2-Ethyl-3,4-ethylenedioxythiophene Market Report Scope & Overview

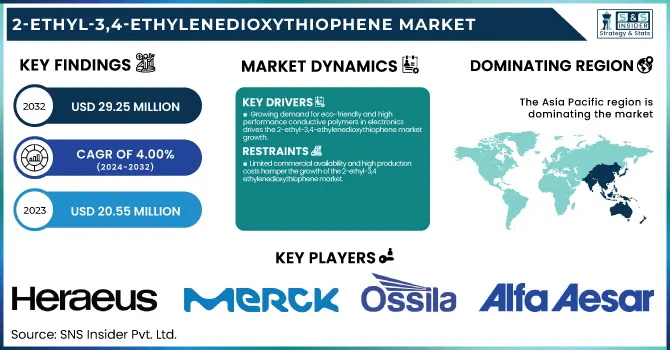

The 2-Ethyl-3,4-ethylenedioxythiophene Market size was USD 20.55 million in 2023 and is expected to reach USD 29.25 million by 2032 and grow at a CAGR of 4.00% over the forecast period of 2024-2032.

To Get more information on 2-Ethyl-3,4-ethylenedioxythiophene Market - Request Free Sample Report

The report offers a focused analysis on key production and innovation dynamics shaping the sector. The report includes 2023 data on global production capacity and utilization rates by country, as well as feedstock price fluctuations and availability by type, highlighting cost-driving factors. It further examines the impact of evolving regulatory frameworks specific to specialty monomers and conductive polymers across major regions. Additionally, environmental metrics, such as emissions data and waste management practices, are evaluated to understand sustainability performance. The report also delves into innovation trends and R&D activities by type, emphasizing product advancements and the growing importance of high-purity E-EDOT derivatives in electronics and material science.

The United States held the largest market share in the 2-Ethyl-3,4-ethylenedioxythiophene (E-EDOT) market in 2023, with a valuation of USD 2.45 million, and is projected to reach USD 3.26 million by 2032, growing at a CAGR of 3.25% during 2024–2032. This dominance is primarily driven by the country's advanced electronics and materials research ecosystem, strong presence of leading chemical manufacturers, and rising demand for high-performance conductive polymers in applications such as flexible electronics, smart coatings, and energy storage devices. Moreover, robust investments in R&D, favorable intellectual property protections, and collaborations between academic institutions and industry players have accelerated the commercialization of specialty monomers like E-EDOT. Additionally, the U.S. benefits from well-established regulatory frameworks and streamlined chemical production infrastructure, enabling consistent quality and supply chain reliability for high-purity materials.

Market Dynamics

Drivers

-

Growing demand for eco-friendly and high-performance conductive polymers in electronics drives the 2-ethyl-3,4-ethylenedioxythiophene market growth.

The increasing demand for eco-friendly and high-performance conductive polymers, particularly in the electronics sector, is a major driver for the 2-Ethyl-3,4-ethylenedioxythiophene (E-EDOT) market. As industries transition toward lightweight, flexible, and sustainable electronic components, E-EDOT’s role in enhancing the electrical conductivity and environmental stability of polymers becomes vital. Its application in antistatic coatings, organic solar cells, OLEDs, and wearable electronics is witnessing significant growth. Manufacturers are also investing in research to develop E-EDOT-based materials with lower environmental impact and improved performance. Moreover, government support for green electronics and cleaner materials adds to the market momentum. This shift toward sustainability aligns with broader regulatory pressures to reduce toxic material usage, making E-EDOT a strategic material for innovation in next-gen electronics, which significantly boosts its market demand across developed and developing economies.

Restrain

-

Limited commercial availability and high production costs hamper the growth of the 2-ethyl-3,4-ethylenedioxythiophene market.

One of the key restraints hindering the growth of the 2-Ethyl-3,4-ethylenedioxythiophene (E-EDOT) market is its limited commercial availability coupled with high production costs. The synthesis of E-EDOT involves complex chemical processes and requires high-purity feedstocks, which are not readily available at scale. This results in relatively high material costs, making it challenging for small and medium-scale manufacturers to adopt E-EDOT-based formulations. Furthermore, limited suppliers globally constrain market competitiveness and pose challenges in maintaining consistent quality and supply. The lack of large-scale manufacturing infrastructure and specialized handling requirements further adds to the overall cost burden. These factors collectively slow down the widespread adoption of E-EDOT in cost-sensitive industries, especially in emerging economies where alternative conductive materials are preferred due to their affordability and broader accessibility in the global supply chain.

