Synthetic Paper Market Size:

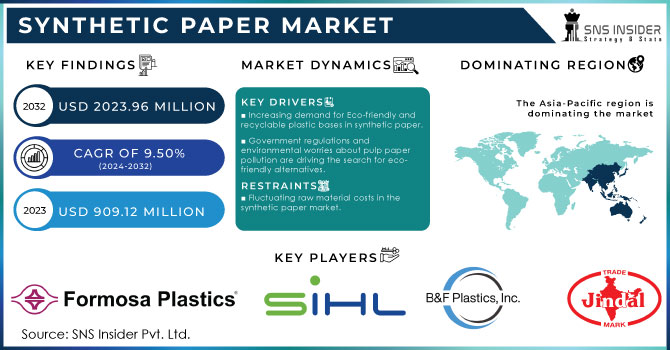

The Synthetic Paper Market Size was valued at USD 909.12 million in 2023 and is expected to reach USD 2023.96 million by 2032 and grow at a CAGR of 9.50% over the forecast period 2024-2032. The synthetic paper market is becoming popular, driven by environmental awareness and technological advancements. Eco-conscious consumers demand sustainable packaging solutions, and synthetic paper offers a compelling alternative to traditional paper, which often relies on deforestation. Beyond its eco-friendly appeal, synthetic paper boasts superior performance. For instance, the EU's Circular Economy Action Plan aims to standardize sustainable goods inside the EU. This includes actions to encourage environmentally friendly packaging options and lessen packaging waste. Because synthetic paper is robust and recyclable, it supports these objectives.

Get more information on Synthetic Paper Market - Request Sample Report

In 2023, Yupo focused on sustainable production practices, developing recyclable synthetic paper options and working to reduce the carbon footprint of their manufacturing processes.

Furthermore, it surpasses traditional paper in terms of durability, with exceptional resistance to tearing, chemicals, moisture, and grease. its superior heat sealability, printability, and high strength make it a versatile choice across various industries, including packaging, food and beverage production, consumer goods, transportation, and pharmaceuticals.

The US market is spearheading the adoption of synthetic paper, with a growing preference for eco-friendly alternatives over traditional materials like vinyl. This shift reflects a heightened focus on environmental responsibility. Ongoing research and development focused on reducing production costs will play a crucial role in expanding synthetic paper's market share. Government initiatives promoting sustainability and seeking solutions to reduce waste and increase recyclability perfectly align with the advantages of synthetic paper.

Synthetic Paper Market Dynamics:

Drivers

Increasing demand for Eco-friendly and recyclable plastic bases in synthetic paper.

Traditional paper is derived from wood pulp, and synthetic paper takes an inorganic approach, utilizing plastics such as polyolefin resin or polypropylene. This shift in material composition facilitates a meticulously controlled manufacturing process that minimizes waste generation and environmental hazards. Furthermore, synthetic paper boasts recyclability, granting it a second life as new plastic resins and significantly reducing its environmental footprint. Industry leaders are actively embracing sustainability practices. For instance, Polyart champions a "4 Rs" philosophy (Recycle, Reuse, Respect, Reduce) to minimize their environmental impact throughout the value chain. Similarly, Nan Ya Plastics leverages an eco-friendly process for creating their patented PEPA product, while Yupo Corporation prioritizes the traditional "3 Rs" (Reuse, Recycle, Repurpose) within their production cycle. By prioritizing sustainability and offering superior performance characteristics, synthetic paper is well-positioned to transform the paper industry.

Government regulations and environmental worries about pulp paper pollution are driving the search for eco-friendly alternatives.

