Insoluble Sulfur Market Report Scope & Overview:

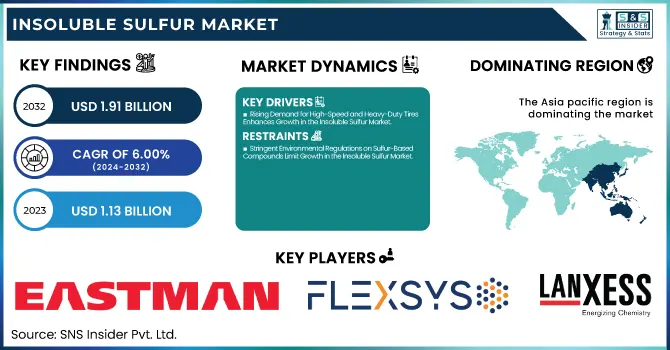

The Insoluble Sulfur Market Size was valued at USD 1.13 Billion in 2023 and is expected to reach USD 1.91 Billion by 2032, growing at a CAGR of 6.00% over the forecast period of 2024-2032.

To Get more information on Insoluble Sulfur Market - Request Free Sample Report

The Insoluble Sulfur Market is evolving rapidly, driven by increasing demand in tire manufacturing and industrial rubber applications. Our report provides an in-depth supply chain analysis, outlining raw material sourcing, logistics, and production hubs shaping market efficiency. A detailed study of pricing trends and cost structures highlights raw material fluctuations and their impact on profitability. Stringent regulatory and environmental factors influence production, with sustainability and compliance playing key roles. Investment and financial analysis explore capital expenditures, mergers, and acquisitions defining market competition. Additionally, a shifting distributor and supply network impacts global trade and supply chain resilience. Our report delivers exclusive insights, offering a strategic perspective on the market’s growth, challenges, and future opportunities.

Insoluble Sulfur Market Dynamics

Drivers

-

Rising Demand for High-Speed and Heavy-Duty Tires Enhances Growth in the Insoluble Sulfur Market

The global expansion of high-speed and heavy-duty transportation is fueling the Insoluble Sulfur Market. Tires designed for heavy commercial vehicles, aviation, and performance automobiles require superior heat resistance, tensile strength, and durability, which insoluble sulfur provides. With the rise in global logistics, freight transportation, and long-haul trucking, the demand for durable and high-load-bearing tires is increasing. Heavy-duty tires require optimized vulcanization processes to maintain strength under extreme weight and road conditions. Additionally, motorsports and high-speed vehicle manufacturers are pushing for advanced tire technologies that enhance grip, stability, and longevity. Insoluble sulfur plays a crucial role in these applications, ensuring the rubber compounds retain their integrity under high stress. Furthermore, as electric vehicles gain traction, the need for specialized tires with lower rolling resistance and enhanced wear resistance is driving research into optimized insoluble sulfur-based formulations. This growing focus on durability, efficiency, and safety across transportation industries is reinforcing the demand for high-quality vulcanizing agents like insoluble sulfur.

Restraints

-

Stringent Environmental Regulations on Sulfur-Based Compounds Limit Growth in the Insoluble Sulfur Market

Government-imposed environmental regulations on sulfur-based chemicals are restricting the Insoluble Sulfur Market. The production of insoluble sulfur involves chemical processes that release sulfur dioxide and other pollutants, leading to tighter industrial emission control policies. Many countries are enforcing strict environmental standards, compelling manufacturers to adopt costly compliance measures such as emission-reduction technologies and alternative processing methods. These additional costs impact the profitability of insoluble sulfur producers, limiting market expansion. Furthermore, the growing push for sustainable and biodegradable alternatives in the rubber industry has led some companies to explore alternative vulcanizing agents, reducing dependence on sulfur-based solutions. Regulatory scrutiny is particularly high in regions with strict environmental policies, such as Europe and North America, where industries must adhere to low-emission production standards. While technological advancements are helping mitigate these environmental concerns, the continuous evolution of regulations creates uncertainty in the market. Companies must invest heavily in research and sustainable manufacturing practices to maintain compliance, making market entry and expansion challenging for new and existing players.

