5G NTN Market Report Scope & Overview:

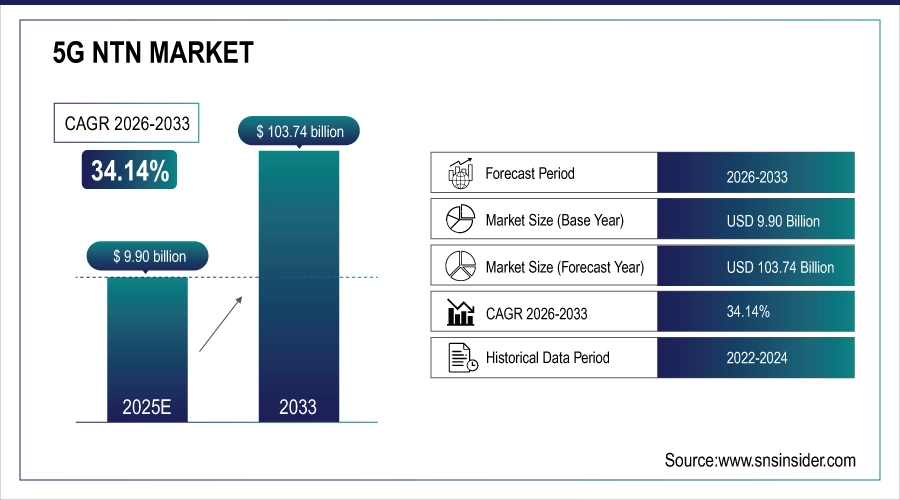

The 5G NTN Market size is valued at USD 9.90 Billion in 2025E and is expected to reach USD 103.74 Billion by 2033, growing at a CAGR of 34.14% over 2026-2033.

Driven by rising demand for truly ubiquitous connectivity, IoT ecosystem growth, and government initiatives aimed at closing the digital divide, the 5G Non-Terrestrial Network (NTN) Market is on a course for rapid growth. The integration of satellite and aerial platforms with terrestrial networks of 5G fosters seamless coverage in maritime, aviation, rural, and remote areas. Global deployment of these capabilities for improved mobile broadband, mission-critical communications and massive machine-type connectivity applications is enabling new opportunities for industrial sectors, thanks to the standardization work made through 3GPP Release 17/18, further developments in beamforming technology and the reduction of satellite launch costs.

5G NTN Market Size and Forecast:

-

Market Size in 2025E: USD 9.90 Billion

-

Market Size by 2033: USD 103.74 Billion

-

CAGR: 34.14% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on 5G NTN Market - Request Free Sample Report

5G NTN Market Trends:

-

Accelerated deployment of LEO satellite constellations with integrated 5G NR capabilities for global broadband coverage.

-

Growing convergence of terrestrial and non-terrestrial networks enabling seamless handover between cellular and satellite systems.

-

Advancements in beamforming and spectrum sharing technologies optimizing satellite capacity for 5G services.

-

Increasing standardization through 3GPP Releases 17-19 defining NTN architecture, protocols, and interoperability.

-

Rising investment in direct-to-device satellite connectivity eliminating need for specialized user equipment.

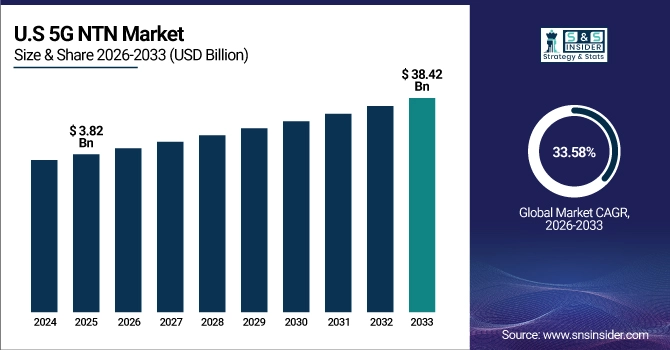

U.S. 5G NTN Market size is valued at USD 3.82 billion in 2025E and is expected to reach USD 38.42 billion by 2033, growing at a CAGR of 33.58% during 2026-2033.

The U.S. 5G NTN Market leads globally due to early technology adoption, substantial private investments in satellite constellations, and strong regulatory support from FCC for spectrum allocation. Presence of key players, such as SpaceX, Amazon, and Lockheed Martin, combined with defense applications and rural connectivity initiatives, drives accelerated market expansion across the region.

