Email Security Market Report Scope & Overview:

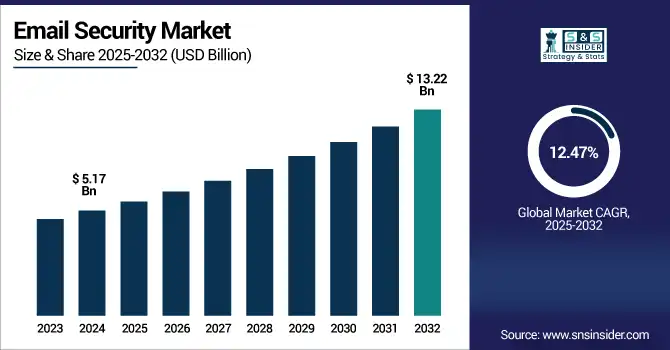

The Email Security Market size was valued at USD 5.17 billion in 2024 and is expected to reach USD 13.22 billion by 2032, expanding at a CAGR of 12.47% over the forecast period of 2025-2032.

The email security market is witnessing tremendous growth due to the rising number of phishing, ransomware, and business email compromise attacks. Email is still an essential form of communication, and businesses are investing in advanced security, such as encryption, anti-malware, and spam filters. The growth of remote work, cloud usage, and stringent data privacy laws is also fueling demand. Artificial intelligence and machine learning are continuing to improve the efficiency of threat detection, and the market is now more accessible, with an increasing SMEs deploying cloud-based solutions. North America is the market leader, and Asia Pacific is the fastest-growing. The market is important for protecting digital communications across industry segments and company sizes more generally.

To Get more information on Email Security Market - Request Free Sample Report

According to research, in 2024, over 333 billion emails are exchanged daily, with 1 in every 99 being a phishing attempt. Around 85% of organizations faced at least one phishing attack, while email-delivered ransomware incidents surged by 67% year-over-year.

The U.S Email Security Market size reached USD 1.16 billion in 2024 and is expected to reach USD 2.72 billion in 2032 at a CAGR of 11.31% from 2025 to 2032.

The U.S. has the largest market size in the world due to technological advances in IT infrastructure, higher awareness of cybersecurity threats, and a large number of major email security market companies such as Microsoft, Cisco, and Proofpoint. Read more about these laws and other sales compliance laws you need to comply with. Also, the HIPAA & CCPA Takeaway The country’s strong stance on regulation, including laws like HIPAA and CCPA, urges companies to take email protection head-on. Moreover, the rise of phishing attacks, BEC, and remote work practices is fuelling demand for secure cloud-based and AI-based email security solutions among U.S.-based enterprises of all sizes.

Email Security Market Dynamics

Drivers:

-

Proliferation of AI-Driven Phishing-as-a-Service Platforms Elevates Email Security Requirements Across Organizations.

Rise of Phishing-as-a-Service (PhaaS) platforms driven by AI has made Unwanted Email Traffic more aggressive and faster-paced than before. Things like AI allow even lay people to run elaborate phishing schemes with advanced tools that can figure out how to word an email to sound just like a real company. The scalability and availability of PhaaS have also greatly reduced the export costs for cyberattackers, resulting in an explosion of credential theft and e-fraud. That’s why organizations are turning to advanced email security solutions powered by transforming analytics-based AI to automatically find, respond to and stop new and advanced email threats faster than ever.

Restraints:

-

High Implementation Costs and Complexity Hinder Adoption of Advanced Email Security Solutions Among Small and Medium Enterprises.

Deploying all-encompassing security measures for email solutions is relatively costly with high technical overhead for small and medium-sized enterprises (SMEs). And the prices of purchasing, deploying, and maintaining advanced security are potentially beyond the reach of small and medium businesses with tight budgets. Furthermore, the difficulty in adding the solutions to existing systems and the fact that they require a dedicated IT staff serve as implementation obstacles. This financial and operational strain impedes the ability of SMEs to defend themselves against advanced email-borne threats, making them an easy target for hackers and much more likely to suffer the consequences of a breach.

Opportunities:

-

Rising Adoption of Cloud-Based Email Security Solutions Among Small and Medium Enterprises Presents Significant Growth Opportunities.

The growing adoption of cloud-based email security solutions represents lucrative opportunities for the market's growth, especially within SMEs. Cloud Security As-A-Service Firm Vavrinek can help with your cloud security needs, offering scalable, cost-effective, easy-to-deploy security. These are usually offered as a premium but include functionality like spam filtering, malware protection and data loss prevention, which are important to keep sensitive email communications safe. The flexibility and the elimination of in-house IT infrastructure requirements make cloud-based security a desirable choice for SMEs looking to improve their cybersecurity stance. With the increasing cyber threats, it is expected to have such solutions will be in even greater demand.

Challenges:

-

Rapid Evolution of Sophisticated Email Threats Outpaces Traditional Security Measures, Creating Significant Challenges for Organizations.

