Bio Detectors and Accessories Market Report Scope & Overview:

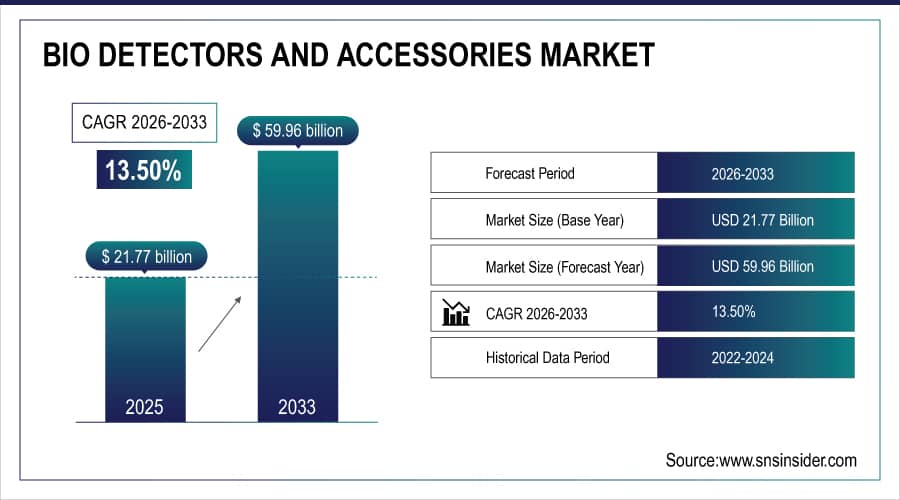

The Bio Detectors and Accessories Market size is estimated at USD 21.77 billion in 2025 and is expected to reach USD 59.96 billion by 2033, growing at a CAGR of 13.50% over 2026-2033.

The global bio detectors and accessories market trend include significant expansion driven by increasing biosecurity threats, rising demand for rapid pathogen detection, and growing applications across clinical diagnostics, food safety testing, and environmental monitoring. Advanced biotechnology innovations, including portable detection systems, microfluidic-based sensors, and real-time monitoring capabilities are transforming the landscape of biological threat identification and disease diagnosis. The integration of artificial intelligence and machine learning algorithms with bio detection technologies is enhancing accuracy, sensitivity, and speed of pathogen identification, thereby driving adoption across defense, healthcare, and food industries and boosting Bio Detectors and Accessories Market growth globally.

For instance, in April 2024, the deployment of advanced bio detection systems in airports and border checkpoints increased by 22% globally, reflecting heightened biosecurity concerns and accelerating adoption of rapid screening technologies.

Bio Detectors and Accessories Market Size and Forecast:

-

Market Size in 2025E: USD 21.77 billion

-

Market Size by 2033: USD 59.96 billion

-

CAGR: 13.50% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Bio Detectors and Accessories Market - Request Free Sample Report

Bio Detectors and Accessories Market Trends:

-

Rising global biosecurity threats and bioterrorism concerns are driving demand for advanced detection systems across defense and homeland security applications.

-

Development of portable, field-deployable bio detection devices with real-time monitoring capabilities for rapid response to biological threats and disease outbreaks.

-

Introduction of nanotechnology-based sensors, CRISPR-based detection methods, and multiplex assay platforms for enhanced sensitivity and specificity in pathogen identification.

-

Use of cloud-based data management systems, IoT-enabled sensors, and AI-powered analytics for automated threat detection, data integration, and decision support.

-

Growth in demand for point-of-care testing devices, disposable consumables, and user-friendly accessories for decentralized testing and immediate results.

-

Partnerships between biotechnology companies, defense contractors, and research institutions to develop next-generation detection technologies and expand commercial applications.

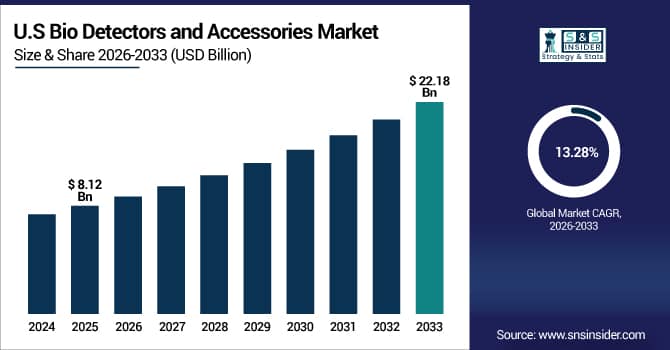

The U.S. Bio Detectors and Accessories Market is estimated at USD 8.12 billion in 2025 and is expected to reach USD 22.18 billion by 2033, growing at a CAGR of 13.28% from 2026-2033.

