Zinc Market Report Scope & Overview:

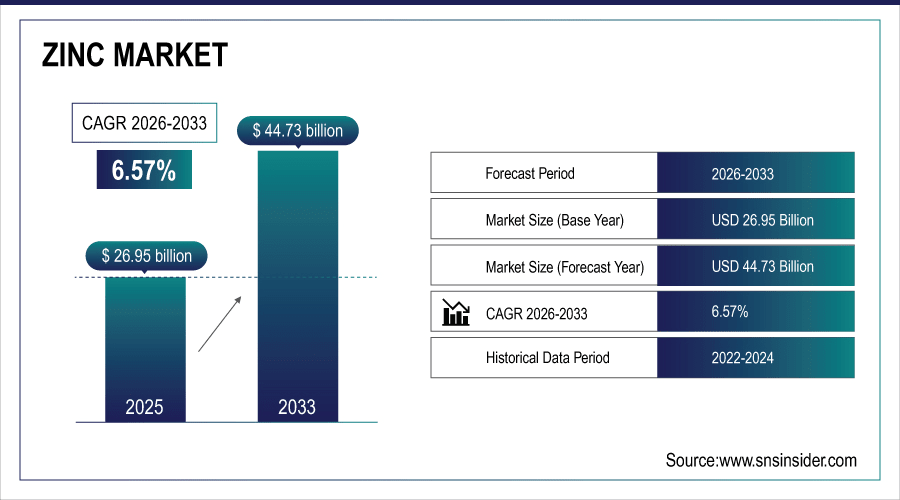

The Zinc Market size was valued at USD 26.95 Billion in 2025E and is projected to reach USD 44.73 Billion by 2033, growing at a CAGR of 6.57% during the forecast period 2026–2033.

The Zinc Market analysis is based on demand from industrial industries, infrastructure developments and the growing use in galvanization, die casting, and batteries. The growth is mainly due to the accelerating construction, automotive & electronics and advancements in zinc alloys and compounds that enable efficient and sustainable applications internationally.

Zinc consumption reached 13.8 million tons in 2025, driven by demand in galvanization, die casting, batteries, and growth across construction and automotive sectors.

To Get More Information On Zinc Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 26.95 Billion

-

Market Size by 2033: USD 44.73 Billion

-

CAGR: 6.57% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Zinc Market Trends:

-

Growing need for anticorrosive materials and galvanizing agents is propelling application of zinc in construction and industrial sectors.

-

Advances in zinc-based alloys, compounds and coatings are improving durability, performance and flexibility, expanding applications.

-

Growing automotive, electrical & electronics and battery industry is surging consumption of zinc-based products.

-

Increasing focus on sustainability and reusable materials are making industries to prefer zinc in place of others metal.

-

Competition in the market is growing as companies shift toward production of high performance, environmentally friendly and special zinc products to cater to advancing industrial needs.

U.S. Zinc Market Insights:

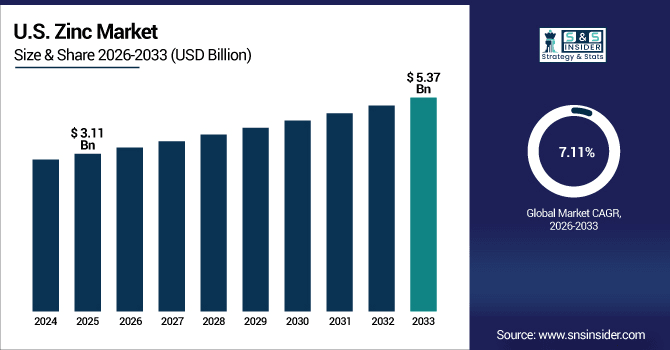

The U.S. Zinc Market is projected to grow from USD 3.11 Billion in 2025E to USD 5.37 Billion by 2033, at a CAGR of 7.11%. Growing demand in automotive, construction and renewable energy sectors along with shift toward high-performance alloys and focus on sustainable, corrosion resistant materials will propel growth.

Zinc Market Growth Drivers:

-

Rising infrastructure and automotive demand for corrosion-resistant materials is accelerating growth in the Zinc market.