The constant evolution of email-based threats, ranging from zero-day exploits to ransomware and AI-generated phishing attacks, is a daunting challenge for organizations. Old security schools of thought have a hard time keeping up with these fast-moving threats, and systems are left open to exploitation. There's a new pattern in threat hunting: cybercriminals are now using more and more sophisticated techniques that take advantage of valid software and are harder to block and detect. This volatile threat environment requires proactive and adaptive security tactics such as real-time threat intelligence and AI-powered defenses in order to defend against advanced email attacks.

Email Security Market Segmentation Analysis

By Component

The Solution segment leads the market, accounting for 60.32% of the revenue in 2024. Demand for integrated security to fight phishing, malware, and data breaches is driving that command. Providers like Microsoft, Cisco, and Proofpoint, for instance, now offer advanced email security services using AI and machine learning to automatically sense signs of trouble on the fly. For example, Zscaler extended the partnership with Vectra AI to strengthen its offering for cloud application security by embedding AI-based threat detection capabilities into its cloud-based web security gateway. It just comes to highlight the importance of sound solutions to secure email communications, especially as threats continue to evolve.

The Services segment is projected to grow at the highest CAGR of 13.15% during the forecast period. This email security market growth is driven by the growing need for managed security services and consulting to manage the complex email threats. Businesses are now looking for professional threat analysis, incident response, and compliance services. Firms such as Barracuda Networks and Zix Corporation are eager to stay competitive, given the trend of remote working environments and a rising need for robust email security solutions. Increasingly sophisticated cyber threats require an equally sophisticated email security service to secure your email.

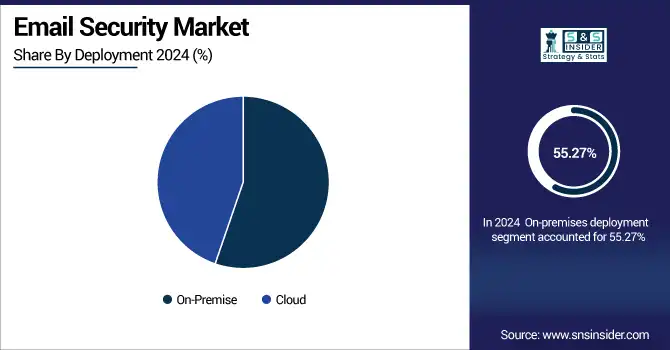

By Deployment

The on-premises deployment segment dominates the market with a 55.27% revenue share in 2024. This is a preference typically found in larger enterprises and government agencies that need to achieve compliance or data sovereignty. On-premises options provide greater customisation and integration features, an important consideration for companies working under a burden of IT complexity. With the rise in cloud adoption, the demand for on-premises email security remains high for those needing to retain control over data and compliance.

The Cloud deployment segment is expected to witness the highest CAGR of 13.06% during the forecast period. The growth market includes factors like scalability, cost savings, and deployment speed that cloud-based email security solutions bring to the market. More and more companies are turning to the cloud to avoid CAPEX and take advantage of charging only for what they use. The flexibility of the Clouds software can adapt rapidly to new security requirements and threats. With an increasing email security market trends of remote working and distributed teams, the need for secure, cloud-based communication platforms increases, and thus, the growth prospects of the cloud sector are promoted.

By Type

End-to-End Email Encryption holds the largest email security market share of 25.27% in 2024. The growing demand for secure communication channels that keep secret data confidential leads to the predominance of this segment. Increasing data breaches and strict data protection compliance norms are urging organizations to implement strong encryption solutions. Advancements in encryption, such as post-quantum encryption and AI-based threat detection, have helped improve the effectiveness and adoption of E2EE solutions.

The Hybrid Email Encryption segment is projected to grow at the fastest CAGR of 14.44% during the forecast period. This extension has been motivated by the requirement for a flexible solution capable of meeting in a middle way the two approaches of end-to-end encryption and gateway dedication. Hybrid encryption secures private correspondence with no hassle for the recipient. The growing adoption of cloud services and remotely accessing services is also helping to push the use cases for hybrid encryption solutions that are scalable and easy to deploy. These aspects drive the growth of the hybrid email encryption market.

By Organization Size

Large Enterprises account for the largest share of 65.27% in 2024. These companies have extensive resources to purchase a full spectrum of email security solutions to defend against today’s complex email threats. The sophistication of their work and the amount of confidential material they manage require strong security. Moreover, bigger organizations encounter increasingly complex and demanding regulations, so this incites the necessity for advanced email security facilities. Vendors are also delivering to these demands by offering solutions that can be scaled to the levels needed for larger organizations.

Small and Medium-sized Enterprises (SMEs) are anticipated to grow at the fastest CAGR of 13.22% during the forecast period. Growing awareness regarding cyber threats and the criticality of securing data is leading to enhanced investment in SME email security. Especially SMEs, such solutions as cloud-based email security solutions are attractive, due to their scalability as well as cost effectiveness. Developing customised solutions that target the security needs and budget of SMEs is becoming easier, as vendors introduce easy, fit-for-purpose email security options that SMEs can implement. This trend highlights the increasing imperative for email security in companies of any size.