The U.S. dominates the global market due to substantial government investments in biosecurity infrastructure, advanced defense programs, and well-established healthcare diagnostic networks. Growing research investment, widespread use of cutting-edge detection technologies, and strict regulatory requirements for environmental monitoring and food safety are driving market expansion. Furthermore, the U.S. is the largest regional market globally due to the presence of top biotechnology businesses and ongoing technical breakthroughs.

Bio Detectors and Accessories Market Growth Drivers:

-

Technological Advancements in Detection Systems are Driving the Bio Detectors and Accessories Market Growth

The development of nanosensor technology, CRISPR-based diagnostics, and automated multiplex detection platforms that offer superior sensitivity, specificity, and quick turnaround times are the main technological factors driving the growth of the bio detectors and accessories market share. In addition to greatly increasing market penetration across the defense, healthcare, and food safety sectors, these ground-breaking solutions address crucial needs for early pathogen identification, bioterrorism prevention, and clinical diagnostics.

For instance, in August 2024, CRISPR-based bio detection systems captured approximately 12% of the clinical diagnostics segment in North America, demonstrating growing preference for molecular detection technologies and expanding market adoption.

Bio Detectors and Accessories Market Restraints:

-

High Equipment Costs and Complexity are Hampering the Bio Detectors and Accessories Market Growth

As advanced detection systems require significant capital investment, specialized technical expertise, and ongoing maintenance expenditures, which limit accessibility for smaller laboratories and resource-constrained settings, the market growth for bio detectors and accessories is constrained by high equipment costs and operational complexity. This obstacle causes slower adoption rates, limited market penetration in underdeveloped nations, and diminished growth potential in price-sensitive markets where end users place a high value on affordability and usability.

Bio Detectors and Accessories Market Opportunities:

-

Expanding Applications in Food Safety and Environmental Monitoring Drive Future Growth Opportunities for the Bio Detectors and Accessories Market

Implementing quick contamination detection systems, water quality monitoring devices, and agricultural pathogen screening technologies provide an opportunity to extend applications across food safety testing and environmental monitoring within the bio detectors and accessories market. Preventive quality control procedures, regulatory compliance verification, and real-time danger identification are made possible by these technologies. These applications may open up substantial growth potential and expand market reach internationally by improving consumer safety, lowering foodborne illness outbreaks, and guaranteeing environmental sustainability through easily available and trustworthy detection techniques.

For instance, in February 2024, the USDA reported that rapid bio detection deployment in food processing facilities increased by 28%, highlighting growing adoption for contamination prevention and regulatory compliance in the food industry.

Bio Detectors and Accessories Market Segment Analysis

-

By product, instruments held the largest share of around 46.82% in 2025E, and the reagents and media segment is expected to register the highest growth with a CAGR of 14.12%.

-

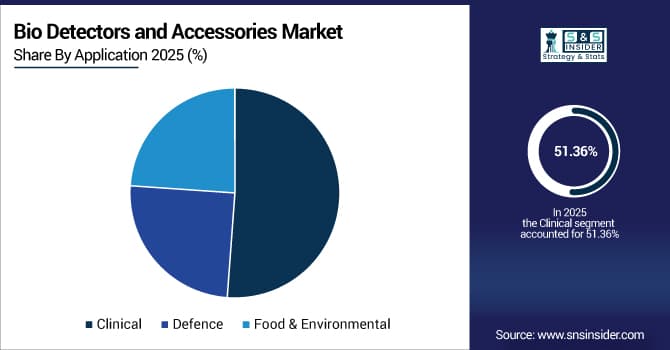

By application, clinical segment dominated the market with approximately 51.36% share in 2025E, while the defence is expected to register the highest growth with a CAGR of 14.85%.

-

By end-use, diagnostics accounted for the leading share of nearly 38.94% in 2025E, and point of care testing is expected to register the highest growth with a CAGR of 14.68%.

By Product, Instruments Lead the Market, While Reagents and Media Registers Fastest Growth

The instruments segment accounted for the highest revenue share of approximately 46.82% in 2025, owing to substantial capital investments in advanced detection platforms, automated analyzers, and high-throughput screening systems essential for laboratory operations. Growth factors include increasing demand for sophisticated biosensor technologies, spectroscopy equipment, and integrated detection workstations across research and clinical facilities.

