users:

-

Mayo Clinic

-

Cleveland Clinic

-

Johns Hopkins Hospital

-

Massachusetts General Hospital

-

Singapore General Hospital

-

Tan Tock Seng Hospital

-

Prince Court Medical Centre

-

Thomson Medical Centre

Recent Developments

-

In November 2024, Philips Healthcare (Koninklijke Philips N.V.) introduced a new line of AI-powered wireless patient monitoring devices, which received FDA clearance for use in both hospital and home care settings.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 198.7 Billion |

| Market Size by 2032 | USD 896.3 Billion |

| CAGR | CAGR of 18.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (WLAN/ Wi-Fi, WPAN, WiMAX, WWAN) • By Component (Hardware, Software, Services) • By Application (Patient-specific, Physiological monitoring, Patient communication, Provider/Payer-specific) • By End Use (Providers, Payers, Patients/Individuals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oura Health, Withings, Polar Electro, Cadi Scientific, HealthHero, Fitbit (Google LLC), Apple Inc., Garmin Ltd., Samsung Electronics Co., Ltd., Xiaomi Corporation |