Erectile Dysfunction Treatment Drugs Market Size & Overview:

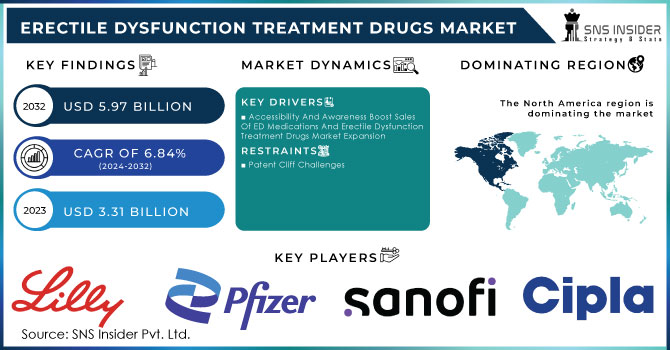

The Erectile Dysfunction Treatment Drugs Market was valued at USD 3.31 billion in 2023 and is expected to reach USD 5.97 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.84% from 2024 to 2032.

Erectile dysfunction (ED) is a growing concern due to modern lifestyles and a rise in chronic conditions. Over 150 million men worldwide have erectile dysfunction, and that number is expected to climb. Erectile dysfunction is linked to diabetes, heart disease, and age. Men with diabetes and those over 65 are more likely to experience erectile dysfunction. Smoking, drinking, and drug use can also contribute for the market expansion.

Get More Information on Erectile Dysfunction Treatment Drugs Market - Request Sample Report

The Erectile dysfunction treatment drugs market is increasing due to demand, with some positive impact from the COVID-19 pandemic. However, limited healthcare access and drug recalls can hinder market growth. There are currently various ED medications available, including Viagra (Sildenafil), Levitra, Cialis, and Stendra. The COVID-19 pandemic itself increased the risk of ED by nearly six times, with an estimated prevalence of 31.8% in men with a history of COVID-19 according to National Library of Medicine, April 2021. Additionally, aging populations and rising rates of chronic diseases like diabetes 72.2% prevalence globally in 2021 with ED as a common symptom as per BMC Endocrine Disorders, July 2021 and hypertension 1.28 billion adults affected globally according to WHO study, 2021 which indicates all contribute to erectile dysfunction treatment drugs market growth.

Market Dynamics

Drivers

-

Accessibility And Awareness Boost Sales Of ED Medications And Erectile Dysfunction Treatment Drugs Market Expansion

An aging population and rising chronic disease rates are key drivers of the erectile dysfunction treatment drugs market. In the US alone, 30 million men experience ED annually as per National Institutes of Health, 2022, and conditions like diabetes 72.2% prevalence globally with ED as a common symptom according to BMC Endocrine Disorders, July 2021 and hypertension 1.28 billion adults affected globally according to WHO, 2021 are becoming increasingly common, further contributing to ED cases. Mental health issues like depression and anxiety, affecting 21 million US adults according to American Hospital Association, 2020, can also be culprits.

Emerging markets present a lucrative opportunity due to their large patient pool, improving healthcare infrastructure, and growing awareness of ED treatment options. The availability of prescription medications like Viagra (Sildenafil) (brand name for Sildenafil Citrate) and generic alternatives from companies like Teva pharmaceuticals makes ED treatment more accessible to a wider range of men. Additionally, new drug formulations and regulatory approvals, such as Teva's launch of ALYQ (generic tadalafil) in 2020, are fueling market growth.

Public awareness about ED medications is on the rise, with sales of phosphodiesterase-5 inhibitors increasing by an average of 285,653 units monthly before March 2020 as per National Center for Biotechnology Information. This increased awareness is likely due to a combination of factors, including educational campaigns and the wider availability of ED medications through online providers and hospital pharmacies.

However, it's important to note that potential side effects like headaches and back pain, as well as interactions with other medications, can deter some men from using ED drugs. Consulting a healthcare professional is crucial before starting any ED medication to ensure it's safe and appropriate for individual needs.

Restraints

-

Patent Cliff Challenges

The erectile dysfunction treatment drugs market is facing headwinds due to the expiration of patents on major medications like Viagra (Sildenafil). This expiration allows generic versions to enter the market, which can significantly drive down prices and erode market share for the original brand-name drugs.

Key Segmentation

By Product

-

Viagra (Sildenafil)

-

Cialis

-

Zydena

-

Levitra

-

Stendra

-

Others

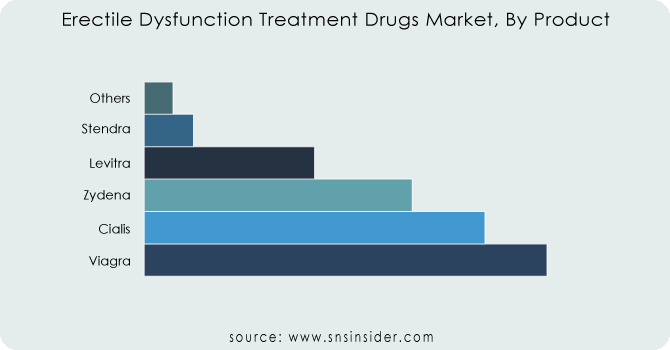

Viagra (Sildenafil) is the current leader of erectile dysfunction treatment drugs market, holding the market share 31.97% in 2023. Companies are working together and developing new products to expand their offerings. This includes deals like Pfizer partnering with a telehealth clinic to offer generic Viagra (Sildenafil) and the recent FDA approval of a topical erectile dysfunction gel for over-the-counter sales. In instance, June 2023, Futura Medical's Eroxon marked a significant step forward - it was the first topical gel for ED to receive FDA clearance for OTC marketing in the US.