The reagents and media segment is anticipated to achieve the highest CAGR of nearly 14.12% during the 2026–2033 period owing to the recurring consumable requirements, expanding test volumes, and continuous replenishment needs. Drivers include growing adoption of molecular diagnostics, immunoassay-based detection methods, and culture media formulations for pathogen isolation and identification protocols.

By Application, the Clinical Segment Dominates, While the Defence Segment Shows Rapid Growth

The Clinical segment held the largest revenue share of approximately 51.36% in 2025 due to the widespread utilization in infectious disease diagnostics, hospital-acquired infection surveillance, and patient screening programs requiring accurate pathogen identification. Key factors driving this segment include increasing healthcare expenditure, rising infectious disease prevalence, and mandatory diagnostic testing protocols in clinical settings worldwide.

The defence segment is predicted to grow at the strongest CAGR of approximately 14.85% during 2026–2033, driven by the rising biosecurity threats, bioterrorism preparedness initiatives, and military biodefense programs. Contributing factors include increased government funding for biological threat detection, deployment of field-portable detection units, and strategic investments in rapid response capabilities for protecting personnel and civilian populations.

By End-Use, Diagnostics Lead, and Point of Care Testing Registers Fastest Growth

The diagnostics segment accounted for the largest share of the bio detectors and accessories market with about 38.94%, owing to extensive laboratory testing requirements, centralized diagnostic facilities, and comprehensive pathogen screening programs supporting clinical decision-making. Factors driving this segment include standardized testing protocols, insurance reimbursement coverage, and established laboratory networks providing high-volume diagnostic services for infectious disease management and epidemiological surveillance.

Additionally, the point of care testing segment is slated to grow at the fastest rate with a CAGR of around 14.68% throughout the forecast period of 2026–2033, as portable devices, rapid test kits, and bedside diagnostic systems provide immediate results, decentralized testing capabilities, and reduced turnaround times. Increased adoption stems from emergency response requirements, remote healthcare delivery models, and patient preference for convenient testing options, while these systems enable timely clinical interventions and improved patient outcomes through accessible diagnostic solutions.

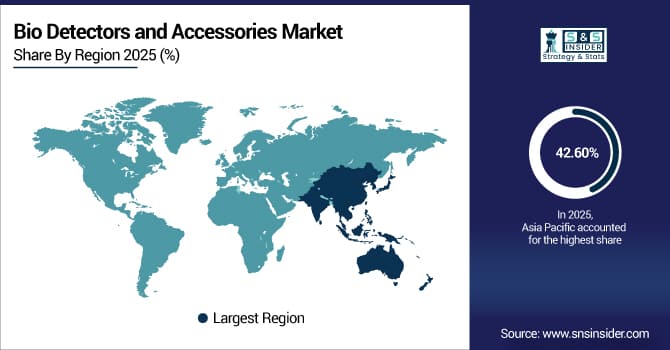

Bio Detectors and Accessories Market Regional Highlights:

Asia Pacific Bio Detectors and Accessories Market Insights:

Asia Pacific is the fastest-growing segment in the bio detectors and accessories market with a CAGR of 14.72%, as awareness of infectious disease threats, food safety concerns, and biosecurity challenges grows alongside expanding healthcare infrastructure in developing economies. Rapid urbanization, expanding government activities for disease surveillance and prevention programs, and rising research investments are all contributing factors. Access to detection technologies in urban and semi-urban areas is being improved by the expansion of pharmaceutical companies and diagnostic facilities throughout the region. International cooperation, technology transfer agreements, and favorable regulations all support market expansion. Growing accessibility and affordability of detection tools and consumables, along with competitive pricing advantages over Western markets, propel significant expansion in the Asia Pacific area.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Bio Detectors and Accessories Market Insights:

North America accounted for the highest revenue share of approximately 37.31% in 2025 of the bio detectors and accessories market, owing to substantial defense spending on biodefense programs, advanced healthcare diagnostic infrastructure, and heightened biosecurity awareness following biological threat incidents. Strong regulatory frameworks, broad insurance coverage that supports diagnostic testing, widespread use of state-of-the-art detection technology, and substantial research funding are all contributing factors. Additionally, government contracts, homeland security programs, and ongoing innovation by top biotechnology firms guarantee market dominance and significant profits from sales of bio detecting systems globally.