5G NTN Market Growth Drivers:

-

Increasing Demand for Global Connectivity and Bridging Digital Divide Drives 5G NTN Deployment for Remote, Rural, and Underserved Regions Beyond Terrestrial Network Coverage

Around 3 billion people lack dependable internet connectivity globally, mostly in distant, rural, and maritime locations where terrestrial infrastructure is not financially feasible. In order to support government digital inclusion objectives and humanitarian connectivity projects, 5G NTN solutions that use satellite and aerial platforms offer cost-effective coverage extension. High-speed internet, emergency communications, and Internet of Things services are made possible across geographically difficult areas by the integration of 5G NR with satellite networks, meeting social connectivity requirements as well as business prospects.

In 2025, 68% of national digital inclusion programs incorporated 5G NTN solutions, extending broadband access to 120 million previously unconnected users across remote islands, mountainous regions, and maritime corridors.

5G NTN Market Restraints:

-

High Initial Deployment Costs, Complex Spectrum Coordination, and Regulatory Challenges Across Jurisdictions Delay 5G NTN Commercialization Timelines

With LEO constellations costing USD 5 – USD 10 billion for global coverage, deploying 5G NTN infrastructure will involve a significant capital investment in user terminals, ground stations, and satellite constellations. The ITU facilitates intricate international negotiations for spectrum coordination between satellite operators, terrestrial networks, and neighboring services. Additional obstacles are created by regulatory differences between nations with regard to equipment certification, data sovereignty, and landing rights, especially for international service providers looking to conduct smooth cross-border business.

In 2025, 62% of 5G NTN projects faced 6-18 month delays due to regulatory approvals and spectrum coordination issues, with average licensing costs increasing by 25% across multiple jurisdictions.

5G NTN Market Opportunities:

-

Emerging direct-to-device satellite connectivity eliminates need for specialized equipment, creating massive consumer market opportunities for 5G NTN services

Recent 3GPP standardization enables 5G smartphones to connect directly to satellites without additional hardware, creating addressable market of 1.5+ billion smartphone users in areas with partial or no terrestrial coverage. This capability supports emergency messaging, basic broadband, and IoT services through existing consumer devices. Partnerships between satellite operators and mobile network operators are accelerating service launches, with premium connectivity packages expected to generate $25+ billion annually by 2030 from consumer and enterprise segments.

In 2025, 45% of new flagship smartphones incorporated 5G NTN capabilities, with satellite emergency services becoming standard feature, driving 200 million potential users for basic satellite connectivity services.

5G NTN Market Segment Highlights:

-

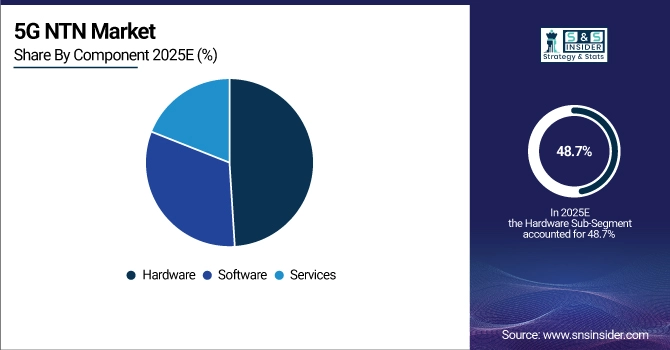

By Component: Hardware led with 48.7% share, while Services is the fastest-growing segment with CAGR of 38.2%.

-

By Platform: LEO Satellite led with 42.3% share, while UAS Platform is the fastest-growing segment with CAGR of 41.5%.

-

By Location: Remote led with 35.8% share, while Maritime is the fastest-growing segment with CAGR of 39.7%.

-

By Application: Enhanced Mobile Broadband led with 44.2% share, while Massive Machine-Type Communications is the fastest-growing segment with CAGR of 37.8%.

-

By End-Use: Aerospace & Defense led with 32.6% share, while Maritime is the fastest-growing segment with CAGR of 40.3%.

5G NTN Market Segment Analysis:

By Component: Hardware Segment Dominated the Market, while Services is the Fastest-growing Segment Globally

Hardware dominates the 5G NTN market, accounting for nearly half of total revenue, driven by substantial investments in satellite manufacturing, launch vehicles, ground station equipment, and user terminals. Key hardware includes phased array antennas, regenerative payloads, gNodeB satellite variants, and compact user equipment supporting both terrestrial and non-terrestrial connectivity.

Services represent the fastest-growing segment, projected at 38.2% CAGR, fueled by increasing demand for network integration, managed operations, and consulting. As 5G NTN deployments scale, organizations require specialized expertise for spectrum management, regulatory compliance, and hybrid network optimization. Service providers offer end-to-end solutions including network design, integration with existing mobile operator infrastructure, 24/7 operations support, and performance optimization, reducing implementation risks and accelerating time-to-market for communication service providers.

