Custom Software Development Market Report Scope & Overview:

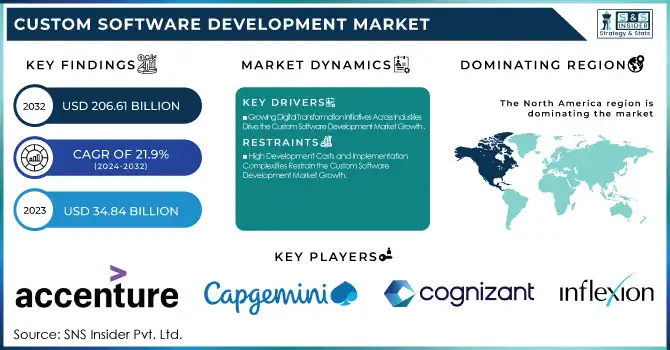

The Custom Software Development Market Size was valued at USD 34.84 Billion in 2023 and is expected to reach USD 206.61 Billion by 2032 and grow at a CAGR of 21.9% over the forecast period 2024-2032.

To Get more information on Custom Software Development Market - Request Free Sample Report

The Custom Software Development Market includes demand trends, investment patterns, revenue share by development type, pricing analysis, profit margins, technological adoption rates, client spending behavior, regulatory impact assessments, and project turnaround time analysis. The rising adoption of cloud-based and AI-powered solutions in BFSI, healthcare, and retail is shaping demand. Investment trends highlight digital transformation priorities, while revenue share indicates growth in web-based, mobile, and enterprise solutions. Regulatory compliance (GDPR, HIPAA) impacts software adoption, and low-code/no-code platforms improve development speed and efficiency, influencing market expansion.

Custom Software Development Market Dynamics

Key Drivers:

-

Growing Digital Transformation Initiatives Across Industries Drive the Custom Software Development Market Growth

The increasing adoption of digital transformation initiatives across industries such as BFSI, healthcare, retail, and manufacturing is a key driver of the Custom Software Development Market. Organizations are shifting from traditional legacy systems to cloud-based, AI-driven, and automation-powered custom solutions to enhance operational efficiency, customer experience, and data security. The growing reliance on enterprise software, mobile applications, and web-based platforms has led to significant demand for customized software tailored to specific business needs.

Additionally, the rise of IoT, machine learning, and blockchain technologies is pushing companies to invest in scalable, flexible, and secure software solutions. Startups and enterprises are increasingly leveraging low-code/no-code platforms and AI-driven development tools to accelerate software delivery and reduce time-to-market. Leading technology firms such as Microsoft, IBM, and Infosys are expanding their custom software offerings to cater to evolving business demands.

Restrain:

-

High Development Costs and Implementation Complexities Restrain the Custom Software Development Market Growth

Despite its growing demand, the Custom Software Development Market faces challenges due to high development costs and implementation complexities. Unlike off-the-shelf software, custom solutions require significant financial investment, extensive planning, and long development cycles, making them less accessible for small and medium-sized enterprises (SMEs) with limited budgets. The need for skilled software developers, UI/UX designers, and cybersecurity experts further increases operational costs.

Furthermore, data migration challenges, compliance issues, and regulatory approvals add layers of complexity, delaying project completion. Enterprises must also ensure data protection, encryption, and cybersecurity compliance, increasing the need for advanced security measures, which can be costly. While large enterprises can afford customized, AI-driven solutions, smaller businesses often opt for subscription-based SaaS alternatives to reduce costs. Despite these challenges, advancements in low-code/no-code development, cloud computing, and AI-powered automation are expected to help mitigate some of the cost and complexity restraints in the coming years.

Opportunities:

-

Rising Adoption of AI and Automation Creates Lucrative Opportunities for the Custom Software Development Market

The increasing adoption of AI, machine learning, and automation technologies presents significant growth opportunities in the Custom Software Development Market. Businesses are leveraging AI-powered chatbots, predictive analytics, robotic process automation (RPA), and intelligent business insights to optimize workflows and enhance decision-making. The demand for AI-driven custom software solutions is surging across industries such as healthcare, BFSI, retail, and logistics, where automation can improve efficiency, reduce costs, and eliminate human errors. Companies are increasingly seeking personalized AI-based applications that cater to customer engagement, fraud detection, supply chain optimization, and data analytics.

Additionally, the rise of self-learning algorithms, AI-driven cybersecurity, and natural language processing (NLP) is revolutionizing how businesses operate and interact with customers. As AI technology evolves, custom software developers are integrating automation, cloud computing, and AI-driven analytics into their solutions to offer scalable, cost-effective, and high-performance applications. This ongoing trend is expected to fuel innovation and market growth in the coming years.

Challenge:

-

Data Security Risks and Cyber Threats Pose a Significant Challenge in the Custom Software Development Market

One of the most critical challenges in the Custom Software Development Market is the growing risk of data breaches, cyber threats, and security vulnerabilities. As businesses increasingly rely on custom-built cloud-based, AI-powered, and IoT-integrated solutions, they become more susceptible to cyberattacks, data theft, and ransomware incidents. Custom software often processes sensitive business and customer information, making it a prime target for hackers. Companies operating in BFSI, healthcare, and government sectors are particularly vulnerable to data leaks and compliance violations, requiring stringent security measures.

