X-Ray Irradiation Market Report Scope & Overview:

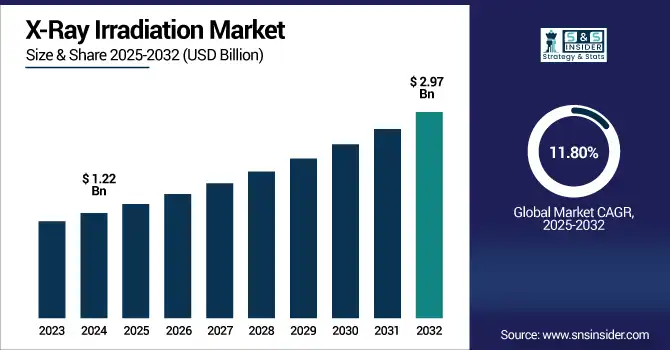

The X-ray irradiation market size was valued at USD 1.22 billion in 2024 and is expected to reach USD 2.97 billion by 2032, growing at a CAGR of 11.80% over 2025-2032.

To Get more information on X-RAY IRRADIATION MARKET- Request Free Sample Report

The X-ray irradiation market growth is driven by the growing need for non-isotopic sterilization in medical, pharmaceuticals, food, and electronics. Prominent factors responsible for this trend are the global shift in gamma-based technologies to X-ray and the accompanying benefits of improved safety, cost-effectiveness, and simplicity of logistics. With the growing need for medical device and pharmaceutical sterilization, manufacturers are ramping up capacity and purchasing large capacity X-ray systems. R&D activity directed towards reducing system efficiency, dose uniformity, and thermal management is also contributing to market development.

In May 2025, Philips launched the RADIQAL trial, a multinational clinical study enrolling 824 coronary patients across Spain, the Czech Republic, Denmark, and the U.S.

For instance, research work on compact X-ray sources and AI-based control platforms is highlighted. Regulatory support, with fast approvals for X-ray sterilization in clinical and industrial applications, will also boost market growth. Furthermore, raising consciousness of blood safety & food decontamination is broadening applications that directly impact X-ray irradiation market growth, X-ray irradiation market share, and X-ray irradiation market.

In May 2025, Sterigenics (a Sotera Health company) announced the expansion of its Haw River, North Carolina, campus with a new high-throughput X-ray sterilization facility, scheduled to open late 2025.

Market Dynamics:

Drivers:

-

Rising Demand for Non-Radioactive, High-Precision Sterilization Technologies Propels Market Growth

The X-Ray Irradiation market growth is the demand for a non-radioactive and efficient method of sterilization in an array of healthcare, pharmaceutical, and food processing applications. Environmental and regulatory pressures are driving a move away from traditional gamma irradiation with radioactive isotopes like Cobalt-60. This change is generating interest in X-Ray systems, which are safer to manage, more compatible with facility operations, and sometimes less expensive. The World Health Organization and FDA are focusing more on the sterility assurance of single-use devices, driving the requirement for an ever-larger number of products to go through in-line X-ray inspection by a validated process.

Furthermore, investments into sophisticated system designs – e.g., dual beam configurations and energy effective dose control – contribute to improved throughput and efficiency. Companies such as IBA and E-BEAM Services are also increasing their R&D investment in modular, automated X-ray platforms. Such a timeline should underpin a strong demand trend given that more than 60% of SSSI-capable facilities are expected to upgrade to non-radioactive-based technologies by 2027, according to industry sources. Robust, supply-side investments, increasing R&D ventures, and accelerating regulatory approval timelines are together driving growth in the X-ray irradiation market and broadening the scope over industries.

Restraints:

-

High Initial Costs and Infrastructure Complexity Impede Market Growth

The X-ray irradiation market growth is being impeded by high initial investment costs and intricate infrastructure. While some x-ray-based devices may be compact and preformatted, systems that irradiate with x-rays typically require heavy shielding, power, and exhaust system retrofits to accommodate high throughput. Industrial levels of protection can be achieved by X-ray-only systems, but installation costs are greater than USD 5 million per facility, expensive for a mid-size manufacturer or low-income healthcare system. Then there is the requirement for specialized workforce training to safely operate the systems, which increases the length of the onboarding process.

The adoption of X-ray irradiation has been inconsistent in countries with limited regulatory pathways or funding availability, such as some parts of Southeast Asia or Latin America. Furthermore, a few service providers provide maintenance and validation support that increases the operational overhead. All of these considerations combine to limit the more widespread use of X-ray systems even as market demand continues to increase. Logistics bottlenecks involving critical parts such as high-voltage generators and cooling systems are also holding back roll-outs, so as to creating a brake on growth potential.