By Platform: LEO Satellite Segment Led the Market, while UAS Platform is the Fastest-Growing Segment in the Market

LEO Satellites lead the platform segment with 42.3% market share, revolutionizing 5G NTN through constellations orbiting 500-1,200 km altitude offering 20-40 ms latency comparable to terrestrial networks. Companies, such as SpaceX (Starlink), OneWeb, and Amazon (Project Kuiper) are deploying thousands of LEO satellites with integrated 5G capabilities, enabling global coverage for broadband, IoT, and backhaul services.

UAS (Unmanned Aerial Systems) Platforms show the fastest growth at 41.5% CAGR, providing flexible, on-demand connectivity solutions for temporary events, disaster recovery, and network densification. High-altitude platform stations (HAPS) including solar-powered drones and balloons operate in stratospheric regions, serving as quasi-stationary base stations covering diameter up to 100 km.

By Location: Remote Segment Led the Market, while Maritime is the Fastest-Growing Segment in the Market

Remote locations represent the largest segment for 5G NTN deployment, addressing critical connectivity gaps in polar regions, deserts, mountainous areas, and isolated islands where terrestrial infrastructure is economically impractical. Governments and telecom operators leverage satellite and aerial platforms to deliver essential services including telemedicine, distance education, and emergency communications to remote communities.

Maritime applications show the fastest growth at 39.7% CAGR, transforming connectivity across commercial shipping, cruise lines, fishing fleets, and offshore installations. 5G NTN enables high-bandwidth applications previously unavailable at sea, including real-time fleet monitoring, crew welfare services, maritime IoT sensors, and navigation assistance. Integration with existing maritime communication systems (VSAT, L-band) creates hybrid solutions offering reliable, cost-effective connectivity across global shipping routes, with particular growth in automated vessel operations and environmental monitoring compliance.

By Application: Enhanced Mobile Broadband led, while Massive Machine-Type Communications is the fastest-growing segment.

Enhanced Mobile Broadband (eMBB) leads application segments with 44.2% share, driven by consumer demand for high-speed internet in connectivity-challenged areas and mobility scenarios, such as aircraft and trains. 5G NTN enables broadband experiences previously limited to urban areas, supporting video streaming, video calls, and cloud applications anywhere on Earth.

Massive Machine-Type Communications (mMTC) grows fastest at 37.8% CAGR, addressing exponential IoT device proliferation across agriculture, environmental monitoring, asset tracking, and infrastructure management. 5G NTN supports millions of low-power, low-data-rate devices across vast geographical areas, enabling applications, such as precision agriculture sensors, pipeline monitoring, wildlife tracking, and smart grid management in remote regions.

By End-Use: Aerospace & Defense Segment Dominated the Market, while Maritime is the Fastest-growing Segment in the Market

Aerospace & Defense dominates end-use segments with 32.6% share, leveraging 5G NTN for tactical communications, intelligence surveillance and reconnaissance (ISR), UAV command and control, and airborne connectivity. Dual-use technologies developed for defense often transition to commercial aviation connectivity, with in-flight broadband becoming standard service across commercial airlines through hybrid satellite-air-to-ground networks.

Maritime end-use shows fastest growth at 40.3% CAGR, revolutionizing connectivity across commercial shipping, cruise tourism, offshore energy, and maritime safety. 5G NTN enables digital transformation of maritime operations through real-time vessel performance monitoring, predictive maintenance, electronic navigation updates, and crew welfare services.

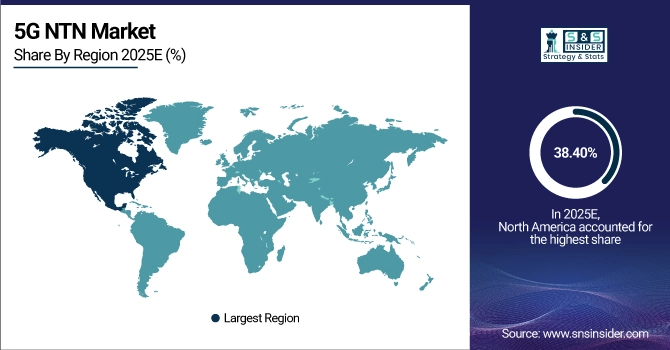

5G NTN Market Regional Analysis:

North America 5G NTN Market Insights:

North America dominated the 5G NTN Market with 38.40% share in 2025, driven by aggressive private sector investment in satellite constellations, favorable regulatory environment from FCC, strong defense spending, and presence of technology leaders including SpaceX, Amazon, and Lockheed Martin. Early adoption of direct-to-device services, rural connectivity initiatives, and aerospace innovation clusters further reinforce regional leadership in both technology development and service deployment.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific 5G NTN Market Insights:

Asia Pacific exhibits fastest growth at 36.80% CAGR over 2026–2033, fueled by massive unconnected populations, government digital inclusion programs, expanding maritime activities, and growing satellite manufacturing capabilities. Countries, such as China (GW constellation), India (NSIL), Japan (Sky Perfect JSAT), and Australia lead regional adoption, addressing unique challenges of archipelagic nations, mountainous terrains, and rapidly digitizing economies through integrated terrestrial-NTN networks.

