Connected Mining Market Report Scope & Overview:

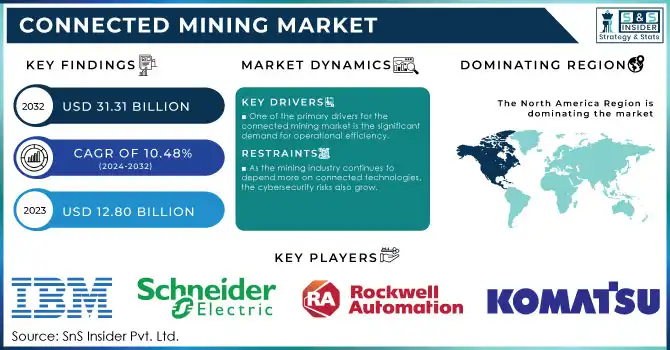

The Connected Mining Market Size was valued at USD 12.80 billion in 2023 and is expected to reach USD 31.31 billion by 2032, growing at a CAGR of 10.48% over the forecast period 2024-2032.

The connected mining market is experiencing significant growth as the industry accelerates toward greater automation and digitalization. This transformation is largely driven by advancements in IoT (Internet of Things), AI (Artificial Intelligence), machine learning, big data analytics, and cloud computing. Cloud-based systems are revolutionizing the connected mining industry by providing unmatched scalability, enabling mining companies to expand their operations without the need for substantial infrastructure investment. According to a survey of 800 organizations, more than 94% of businesses with over 1,000 employees now have a substantial portion of their workloads in the cloud, with 80% of these organizations utilizing multiple public or private cloud solutions. The widespread adoption of cloud platforms allows mining companies to store and process vast amounts of data generated from mining sites, providing real-time accessibility for decision-making. This ensures informed decisions are made swiftly, no matter the location, which enhances operational efficiency. The solutions segment, particularly asset tracking and optimization, is the dominant force in the market.

To Get More Information on Connected Mining Market - Request Sample Report

In addition, the services segment is also experiencing significant growth, particularly in deployment, maintenance, and integration services. These services, including professional and managed services, play a crucial role in ensuring the smooth operation of connected mining systems. As mining companies continue to adopt more advanced technologies, these services are projected to grow rapidly, enabling businesses to streamline operations and reduce IT complexities, further driving the connected mining market forward.

Connected Mining Market Dynamics

Drivers

-

One of the primary drivers for the connected mining market is the significant demand for operational efficiency.

Digital technologies like IoT, cloud computing, and AI allow mining companies to automate tasks, streamline workflows, and minimize downtime. By utilizing real-time monitoring and data analytics, businesses can identify operational obstacles, oversee equipment efficiency, and monitor environmental conditions, resulting in enhanced productivity. Devices connected to the Internet of Things gather information about machinery, employees, and the environment, enabling businesses to implement preventative actions for upkeep, fixing, and security. These technologies improve asset management and simplify the supply chain, leading to more flexible and reactive mining operations. When mining companies implement connected solutions, they can lower operational costs, enhance safety, and better achieve production goals. Efforts to increase operational efficiency are important for both boosting productivity and maintaining long-term viability.

-

Mining companies are facing growing demands to adhere to more stringent environmental rules and sustainable efforts.

With the implementation of stricter regulations on carbon emissions, waste disposal, and land restoration by governments globally, mining companies need to utilize innovative technologies to meet these requirements and minimize their ecological footprint. Connected mining solutions help companies achieve these objectives by offering in-depth, up-to-the-minute information to monitor and control their environmental impact. One important use of connected technologies for meeting regulations is through monitoring and reporting. IoT devices and sensors gather data constantly on different environmental aspects like water usage, emissions, and energy consumption. This information can be sent to regulatory agencies to make sure that businesses are complying with environmental regulations and dodging fines. Automating data collection and reporting helps companies simplify compliance initiatives and minimize the chance of fines or legal problems.