Segmentation Analysis:

By Application

The X-ray irradiation market was led by medical devices with a share of 35.2% in 2024. The production globally of disposable and implantable medical devices, like catheters, surgical kits, and orthopedic implants, has strongly urged the demand for validated sterilization processes. Regulatory authorities such as the FDA and EU MDR demand high sterility assurance levels (SAL), for which X-ray is a perfect tool offering high penetration and reliable dose control without utilizing radioactive isotopes. Its decline is because of safety and environmental reasons, the move away from ethylene oxide mess is also driving growth in this market.

The application of blood & tissue irradiation will see the fastest growth owing to increased blood transfusion procedures and the surging demand to prevent the TA-GvHD. Hospitals and blood banks are purchasing purpose-built X-ray irradiators as safer, easier-to-manage alternatives to gamma systems. Guidelines issued by the AABB and the WHO endorsing irradiation of high-risk patients also support growth.

By Capacity

Large systems held the largest share of the X-ray irradiation market by capacity in 2024, representing 41.7% of the overall total. Such systems are popular for high-throughput sterilization service providers and pharmaceutical/medical device manufacturers to precisely perform bulk sterilization. Rapidly growing numbers of contract manufacturing centers and central sterilization services have resulted in extensive use of high-capacity X-ray infrastructure, with North America and Europe particularly prominent in this domain.

Mobile/portable units are the fastest growing capacity segment on the basis of demand from field hospitals, military medical units, and remote diagnostic labs. They are portable, easy to be set-up, and applicable for low-infrastructure settings where standard sterilization processes are not possible. There are also growing number of humanitarian and rural health programs that have adopted them which has helped market growth.

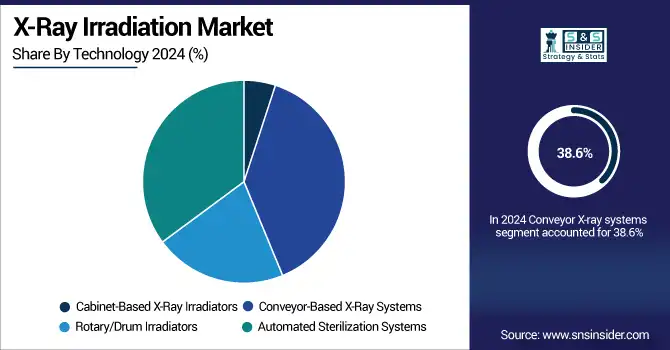

By Technology

Conveyor X-ray systems were the dominant technology segment, accounting for 38.6% of the global market in 2024, on account of their scalability and high throughput. Such systems are preferred for continuous sterilizing operations and are characterized by their capacity for processing large volumes without the need for substantial human interaction. In commercial installations, their compatibility with automation and their energy efficiency make them even more desirable.

Automated sterilization systems as the fastest growing technology segment, and the shift from conventional sterilization methods to digital and AI-based sterilization is expected to drive market growth. Such systems provide real-time monitoring, dose tracking, and predictive maintenance, thus minimising any risk of human error and meeting any regulations. This segment is being driven by strong adoption in pharmaceutical CDMOs and high-volume medical device manufacturers.

By End-User

The pharmaceutical & biotechnology companies accounted for the largest potential market share of 33.8% in 2024. The growth of biologics, sterile injectables, and vaccines, particularly post-COVID, is fueling the demand for proven, residue-free sterilization options such as X-ray. The capability of sterilizing such heat-sensitive materials without loss of efficacy underscores the relevance to pharmaceutical applications of X-rays.

Blood banks & transfusion centers are the fastest-growing end-user segment. Increased incidence of chronic disease and surgery procedures involving blood transfusion is also contributing to the requirement for a safe blood supply. Currently, to reduce the regulatory difficulty, safety and installation, and maintenance issues, X-ray irradiation systems are now replacing the current gamma irradiators in those facilities.

Regional Analysis:

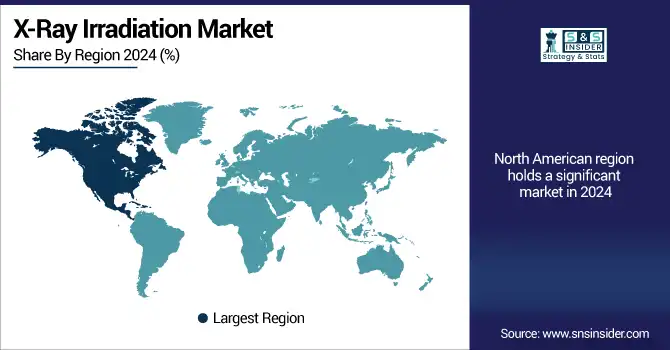

North America led the X-ray irradiation market in 2024. The region has a well-established base of advanced healthcare infrastructure, high adoption of non-radioactive sterilization, and the presence of a large number of pharmaceutical manufacturing companies.

