Adsorbents Market Report Scope & Overview

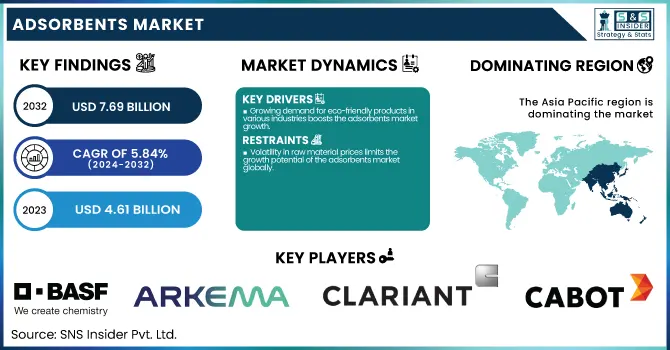

The Adsorbents Market size was USD 4.61 billion in 2023 and is expected to reach USD 7.69 billion by 2032 and grow at a CAGR of 5.84% over the forecast period of 2024-2032.

To Get more information on Adsorbents Market - Request Free Sample Report

The Statistical Insights and Trends Reporting for the Adsorbents Market provides an in-depth look at critical industry indicators. It includes data on production capacity and utilization rates by adsorbent type and key producing regions for 2023, helping to benchmark operational efficiency. The report also analyzes feedstock cost trends by adsorbent category, offering insight into pricing pressures. Additionally, it evaluates regulatory impacts across major markets, with emphasis on environmental compliance. The report presents emissions profiles, waste management practices, and sustainability initiatives by region, highlighting progress toward green manufacturing. Furthermore, it assesses innovation pipelines and R&D investments by type, alongside insights into software adoption for material performance modeling and regulatory tracking in the adsorbents value chain.

The United States held the largest share in the Adsorbents Market in 2023, with a market size of USD 0.83 billion, projected to reach USD 1.46 billion by 2032, growing at a CAGR of 6.45% during 2024–2032. It is due to its strong industrial base, particularly in sectors such as oil & gas, chemicals, water treatment, and air separation. The country is home to numerous refineries and petrochemical facilities, which are major consumers of adsorbents like molecular sieves, activated alumina, and activated carbon for drying, purification, and separation processes. Additionally, stringent environmental regulations enforced by agencies such as the EPA have driven the adoption of advanced adsorbents for emissions control and waste management. The presence of leading market players, robust R&D investments, and widespread adoption of innovative adsorbent technologies have further strengthened the U.S. market. Moreover, the increasing demand for clean water and industrial gas processing supports continued growth and dominant market positioning in the region.

Market Dynamics

Drivers

-

Growing demand for eco-friendly products in various industries boosts the adsorbents market growth.

The increasing global focus on sustainability and environmental protection is significantly driving the demand for eco-friendly adsorbents across various industries. Sectors such as oil & gas, water treatment, and food & beverages are actively adopting environmentally safe and biodegradable adsorbents like activated carbon and silica gel to comply with stringent environmental regulations. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Environment Agency (EEA) are implementing tighter emission standards and waste discharge limits, pushing industries to shift toward sustainable solutions. Additionally, industries are becoming more conscious of their carbon footprints and waste management practices, further accelerating the adoption of green adsorbents. This trend is not only boosting demand for natural and renewable adsorbent materials but also encouraging innovation in bio-based adsorbent development, thereby positively influencing market growth.

Restrain

-

Volatility in raw material prices limits the growth potential of the adsorbents market globally.

Fluctuating raw material prices present a significant restraint to the growth of the adsorbents market. Key materials used in the production of adsorbents, such as coal, alumina, and silica, are subject to price volatility due to changing supply-demand dynamics, geopolitical tensions, and trade regulations. These unpredictable cost variations can severely impact the profitability of manufacturers, especially those operating on thin margins. Moreover, the reliance on non-renewable sources for raw materials makes the supply chain more vulnerable to disruptions. This uncertainty often discourages long-term investments and expansion plans in the market. Smaller players, in particular, face challenges in absorbing high raw material costs, which can affect product pricing and competitiveness. As a result, such market fluctuations hinder consistent growth and pose challenges in meeting the increasing global demand for high-performance adsorbents.