Rising infrastructure development and automotive production is the primary driver of Zinc market growth. Growing preference for corrosion resistant, long lasting and efficient materials is creating demand across construction, electrical and industrial purposes. That’s fanning consumption plus growth in renewables and battery technologies is also fueling demand. Innovation in zinc alloys, coatings and specialty compounds is driving performance, sustainability and flexibility while enabling greater market penetration and long-term growth.

Zinc demand grew by 4.6% in 2025, driven by expanding infrastructure, automotive production, and renewable energy applications.

Zinc Market Restraints:

-

Volatility in raw material prices and environmental regulations are limiting large-scale production and industrial adoption of zinc.

Volatility in raw material prices and stringent environmental regulations are significant factors restraining the growth of the Zinc market. Reliance on mined zinc and zinc-derived compounds renders manufacturers susceptible to price variation and supply chain insecurity. Moreover, adherence to limit values and regulations for waste management leads to higher production costs. Smaller manufacturers may find it difficult to adapt new processing technologies or ramp-up production lines, so difficulties in capturing industrial demand growth despite the overall pie expanding.

Zinc Market Opportunities:

-

Increasing adoption of sustainable, high-performance zinc alloys and compounds presents opportunities for innovation across industries globally.

Increasing adoption of sustainable and high-performance zinc alloys and compounds presents a significant opportunity for the Zinc market. Advanced formulations and unique coatings also can optimize durability, corrosion resistance and performance in construction, automotive and industrial applications. Increasing adoption in batteries, renewable energy and specialty chemicals and the capability of manufacturers to converge their offerings with changing industry standards and tap fertilize end-use sectors are anticipated to stimulate long-term market growth & innovation.

High-performance zinc alloys and compounds for 18% of industrial material innovations in 2025, driven by demand in construction, automotive, and renewable energy applications.

Zinc Market Segmentation Analysis:

-

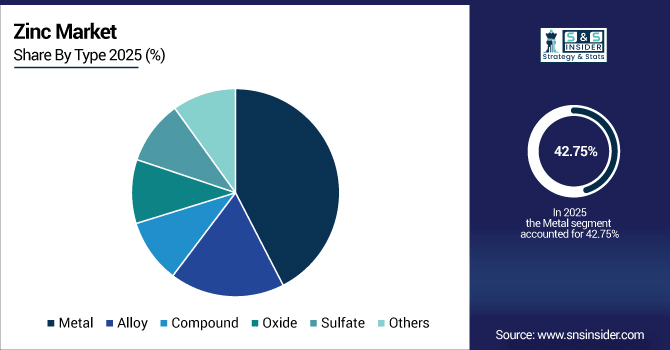

By Type, Metal held the largest market share of 42.75% in 2025, while Oxide is expected to grow at the fastest CAGR of 8.21%.

-

By Form, Ingot dominated with a 39.62% share in 2025, while Powder is projected to expand at the fastest CAGR of 7.89%.

-

By Application, Galvanization accounted for the highest market share of 46.13% in 2025, and Batteries is projected to record the fastest CAGR of 9.05%.

-

By End-Use Industry, Construction held the largest share of 43.58% in 2025, while Automotive is expected to grow at the fastest CAGR of 8.74%.

By Type, Metal Dominates While Oxide Expands Rapidly:

Metal segment dominated the market as there is extensive industrial usage such as galvanization, die casting and construction among others. It is a popular option in all industries due to its well-developed supply chain system, durability and versatility. Oxide is the fastest-growing segment, powered by discoveries in batteries and chemicals plus advances in coatings. Rising popularity for green and sustainable zinc oxide compounds is driving the demand, as leading manufacturers are adopting better ecological solutions to replace other materials in numerous applications.

By Form, Ingot Dominates While Powder Expands Rapidly:

The Ingot segment dominated the market due to its high levels of availability in bulk, transportability ease, and direct employment into manufacturing processes for construction, automotive and industrial. Its reproducibility and repeatability endorse mass use. Powder is the fastest growing segment, driven by niche industrial applications such as coatings, alloys and additive manufacturing. Advances in powder technologies and increasing demands for meticulously engineered zinc products are creating expansion within this growing market.

By Application, Galvanization Dominates While Batteries Expand Rapidly:

Galvanization segment dominated the market, as it helps in the protection from corrosive elements for construction, automotive and industrial equipment. High acceptance has to be underlayed by wide regulations and long lifetimes. Batteries is the fastest-growing segment, propelled by the increase of renewable power sources, electric cars and mobility tools, driven by increasing demand for high-performance zinc-based battery materials and cost-effective energy storage options, providing new opportunities for innovation and market entry.