Opportunities

-

Expansion of the Electric Vehicle Sector Drives Demand for Advanced Tire Solutions in the Insoluble Sulfur Market

The rapid expansion of the electric vehicle industry is creating new opportunities for the Insoluble Sulfur Market. Electric vehicles require specialized tires designed for low rolling resistance, high durability, and superior traction to optimize battery efficiency and vehicle performance. Unlike conventional vehicles, electric cars generate higher torque, increasing tire wear and necessitating more durable rubber compounds. Insoluble sulfur plays a crucial role in the vulcanization of these advanced rubber compounds, ensuring they meet the demanding performance standards of electric vehicles. Additionally, global government initiatives promoting electric mobility and sustainability are accelerating investments in innovative tire technologies. Leading tire manufacturers are investing in research and development to produce energy-efficient and environmentally friendly tire solutions tailored for electric vehicles. As the electric vehicle market grows, the need for high-performance rubber formulations using insoluble sulfur is set to rise, providing a lucrative opportunity for market expansion.

Challenge

-

Increasing Competition from Alternative Vulcanizing Agents Challenges the Growth of the Insoluble Sulfur Market

The Insoluble Sulfur Market is facing growing competition from alternative vulcanizing agents that offer improved performance and environmental benefits. Chemical companies are developing new cross-linking agents, such as peroxide-based and nitrogen-based vulcanization systems, which provide superior elasticity, faster curing times, and reduced sulfur emissions. Some of these alternatives are gaining traction due to their sustainability advantages and lower environmental impact. Additionally, the push for bio-based rubber solutions is leading to the exploration of novel vulcanization techniques that challenge the dominance of sulfur-based curing agents. As tire and rubber manufacturers seek eco-friendly solutions, the adoption of alternative vulcanization technologies is increasing. This competitive pressure is forcing insoluble sulfur manufacturers to invest in innovation and differentiation strategies to maintain their market position.

Insoluble Sulfur Market Segmental Analysis

By Grade

Regular Grade dominated the Insoluble Sulfur Market in 2023 with a market share of 50.3%. This segment led due to its extensive use in standard tire manufacturing and general rubber processing. Regular grade insoluble sulfur is cost-effective and widely used in mass-produced automotive and commercial vehicle tires, aligning with the steady demand for passenger cars and commercial fleets worldwide. According to the U.S. Tire Manufacturers Association (USTMA), global tire production has been on the rise, with a significant share allocated to passenger and commercial vehicle tires, which predominantly use regular grade sulfur. Additionally, the European Tyre and Rubber Manufacturers’ Association (ETRMA) reported that European tire production rebounded post-pandemic, increasing the demand for insoluble sulfur. Governments worldwide, such as China's push for domestic tire production under the "Made in China 2025" initiative, have further supported this demand, solidifying the dominance of the regular-grade segment.

By Application

Tire Manufacturing dominated the Insoluble Sulfur Market in 2023 with a market share of 72.5%. The dominance is driven by the expanding global automotive industry, where tires require high-performance rubber compounds for enhanced durability and safety. The rising adoption of electric vehicles (EVs), which require specialized low-rolling-resistance tires, has further increased the demand for insoluble sulfur. The International Organization of Motor Vehicle Manufacturers (OICA) reported a steady rise in vehicle production, especially in Asia-Pacific and North America, where tire demand is highest. Additionally, the United Nations Environment Programme (UNEP) has been promoting sustainable mobility, indirectly influencing tire manufacturers to optimize formulations using insoluble sulfur. Government policies, such as India's PLI scheme for Advanced Chemistry Cells (ACC) Battery Manufacturing, indirectly fuel tire production by boosting EV manufacturing, ensuring tire demand remains robust. Leading tire manufacturers like Michelin, Bridgestone, and Goodyear have been expanding production facilities, reinforcing the segment’s dominance.

By End-Use Industry

The Automotive industry dominated the Insoluble Sulfur Market in 2023 with a market share of 68.2%. This dominance is attributed to the increased production of vehicles and the rising need for durable, high-performance tires. The International Energy Agency (IEA) reported that EV sales surpassed 14 million units in 2023, intensifying the demand for specialized rubber components. Additionally, the U.S. Department of Energy (DOE) has introduced incentives for fuel-efficient vehicles, indirectly boosting tire and rubber component manufacturing, where insoluble sulfur is crucial. The rise in commercial vehicle fleets due to the expansion of e-commerce and logistics services has further fueled the demand for high-load-bearing tires, increasing insoluble sulfur consumption. Moreover, global automotive leaders like Tesla, Toyota, and Volkswagen have been ramping up vehicle production, further cementing the automotive sector’s dominance in the insoluble sulfur market.