Restraints

-

As the mining industry continues to depend more on connected technologies, the cybersecurity risks also grow.

The presence of IoT devices, sensors, and cloud-based platforms in mining operations increases the risk of cyberattacks, leading to potential exposure of sensitive data, operational disruptions, and substantial financial damages. Cybercriminals could potentially attack interconnected mining systems to pilfer confidential data, tamper with machinery, or disturb crucial activities. Mining companies need to make significant investments in cybersecurity, such as encryption, firewalls, and intrusion detection systems, to combat the increasingly complex cyber threats. Nevertheless, the ongoing development of online dangers requires companies to frequently upgrade and improve their security measures, increasing the challenge and expense of managing a connected mining system.

Connected Mining Market Segmentation Analysis

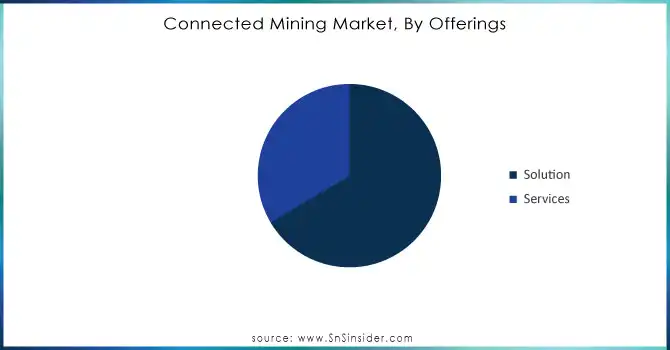

By Offering

The solutions segment dominated the market in 2023 with a 66% market share. These include automation, data analytics, IoT systems, and cloud-based platforms, designed to optimize operations, increase productivity, and reduce costs. The increasing adoption of AI, machine learning, and real-time data analytics in the mining sector contributes to the growth of this segment. Companies like Hexagon Mining, with its Mining Automation platform, and Caterpillar, providing Cat MineStar System, have applied these solutions to enhance safety, reduce downtime, and improve operational efficiency in mining.

The services segment is expected to have the fastest CAGR during 2024-2032. These services support the seamless integration and customization of mining solutions. With the growing adoption of connected technologies, services are becoming essential to ensure system interoperability and long-term support. Companies like Accenture offer Digital Transformation Services, helping mining companies implement advanced technologies like IoT and automation.

Do You Need any Customization Research on Connected Mining Market - Enquire Now

By Mining Type

The underground mining segment held the majority market share of 58% in the connected mining market in 2023, because of the growing need for precious minerals and metals located far beneath the surface of the earth. As mines delve further underground, the level of operations becomes more intricate, with the need for advanced technologies to oversee, automate, and ensure safety in underground mining. Connected mining technologies in this sector boost operational effectiveness, minimize hazards, and enhance worker safety in potentially dangerous surroundings. Caterpillar and Komatsu offer mining solutions for underground operations, incorporating IoT, automation, and AI to enhance efficiency and increase productivity.

Surface mining is expected to become the most rapidly expanding sector in the connected mining market during 2024-2032. The increased need for resources such as coal, copper, and limestone from surface mining operations is responsible for this expansion. Surface mining includes taking away soil, rock, and other materials to reach valuable minerals. It significantly benefits from connected mining technologies, allowing for remote monitoring, asset management, and evaluating environmental impact. Prominent companies such as Rio Tinto and BHP have led the way in implementing autonomous systems and real-time monitoring to enhance efficiency in their surface mining activities.

Connected Mining Market Regional Overview

North America dominated the market in 2023 with a 35% market share, driven by substantial investments in digital transformation and the widespread adoption of advanced mining technologies. Companies like ABB and Schneider Electric also provide critical infrastructure solutions that enable efficient operations. The market in North America continues to grow as mining companies seek to enhance productivity and sustainability, with the U.S. and Canada being major contributors due to their technological advancements and focus on reducing environmental impact.