The traditional paper industry, dominated by wood-based pulp paper (around 400 million tons globally), faces growing challenges. These papers, while cheaper, contribute to deforestation and environmental pollution. Stringent government regulations aimed at waste reduction and environmental protection are pushing for more sustainable alternatives. Synthetic paper emerges as a potential solution. Its production process is eco-friendly and does not rely on tree harvesting, helping to preserve natural resources. This focus on sustainability aligns with the growing concerns around deforestation and pollution. However, the higher cost of synthetic paper compared to traditional pulp paper currently limits its market share. Manufacturers are actively pursuing research and development to bring down production costs, making synthetic paper a more viable option.

Restrain

Fluctuating raw material costs in the synthetic paper market.

The prices of key materials like polybutylene, polypropylene, and polyethylene can be volatile. This instability can significantly impact production and product costs, which are already on the higher end. Limited plastic supply further restricts the market's growth potential. Synthetic paper relies on these plastics, and any constraints in their availability can hinder production. Crude oil prices play a double role. Since crude oil is a major source material for PP and PE, price fluctuations in crude oil directly affect the cost of synthetic paper. As crude oil prices are expected to rise in the coming years, the cost of synthetic paper is likely to follow suit. These price fluctuations are a complex issue driven by a combination of factors. The growth of applications demanding synthetic paper will naturally increase demand for raw materials. However, if the availability of these materials doesn't keep pace, prices will continue to rise, potentially hindering the market's overall growth.

Synthetic Paper Market Segmentation

By Material Type

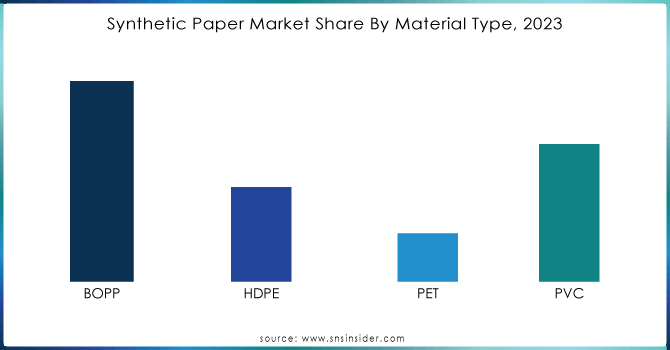

The BOPP (Biaxially Oriented Polypropylene) sub-segment dominated the synthetic paper market, capturing a massive 58% of global revenue in 2023. This leadership position can be attributed to the superior strength BOPP offers. This strength makes it the ideal choice for packaging perishable items like snacks, fast food, vegetables, fruits, and confectionery. These products require added protection during transport and storage, and BOPP films are delivered. Beyond its strength advantage, BOPP boasts other desirable properties – it's a versatile performer. This versatility translates to extensive use in packaging a wide range of products, including chemicals, textiles, cosmetics, and of course, food and beverages. BOPP, particularly in emerging economies like India and China. The growth of these key application industries is expected to fuel a surge in demand for BOPP films throughout the Asia Pacific region in the coming years.

By Application

The printing segment held the largest market share around 38.22% in the application segment of the synthetic paper market in 2023. This dominance is fueled by several factors that make synthetic paper an ideal printing substrate. Micro-pores on the surface of synthetic paper create a strong bond with ink, resulting in high-quality printing finishes. Synthetic paper outshines traditional paper in terms of durability, tear resistance, water resistance, and resistance to scratches and abrasions. These superior properties make it a reliable and long-lasting choice for various printing applications. An additional advantage is the low static surface of synthetic paper. This eliminates double feeding, a common issue with traditional paper, and ensures a smoother printing process. This compatibility extends to a wide range of printers, making synthetic paper a versatile option for diverse printing needs.

By End-use

In the End-use segment, industrial held the largest market share in 2023. The industrial segment of the synthetic paper market is experiencing significant growth due to several key factors. Synthetic paper offers superior durability and resistance to harsh environmental conditions, making it ideal for industrial applications such as tags, labels, and safety signs that are exposed to extreme temperatures, moisture, and chemicals. Additionally, the growing emphasis on sustainability within the industrial sector is driving demand for eco-friendly materials like synthetic paper, which can be recycled and has a lower environmental impact compared to traditional paper. Innovations in printing and coating technologies have also enhanced the performance characteristics of synthetic paper, making it suitable for high-quality, durable printing required in industrial settings.