Insoluble Sulfur Market Regional Outlook

Asia Pacific dominated the Insoluble Sulfur Market in 2023, capturing 42.8% of the global market share, primarily due to its well-established tire manufacturing sector and increasing automotive production. Countries such as China, India, Japan, and South Korea drive the demand, with China leading as the largest producer and consumer of insoluble sulfur due to its dominance in automotive and rubber processing industries. According to the China Association of Automobile Manufacturers (CAAM), China produced over 30 million vehicles in 2023, significantly increasing the demand for high-performance tires that require insoluble sulfur for vulcanization. India follows with rapid industrialization and tire production growth, supported by initiatives like the PLI Scheme for Auto and Auto Components by the Government of India, aimed at boosting domestic manufacturing. Japan and South Korea, home to Toyota, Honda, Hyundai, and Kia, contribute significantly to the market due to their export-driven automotive industries. Additionally, Southeast Asian countries such as Thailand and Indonesia, known as global tire manufacturing hubs, further bolster the demand for insoluble sulfur. Investments from key players like Bridgestone, Michelin, and Sumitomo Rubber Industries in expanding production facilities across Asia Pacific have cemented the region’s leadership in the market.

Moreover, Europe emerged as the fastest-growing region in the Insoluble Sulfur Market, with an estimated CAGR of 6.5% during the forecast period, driven by sustainability initiatives, stringent environmental regulations, and increasing demand for green tires. The European Union’s Green Deal and Euro 7 emission standards are pushing tire manufacturers to adopt eco-friendly production methods, indirectly boosting the demand for insoluble sulfur. Germany leads the European market with its strong automotive sector, housing major manufacturers such as Volkswagen, BMW, and Mercedes-Benz, which increasingly rely on advanced rubber processing technologies. France follows closely, with Michelin investing in research for high-performance, long-lasting tires that utilize insoluble sulfur in vulcanization. The United Kingdom is also witnessing growth due to investments in electric vehicle (EV) infrastructure, driving the need for specialized EV tires. Moreover, Poland and Hungary have emerged as key tire manufacturing hubs, attracting investments from Continental, Pirelli, and Bridgestone, further propelling market growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Changde Dingyuan Chemical Industrial Limited

-

China Sunsine Chemical Holdings Ltd.

-

Eastman Chemical Company

-

Grupa Azoty S.A.

-

Henan Kailun Chemical Co., Ltd.

-

Heze Great Bridge Chemical Co., Ltd.

-

Lanxess AG

-

Ningbo Actmix Rubber Chemicals Co., Ltd.

-

Oriental Carbon & Chemicals Ltd. (OCCL)

-

Pelican Rubber Ltd.

-

SANSHIN CHEMICAL INDUSTRY CO., LTD.

-

Shandong Yanggu Huatai Chemical Co., Ltd.

-

Sunsine Chemical Holdings Ltd.

-

Wuxi Huasheng Rubber Technical Co., Ltd.

-

Leader Technologies Co., Ltd.

-

LIONS INDUSTRIES s.r.o.

-

Shandong Xiangyu Chemical Co., Ltd.

Recent Developments

-

August 2024: Flexsys increased global prices by up to 12% for Insoluble Sulfur, 6PPD, and 4-ADPA products from September 1, 2024, citing inflation. The company also invested in a Next Generation Antidegradant for sustainable tire manufacturing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.13 Billion |

| Market Size by 2032 | USD 1.91 Billion |

| CAGR | CAGR of 6.00% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (High Thermal Stability (HTS), Medium Thermal Stability (MTS), Regular Grade) •By Application (Tire Manufacturing, Footwear, Industrial Rubber Goods, Adhesives & Sealants, Others) •By End-Use Industry (Automotive, Construction, Aerospace, Chemical & Petrochemical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oriental Carbon & Chemicals Ltd. (OCCL), Eastman Chemical Company, China Sunsine Chemical Holdings Ltd., Shikoku Chemicals Corporation, Henan Kailun Chemical Co., Ltd., Ningbo Actmix Rubber Chemicals Co., Ltd., Grupa Azoty S.A., Kuantum Corp, Pelican Rubber Ltd., Lanxess AG and other key players |