Fire-resistant Fabrics Market Analysis & Overview:

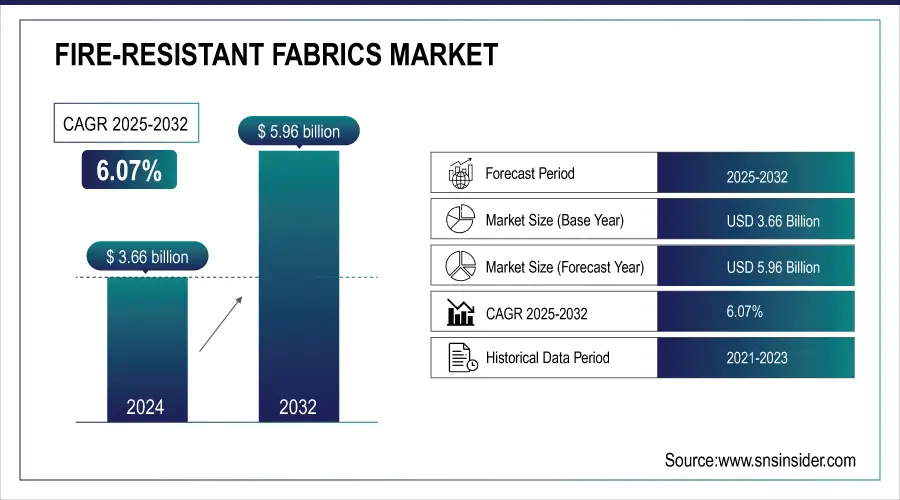

The Fire-resistant Fabrics Market size was valued at USD 3.66 billion in 2024 and is expected to reach USD 5.96 billion by 2032, growing at a CAGR of 6.07% over the forecast period of 2025-2032.

To Get more information on Fire-resistant Fabrics Market - Request Free Sample Report

The Fire-resistant Fabrics Market is witnessing strong growth due to rising demand for flame-resistant protective apparel in high-risk industries such as oil & gas, construction, electrical utilities, and firefighting. Workplace safety concerns, coupled with strict regulatory mandates, are pushing employers to invest in advanced protective clothing that ensures compliance while offering durability, comfort, and multi-hazard protection. A shift toward lightweight, breathable, and naturally fire-resistant fabrics further supports adoption. Growing complexity in occupational hazards and increasing public safety awareness continue to fuel demand. According to the U.S. Department of Energy, every dollar invested in workplace safety returns USD 4–6, reinforcing the value of protective FR apparel and driving market expansion.

Key Fire-resistant Fabrics Market Trends

-

Integration of nanotechnology is improving fire resistance, durability, and flexibility of fabrics across multiple industries.

-

Rising demand for eco-friendly, bio-based, and recyclable fire-resistant fabrics supports sustainability and circular economy goals.

-

Increasing adoption of fire-resistant fabrics in home furnishings, upholstery, and public infrastructure enhances safety standards.

-

Advancements in coating and chemical treatment methods are enabling fabrics with superior performance and longevity.

-

Growing use of fire-resistant fabrics in automotive and aerospace interiors ensures passenger safety and regulatory compliance.

-

Strategic collaborations between textile manufacturers and PPE producers are resulting in customized, industry-specific protective fabric solutions.

-

Development of smart fabrics with integrated fire resistance and thermal sensors enhances workplace hazard monitoring.

-

Rising preference for multifunctional fabrics that combine fire resistance with chemical, abrasion, and water protection.

-

Expansion of fire-resistant fabrics in military and defense applications ensures advanced protection under extreme conditions.

-

Growing investments in research for lightweight, high-strength fire-resistant fabrics support next-generation protective apparel innovations.

Fire-resistant Fabrics Market Growth Drivers

-

Rising Industrial Safety Regulations and PPE Mandates Drives the Market Growth

The increasing emphasis on workplace safety regulations globally is due to stringent occupational safety norms from governments, especially related to high-risk sectors such as oil & gas, electrical utilities, chemicals, construction, and defense. In the U.S., agencies, such as OSHA (Occupational Safety and Health Administration) and NFPA (National Fire Protection Association) have released standards that mandate flame-resistant (FR) clothing for personnel who face thermal and electrical hazards. Such components have led to the increased use of aramid fibers, FR fabrics in PPE, such as coveralls, jackets, gloves, and others. Related to workplace safety being prioritized and compliance mandated, the demand for FR apparel is on the rise. Flame resistant fabrics market investment is also about mitigation against costly incidents and liabilities, according to companies.

