Mining Automation Market Size:

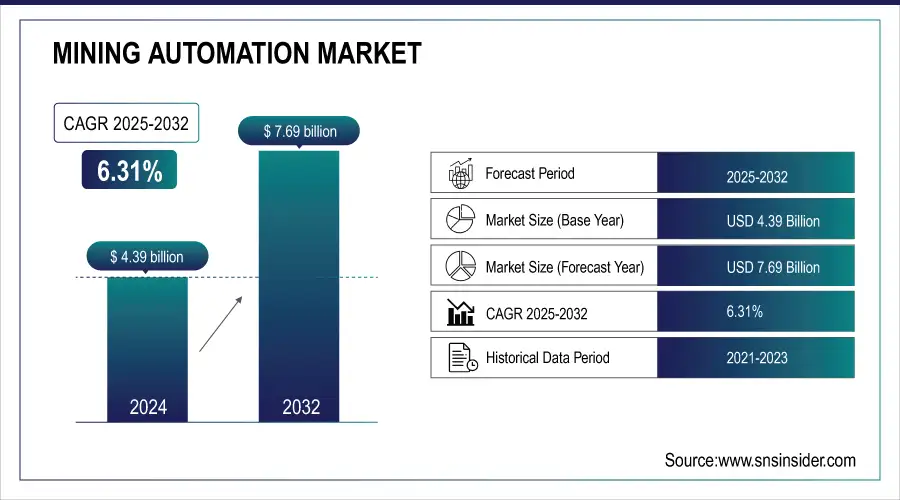

The Mining Automation Market Size was valued at USD 4.39 Billion in 2025E and is expected to reach USD 7.69 Billion by 2033 and grow at a CAGR of 6.31% over the forecast period 2026-2033.

Automated mining systems are revolutionizing the industry by significantly enhancing operational efficiency through continuous operations, reduction of downtime, and optimized resource extraction. For example, the combination of automated drilling rigs with driverless cars enables mining businesses to run around the clock without the disruptions caused by human labor, including shift changes and exhaustion. It has been demonstrated that this ongoing activity increases productivity by 5–10%, which is the same as a conventional mining business opening a new mine.

Mining Automation Market Size and Forecast:

-

Mining Automation Market Size in 2025E: USD 4.39 Billion

-

Mining Automation Market Size by 2033: USD 7.69 Billion

-

CAGR: 6.31% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Mining Automation Market - Request Sample Report

Furthermore, real-time equipment monitoring and preventative maintenance are made possible by predictive maintenance solutions, which are fueled by AI and IoT and reduce unplanned downtime. To reduce operating disruptions and increase the lifespan of mining equipment, data from equipment sensors, for instance, can be used to forecast possible failures and fine-tune maintenance schedules.

According to the data from the U.S. Bureau of Labor Statistics indicates that the use of these technologies has also decreased workplace accidents since they allow autonomous systems to take over risky duties, increasing overall safety.

Key Mining Automation Market Trends

-

Increasing adoption of autonomous haul trucks, drills, and loaders to enhance productivity, reduce operational costs, and improve worker safety in mining environments.

-

Growing integration of artificial intelligence (AI), IoT, and machine learning (ML) technologies for real-time data analytics, predictive maintenance, and process optimization.

-

Rising implementation of remote and centralized operation centers to minimize on-site workforce requirements and ensure continuous mining operations in hazardous zones.

-

Expanding use of smart mine management software and digital platforms for efficient fleet tracking, production scheduling, and equipment monitoring.

-

Shift toward sustainable and energy-efficient mining automation solutions to reduce carbon emissions and comply with stringent environmental regulations.

-

Increasing investments in advanced communication infrastructure, including 5G and edge computing, to enable seamless connectivity across autonomous mining systems.

-

Growing emphasis on worker safety and risk mitigation through automation-driven monitoring systems and reduced human intervention in critical operations.

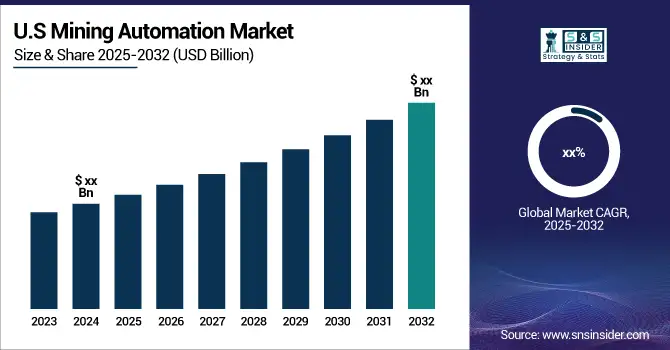

The U.S. Mining Automation market size was valued at an estimated USD 1.65 billion in 2025 and is projected to reach USD 2.95 billion by 2033, growing at a CAGR of 5.8% over the forecast period 2026–2033. Market growth is driven by increasing focus on improving operational efficiency, worker safety, and productivity in mining operations. Rising adoption of autonomous haulage systems, automated drilling, and real-time monitoring solutions is accelerating market expansion across surface and underground mining activities. Additionally, advancements in AI, robotics, and IoT-enabled mining technologies, along with growing emphasis on cost reduction and sustainability, further support the steady growth outlook of the U.S. mining automation market during the forecast period.

