Adaptive Content Publishing Market Report Scope & Overview:

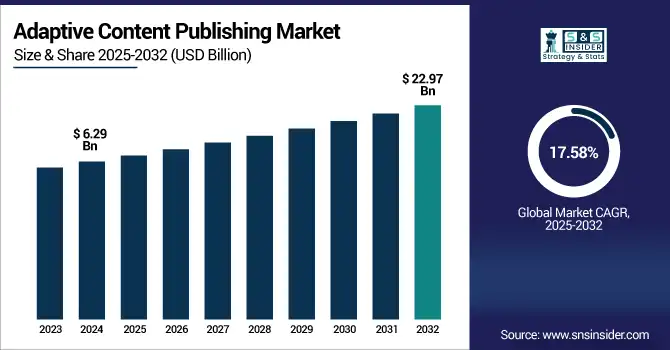

The Adaptive Content Publishing Market size was valued at USD 6.29 billion in 2024 and is expected to reach USD 22.97 billion by 2032, expanding at a CAGR of 17.58% over the forecast period of 2025-2032.

To Get more information on Adaptive Content Publishing Market - Request Free Sample Report

The Adaptive Content Publishing Market is expanding rapidly as businesses adopt dynamic, personalized content strategies to enhance user engagement across digital platforms. Key sectors like education, healthcare, retail, and finance are leveraging adaptive publishing to deliver consistent, tailored experiences. Cloud-based deployment leads due to its scalability, while video and interactive formats dominate content preferences. North America holds the largest market share, while Asia Pacific is the fastest-growing region. Major players such as Adobe, Microsoft, Salesforce, and Google are driving innovation with AI and analytics, streamlining content creation, personalization, and omnichannel distribution in this evolving digital landscape.

According to research, adaptive content platforms enhanced with analytics and automation tools boost content production speed by 45%. In sectors like education and healthcare, they reduce course dropout rates by 22% and improve patient information recall by 47%, respectively.

The U.S Adaptive Content Publishing Market size reached USD 1.75 billion in 2024 and is expected to reach USD 5.95 billion in 2032 at a CAGR of 16.58% from 2025 to 2032.

The U.S. dominates the Adaptive Content Publishing Market due to its robust digital infrastructure, huge content consumption, and early adoption of AI-powered publishing tools. With the likes of Adobe, Microsoft, and Salesforce calling the country home for tech, it's all down to the country's unprecedented innovation in content solutions. Drivers include an increasing need for personalized digital experiences, great leverage of AI and analytics, and a full embrace of omnichannel. Further, increasing investments in EdTech and e-learning, and the adoption of remote and hybrid work models, are propelling the adaptive content publishing market growth. These conditions make the U.S. market the best and most sensational market on earth.

Market Dynamics

Drivers

-

Rising Demand for AI-Powered Personalization Tools Across Digital Publishing Channels Drives Market Growth.

The growing need to deliver custom content experiences for various audience segments is also fueling the adoption of AI-powered personalization tools in content publishing. Companies are using machine learning algorithms and predictive analytics that enable them to personalize their messages in everything from their websites to their mobile apps to their emails. This allowed to reach a better user engagement, improved conversion rate, and stronger user retention. The developments come after the likes of Adobe’s AI improvements in Experience Manager and Salesforce’s AI-driven generative integration in its Marketing Cloud. The growing demand for dynamic, context-rich content in industries such as education, retail and media is also driving the growth of adaptive content publishing solutions.

Restrains:

-

Growing Concerns Over Data Privacy and Compliance Regulations Restrain Market Expansion.

Despite the advantages of adaptive content publishing, rising concerns over data privacy and regulatory compliance serve as significant barriers to market expansion. Adaptive systems rely heavily on user data, raising concerns regarding GDPR, CCPA, and HIPAA compliance, especially in sensitive sectors like healthcare and finance. Companies are afraid of potential penalties for failing to comply and backlash from misuse of personal data. Recent news of content personalization tools overstepping their bounds with behavioral data has also forced increased scrutiny. Companies are increasingly wary when implementing advanced personalization capabilities, and some may even choose to hold back on fully implementing these features until the desired data privacy protections are in place, slowing down market deployments.

Opportunities:

-

Emerging Use of Adaptive Publishing in Higher Education and Corporate Learning Presents Strong Growth Potential.

The increasing demand for personalized learning experiences in higher education and corporate training presents a major opportunity for adaptive content publishing platforms. Educational institutions and businesses are adopting adaptive learning technologies to improve learner engagement, retention, and performance. Learning Technology Platforms are linking with LMS systems to automatically adapt content to match the level of understanding and user completion rates. Recent developments include Microsoft combining its educational content tools with AI and the increasing investment in EdTech startups. With hybrid learning models on the rise across the world, adaptive publishing provides a scalable way to provide personalized, competency-based content, building a more equitable and efficient education system.