For instance, OSHA estimates that the U.S. employers pay approximately USD 453 each year for FR clothing in danger areas. It highlights a huge play for the use of fireproof fabric in the sectors of energy and utilities.

Fire-resistant Fabrics Market Growth Restraints

-

High Cost of Inherent Fire-resistant Fabrics May Hamper the Market Growth

Inherent FR fabrics are made from specific fibers (aramids, modacrylics, and PBI) that maintain a durable level of protection that does not wash out after repeated wear. But they cost many times more than treated fabrics, which obtain their flame resistance by undergoing a chemical treatment process. This price difference becomes one of the major obstacles, particularly for small to mid-sized companies, or for companies in price-sensitive sectors including manufacturing or textiles. In addition, higher production costs of the inherent FR fabrics, due to the necessary raw materials and advanced production technologies, restrict their availability in developing countries. These cost problems inhibit adoption even with security advantages.

Fire-resistant Fabrics Market Growth Opportunities

-

Innovation in Multi-Functional and Sustainable FR Fabrics Creates an Opportunity in the Market

The fire-resistant fabrics market is witnessing growth through the development of next-generation multifunctional FR textiles, combining fire resistance with features like anti-static, UV protection, moisture-wicking, and water repellency. Increasing environmental awareness is driving demand for sustainable, halogen-free, and recyclable FR fabrics, especially in military, utilities, and construction sectors. Technological innovations, including nanotechnology, brush finishes, and eco-friendly materials, are enabling lightweight, breathable, and comfortable fabrics without compromising protection. In 2023, Milliken & Company invested USD 25 million in U.S.-based R&D infrastructure to advance sustainable, high-performance FR textiles, supporting regulatory compliance and expanding applications in defense, utility, and industrial safety markets.

Fire-resistant Fabrics Market Segment Highlights

By Type

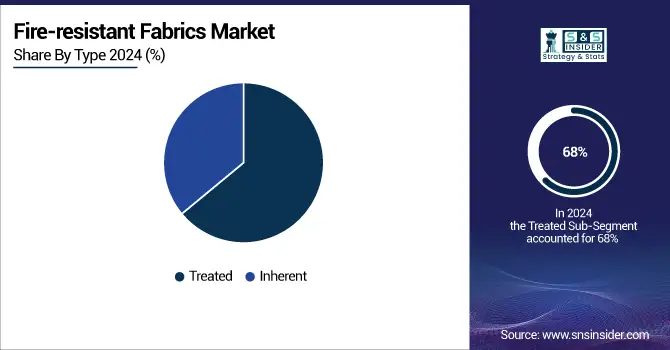

In 2024, treated fire-resistant fabrics dominated the market with about 68% share, driven by cost-effectiveness, easy availability, and suitability for diverse industrial uses. Produced by chemically treating base materials like cotton or polyester, they offer a balance of performance, safety, and affordability, making them ideal for cost-sensitive, high-volume applications in construction, oil & gas, and manufacturing. Inherent fire-resistant fabrics also held a notable share due to permanent flame resistance and durability at the fiber level, ensuring long-lasting protection. Their reliability makes them vital in safety-critical sectors such as oil & gas, military, firefighting, and electrical utilities.

By Application

In 2024, the apparel segment dominated the fire-resistant fabrics market with about 62.23% share, driven by rising demand for protective clothing in high-risk industries such as oil & gas, construction, defense, electrical utilities, and firefighting. Coveralls, jackets, gloves, and hoods are widely used to shield workers from thermal hazards, arc flashes, and flash fires, with strict OSHA and NFPA standards encouraging employer investments in FR garments. Non-apparel applications also held a notable share, with growing use in curtains, upholstery, wall coverings, automotive interiors, and building insulation, as industries and infrastructure projects comply with stringent fire safety regulations.

By End-Use

In 2024, the industrial segment dominated the fire-resistant fabrics market with about 62.23% share, driven by widespread demand in high-risk sectors such as oil & gas, chemicals, mining, manufacturing, and metal processing. Workers in these industries face constant exposure to heat, flames, electrical arcs, and flammable materials, necessitating compliance-driven use of FR protective clothing. Defense and public safety services also held a significant share, as military, firefighting, police, and emergency response teams require high-performance flame-resistant uniforms, gloves, and gear to ensure durability, comfort, and reliable thermal protection in extreme and hazardous operating conditions.