Mining Automation Market Growth Drivers

Rising need for productivity and safety in the mines are driving the market growth.

Metals and minerals are in demand all over the world. Mining corporations are under pressure to increase profits and reduce overhead costs. Technologies that minimize downtime and enhance output by offering continuous operations for which little human intervention is needed such as automated drilling and haulage systems are being used. Over the past ten years, the use of automatic systems has assisted in reducing mining-related deaths by roughly 30%, as per the U.S. Department of Labor’s Mine Safety and Health Administration. Moreover, these modern technologies can alleviate human exposure to hazardous situations, like as unstable rock formations and underground mining, and enhance safety while improving production rates.

Moreover, most governments in Canada and Australia, which are among the world’s top mining nations, seem to agree. Recently, the Australian government has invested in a variety of initiatives in order to promote the development and use of innovative mining systems. Increased productivity and a safer working environment have once again demonstrated the dual advantages of automation. The mining industry is increasingly adopting this technology as a result of the increased emphasis on both performance and safety.

Mining Automation Market Restraints

High costs and high capital investment hamper the market growth.

High costs and significant capital investment requirements are major restraints that hinder the growth of the mining automation market. Significant upfront costs are associated with the implementation of automated systems in mining operations. These costs include the acquisition of cultured equipment, the integration of complex software, and the installation of supporting infrastructure. These expenses may be unaffordable, particularly for smaller mining firms or those doing business in areas with constrained funding sources. The overall financial burden is further increased by the constant upkeep, upgrades, and training needed to guarantee the effective operation of automated systems.

Mining Automation Market Segmentation Analysis:

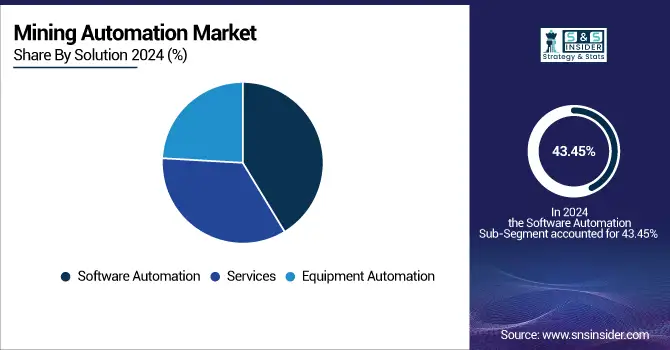

By Solution

The software automation solution type held the largest market share around 43.45% in 2025. Because it plays a crucial part in improving decision-making, safety, and operational efficiency in mining operations. Predictive maintenance, fleet management systems, and real-time data analytics are just a few of the many uses of software automation that are crucial for maximizing mining equipment efficiency and minimizing downtime. Mining businesses can monitor and control operations remotely with the help of these solutions, which increases production and reduces costs. Additionally, the need for advanced software that can integrate different parts of mining operations from exploration to production and it has increased as the mining industry continues to pursue digital transformation methods.

By Application

The mineral mining segment held the largest market share around 42.13% in 2025. It is anticipated that the application of metal mining will rise significantly during the projection period. The development in the use of autonomous technology in metal prospecting activities is the reason for the expansion. Furthermore, revenue growth is anticipated as a result of the application sectors' growing need for metals like copper, zinc, lead, and nickel. In addition, the need for automated solutions in the metal mining industry has surged in response to the growing demand for base metals.

