Palliative Care Market Size and Growth Analysis:

Get More Information on Palliative Care Market - Request Free Sample Report

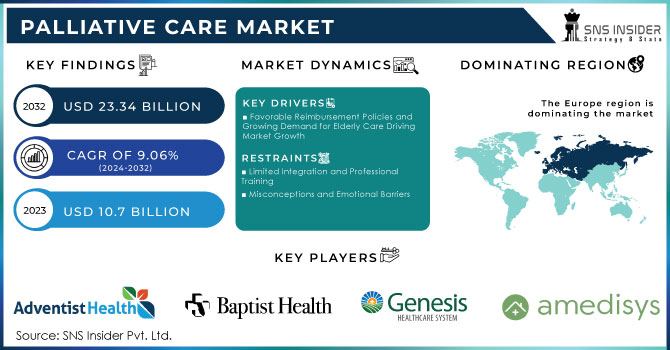

The Palliative Care Market was valued at USD 10.7 Billion in 2023 and is expected to reach USD 23.34 Billion by 2032 and grow at a CAGR of 9.06% over the forecast period of 2024-2032.

The growing incidence of life-threatening conditions is providing significant impetus for the palliative care market, which is becoming increasingly important globally in caring for patients and their families with a qualitative approach to improve the quality of life. Palliative care plays a very important role in symptom management, reducing pain, and in the emotional, social, and spiritual issues of patients having serious illnesses. An estimated 56.8 million patients require palliative care annually, including 25.7 million of them in their last year of life. But presently, only a minuscule 14% receive such care; the rest of the percentage reflects unmet demand. Positive government initiatives coupled with an ever-growing demand for better patient outcomes are forming the thrust in the growth of the market. For example, the Australian government allocated USD 53 million in May 2023 to assist 14 national projects of palliative care aimed to improve access and enhance the quality of the service. Alongside, funding has been allocated to training service providers and also GPs in advanced care planning-amounting to around USD 15.9 million. This reflects the growing importance of care across the national frameworks of healthcare.

The number of private and public care providers is, therefore, burgeoning across developing countries, a trend likely to continue driving the market. There is increased awareness of the services provided by palliative care: more individuals are asking for complete care, including home-based sites at which multidisciplinary teams begin intervention, especially pain management, disease control, and emotional support. Technological advances - such as mobile palliative care units and apps - are also revolutionizing the provision of care. For instance, in July 2023, students from the International Institute of Information Technology in Hyderabad (IIITH) began working on a palliative care app intended to better the situation for Indian people at large. The country has only 1% coverage of palliative care compared to a global average of 14%.

The aging population and the growing burden of non-communicable diseases will also drive a strong demand for palliative care. Early intervention and delivery of palliative care can decrease hospital admissions such as unnecessary admissions therefore improving overall health outcomes. It is therefore a critical component of modern healthcare systems.

| Condition | Description | Management Approaches |

|

Cancer |

Various types of malignancies affecting overall health |

Pain management, emotional support |

|

Heart Disease |

Chronic heart conditions leading to significant morbidity |

Symptom control, lifestyle changes |

|

Respiratory Diseases |

Chronic obstructive pulmonary disease (COPD), asthma |

Breathing support, medication management |

|

Neurological Disorders |

Conditions like Alzheimer’s and Parkinson’s |

Cognitive support, caregiver training |

|

Renal Failure |

Advanced kidney disease requiring symptom management |

Dialysis options, fluid management |

Market Dynamics

Drivers

-

Favorable Reimbursement Policies and Growing Demand for Elderly Care Driving Market Growth

Factors driving market growth include favorable reimbursement policies and increased access to palliative care. Recent changes in healthcare policies have led to the inclusion of palliative care services in the array of essential healthcare systems. For example, Medicare Hospice Benefits absorb 87% of the expenses related to patient days at the hospice and palliative care facilities while the rest of the expenses are borne by Medicaid, private providers, self-pay, and philanthropic agencies. This financial investment has motivated the increase in adoption from primary to secondary levels of care.