By End-Use Industry, Construction Dominates While Automotive Expands Rapidly:

Construction segment dominated the market as zinc is widely used for galvanization, structural alloys and as a protective coating in infrastructure projects. Its strength, resistance to corrosion and conformity with building codes underpin its widespread use. The automotive is the fastest growing segment, due to electric car production, rising safety requirements and demand for corrosion-resistant lightweight parts. Advancements in zinc alloys and environmental manufacturing processes are accelerating the use of zinc in automotive applications.

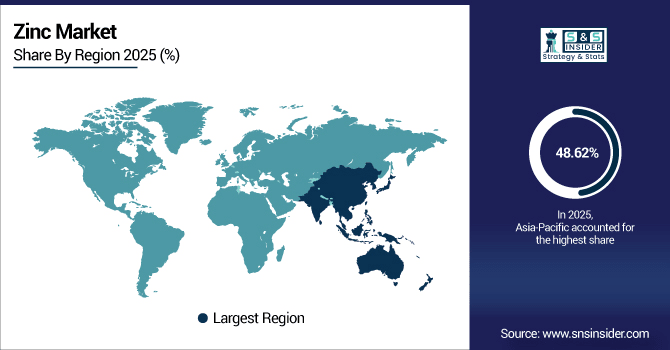

Zinc Market Regional Analysis:

Asia-Pacific Zinc Market Insights:

The Asia-Pacific Zinc Market dominated with a 48.62% market share in 2025, drawn by the industrialization that have led to huge demand in construction and automobile sectors together with exceptional growth rate. Wide acceptance of galvanization, die casting, and zinc-based alloys in China, India, Japan and South Korea competitively rule the market. Increased manufacturing activities, urbanization and preference for long-lasting, corrosion resistant materials have reinforced its dominance in the zinc market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Zinc Market Insights:

China led the Zinc market on account of huge industrial activities, increasing construction & automotive industry and robust demand for galvanization and zinc alloys. Boosted production, infrastructure construction and increasing usage of hardware, corrosion-resistant materials are continuing to stimulate market demand and providing new opportunities for zinc suppliers in the country.

North America Zinc Market Insights:

North America is the fastest growing region with the CAGR of 8.07% and is contributing to rise in demand for Zinc owing to growth in automotive industry, renewable energy, batteries etc. Rising use due to the impression of technological progress in zinc alloys and coatings and growing industrial & infrastructure investment is driving its adoption. Increasing trend toward sustainable, high performance and corrosion resistant materials will stimulate industry growth, along with strong manufacturing capabilities and pervasiveness across specialty chemical, construction, industrial applications.

U.S. Zinc Market Insights:

The U.S. Zinc Market is mainly increasing demand for corrosion-resistant and high-performance materials in construction, automotive, and industrial sector along with superior manufacturing capabilities. Positives developments in zinc alloy, coatings and sustainable production innovation coupled with increasing infrastructure and renewable energy investment will drive the market forward.

Europe Zinc Market Insights:

The Europe Zinc Market is thriving on account of increasing demand of corrosion resistance and high-performance content in construction, automotive and industry. Key market are Germany, France and the UK. Growth will be supported by robust manufacturing capabilities, technological advances in zinc alloys and coatings, growing penetration in renewable energy and battery applications, and intensified focus on sustainability, environmental regulations, and durable materials throughout the region to bolster market gains.

Germany Zinc Market Insights:

Germany is a key market for products of Zinc with robust applications in construction, automotive and industrial sectors. Existing manufacturing facilities and successful use of galvanizing and zinc alloys bolster growth. Focus on sustainability, on durable materials and advanced coatings continue to fuel market growth and increasing infrastructure and renewable energy projects.

Latin America Zinc Market Insights:

The Latin America Zinc market is growing at a steady pace due to the increase in demand from construction, automotive and other industries. The growth is fuelled by the infrastructure development, rising manufacturing capacities, and growing demand for corrosion-resistant & high-performance zinc alloys. Advancements in coatings, renewable energy applications, and eco-friendly production techniques are unveiling untapped potential in emerging markets including Brazil, Mexico and Argentina.