The U.S. X-ray irradiation market size was valued at USD 0.45 billion in 2024 and is expected to reach USD 1.08 billion by 2032, growing at a CAGR of 11.47% over 2025-2032. The US dominates the region and has a regional share of more than 60%, spurred by players such as Sterigenics expanding their facilities at a breakneck pace and growing FDA support for X-ray-based sterilization. The U.S. also has many centralized blood banks and high-volume device manufacturers converting from gamma to X-ray sterilization. Safety and environmental legislations are leading to consistent adoption of X-ray systems in diagnostic labs and pharma in Canada.

Europe was the second most rapidly growing region in 2024, driven by strict EU sterilization regulations and a growing demand for clean-label food processing and pharmaceutical sterility assurance. Germany led the regional market on the back of its advanced manufacturing sector and high expenditure on automated X-ray systems. Rapid advancement in Imaging and irradiation technologies and the presence of major Key players, the global X-ray irradiation market is expected to support the growth. Due to recent EU MDR compliance changes, France and the UK’s hospital and CRO landscapes are quickly embracing X-ray systems.

Asia Pacific was the fastest-growing region over the forecast period, owing to rising industrial and pharmaceutical exports along with governmental support for modern sterilization technologies.

China is the largest market in the region and holds a significant share in it, as it is a home to large pharmaceutical and electronics manufacturing clusters and the government’s investments in high-throughput X-ray systems. Positive is the National Health Commission’s encouragement of rural hospitals to establish blood irradiation facilities. A new era of contract sterilization demand is particularly among mid-size pharma companies in India. Japan and South Korea are specifically targeting hospital-based adoption and the inclusion of AI-based X-ray platforms into diagnostic and therapeutic environments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Prominent X-ray irradiation companies operating in the market include STERIS, Ionisos, SteriTek, Inc., Symec Engineers (India) Pvt. Ltd, Sterigenics U.S., LLC – A Sotera Health company, IBA Industrial Solution, E-BEAM Services, Inc., KUB Technologies Inc., Precision X-Ray, Hopewell Designs, Inc., Dandong Mastery Technology Co., Ltd, Raycision Medical Technology Co., Ltd., PTW Freiburg GmbH, Zhuhai Livzon Diagnostics Inc. (Livzon Pharmaceutical Group Inc.), Rad Source Technologies, Hitachi High-Tech Corporation, Gilardoni S.p.A., Scanna MSC Ltd, AROMA Engineering Co. Ltd, and Xstrahl Ltd.

Recent Developments:

-

In June 2025, IBA announced the installation of its "Be Wide" X-ray irradiation solution at Steri-Tek’s Texas facility near Dallas-Fort Worth. This upgrade will quintuple processing capacity, enabling full-pallet sterilization and significantly boosting throughput in medical device sterilization workflows.

-

In Nov 2023, Ionisos began construction of a brand-new X-ray sterilization facility in Henriville, France, aiming for completion by 2025. This move strengthens their service portfolio with precision-minded X-ray sterilization and underscores a commitment to sustainable, eco-friendly practices, positioning Ionisos ahead in the European sterilization landscape.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.22 billion |

| Market Size by 2032 | USD 2.97 billion |

| CAGR | CAGR of 11.80% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Medical Devices, Pharmaceuticals, Biotech & Laboratory Supplies, Food & Agriculture, Blood & Tissue Irradiation, Veterinary Healthcare, Cosmetics & Personal Care Products, Electronic Components) • By Capacity (Small-scale Systems, Mid-scale Systems, Large-scale Systems, Pilot-scale Units, High-throughput Industrial Units, Mobile/Portable Units, Custom/On-Demand Service Providers) • By Technology (Cabinet-Based X-Ray Irradiators, Conveyor-Based X-Ray Systems, Rotary/Drum Irradiators, Automated Sterilization Systems) • By End-user (Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs)/CMOs, Blood Banks & Transfusion Centers, Food Processing Companies, Others [Academic & Research Institutes, Cosmetic Manufacturers, Electronics Manufacturers]) |

| Regional Analysis/Coverage | North America (U.S., Canada), Europe (Germany, France, UK, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

| Company Profiles | STERIS, Ionisos, SteriTek, Inc., Symec Engineers (India) Pvt. Ltd, Sterigenics U.S., LLC – A Sotera Health company, IBA Industrial Solution, E-BEAM Services, Inc., KUB Technologies Inc., Precision X-Ray, Hopewell Designs, Inc., Dandong Mastery Technology Co., Ltd, Raycision Medical Technology Co., Ltd., PTW Freiburg GmbH, Zhuhai Livzon Diagnostics Inc. (Livzon Pharmaceutical Group Inc.), Rad Source Technologies, Hitachi High-Tech Corporation, Gilardoni S.p.A., Scanna MSC Ltd, AROMA Engineering Co. Ltd, and Xstrahl Ltd. |