Asia-Pacific is the fastest-growing region in the connected mining market during the forecast period 2024-2032, due to rapid industrialization, increasing adoption of automation, and government-driven initiatives in countries like China, India, and Australia are fueling this growth. Key players in the region include Rockwell Automation and Trimble, who are focusing on leveraging AI and IoT technologies to enhance mining safety and operational efficiency. Australia, in particular, is leading the charge with large-scale mining operations adopting smart mining technologies, which help reduce costs and increase resource yield.

Key Players in Connected Mining Market

The major key players in the Connected Mining Market are:

-

Cisco (Industrial IoT Solutions, Networking for Mining Operations)

-

IBM (Maximo Asset Management, IBM Watson for IoT)

-

Eurotech Communication (Everyware IoT, ReliaGate Edge Gateway)

-

SAP (SAP Digital Manufacturing Cloud, SAP Leonardo IoT)

-

ABB (ABB Ability MineOptimize, ABB Ability Safety and Asset Management)

-

Schneider Electric (EcoStruxure Mining, EcoStruxure Asset Advisor)

-

Rockwell Automation (FactoryTalk, PlantPAx Distributed Control System)

-

Komatsu (Komatsu Mining Service, Autonomous Haulage System)

-

Caterpillar (Cat MineStar, Cat Command for Hauling)

-

Trimble (Trimble Connected Mine, Trimble Fleet Management)

-

PTC (ThingWorx, Vuforia Augmented Reality)

-

Siemens (MindSphere, Siemens Digital Industries)

-

MST Global (MST iVolve, IntelliFLEET)

-

Howden (Howden Compressors, Howden Fans for Mining Ventilation)

-

Hexagon (MinePlan, HxGN MineOperate)

-

Accenture (Accenture Connected Mining, Accenture IoT Analytics)

-

Hitachi (Hitachi Smart Mining, IoT for Mining Equipment)

-

Wipro (Wipro’s IoT for Mining, Wipro Connected Solutions)

-

GE Digital (Predix, GE Digital APM)

-

Getac (Getac Mining Solutions, Getac Rugged Devices for Mining)

Providers of software in the Connected Mining Market:

-

PTC

-

Accenture

-

Wipro

-

IBM

-

SAP

-

Hexagon

-

Zyfra

-

IntelliSense.io

-

Axora

-

Applied Vehicle Analysis

Recent Developments

-

January 2024: ABB announced its decision to purchase Real Tech, a prominent Canadian company known for its cutting-edge optical sensor technology used in water monitoring and testing.

-

August 2024: ABB has created a new feature in its ABB Ability Predictive Maintenance for Grinding platform to improve the speed and efficiency of troubleshooting and diagnostics in mineral processing.

-

September 2024: SAP SE, a major provider of business solutions, finalized its purchase of WalkMe Ltd, a company specializing in digital adoption platforms. WalkMe's technology allows for the execution of workflows in various business software applications, enhancing user experience and adoption while also facilitating business transformation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.80 Billion |

| Market Size by 2032 | USD 31.31 Billion |

| CAGR | CAGR of 10.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Solutions, Services) • By Mining Type (Surface, Underground) • By Deployment (On-premises, Cloud) • By Application (Exploration, Processing and Refining, Transportation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco, IBM, Eurotech Communication, SAP, ABB, Schneider Electric, Rockwell Automation, Komatsu, Caterpillar, Trimble, PTC, Siemens, MST Global, Howden, Hexagon, Accenture, Hitachi, Wipro, GE Digital, Getac |

| Key Drivers | • One of the primary drivers for the connected mining market is the significant demand for operational efficiency. • Mining companies are facing growing demands to adhere to more stringent environmental rules and sustainable efforts. |

| RESTRAINTS | • As the mining industry continues to depend more on connected technologies, the cybersecurity risks also grow. |