Middle East and Africa Zinc Market Insights:

The Middle East & Africa Zinc Market is anticipated to experience continuous growth with the growing demand from construction, automotive, and industrial sectors. This growth is facilitated by infrastructure initiatives, urbanization trends, and the demand for corrosion-resistant zinc alloys. In addition, government measures, sustainable zinc production and a trend toward long-lasting materials boost the regional market.

Zinc Market Competitive Landscape:

Glencore, headquartered in Switzerland, is one of the world’s largest and most influential zinc producers, with fully integrated operations encompassing mining, smelting, and trading. The company was the largest producer of zinc, benefiting from good asset spread in key producing regions including Australia, Canada and Kazakhstan driving another benchmark for secure supply and market credibility. Its advanced logistics, operational efficiency and strong sustainability management have helped make Glencore one of the world’s leading producers in the zinc market.

-

In August 2025, Glencore upgraded its smelter at Port Pirie in South Australia by improving the furnaces, acid plant, fume handling, wastewater treatment and refinery flues. This enhances the efficacy of operations, promotes the production of lead, copper, silver and gold one shift at a time and allows for a shift toward alloys including antimony and bismuth for renewables, electronics and defence.

Hindustan Zinc Limited (HZL), a subsidiary of Vedanta Limited, is India’s largest integrated zinc producer and a globally significant player in the zinc industry. A market leader, it runs modern mines and smelters in Rajasthan using cutting edge technology, efficient processes and state of the art equipment for cost-effective quality production, with minimal emissions. With a strong domestic and supply chain, high-volume production capacity, quality and operational excellence, HZL is one of the largest producers of zinc in bulk and concentrates.

-

In October 2025, Hindustan Zinc launched a fleet of 40 Electric Vehicle (EV) bulkers at its Debari smelter in Udaipur, India. The EVs transport calcine a by-product of the roasting process to the Chittorgarh zinc-lead smelter.

Nyrstar, headquartered in Belgium, is a prominent zinc producer with extensive mining, smelting, and refining operations across Europe, the Americas, and Australia. By virtue of its capacity, leading refining technology and diversified supply sources, the company is a dominant player in the world zinc industry. The Company's clear target is to become a leader with a reputation as a manufacturer of high-quality zinc products, that can influence prices and ensure supply stability in the market when demand across construction, automotive, and industry increases.

-

In August 2025, Nyrstar implemented operational enhancements at its Port Pirie and Hobart facilities in Australia. These improvements stabilize production and maintain continuous output of zinc and other critical metals.

Zinc Market Key Players:

Some of the Zinc Market Companies are:

-

Glencore

-

Hindustan Zinc Limited

-

Nyrstar

-

Teck Resources

-

Zijin Mining Group

-

Vedanta Limited

-

Southern Copper Corporation

-

Korea Zinc

-

Boliden Group

-

Hudbay Minerals

-

Zhongjin Lingnan Nonfemet Company Limited

-

MMG Limited

-

Industrias Peñoles

-

Volcan Compañía Minera

-

New Century Resources

-

Minera San Cristóbal

-

China Northern Rare Earth Group High-Tech

-

Grupo México

-

Southern Peru Copper Corporation

-

China National Nonferrous Metal Mining Group Corporation (CNMC)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 26.95 Billion |

| Market Size by 2033 | USD 44.73 Billion |

| CAGR | CAGR of 6.57% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Metal, Alloy, Compound, Oxide, Sulfate, Others) • By Form (Sheet, Powder, Ingot, Dust, Others) • By Application (Galvanization, Die Casting, Brass & Bronze, Chemicals, Batteries, Pharmaceuticals, Others) • By End-Use Industry (Construction, Automotive, Electrical & Electronics, Consumer Goods, Industrial Machinery, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Glencore, Hindustan Zinc Limited, Nyrstar, Teck Resources, Zijin Mining Group, Vedanta Limited, Southern Copper Corporation, Korea Zinc, Boliden Group, Hudbay Minerals, Zhongjin Lingnan Nonfemet Company Limited, MMG Limited, Industrias Peñoles, Volcan Compañía Minera, New Century Resources, Minera San Cristóbal, China Northern Rare Earth Group High-Tech, Grupo México, Southern Peru Copper Corporation, China National Nonferrous Metal Mining Group Corporation (CNMC) |