Opportunity

-

Emerging applications in wearable technology and organic solar cells offer growth opportunities for the e-edot market.

The rising innovation in wearable technology and organic photovoltaic (OPV) systems presents a promising opportunity for the 2-Ethyl-3,4-ethylenedioxythiophene (E-EDOT) market. As the demand for flexible, lightweight, and energy-efficient materials increases, E-EDOT’s ability to enhance conductivity and stability in thin-film applications positions it as a key component in next-generation electronic materials. Its compatibility with flexible substrates and its role in improving the performance of organic semiconductors make it ideal for use in smart textiles, biosensors, and flexible energy devices. Research institutions and tech start-ups are increasingly experimenting with E-EDOT in their R&D pipelines, backed by funding initiatives promoting green energy and sustainable materials. With major tech companies investing in wearable innovation and solar integration, the expanding end-use base is expected to create a lucrative growth pathway for E-EDOT across global markets.

Challenge

-

Technical barriers in large-scale processing and standardization remain a significant challenge for E-Edot market expansion.

Despite its promising performance characteristics, the 2-Ethyl-3,4-ethylenedioxythiophene (E-EDOT) market faces a substantial challenge due to technical barriers in large-scale processing and standardization. The chemical’s sensitivity to handling conditions and its intricate polymerization behavior make it difficult to standardize for mass production without compromising on quality. This creates inconsistency in performance across batches, which is a major concern for high-precision applications in electronics and optoelectronics. Moreover, many industries lack the specialized equipment and knowledge required to integrate E-EDOT into existing production lines. The absence of universally accepted processing standards and performance benchmarks limits its commercial scale-up. Overcoming these technical challenges requires significant investment in advanced manufacturing technologies and process development, which may deter smaller players and slow down adoption in regions with limited technological infrastructure.

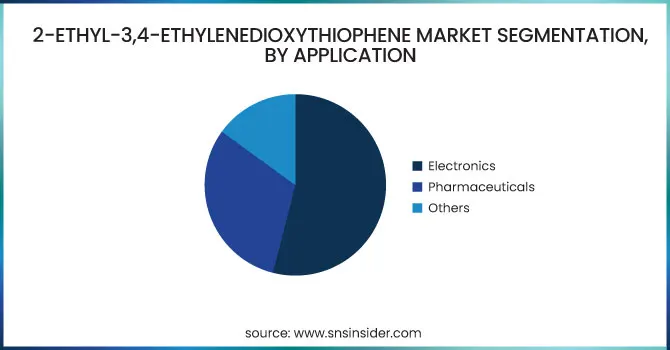

Segmentation Analysis

By Application

Electronics held the largest market share, around 54%, in 2023. It is attributed to the electronics segment, which remains a crucial factor as a conductive polymer component used to improve performance in advanced electronics processes. E-EDOT has been applied for antistatic coatings, organic field-effect transistors (OFETs), organic light-emitting diodes (OLEDs), and organic photovoltaics (OPVs), in which high conductivity, heat stability, and environmental durability could be provided. The growing demand for light, flimsy, and compact electronic devices to further advance applications such as wearable electronics, foldable electronics, and smart sensors has further encouraged the utilization of E-EDOT-based materials. High-performance organic electronics commercialization encompasses significant R&D activities in the U.S., Japan, and Korea, which also help to retain this segment domain. This ongoing move to lower energy consumption and more sustainable electronic components reinforces the position of E-EDOT as a special-purpose monomer of choice for use in the electronics sector.