Opportunity

-

Rising demand from emerging economies presents lucrative growth opportunities for adsorbents market players.

The growing industrialization and urbanization across emerging economies, particularly in Asia-Pacific, Latin America, and the Middle East, are opening up substantial growth opportunities for the adsorbents market. Rapid developments in sectors such as petroleum refining, chemical manufacturing, gas processing, and municipal water treatment in countries like India, China, Brazil, and Saudi Arabia are creating strong demand for adsorbents to enhance purification and separation processes. Moreover, these regions are increasingly implementing environmental regulations aligned with global standards, pushing industries to adopt advanced adsorbent technologies. Government investments in clean water initiatives, air quality improvement, and industrial waste reduction are also supporting market expansion. Furthermore, rising awareness about environmental protection and a shift toward sustainable industrial operations in these economies are expected to drive long-term demand, providing global players with untapped market potential and new revenue streams.

Challenge

-

Stringent environmental and disposal regulations create operational challenges for adsorbent manufacturers worldwide.

While environmental regulations drive demand, they also impose significant operational challenges for adsorbent manufacturers, particularly concerning production emissions and waste disposal. The manufacturing of certain types of adsorbents, such as activated carbon and alumina-based materials, can involve energy-intensive processes that generate carbon emissions and hazardous byproducts. Regulatory authorities in the U.S., European Union, and Japan have imposed strict norms on emissions, waste disposal, and environmental compliance, increasing the operational burden on producers. Complying with these regulations requires continuous investments in pollution control technologies, process upgrades, and certifications, which can escalate production costs and limit profit margins. Additionally, the disposal of spent adsorbents, especially those used in industrial gas and liquid purification, must follow hazardous waste protocols, further complicating logistics and increasing compliance overheads. These constraints challenge both scalability and innovation in the global adsorbents market.

Segmentation Analysis

By Type

Molecular Sieves held the largest market share at around 44% in 2023. It is owing to the presence of factors such as better adsorption characteristics, greater selectivity, and thermal stability, which make it suitable for different types of industrial applications. They are crucial for gas drying, air separation, petroleum refining, and chemical processing, as these synthetic zeolites are used for the effective separation of molecules on a size and polarity basis. Molecular sieves are widely used in oil & gas and petrochemical sectors for dehydration and purification, as they are highly effective adsorbents of both water and impurities from hydrocarbons and natural gas. Their reusability and long life make them even more cost-effective and appealing. In addition, increasing demand for energy-efficient and environmentally compliant separation technologies is fueling the demand for molecular sieves across major end-use industries, thereby bolstering their dominance among adsorbents in the global adsorbents market.

By Application

Petroleum refining held the largest market share, around 26%, in 2023. It is due to the high need for high-performance adsorbents in the purification and separation processes taking place in this sector. The use of adsorbents such as molecular sieves, activated alumina, and activated carbon for drying, desulfurization, and removal of impurities from feedstocks and final products is widespread in petroleum refining. They contribute to the enhancement of fuel quality, compliance with environmental regulations, and an increase in operational efficiencies. This sector will continue to stay in a dominant position as the average industrial demand for refined petroleum products such as gasoline, diesel, and jet fuel remains high globally, especially in emerging economies. Increasingly stringent government-mandated emissions and fuel quality standards, such as those from the U.S. EPA and the European Union, have raised the requirement for advanced adsorbents in refining. Such heavy dependency on industry bolsters petroleum refining to dominate the top on-demand application segment in the market.

Regional Analysis

Asia Pacific held the largest market share, around 42%, in 2023. It is due to the high demand of adsorbents from the key end-use sectors, rapidly developing industrial base, and the positive government support in various countries present in the Asia Pacific region. In this region, the petroleum refining, chemical manufacturing, gas processing, and water treatment industries are growing rapidly, as these industries are important consumers of adsorbents (molecular sieves, activated carbon, and silica gel). Growing emphasis on environmental sustainability in the region and stringent regulations on emissions and wastewater disposal are other major factors fueling the advanced adsorbent technologies market. In addition, availability of inexpensive manufacturing facilities, raw materials availability and rising foreign investments in industrial as well as environmental sectors has positively facilitated growth of the market. An increase in population, urbanization, and industrialization in Asia Pacific region are expected to require clean water for municipal use, processed food and air purification, which will augment the demand for adsorbents for different applications.