The shift towards home-based palliative care service has significantly decreased hospitalization and total Medicare spending, which encourages health systems and payers to adopt these models based on their financial savings and quality improvements. Organizations set up for palliative care widely opened up access, so more patients and families can be cared for. This has enabled the co-ordination of palliative care, improvement of the quality of life of patients, cost savings, stronger referral network, and through an approach of symptom management, pain relief, counseling through grief, and daily support in consideration to increase market growth through the growing number of elderly people. The Department of Economic and Social Affairs reports the following figures: in 2020, there were 727 million people aged 65 and over; this population number is to rise by more than double and reach 1.5 billion people by 2050. WHO expects the percentage of persons aged 60 years or over to increase from 12% in 2015 to 22% in 2050. With elderly people being more prone to chronic diseases, such as cancer, cardiovascular diseases, and neurological disorders, there is an increasing demand for specialized palliative care. The European Union Geriatric Medicine Society and the European Association for Palliative Treatment already work for better care delivery in age-related chronic conditions across all healthcare settings. The demand for palliative care will experience dramatic growth with this demographic shift in the future.

Restraints

-

Limited Integration and Professional Training

-

Misconceptions and Emotional Barriers

Key Segmentation

By Condition

By condition, the palliative care market is divided into cancer, dementia, HIV, cerebrovascular disease, respiratory disease, and others. In the year 2023, the share of revenue in the cancer segment accounted for the largest share at 36.9%. This is mainly on account of the rising global incidence of cancer and an expanding focus on palliative care services to enhance the quality of life of patients with cancer and their families. The Globocan 2020 statistics report 19.3 million new cancer cases and nearly 10 million deaths worldwide. As such, palliative care is very important in the treatment course of cancer for that stage to offer these patients comprehensive holistic physical, emotional, and psychological support at every single stage.

Meanwhile, the respiratory disease segment is likely to grow the most between 2024 and 2032. This will be due to a continued increasing prevalence of conditions such as COPD and asthma, as well as demands for coordinated services in respiratory and palliative care. The Institute for Health Metrics and Evaluation reports that as of 2019, chronic respiratory diseases were ranked as the third leading cause of death globally, responsible for approximately 4 million deaths, affecting around 454.6 million individuals.

By Diagnostic Group

The Non-Communicable Diseases (NCD) segment generated maximum revenue in the year 2023 with a share of 68.0%. This is primarily because of the rise in NCD cases arising from either lifestyle or sedentary habits. NCD encompasses a wide category of diseases like cancer, cardiovascular diseases, diabetes, chronic respiratory diseases, and neurodegenerative conditions. The WHO reports that NCDs account for 41 million deaths annually, representing 74% of total mortality. A huge number of organizations are making specific centers where specific care shall be administered to victims in a bid to respond to the growing demand. In January 2022, Boots Company PLC partnered with Macmillan Cancer Support and NHS to offer increased access to palliative care to critically ill patients and their families affected by cancer in the UK.

The maternal, perinatal, and nutritional conditions (MPNC) segment will register the maximum growth rate during the forecast period due to the growing incidence of these conditions. According to the WHO in 2020 about 2.4 million newborns died within thirty days following delivery, with an average of around 6,700 deaths each day. Neonatal deaths constitute nearly 47% of all deaths occurring among children aged below five years of age and hence distinctly call for much more specialized palliative care within this field.

By Age Group

The palliative care market can be segmented into pediatric, adult, and geriatric. Adult was the leading segment of the market in 2023, accounting for 51.0%. This is primarily because the prevalence of chronic and life-threatening conditions, such as cancer, cardiovascular diseases, and neurodegenerative conditions, among adults, is on the rise. These demand palliative care for treatment, alleviation, and improvement in the patient's standard of living. This has resulted in a high demand for such services in the adult population.

The pediatric segment is expected to witness the fastest CAGR from 2024 to 2032 mainly because of the rising prevalence of chronic and life-threatening diseases among children. These include birth disorders, cancer, and neurological conditions. The conditions require intense and specialized care from the palliative approach to aid in bettering the quality of the lives of children as they offer crucial physical and emotional care. With this, most of the providers have taken the services open to the highly increasing need. In October 2022, for example, the Bai Jerbai Wadia Hospital for Children, in partnership with the Cipla Foundation, launched a pediatric palliative home care service commonly known as Titli. The program grants relief from such serious conditions kids are always facing, from pain and symptom management to some emotional support and practical guidance.

By Provider

Based on provider, the palliative care market can be segmented into hospitals & clinics, home-based care, and community settings. In 2023, the home-based care segment accounted for the largest share of 44.6% of the market revenue share and is expected to continue its steep growth during the forecast period 2032. This growth is primarily due to the increasing desire of older patients to receive care in a home setting. Besides, several service providers are opening dedicated home care centers. For example, in February 2021, Mount Sinai Health System collaborated with Contessa Health, Inc. for the launch of "Palliative Care at Home," a program that delivers services in the comfort of the patient's own home to patients with very serious health conditions.