Regional Analysis

Asia Pacific held the largest market share, around 52%, in 2023. This is due to the electronics base is fast expanding, especially in countries like China, Japan, South Korea, and Taiwan. They are the world leading hubs of manufacture for consumer electronics, semiconductors, and display technologies that are increasingly dependent on high-performance conductive polymers like E-EDOT. The region also appreciated government policies in support of advanced materials and domestic innovation, as well as increasing investments in flexible electronics, organic solar cells, and smart devices. Additionally, affordable raw materials, cheap labor, and robust supply chain infrastructure have encouraged several leading international chemical companies to set up manufacturing units in the area. Asia Pacific is anticipated to hold its dominant position in the E-EDOT market across the forecast timeframe, on account of ongoing technological advancements and increasing penetration of environment-friendly materials.

Europe held a significant market share. This is due to a high focus on sustainable materials, the presence of advanced research with high capability, and high demand for next-generation electronics. Germany, France, and Holland take the lead in organic electronics and smart materials, where E-EDOT significantly contributes to conductivity or stability. E-EDOT is being increasingly adopted in energy applications as the region is heavily focused on green energy solutions comprising organic photovoltaics (OPVs) and flexible solar panels. Europe already has well-developed regulatory frameworks as well as funding to support environmentally sustainable development, and as a result, it is relatively advanced with the R&D of next-generation polymers and monomers. Additionally, major chemical and material science companies are present in the region and hence developing conductive polymer formulations which further establishes Europe as the leading region for global E-EDOT market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Heraeus (E-EDOT Monomer, Conductive Polymer Solution)

-

Merck Group (EDOT Derivatives, High-Purity E-EDOT)

-

Ossila (E-EDOT Powder, Polymer Precursors)

-

Tokyo Chemical Industry – TCI (E-EDOT, Specialty Monomers)

-

Alfa Aesar (E-EDOT Reagent, Laboratory-Grade Monomer)

-

Sigma-Aldrich (E-EDOT, Electroactive Monomer)

-

Santa Cruz Biotechnology (2-Ethyl EDOT, Research Grade Monomer)

-

BOC Sciences (Custom E-EDOT, Functional Thiophenes)

-

Biosynth Carbosynth (E-EDOT Intermediate, Custom Synthesis Products)

-

Amadis Chemical (E-EDOT Derivative, Specialty Intermediates)

-

SynQuest Labs (E-EDOT, Electronic-Grade Thiophene)

-

SONTARA Organo Chemicals (E-EDOT, Fine Chemicals)

-

Chemieliva Pharmaceutical (High-Purity E-EDOT, Custom Organic Compounds)

-

Hangzhou Keying Chem (E-EDOT Intermediate, Conductive Polymer Precursor)

-

Wako Chemicals (E-EDOT, Specialty Monomers)

-

Shanghai T&W Pharmaceutical (E-EDOT, Electronic Intermediates)

-

Dayang Chem (2-Ethyl EDOT, Functional Polymer Materials)

-

Finetech Industry (E-EDOT Monomer, Advanced Organic Materials)

-

Glentham Life Sciences (E-EDOT, High-Performance Chemicals)

-

Zibo Haiwang (E-EDOT, Conductive Polymer Monomers)

Recent Developments:

-

In September 2024, Ossila Ltd. introduced a new range of EDOT-based materials designed for use in organic light-emitting diodes (OLEDs), organic photovoltaics (OPVs), and organic thin-film transistors (OTFTs).

-

In 2023, Merck Group broadened its product range by incorporating high-purity EDOT derivatives. This move strengthened its position in the specialty chemicals sector, catering to growing industry demands.

-

In 2023, Sigma-Aldrich expanded its product catalog with a wider selection of EDOT derivatives. The expansion aimed to support both research and industrial use in the field of conductive polymers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 20.55 Million |

| Market Size by 2032 | USD29.25Billion |

| CAGR | CAGR of4.00% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Electronics, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Heraeus, Merck Group, Ossila, Tokyo Chemical Industry – TCI, Alfa Aesar, Sigma-Aldrich, Santa Cruz Biotechnology, BOC Sciences, Biosynth Carbosynth, Amadis Chemical, SynQuest Labs, SONTARA Organo Chemicals, Chemieliva Pharmaceutical, Hangzhou Keying Chem, Wako Chemicals, Shanghai T&W Pharmaceutical, Dayang Chem, Finetech Industry, Glentham Life Sciences, Zibo Haiwang |