Challenges:

-

Lack of Standardization in Content Structuring and Metadata Usage Challenges Interoperability Across Platforms.

A major issue in the adaptive content publishing environment is the absence of a standardised content structure and metadata model. If that isn’t standard, content produced for one platform can only be used with difficulty for others. The effect is higher cost of operation inefficiencies with content management and fragmented end-user experiences. “The lack of universal protocols makes those solutions not scalable and cooperation between content management systems, personalization engines, or analytics tools almost impossible. Although there are some active initiatives for the standardisation of the tagging content through open-source frameworks, interoperability remains a future problem. Businesses are now asking for such universal standards to make sure it can be consistently implemented across their digital estates.

Segment Analysis

By Content Format

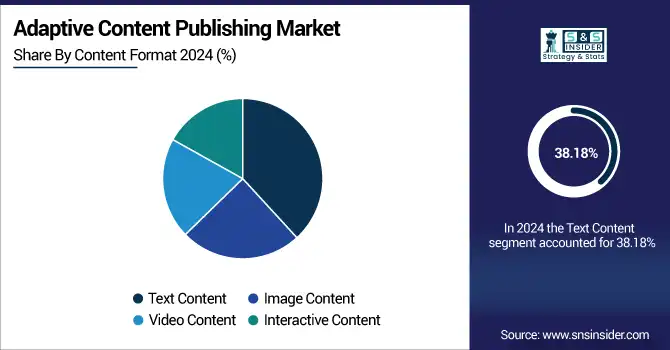

Text Content emerged as the leading segment in 2024, accounting for 38.18% of the total revenue, on account of its core application in documentation, e-learning, legal, and corporate communications. There is a surging demand for structured, searchable, and scalable content. Firms such as Adobe (FrameMaker) and Microsoft (Editor Suite) intensified their deep learning-driven capabilities for grammar, formatting, and content structuring. This category is due to the change in timing, quality, and delivery concepts, with advantages of the factors of harmony and communication in volume in the context of the digital domain, whose framework frames the model by adaptive content publishing market industry-specific strategies in the business environment.

Interactive Content is projected to grow at the fastest CAGR of 19.04% during 2025–2032, as it provides compelling and interactive experiences through videos, polls, quizzes, and infographics. This allows for optimal user retention and is best for education and marketing. TechSmith’s Snagit and Camtasia add more in-the-moment interactivity, and Contentful now allows modular incorporation of live data. The growing popularity of microlearning and the continuous, real-time audience engagement is fueling the need for an adaptive, responsive publishing, which is why Interactive Content becomes more and more essential to a user-oriented strategy.

By Deployment Mode

Cloud-Based Deployment accounted for 28.48% of the market share in 2024, leading due to its scalability, cost-effectiveness, and accessibility across geographies. Enterprises favor platforms like Salesforce CMS, Oracle Content Management, and HubSpot for real-time collaboration and content dissemination. This segment is driven by the growing adoption of remote and hybrid work environments and the need for seamless cross-functional team collaboration in real-time, pushing enterprises toward SaaS-enabled adaptive publishing platforms.

Hybrid Deployment is expected to grow at a CAGR of 10.51%, offering a blend of data control through on-premise setups and the flexibility of cloud accessibility. Adaptive content publishing market companies such as IBM and Microsoft are leading in this space, providing hybrid cloud content infrastructure like IBM’s Cloud Pak and Microsoft’s Azure Stack. The growth is driven by the increasing demand from sectors like healthcare and banking for data sovereignty, security, and flexibility, while still benefiting from cloud-driven scalability.

By Industry Vertical

The Retail and Consumer Goods segment dominated the market in 2024 with a 28.39% revenue share, leveraging adaptive publishing for personalized customer engagement, omnichannel promotions, and real-time content updates. Companies like Salesforce, Bynder, and HubSpot help retail businesses deliver personalized product content across e-commerce and digital platforms. The driver here is the increasing competition in digital retail, compelling brands to optimize customer journeys and conversions through real-time content personalization and adaptive marketing campaigns.

The Healthcare segment is projected to register the fastest CAGR of 18.98% over the forecast period. The need for patient-specific educational content, telemedicine resources, and compliance documents is pushing demand for adaptive publishing solutions. Adobe and Microsoft are enhancing healthcare content tools with secure, multilingual, and accessibility-ready features. This growth is driven by the surge in digital health adoption, demand for EHR-integrated publishing tools, and regulatory compliance needs for personalized healthcare communication.