The growth in the hospitals & clinics segment is also expected to be significant during the forecast period. This is due to its well-established infrastructure and the potential of hospitals and clinics to service even the most complex medical cases. Expanding service offerings and increased reimbursement by payers for palliative care services are additional contributors to the growth of this segment. According to data from Yale University, more than 1,700 U.S. hospitals with more than 50 beds already offer palliative care programs.

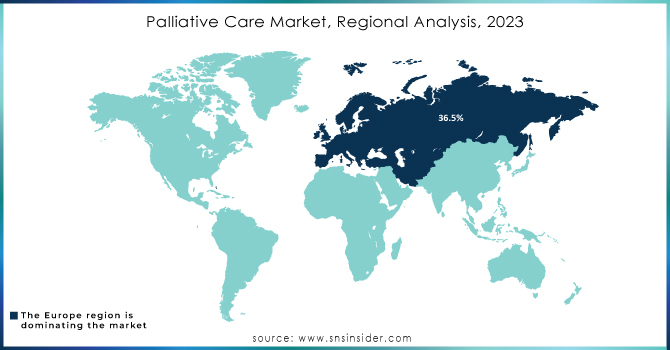

Regional Analysis

Europe accounted for 36.5% of the global palliative care market share in 2023. The region's vast geriatric population has increased the demand for sophisticated services, including end-of-life care. Countries such as Germany, Italy, and the UK have introduced a palliative care service into their health care systems; hence its significance in offering holistic medical care will be taught to patients while undergoing treatment. According to the World Health Organization, 63% of the Western European countries and 26% of the Central and Eastern European nations have developed separate national plans for palliative care.

The MEA region is expected to experience the fastest CAGR from 2024 to 2032. High prevalence rates of chronic and non-communicable diseases, such as cancer, cardiovascular conditions, and diabetes, are driving the demand for palliative care services in the region. Countries like the UAE, Jordan, and Egypt, for instance, are investing heavily in improving healthcare infrastructure and services. Several other MEA nations are incorporating palliative care into their healthcare systems, deeming it essential for patients with life-threatening illnesses. For example, in March 2023, Jordan's Ministry of Health presented a strategic plan for the period 2023–2025 with integrated health system development and opportunities for diagnosing, curing, rehabilitating, and palliative care services.

Need any customization research on Palliative Care Market - Enquiry Now

Key Players in the Palliative Care Market

Hospitals and Healthcare Systems

-

Baptist Health

-

Genesis HealthCare System

Home Health Services

-

Gentiva Health Services (Kindred at Home)

-

Amedisys

-

VITAS Healthcare

Palliative Care Facilities

-

Teresa Dellar Palliative Care Residence

-

Fonthill Care

-

Drakenstein Palliative Hospice

Specialized Palliative Care Providers

-

HammondCare

-

Banksia Palliative Care Service Inc.

-

Alpha Palliative Care

Recent Developments

In March 2024, the University of Florida (USF) Health College of Nursing launched a new graduate certificate program in hospice and palliative care, aimed at enhancing the skills of nurses in managing care for patients with life-threatening conditions.

In March 2024, Oxford introduced a Virtual Ward for palliative care, specifically designed for patients who wish to receive end-of-life care at home.

In March 2024, the United Nations Development Program (UNDP) partnered with the European Union and the Ukrainian Ministry of Health to distribute specialized vehicles to healthcare institutions.

In February 2023, Pallium India partnered with Athulya Senior Care to launch palliative care services in South India.

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.7 Billion |

| Market Size by 2032 | US$ 23.34 Billion |

| CAGR | CAGR of 9.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Condition (Cancer, Dementia, HIV, Cerebrovascular Disease, Respiratory Disease, Others) • By Diagnostic Group (Communicable diseases, Non-communicable diseases, Injury, poisoning, external causes, Maternal, perinatal, and nutritional conditions) • By Age Group (Pediatric, Adult, Geriatric) • By Provider (Hospitals and Clinics, Home-based, Community Settings) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Adventist Health, Baptist Health, Genesis HealthCare System, Gentiva Health Services, Amedisys, VITAS Healthcare, Teresa Dellar Palliative Care Residence, Fonthill Care, Drakenstein Palliative Hospice, HammondCare, Banksia Palliative Care Service Inc., Alpha Palliative Care and Others |

| Key Drivers | • Favorable Reimbursement Policies and Growing Demand for Elderly Care Driving Market Growth |

| Market Restraints | • Limited Integration and Professional Training • Misconceptions and Emotional Barriers |