By Industry Vertical

The Banking, Financial Services, and Insurance (BFSI) sector holds the largest market share of 25.62% in 2024. Sensitive financial information and relatively high-stakes hacking risks demand strong email protection in this industry. Regulatory compliance, like GDPR and PCI DSS, further promotes the demand for an advanced email security solution. BFSI companies are deploying encryption, threat defense, and data leak prevention tools to protect their communications.

The Healthcare sector is projected to grow at the highest CAGR of 13.84% during the forecast period. The growing digitization of patient records, along with the necessity of protecting sensitive health information, has made email security in this space particularly crucial. To adhere to regulations such as HIPAA, the use of secure email for communication is required. Healthcare companies are now also employing encryption and threat detection technologies to secure their data and protect patient privacy.

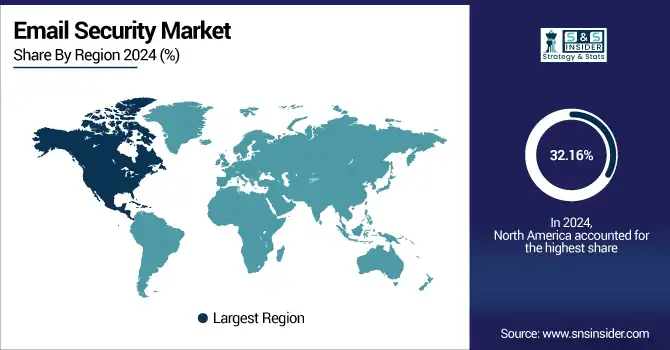

Email Security Market Regional Analysis

North America dominated the market in 2024 with a 32.16% market share owing to the high cyber-attack awareness, developed IT infrastructure, and stringent data protection laws. The presence of giants such as Cisco, Microsoft, and Proofpoint has also contributed to the continued growth and development of the region through constant innovation and product improvement.

The United States is a leading country in the market on account of robust cybersecurity measures, occurrence of frequent cyberattacks, and deployment of massive digital infrastructure and world-class enterprise email security systems among various industries such as BFSI, healthcare, and government.

Europe is governed by stringent regulations, such as GDPR, that require organizations to have stringent measures in place to protect the data. Companies in the industry are also using email encryption and advanced threat protection to meet compliance and protect sensitive communications.

Germany is the most significant country as it leads the way in the implementation of data privacy laws, besides having a significant manufacturing and BFSI sector, and a government that has been focusing on promoting cybersecurity policies and programs for digital trust.

The Asia Pacific region is dynamic, with the fastest-growing CAGR of 13.18 %. Digital transformation accelerated the move to cloud, and a better understanding of cyber risks in developing economies is one of the factors driving the need for email security solutions in the region.

China leads this country race due to a huge enterprise base, growing data privacy fears, and significant investments in cybersecurity technologies, particularly across finance and e-commerce.

Middle East & Africa and Latin America regions are experiencing higher growth for email security adoption owing to growing cyber threats, digitalization across critical industry sectors, and changing regulatory landscape. The UAE and Brazil are examples of nations in these regions that are leading the way with significant investments in digital and robust data protection projects.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the Email Security Market are Cisco Systems, Inc., Microsoft Corporation, Fortinet, Inc., Trend Micro Incorporated, Proofpoint, Inc., Mimecast Services Ltd., Barracuda Networks, Inc., Sophos Group plc, McAfee Corp., Symantec Corporation (Broadcom Inc.), and others.

Key Developments

-

In May 2025, Cisco Duo introduced AI-powered behavioral analytics to enhance identity security, adding sophisticated features such as identity quarantining and network isolation to actively counter growing cyber threats and increase organizational resiliency.

-

In October 2024, Barracuda Networks, Inc. was awarded the 2024 CyberSecurity Breakthrough Award for its groundbreaking Email Protection platform, citing its innovation in protecting against phishing, ransomware, and sophisticated email threats.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.17 Billion |

| Market Size by 2032 | USD 13.22 Billion |

| CAGR | CAGR of 12.47% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Solution, Services) •By Deployment (Cloud, On-Premise) •By Type (Boundary Email Encryption, End-to-End Email Encryption, Gateway Email Encryption, Hybrid Email Encryption, Client Plugins) •By Organization Size (SMEs, Large Enterprises) •By Industry Vertical (BFSI, IT & Telecom, Government, Healthcare, Retail, Manufacturing, Energy & Utilities) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Cisco Systems, Inc., Microsoft Corporation, Fortinet, Inc., Trend Micro Incorporated, Proofpoint, Inc., Mimecast Services Ltd., Barracuda Networks, Inc., Sophos Group plc, McAfee Corp., Symantec Corporation (Broadcom Inc.) |