Fire-resistant Fabrics Market Regional Analysis:

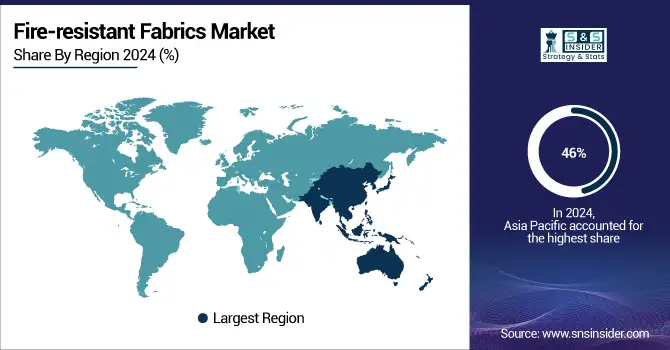

Asia Pacific Fire-resistant Fabrics Market Insights

Asia Pacific Fire-resistant Fabrics market held the largest market share, around 46%, in 2024. It is due to the rapid industrialization, urbanization, and increasing manufacturing activities in nations including China, India, and Southeast Asia. It offers a long-term forecast in terms of revenue across various verticals of ingredients, regions, and applications. The increasing awareness of the safety-at-work and progressive implementation of stringent occupational safety legislations are other role of factors that propulsion the demand for fire-retardant fabrics in the market. Low labor costs, available raw materials, and a large-scale manufacturing base have additionally turned Asia-Pacific to be an attractive manufacturing base region for global FR fabric companies.

For instance, in 2023, Teijin Aramid launched its high-performance Tenax fire-resistant fabrics line in the Asia-Pacific region, specially designed for industrial and firefighting applications. It strengthens the regional availability of high-performance FR textile offerings and addresses growing local demand.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Fire-resistant Fabrics Market Insights

North America Fire-resistant Fabrics market held a significant market share and is the fastest-growing segment in the forecast period due to developed industries and the robust enforcement of workplace safety statutes for major sectors including oil & gas, utilities, transportation and defense. The region is supported by robust institutional setups, where several organizations including NFPA and ASTM focus on standardizing safety compliance. As the awareness towards labor safety is high among manufacturers and consistent investments in protective apparel are being made, both inherent and treated varieties of fire-resistant textiles have witnessed significant demand. Besides this, the manufacturers here in North America will also increase their investment in product innovation and sustainability and multi-function performance that will be catering to the varied industrial needs. The presence of key market players also translates regional domination.

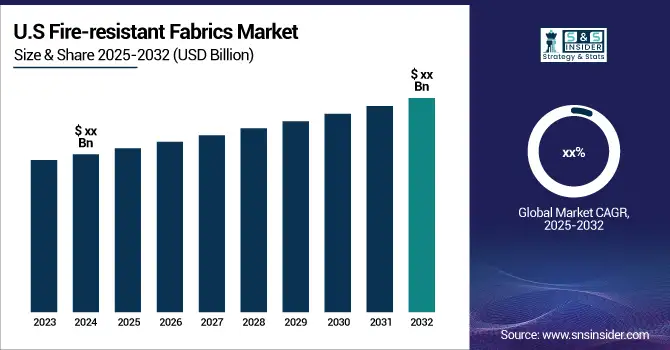

The U.S Fire-resistant Fabrics market size was USD 596 million in 2024 and is expected to reach USD 1059 million by 2032 and grow at a CAGR of 7.22% over the forecast period of 2025-2032. The country’s growth is attributable to nationwide safety standards, enormous defense dollar expenditures, and widespread presence of flame-resistant PPE within energy, construction and public safety sectors. While flame-resistant clothing is mandated under OSHA regulations and military standards, many domestic manufacturers have ramped up production further and continue to develop new fabric technology. It is also the U.S. that leads in R&D, especially of lighter, more breathable, and environmentally-sound fire-retardant materials.

In 2023, Auburn Manufacturing Inc. axed the production of some products in Maine this year and added workers because of rising demand from industrial and military customers.

Europe Fire-resistant Fabrics Market Insights

Europe held a significant market share in the forecast period due to the high level of environmental and occupational safety regulations, such as EN ISO 11612 and the REACH compliance in the region. In particular, fire safety standards are integrated into important operational requirements in sectors, such as construction, chemicals, automotive, and transportation. Sustainability is also a key focus for consumers and governments in Europe, which underwrites the development of environmentally sound, recyclable, and low-emission FR materials.

European textile makers are starting to incorporate nanotechnology, along with hybrid materials, into their FR product lines. A mixture of natural and artificial fibers to optimize performance and sustainability, which aligns with the focus on safety and environmental stewardship within the region.