Additionally, compliance with global data privacy laws like GDPR, HIPAA, and CCPA adds another layer of complexity to custom software development. Organizations must invest in robust cybersecurity frameworks, secure coding practices, and AI-powered threat detection to mitigate risks. However, implementing comprehensive security protocols increases development time and costs, posing a challenge for startups and SMEs. As cyber threats evolve, the demand for secure, regulatory-compliant, and AI-enhanced cybersecurity solutions is expected to rise, pushing developers to prioritize security-first software architectures in the market.

Custom Software Development Market Segments Analysis

By Industry Vertical

The IT & Telecom segment held the largest share of the Custom Software Development Market in 2023, accounting for 24% of total revenue. The industry's increasing reliance on cloud computing, AI-driven automation, and cybersecurity solutions has driven demand for tailored software solutions that optimize network infrastructure, customer relationship management (CRM), and data analytics. Leading technology firms such as Microsoft, Infosys, and Tata Consultancy Services (TCS) have launched custom AI-powered software solutions to enhance telecom operations and network security.

For instance, Microsoft's Azure AI and cloud-based application development tools help telecom providers improve network scalability and predictive maintenance. Similarly, TCS has expanded its telecom-specific software offerings, focusing on 5G network optimization and automated IT service management.

The Government segment emerged as the fastest-growing segment in the Custom Software Development Market, recording a CAGR of 24.18% during the forecast period. Governments worldwide are investing heavily in digital transformation, cloud-based governance platforms, AI-driven data analytics, and cybersecurity solutions, creating a surge in demand for customized software tailored for public sector applications. Countries such as the U.S., U.K., India, and China are implementing e-governance platforms, smart city initiatives, and AI-powered public service management systems, driving market growth.

Governments are also focusing on cybersecurity and data privacy, necessitating customized software solutions for threat intelligence, digital identity verification, and regulatory compliance. The rapid adoption of cloud computing, AI-driven decision-making tools, and big data analytics in public administration has further fueled the demand for custom software tailored to government operations.

By Type

The Enterprise Software segment held the largest share of the Custom Software Development Market in 2023, accounting for 55% of total revenue. Organizations across industries are increasingly adopting tailor-made enterprise solutions to enhance business process automation, customer relationship management (CRM), enterprise resource planning (ERP), and data analytics. The growing need for scalable, cloud-based, and AI-integrated enterprise applications has driven significant investments in custom software development.

The increasing demand for data security, workflow automation, and cloud migration has also led companies like Infosys and Capgemini to develop industry-specific enterprise software solutions. Enterprises are focusing on digital transformation, automation, and data-driven decision-making, further strengthening the dominance of enterprise software in the custom software development market.

The Web-based Solutions segment emerged as the fastest-growing in the Custom Software Development Market, recording a CAGR of 23.02% during the forecast period. The rising adoption of cloud computing, Software-as-a-Service (SaaS), and remote work solutions has significantly fueled the demand for custom web-based applications across industries such as BFSI, healthcare, retail, and IT & telecom. Companies are increasingly investing in scalable, browser-based solutions that offer cross-platform accessibility, enhanced security, and cost-effective deployment.

For example, Google introduced AI-driven web app development tools within its Google Cloud ecosystem, while Microsoft expanded Azure App Service to enhance cloud-based web application performance.

By Deployment Mode

The Cloud segment led the Custom Software Development Market in 2023, capturing 58% of the total revenue share. The rapid adoption of cloud-based solutions across industries such as BFSI, healthcare, IT & telecom, and retail has fueled the demand for scalable, flexible, and cost-effective software deployment. Organizations are increasingly shifting to cloud infrastructure to benefit from remote accessibility, real-time data processing, enhanced security, and seamless integration with third-party applications. Major technology companies like Microsoft, Amazon Web Services (AWS), and Google Cloud have been at the forefront of cloud software development, launching advanced AI-driven and low-code/no-code cloud platforms.

For instance, Microsoft introduced AI-powered updates in Azure for automated cloud application management, while AWS launched serverless computing features for enhanced scalability.

The On-Premise segment emerged as the fastest-growing in the Custom Software Development Market, recording a CAGR of 23.0% during the forecast period. Despite the rapid adoption of cloud solutions, businesses in government, BFSI, defense, and healthcare continue to prioritize on-premise software deployment due to data security concerns, regulatory compliance, and infrastructure control. Industries handling sensitive data require localized software solutions to maintain high levels of security, operational control, and regulatory adherence.

Additionally, custom software development firms like Capgemini and Cognizant are building industry-specific on-premise applications to cater to businesses requiring full data ownership and offline accessibility. With increasing concerns over data breaches, cybersecurity threats, and compliance with stringent regulations like GDPR and HIPAA, enterprises are investing in custom on-premise software.