Europe 5G NTN Market Insights:

Europe holds significant 28.30% market share in 2025, supported by European Space Agency initiatives, EU connectivity projects (IRIS2 constellation), strong regulatory framework for space activities, and presence of leading satellite operators (Eutelsat, SES). Collaborative research through 6G-SANDBOX projects, focus on secure and sovereign connectivity, and integration with terrestrial 5G networks position Europe as innovation hub for advanced NTN architectures and services.

Middle East & Africa and Latin America 5G NTN Market Insights

The Middle East & Africa and Latin America together account for 18.50% market share in 2025, showing accelerating growth driven by expanding satellite communications for oil & gas operations, mining connectivity, rural telemedicine programs, and government initiatives for national broadband coverage. Regional satellite operators (Arabsat and Hispasat), combined with partnerships with global constellation providers, address unique geographical challenges across deserts, rainforests, and extended maritime economic zones.

5G NTN Market Competitive Landscape:

Space Exploration Technologies Corp. (SpaceX)

SpaceX, which was founded in 2002 and has its headquarters in Hawthorne, California, transformed space technology with the Starlink satellite constellation and reusable rockets. Through its 5G NTN projects, the business partners with major mobile operators to provide worldwide connection by integrating direct-to-cellular capabilities onto next-generation Starlink satellites. Rapid constellation deployment is made possible by SpaceX's vertical integration from production to launch.

-

January 2025: SpaceX launched first batch of Starlink satellites with direct-to-smartphone 5G capabilities, initiating commercial testing with multiple mobile network operators globally.

Qualcomm Technologies, Inc.

Qualcomm, a San Diego, California-based company founded in 1985, uses chipsets, software, and licensing to propel advancements in wireless technology. Through collaborations with satellite operators and device makers, the company's Snapdragon Satellite platform provides direct 5G NTN connectivity in smartphones. Global NTN requirements are shaped by Qualcomm's expertise in 3GPP standardization.

-

November 2024: Qualcomm announced Snapdragon Satellite Gen 2 supporting both emergency and broadband services across multiple satellite constellations with improved power efficiency.

Nokia Corporation

Nokia was established in 1865 and has its headquarters in Espoo, Finland. It offers software, services, and network infrastructure all over the world. Satellite radio units, cloud-native core network functions, and end-to-end network slicing for hybrid terrestrial-NTN deployments are among the company's 5G NTN solutions. Nokia leads a number of ESA-funded research projects and collaborates with satellite operators.

-

February 2025: Nokia demonstrated end-to-end 5G network slicing across terrestrial and satellite networks, enabling guaranteed service levels for maritime and emergency services.

5G NTN Market Key Players

-

Space Exploration Technologies Corp. (SpaceX)

-

Nokia Corporation

-

Ericsson AB

-

Huawei Technologies Co., Ltd.

-

Thales Alenia Space

-

Lockheed Martin Corporation

-

OneWeb (Eutelsat Group)

-

Amazon.com, Inc. (Project Kuiper)

-

Viasat, Inc.

-

Intelsat S.A.

-

Telesat Corporation

-

SoftBank Group Corp.

-

Airbus Defence and Space

-

SKY Perfect JSAT Corporation

-

Gilat Satellite Networks Ltd.

-

Cobham SATCOM

-

ST Engineering iDirect

-

AST SpaceMobile, Inc.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2025E |

USD 9.90 Billion |

|

Market Size by 2033 |

USD 103.74 Billion |

|

CAGR |

CAGR of 34.14% From 2026 to 2033 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2033 |

|

Historical Data |

2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Hardware, Software, Services.) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Space Exploration Technologies Corp. (SpaceX), Qualcomm Technologies, Inc., Nokia Corporation, Ericsson AB, Huawei Technologies Co., Ltd., Thales Alenia Space, Lockheed Martin Corporation, OneWeb (Eutelsat Group), Amazon.com, Inc. (Project Kuiper), Viasat, Inc., Intelsat S.A., Telesat Corporation, SoftBank Group Corp., Airbus Defence and Space, Boeing Company, SKY Perfect JSAT Corporation, Gilat Satellite Networks Ltd., Cobham SATCOM, ST Engineering iDirect, AST SpaceMobile, Inc. |