North America held a significant market share. It is owing to the presence of a strong industrial base, high demand from end-use industries such as oil & gas, chemicals, and water treatment, and stringent environmental regulations. Adsorbents such as molecular sieves and activated alumina play a pivotal role in purification and separation of hydrocarbons and petrochemicals, especially in the United States, one of the largest centres for petroleum refining and petrochemical production. The introduction of stringent emission regulations and waste disposal standards by the regulatory authority, for instance, the U.S. Environmental Protection Agency (EPA) has prompted industries to deploy sophisticated adsorbent technologies to meet these standards. Moreover, the region exhibits high innovation potential, with players investing in the development of high-performance and environmentally sustainable adsorbent materials based on advanced functional composites and polymers. This means that the region will also continue to remain relevant at a global scale, owing to the continually growing demand for purification of clean water, industrial gases, and air.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Sorbead, Purmol)

-

Arkema S.A. (Siliporite, Orgalloy)

-

Clariant AG (Tonsil, Tri-Sorb)

-

Cabot Corporation (Darco, Norit)

-

Honeywell International Inc. (UOP Sorbent Guard, UOP Sorbplus)

-

W. R. Grace & Co. (SYLOBEAD, Davison)

-

Axens (AxSorb, AxTrap)

-

Zeochem (ZEOsphere, ZEOcat)

-

Merck KGaA (Supelco, Isolute)

-

Molecular Products Group (ProCarb, CarboSorb)

-

Kuraray Co., Ltd. (Eval, KURASPERSE)

-

AGC Chemicals (SunSpear, Sunsep)

-

Süd-Chemie (Sorbacal, Tonsil Optimum)

-

Calgon Carbon Corporation (Centaur, Filtrasorb)

-

Osaka Gas Chemicals Co., Ltd. (Shirasagi, Gasguard)

-

Sorbead India (Sorbead R, Silica Gel Blue)

-

Jalon (JLOX-100, JL-CMS)

-

Zhejiang Zhengguang Industrial Co., Ltd. (ZGG-13X, ZGG-4A)

-

Shandong Qilu Petrochemical Engineering Co., Ltd. (QL-13X, QL-5A)

-

Fujian Yuanli Active Carbon Co., Ltd. (YLCARB, YL-GAC)

Recent Developments:

-

In 2023, Clariant AG introduced Desi Pak Eco, moisture-absorbing packets made from bio-based paper, designed to safeguard packaged goods from moisture damage.

-

In 2023, Honeywell International Inc. partnered with India's DRDO and CSIR-IIP to boost oxygen production by reallocating adsorbent supplies to medical oxygen plants.

-

In 2023, Zeolyst International introduced a new product portfolio featuring Opal Renew, Opal Infinity, Opal Pure, and Opal Blue, aimed at enhancing innovations in zeolite catalysis and adsorption.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.61 Billion |

| Market Size by 2032 | USD 7.69 Billion |

| CAGR | CAGR of5.84 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Molecular Sieves, Activated Carbon, Silica Gel, Activated Alumina, Others) • By Application (Petroleum refining, Chemicals/Petrochemicals, Gas refining, Water treatment, Air Separation & Drying, Packaging, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Arkema S.A., Clariant AG, Cabot Corporation, Honeywell International Inc., W. R. Grace & Co., Axens, Zeochem, Merck KGaA, Molecular Products Group, Kuraray Co., Ltd., AGC Chemicals, Süd-Chemie, Calgon Carbon Corporation, Osaka Gas Chemicals Co., Ltd., Sorbead India, Jalon, Zhejiang Zhengguang Industrial Co., Ltd., Shandong Qilu Petrochemical Engineering Co., Ltd., Fujian Yuanli Active Carbon Co., Ltd. |