Get Customized Report as per your Business Requirement - Request For Customized Report

Synthetic Paper Market Regional Analysis:

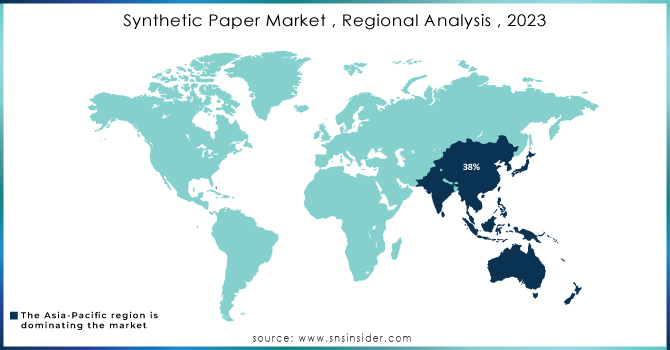

The Asia-Pacific region is leading in the synthetic paper market, claiming a dominant 38% share of global revenue in 2023. This dominance is attributed to several factors fueling demand in the region. key industries like pharmaceuticals, printing & packaging are experiencing significant growth in Asia-Pacific. This translates to a higher demand for synthetic paper as a versatile and durable material. the e-commerce boom in the region is expected to further propel the use of synthetic paper, as its properties make it ideal for packaging products shipped online. The growth story in Asia-Pacific is driven by the rising disposable income and improved living standards of the working class, particularly in developing countries like India and China. This translates to a surge in demand for consumer goods, pharmaceuticals, cosmetics, and food & beverages – industries that all find synthetic paper a valuable asset.

Key Players:

Some of the major players in the Synthetic Paper Market are Formosa Plastics Group, SIHL Group, B & F Plastics, Inc., Jindal Poly Films Ltd., Cosmo Films Ltd., Granwell Products, Inc., Transcendia, Inc., Valéron Strength Film, Toyobo Co., Ltd., TechNova, Yupo Corporation, NAN Ya Plastics Corporation, Hop Industries Corporation, Agfa-Gevaert Group, PPG Industries Inc., and other players.

RECENT DEVELOPMENTS

-

In April 2024: Cosmo Films' arm, Cosmo Synthetic Paper (CSP), is making waves in the industry. they unveiled 8 new brands focused on durability, printability, and sustainability. This positions CSP as a leader offering innovative solutions for the ever-changing world of printing.

-

In May 2023: DuPont announced a production capacity expansion for Tyvek, a popular synthetic paper brand, to meet the surging demand in packaging and labeling.

-

In June 2023: Huhtamaki launched a new line of eco-friendly synthetic paper cups made from compostable plant-based materials.

-

In July 2023: witnessed Sealed Air Corporation acquired RPC Group's Foodservice Packaging business, solidifying their position as a leader in the synthetic paper foodservice packaging market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 909.12 Million |

| Market Size by 2032 | USD 2023.96 Million |

| CAGR | CAGR of 9.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (BOPP, HDPE, Others (PVC and PET)) • By Application (Printing, Paper Bags, Labels) • By End-use (Paper, Packaging, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Formosa Plastics Group, SIHL Group, B & F Plastics, Inc., Jindal Poly Films Ltd., Cosmo Films Ltd., Granwell Products, Inc., Transcendia, Inc., Valéron Strength Film, Toyobo Co., Ltd., TechNova, Yupo Corporation, NAN Ya Plastics Corporation, Hop Industries Corporation, Agfa-Gevaert Group, PPG Industries Inc. |

| Drivers | • Increasing demand over Eco-friendly and recyclable plastic base in synthetic paper. |

| Restraints | • Fluctuating raw material costs in the synthetic paper market. |