Europe Bio Detectors and Accessories Market Insights:

Due to stricter food safety laws, growing infectious disease monitoring requirements, and strong healthcare systems that enable cutting-edge diagnostic capabilities, the European biodetectors and accessories market is the second-largest region after North America. Sustained market expansion across key European countries is facilitated by advantageous reimbursement frameworks, automated laboratory systems, growing acceptance of molecular detection technologies, and EU-wide public health policies.

Latin America (LATAM) and Middle East & Africa (MEA) Bio Detectors and Accessories Market Insights:

The rising prevalence of infectious diseases and the expansion of healthcare infrastructure with better access to diagnostic technologies in Latin America, the Middle East, and Africa fuel the growth of the biodetectors and accessories market. Early illness diagnosis and outbreak management are made easier by the growing use of point-of-care diagnostic technology, government health initiatives, and international aid programs. Stable market growth is being supported by the growing urban populations and rising healthcare spending in these areas.

Bio Detectors and Accessories Market Competitive Landscape:

Thermo Fisher Scientific Inc. (est. 1956) is a global leader in scientific instrumentation and laboratory equipment that delivers innovative solutions for life sciences research and clinical diagnostics. It leverages extensive R&D capabilities and strategic acquisitions to produce advanced bio detection platforms with integrated analytical technologies.

-

In December 2024, launched a next-generation multiplex pathogen detection system featuring AI-powered analysis and cloud connectivity, enabling simultaneous identification of 50+ biological threats for defense and clinical applications.

Danaher Corporation (est. 1969) is a diversified science and technology company specializing in diagnostics, life sciences, and environmental solutions. It invests in molecular detection technologies and automation platforms with the objective of revolutionizing pathogen identification through rapid, accurate, and user-friendly diagnostic systems.

-

In September 2024, received FDA clearance for a portable PCR-based bio detection device designed for field deployment, enhancing rapid response capabilities for infectious disease outbreaks and biosecurity threats.

Roche Holding AG (est. 1896) is a global pioneer in pharmaceuticals and diagnostics with comprehensive solutions for healthcare providers worldwide. The company's bio detection portfolio emphasizes point-of-care testing, molecular diagnostics, and automated laboratory systems featuring robust R&D innovation to maintain competitive advantage in developed and emerging markets.

-

In July 2024, introduced an advanced immunoassay-based bio detection platform with enhanced sensitivity for early pathogen detection, strengthening its infectious disease diagnostics portfolio and expanding market presence across European healthcare systems.

Bio Detectors and Accessories Market Key Players:

-

Thermo Fisher Scientific Inc.

-

Danaher Corporation

-

Roche Holding AG

-

Abbott Laboratories

-

Siemens Healthineers AG

-

Bio-Rad Laboratories Inc.

-

Becton, Dickinson and Company

-

QIAGEN N.V.

-

PerkinElmer Inc.

-

Agilent Technologies Inc.

-

Merck KGaA

-

Bruker Corporation

-

bioMérieux SA

-

Shimadzu Corporation

-

HORIBA Ltd.

-

Teledyne Technologies Incorporated

-

Smiths Detection Group Ltd.

-

Flir Systems Inc.

-

Response Biomedical Corp.

-

BioFire Diagnostics LLC

-

GenMark Diagnostics Inc.

-

Luminex Corporation

-

Hologic Inc.

-

Cepheid (A Danaher Company)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 21.77 Billion |

| Market Size by 2033 | USD 59.96 Billion |

| CAGR | CAGR of 13.50% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Reagents and Media, Accessories and Consumables) • By Application (Clinical, Defence, Food & Environmental) • By End-Use (Point Of Care Testing, Research Laboratories, Diagnostics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., Danaher Corporation, Roche Holding AG, Abbott Laboratories, Siemens Healthineers AG, Bio-Rad Laboratories Inc., Becton, Dickinson and Company, QIAGEN N.V., PerkinElmer Inc., Agilent Technologies Inc., Merck KGaA, Bruker Corporation, bioMérieux SA, Shimadzu Corporation, HORIBA Ltd., Teledyne Technologies Incorporated, Smiths Detection Group Ltd., Flir Systems Inc., Response Biomedical Corp., BioFire Diagnostics LLC, GenMark Diagnostics Inc., Luminex Corporation, Hologic Inc., Cepheid (A Danaher Company) |