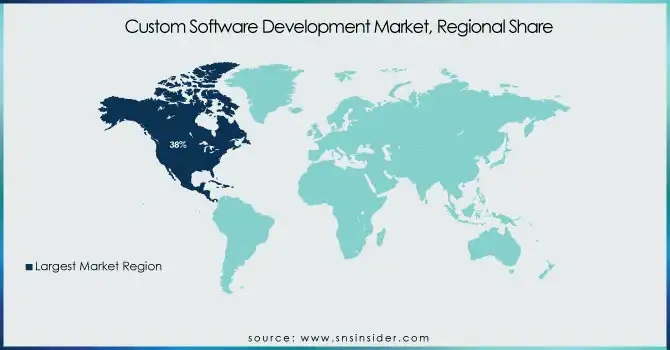

Regional Analysis

In 2023, North America led the Custom Software Development Market, capturing an estimated 38% market share. The region’s dominance is driven by the high demand for enterprise software solutions, strong IT infrastructure, and rapid digital transformation across industries such as BFSI, healthcare, retail, and IT & telecom. The presence of leading technology firms like Microsoft, IBM, Oracle, and Amazon Web Services (AWS) has further fueled innovation in custom application development, AI-powered automation, and cloud computing. Additionally, the rise of digital banking, cybersecurity concerns, and regulatory compliance requirements (such as HIPAA and GDPR compliance solutions) has boosted demand for tailor-made software solutions.

For example, Microsoft’s expansion of Azure-based custom development services and IBM’s AI-integrated enterprise solutions have reinforced North America’s stronghold in the market.

The Asia Pacific region emerged as the fastest-growing market for Custom Software Development, projected to grow at a CAGR of 22.4% during the forecast period. The region’s rapid expansion is fueled by increasing digital transformation, the booming IT sector, rising investments in cloud computing, and growing adoption of AI-driven software solutions. Countries like China, India, Japan, and South Korea are leading the demand for custom software applications in BFSI, manufacturing, e-commerce, and healthcare industries. Additionally, government initiatives such as India’s "Digital India" program and China’s focus on AI-driven automation have accelerated custom software adoption across various sectors. Major tech companies like Tata Consultancy Services (TCS), Infosys, Wipro, and Huawei are heavily investing in custom software solutions, AI development, and cloud-based applications.

The growing presence of startups and SMEs investing in software development outsourcing has also contributed to market growth. With the increasing demand for industry-specific, cost-effective, and scalable custom software solutions, the Asia Pacific region is set to witness exponential growth in the Custom Software Development Market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Custom Software Development Market are:

-

Accenture (Accenture myWizard, Accenture Applied Intelligence)

-

Brainvire Infotech Inc. (Brainvire ERP Solutions, Brainvire eCommerce Development)

-

Capgemini (Capgemini Intelligent Automation Platform, Capgemini Cloud Services)

-

Cognizant (Cognizant TriZetto Healthcare Products, Cognizant BigDecisions)

-

HCL Technologies Limited (HCL Exacto™, HCL Advantage Suite)

-

Iflexion (Iflexion Custom Enterprise Solutions, Iflexion AI & Machine Learning Services)

-

Infopulse (Infopulse Digital Workplace, Infopulse Cloud Transformation)

-

Infosys Ltd. (Infosys Finacle, Infosys EdgeVerve)

-

Magora (Magora Custom CRM Solutions, Magora Mobile App Development)

-

Microsoft (Microsoft Power Apps, Microsoft Azure Custom Solutions)

-

Tata Consultancy Services Limited (TCS BaNCS, TCS MasterCraft)

-

Thoughtworks, Inc. (Thoughtworks Digital Platform Strategy, ThoughtWorks ML & AI Solutions)

-

Tietoevry (Tietoevry Banking Suite, Tietoevry Cloud Services)

-

Trigent Software, Inc. (Trigent Digital Transformation Services, Trigent Cloud App Development)

-

TRooTech Business Solutions (TRooTech AI-Powered Business Solutions, TRooTech Custom ERP Development)

Recent Trends

-

In August 2024, Accenture emphasized that its recent acquisitions in India were strategically driven by the country's abundant talent pool in silicon engineering. This move aimed to enhance Accenture's capabilities in custom software development, leveraging India's expertise to deliver advanced, tailor-made solutions for clients globally.

-

In October 2024, Capgemini unveiled it's augmented engineering' offerings, powered by generative AI. This initiative sought to revolutionize custom software development by integrating AI-driven tools into engineering processes, enabling more efficient and innovative solutions for clients across various industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 34.84 Billion |

| Market Size by 2032 | US$ 206.61 Billion |

| CAGR | CAGR of 21.9 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Development Type (Web-based Solutions, Mobile App, Enterprise Software) • By Deployment Mode (Cloud, On-premise) • By Enterprise Size (Large Enterprises, SMEs) • By Industry Vertical (BFSI, Government, Healthcare, IT & Telecom, Manufacturing, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, Brainvire Infotech Inc., Capgemini, Cognizant, HCL Technologies Limited, Iflexion, Infopulse, Infosys Ltd., Magora, Microsoft, Tata Consultancy Services Limited, Thoughtworks, Inc., Tietoevry, Trigent Software, Inc., TRooTech Business Solutions. |