Mining Automation Market Regional Outlook:

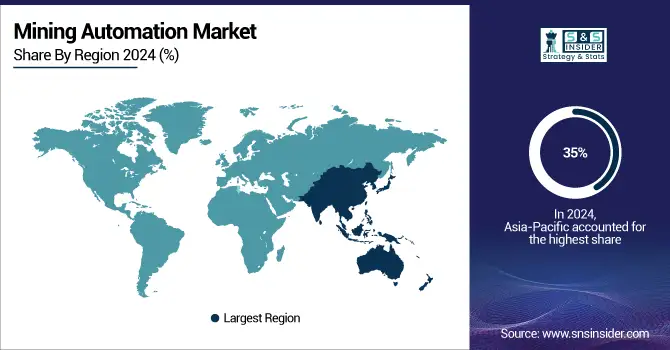

Asia-Pacific Mining Automation Market Insights

In 2025, Asia-Pacific holds a 35% market share and continues to dominate region in the Mining Automation Market. Countries such as China, Australia, India, and Japan are driving this growth due to rapid industrialization, increasing mineral demand, and government-backed initiatives for smart mining. Expanding infrastructure development, rising labor shortages, and growing adoption of autonomous haulage and drilling systems are key growth factors. Major mining firms in the region are investing heavily in digital twins, AI-based fleet management, and advanced communication networks to enhance productivity and safety.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Mining Automation Market Insights

North America leads the global Mining Automation Market with a 23% share, dominated by the U.S. and Canada. Growth is driven by strong investments in autonomous mining equipment, digital transformation initiatives, and early adoption of advanced automation technologies. The region benefits from well-established mining infrastructure, high labor costs prompting automation adoption, and strong government support for sustainable mining operations. Collaboration between technology providers and mining companies, along with continuous R&D in robotics and IoT solutions, further accelerates market expansion across major mining sites in the U.S. and Canada.

Europe Mining Automation Market Insights

Europe accounts for 27% of the global market, led by Germany, the U.K., and the Nordic countries. The region’s focus on safety regulations, environmental sustainability, and efficiency is fueling the adoption of automation technologies in mining operations. Ongoing digitalization efforts, integration of AI-driven monitoring systems, and strong support for green mining initiatives strengthen regional growth. Partnerships among mining operators, automation firms, and technology startups are promoting innovation and modernization of existing mines, particularly in Western and Northern Europe.

Latin America Mining Automation Market Insights

Latin America represents 8% of the global market, with Brazil, Chile, and Mexico leading adoption. The region’s growth is supported by modernization of large-scale mining projects, expanding mineral exports, and growing partnerships with international technology vendors. However, limited technical expertise and budget constraints in smaller operations slow down overall adoption. Investments in autonomous vehicles, fleet monitoring systems, and real-time data analytics are gradually improving productivity, particularly in copper, lithium, and iron ore mines.

Middle East & Africa (MEA) Mining Automation Market Insights

The MEA region accounts for 7% of the global market, with South Africa, Saudi Arabia, and the UAE at the forefront. Growth is driven by increasing investments in mineral exploration, smart mining technologies, and sustainable mining practices. Governments are focusing on diversifying economies through mining sector development, leading to greater demand for automated solutions. Despite challenges such as infrastructure limitations and high initial costs, the adoption of robotics, remote monitoring, and autonomous vehicles is gaining traction, especially across large-scale mines in the region.

Mining Automation Market Competitive Landscape

Komatsu Ltd.

Komatsu Ltd. is a Japan-based multinational corporation specializing in construction, mining, and industrial equipment, with a strong focus on automation and smart mining technologies.

-

In November 2023, Komatsu introduced the Autonomous Haulage System (AHS) Version 6, featuring upgraded AI-driven algorithms and seamless integration with other mining equipment to enhance fleet coordination, minimize downtime, and optimize haulage efficiency.

Sandvik AB

Sandvik AB is a Sweden-based engineering group providing equipment, tools, and digital solutions for the mining and rock excavation industries.

-

In March 2024, Sandvik launched its AutoMine Core platform, which integrates machine learning and real-time analytics for improved automation, safety, and performance across both surface and underground mining operations.

Mining Automation Companies are:

-

Hitachi, Ltd.

-

Liebherr Group

-

Atlas Copco AB

-

Autonomous Solutions Inc.

-

Sandvik AB

-

Siemens AG

-

Komatsu Ltd.

-

Epiroc AB

-

Hexagon AB

-

Rockwell Automation, Inc.

-

ABB Ltd.

-

Schneider Electric SE

-

Trimble Inc.

-

RPMGlobal Holdings Ltd.

-

Komatsu Mining Corp. (Joy Global)

-

Mine Site Technologies Pty Ltd.

-

MST Global (a Komatsu Company)

-

Hitachi Construction Machinery Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.39 Billion |

| Market Size by 2033 | USD 7.69 Billion |

| CAGR | CAGR of 6.31 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Software Automation, Services, Equipment Automation) • By Application (Metal Mining, Mineral Mining, Coal Mining) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Caterpillar, Hitachi, Ltd., Liebherr Group, Atlas Copco AB, Autonomous Solution Inc., Liebherr Group, Rio Tinto, Sandvik AB, Siemens, Komatsu Ltd. & Other Players. |