Competitive Landscape for Fire-resistant Fabrics Market

DuPont was founded in 1802 and is headquartered in Wilmington, Delaware. DuPont is a global innovator in specialty materials and industrial technologies. Among its segments, including Electronics & Industrial, Water & Protection, and Mobility & Materials, the Nomex brand stands out in the fire-resistant fabrics market. Nomex offers inherent flame resistance, durability, and comfort, making it a staple in protective apparel across sectors like firefighting, oil & gas, defense, and electrical utilities.

-

In June 2023, DuPont introduced Nomex Comfort with EcoForce Technology, a sustainable flame-resistant fabric featuring a chemical-repellent finish made from over 50% bio-based materials and free from fluorine chemistry. This innovation enhances worker safety while addressing environmental concerns.

Teijin Limited was established in 1918 and is headquartered in Tokyo, Japan. Teijin Limited is a diversified multinational with strengths in fibers, plastics, composites, and healthcare. Its aramid division produces Twaron and Technora, high-performance para-aramid fibers known for exceptional strength, flame resistance, and thermal stability. These fibers are critical for protective clothing, defense gear, aerospace parts, and industrial safety equipment. Teijin emphasizes sustainability, innovation, and safety, supplying materials that withstand extreme environments while enabling durable and lightweight protective textile solutions worldwide.

-

In April 2023, Teijin Aramid achieved industrial-scale production of Twaron® using recycled feedstock. This milestone marks a significant step toward sustainable manufacturing practices in the aramid fiber industry.

Milliken & Company was founded in 1865 and is headquartered in Spartanburg, South Carolina, USA Milliken & Company is a global manufacturer of textiles, chemicals, floor coverings, and advanced materials. In fire-resistant fabrics, Milliken’s Westex brand is widely recognized for producing innovative FR textiles used in industrial workwear, defense, and emergency response apparel. Its offerings combine flame resistance with comfort, moisture management, and regulatory compliance. The company is committed to advancing workplace safety and sustainability while addressing industry-specific needs for durable, reliable, and high-performance protective clothing.

-

In July 2024, Milliken announced its collaboration with NASA to develop flame-resistant undergarment fabrics for the Artemis missions, aiming to provide astronauts with enhanced protection during lunar expeditions.

Lenzing AG was founded in 1938 and is headquartered in Lenzing, Austria. Lenzing AG is a global leader in sustainable fiber innovation. Its core operations span textiles, nonwovens, and industrial applications. Lenzing FR, the company’s inherently flame-retardant cellulose fiber, delivers thermal stability, comfort, and environmental benefits, sourced from renewable raw materials. These fibers are widely adopted in protective apparel for firefighters, industrial workers, and defense personnel. Lenzing focuses on merging safety and sustainability by offering eco-friendly FR solutions for industries requiring advanced thermal protection.

-

In October 2023, Lenzing introduced the Lenzing Fiber Identification System, enhancing traceability and transparency of its FR fibers in protective garments, ensuring compliance with industry standards and promoting sustainability.

Fire-resistant Fabrics Market Key Players

-

Teijin Limited

-

Milliken & Company

-

TenCate Protective Fabrics

-

Lenzing AG

-

PBI Performance Products

-

W. L. Gore & Associates

-

Huntsman Corporation

-

Indorama Ventures

-

Gun Ei Chemical Industry Co., Ltd.

-

Newtex Industries, Inc.

-

Trevira GmbH

-

Banswara Syntex Limited

-

XM FireLine

-

Apex Mills Corp.

-

Suzhou Top Safety Protection Technology Co.

-

Nam Liong Enterprise Co., Ltd.

-

Mengtex Protective Fabrics

-

Royal TenCate

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.66 Billion |

| Market Size by 2032 | USD 5.96 Billion |

| CAGR | CAGR of 6.07% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Treated, Inherent) • By Application (Apparel, Non-Apparel) • By End-Use (Industrial, Defense & Public Safety Services, Transport, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

DuPont, Teijin Limited, Milliken & Company, TenCate Protective Fabrics, Lenzing AG, PBI Performance Products, W. L. Gore & Associates, Kaneka Corporation, Huntsman Corporation, Indorama Ventures, Gun Ei Chemical Industry Co., Ltd., Newtex Industries, Inc., Trevira GmbH, Banswara Syntex Limited, XM FireLine, Apex Mills Corp., Suzhou Top Safety Protection Technology Co., Nam Liong Enterprise Co., Ltd., Mengtex Protective Fabrics, qand Royal TenCate |