By Component

Content Management Systems (CMS) accounted for the largest market share at 34.19%, reflecting their critical role in managing, editing, and deploying content across platforms. Leaders like Adobe Experience Manager and WordPress are incorporating AI and automation to streamline workflows. The segment is driven by growing enterprise content demands, the need for omnichannel distribution, and structured management of multimedia assets, all of which are central to adaptive publishing capabilities in large organizations.

Personalization Engines are anticipated to grow at a CAGR of 18.73% as organizations prioritize user-centric content delivery. Platforms from Oracle and Salesforce are utilizing AI and machine learning to tailor content based on real-time user behavior. The segment is propelled by rising expectations for personalized digital experiences, especially in e-commerce, media, and healthcare. Adaptive publishing thrives on these engines’ ability to dynamically adjust content, improve engagement, and increase conversion rates in highly competitive digital markets.

By Pricing Model

The Per-user Subscription model captured 32.48% of the adaptive content publishing market share in 2024, favored for its transparent and scalable pricing, especially among SaaS-based providers. Platforms like Contentful and Liferay offer flexible user-based pricing, supporting growing teams and enterprise expansion. The model is driven by ease of budget planning and control, aligning with trends in collaborative cloud publishing tools that require access-based pricing for organizations of various sizes.

Per-feature Subscription is forecasted to expand at a CAGR of 18.91%, catering to businesses demanding modularity and cost-efficiency. Providers like Axure and Bynder allow users to customize plans based on feature requirements such as analytics, AI content generation, or multilingual publishing. This model's growth is driven by SMEs and startups seeking tailored solutions without overpaying for unnecessary features, marking a shift toward more granular and customer-specific pricing strategies in adaptive publishing.

Regional Analysis

North America leads the Adaptive Content Publishing market with a 37.38% share in 2024, driven by high digital literacy, enterprise content automation, and early adoption of AI tools. The region is home to major players like Adobe, Salesforce, and Microsoft, which continuously innovate to meet the growing demand for personalized and scalable digital content delivery. The United States dominates the regional market due to its strong digital infrastructure, large content-driven enterprises, and investments in AI-enabled publishing platforms across sectors such as education, healthcare, and e-commerce.

Europe is experiencing steady growth in the adaptive content space, supported by rising digitization in public services, education, and corporate communications. Government regulations promoting content accessibility and GDPR compliance also accelerate the need for adaptive, secure content management across organizations. Germany leads the European market due to its strong publishing industry, emphasis on technical documentation, and high demand for localized and structured content in engineering, manufacturing, and healthcare sectors.

Asia Pacific is the fastest-growing region, expanding at a CAGR of 28.19% due to increased digital transformation in countries like India, China, and Japan. The rising use of mobile-first content platforms, e-learning, and multilingual publishing solutions is fueling regional adoption. China dominates the Asia Pacific market, driven by its booming e-commerce, EdTech expansion, and government-backed digital initiatives. The demand for real-time content personalization and localization is surging across industries.

The Middle East & Africa and Latin America are experiencing emerging growth in adaptive content publishing, driven by increased investments in digital infrastructure, mobile learning, and bilingual content needs. The UAE leads in MEA due to smart government initiatives, while Brazil dominates Latin America with its expanding e-learning platforms and rising demand for localized content solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the Adaptive Content Publishing Market are Adobe, Salesforce, Microsoft, Google, IBM, Oracle, Hubspot, Liferay, Contentful, Bynder, and others.

Key Developments

-

In June 2025, Adobe introduced the LLM Optimizer to enhance brand visibility across AI-powered platforms, along with major upgrades to GenStudio, enabling generative AI-driven video and display ad creation for more efficient, scalable content publishing.

-

In January 2024, Contentful launched "Contentful AI", a suite of generative content tools and workflow automation features. The update enhances adaptive publishing by enabling modular content creation, streamlining processes, and scaling personalized digital experiences across platforms.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.29 Billion |

| Market Size by 2032 | USD 22.97 Billion |

| CAGR | CAGR of 17.58% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Content Format (Text Content, Image Content, Video Content, Interactive Content) •By Deployment Mode (Cloud-based, On-premises, Hybrid) •By Industry Vertical (Healthcare, Financial Services, Retail and Consumer Goods, Education, Manufacturing) •By Component (Content Authoring Tools, Content Management Systems, Personalization Engines, Analytics and Reporting Tools) •By Pricing Model (Per-user Subscription, Per-seat Subscription, Per-feature Subscription, One-time License Purchase) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Adobe, Salesforce, Microsoft, Google, IBM, Oracle, Hubspot, Liferay, Contentful, Bynder Inc. |