Furthermore, for other erectile dysfunction treatment drugs market is expected to grow even faster, at over 13% per year. This is because there are many different erectile dysfunction medications available, and some are becoming easier to access. For example, a generic version of Cialis was recently approved for over-the-counter sale in Poland. These developments make it more convenient for men to get the treatment they need.

Need any customization research on Erectile Dysfunction Treatment Drugs Market - Enquiry Now

By Mode Of Administration

-

Oral Medication

-

Injectable Medication

The erectile dysfunction treatment drugs market in 2023, oral medications (56.19%) like Cialis, Stendra, and Viagra (Sildenafil) dominating, and this dominance is forecast to hold strong. There are two key reasons behind this trend like convenience and affordability. Unlike injectable medications, oral drugs offer a discreet and user-friendly option for patients as they can be self-administered at home. Additionally, oral medications are generally less expensive than injectables, making them a more accessible treatment for a wider range of men. These factors combined are propelling the oral medication segment to be the driving force of the erectile dysfunction treatment drugs market.

By Distribution Channel

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

Hospital pharmacies dominating in the erectile dysfunction treatment drug market, capturing the largest share 56.30% in 2023. This dominance stems from a three-pronged advantage such as a growing number of ED cases requiring treatment, a wider range of ED medications stocked (including those with stricter controls), and a focus on prescription drugs, which form a major chunk of the erectile dysfunction treatment drugs market.

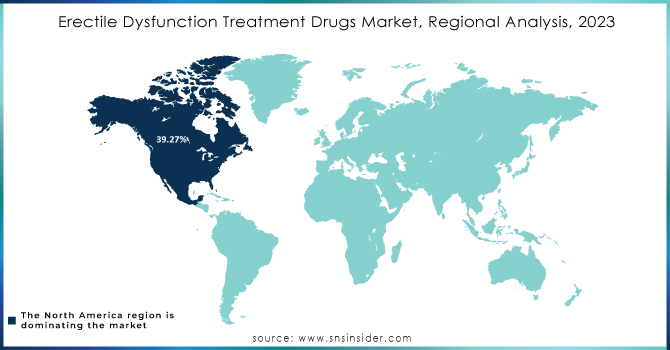

Regional Analysis

North America is the world's biggest for erectile dysfunction treatment drugs market, holding the largest share 39.27% in 2023. This is due to a few reasons that is, there are many men in North America with ED. The healthcare system is well-developed, making it easier for men to get diagnosed and treated. Finally, new ED treatments get approved for sale quickly in North America. For example, a generic version of a medication used to treat ED was recently approved by the FDA. This makes these medications more affordable and accessible, which increases the number of men who can get treatment and boosts the overall market size.

Asia Pacific is expected to be the fastest growing region in the coming years, with a projected growth rate of over 10% annually. This surge is driven by two main factors such as, new ED medications are being introduced in Asia Pacific at a steady pace. For instance, telemedicine platforms are being used to deliver treatments like Silcap and Wafesil in Australia. This increased access to new options is fueling market growth. Research shows a significant portion of the male population in Asia Pacific experiences ED, with rates ranging from 9% to 73% depending on the location. This high prevalence suggests a large potential erectile dysfunction treatment drugs market in the region.

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some of the major key players of the erectile dysfunction treatment drugs market are: Eli Lilly and Company, Pfizer Inc., Sanofi, Cipla Inc, Teva Pharmaceutical Industries Ltd., Bayer AG, Sun Pharmaceutical Industries Ltd., VIVUS, Inc., Petros Pharmaceuticals, Inc., Adamed, Auxilium Pharmaceuticals, Inc. and other players.

Recent Developments Of The Erectile Dysfunction Treatment Drugs Market

-

In a May 2022 deal, Aspargo Laboratories, Inc., a company focused on innovative formulations of existing medications, acquired the Bandol prescription brand for erectile dysfunction from Laboratorios Rubio S.A., a Spanish specialty pharmaceutical company.

-

Generic Options Emerge: In 2021, Glenmark Pharmaceuticals received US approval for their generic tadalafil tablets, offering more affordable treatment options for patients.

-

Digital Health Integration: Greenstone, a subsidiary of Pfizer, partnered with Roman, a digital men's health clinic, in 2021. This collaboration allows Roman to offer generic Viagra (Sildenafil) online, potentially increasing access and convenience for consumers.

-

New Topical Treatments: Futura Medical launched Eroxon gel in the UK in 2021, providing a topical alternative for treating erectile dysfunction.

-

China Approves Sublingual Sildenafil: iX Biopharma signed a licensing deal to bring Wafesil, a fast-acting sublingual sildenafil wafer, to the Chinese market for treating erectile dysfunction.

-

New ED Tablet Debuts in UK: Almus launched its Almus Erectile Dysfunction Relief 50mg film-coated tablets in the UK pharmaceutical market, providing another treatment option for men.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.31 billion |

| Market Size by 2031 | US$ 5.97 Billion |

| CAGR | CAGR of 6.84 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Viagra (Sildenafil), Cialis, Zydena, Levitra, Stendra, Others) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) • By Mode Of Administration (Oral Medication, Injectable Medication) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Eli Lilly and Company, Pfizer Inc., Sanofi, Cipla Inc, Teva Pharmaceutical Industries Ltd., Bayer AG, Sun Pharmaceutical Industries Ltd., VIVUS, Inc., Petros Pharmaceuticals, Inc., Adamed, Auxilium Pharmaceuticals, Inc. |

| Key Drivers | • Accessibility And Awareness Boost Sales Of ED Medications And Erectile Dysfunction Treatment Drugs Market Expansion |

| RESTRAINTS | • Patent Cliff Challenges |