Slurry Oil Market Report Scope & Overview:

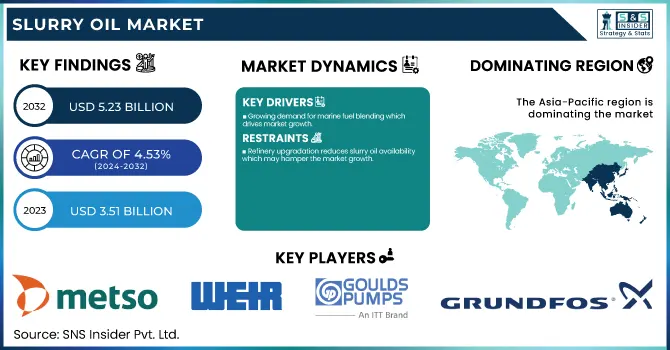

The Slurry Oil Market size was USD 3.51 Billion in 2023 and is expected to reach USD 5.23 Billion by 2032 and grow at a CAGR of 4.53 % over the forecast period of 2024-2032. The Slurry oil market report provides a detailed analysis of production volume and refinery utilization rates across key countries, along with pricing trends by type and region. It examines the regulatory and environmental impact, focusing on emissions policies and disposal restrictions. The report highlights demand distribution by end-use applications, including marine fuel blending and power generation. Additionally, it explores technological advancements and R&D investments in slurry oil upgrading for cleaner fuel alternatives. A comprehensive export and trade analysis identifies key importing and exporting nations and geopolitical influences. The report delivers data-driven insights into market dynamics, helping stakeholders navigate evolving regulations and industry innovations.

To Get more information on Slurry Oil Market - Request Free Sample Report

Slurry Oil Market Dynamics

Drivers

-

Growing demand for marine fuel blending which drives market growth.

The growth of the slurry oil market is majorly attributed to the developing use of slurry oil as a blend stock for marine fuel. As the need for cheaper alternative fuels is growing, slurry oil is being mixed with marine fuels to increase combustibility while at the same time bringing down the total price of fuels for shipping companies. Changes in LUFO and bunker fuel formulations due to the International Maritime Organization (IMO) 2020 sulfur regulations have made slurry oil a valuable blending component towards very low sulfur fuel oil (VLSFO). Furthermore, large refineries and the shipping sector are taking advantage of the properties of slurry oil formulating high carbon and calorific value contents to help fuel grade in large-scale vessels. Increasing international trade and maritime activities, especially in the Asia-Pacific and Middle East regions, is further driving demand for slurry oil in marine fuel applications. The higher production and transaction volume of slurry oil again strengthens its position in the world energy system.

Restraint

-

Refinery upgradation reduces slurry oil availability which may hamper the market growth.

Advanced technologies of refinery upgradation are increasingly being adopted which is affecting the availability of slurry oil resulting in restricting the market growth. Refineries are rapidly moving to residue upgrading processes like hydrocracking, delayed coking, and fluid catalytic cracking (FCC) upgrades which use heavy residual oils converting them into higher-value products such as diesel, gasoline, and petrochemicals. This transition subsequently lowers the yield of slurry oil, which is conventionally an FCC unit output. Moreover, tighter environmental regulation is forcing refiners toward cleaner refining technology, which further restricts slurry oil output. Due to refinery upgrades that optimize capabilities and help meet ever-present global emission standards, the availability of slurry oil is set to decrease, limiting its use in various applications from marine fuel blending to power generation and asphalt production. The decreased supply, alongside increased demand in major sectors, could cause substantial price fluctuations and impact market development in the longer run

Opportunity

-

Investments in waste oil recycling and sustainability create an opportunity in the market.

The growing attention towards waste oil recycling, as well as sustainability, is creating new growth opportunities for the slurry oil market. With increasingly stringent environmental regulations and the transition of industry to a circular economy, new advanced recycling technologies enable to conversion of slurry oil to high-value products including low-sulfur fuel, lubricants, and petrochemical feedstocks. Advancements in hydrotreatment, catalytic cracking, and solvent extraction have allowed slurry oil to be turned into low-carbon fuels, resulting in less waste and better regulatory compliance. Waste oil recovery initiatives are also being promoted around the world by various governments and regulatory bodies to curb the environmental risks posed by improper disposal. In addition, numerous oil refineries and marine fuel suppliers are looking into sustainable blending possibilities that involve mixing recycled slurry oil into low-emission fuel compositions. Such investment will pay off not only with significantly improved profit margin due to higher recycling cost-effective than importing virgin crude oil but also in line with world sustainability efforts, making this slurry oil recycling a strategic growth opportunity.

Challenges

-

Limited refinery upgrading infrastructure may challenge the market growth.

The limited availability of advanced refinery upgrading infrastructure is one of the greatest obstacles facing the slurry oil market, which limits the extent to which it can be processed into higher-value fuels. Most refineries, especially in developing areas, use traditional refining technologies that are incapable of effective conversion of slurry oil to lighter, more usable products. Since hydrocracking and slurry hydro conversion as upgrading processes are very capital intensive, these processes are economically challenging for smaller refineries to adopt. This has left significant amounts of slurry oil either largely underutilized or used mainly in low-value applications such as fuel blending and asphalt production. In addition to its improving but still low value, the commercial viability of slurry oil is hampered by important environmental regulations that create problems for refineries that do not have appropriate upgrading units. Absence of infrastructure curtails market growth, as industries move to cleaner fuel options and those with better refining efficiency.

Slurry Oil Market Segmentation Analysis

By End Use

Automotive held the largest market share around 42% in 2023. It is owing to its usage in carbon black manufacturing, which, in turn, is indispensable for tire production. Carbon black made from slurry oil serves as an important reinforcing agent play in automotive tires, improving longevity, toughness, and wear resistance. The increasing demand for passenger and commercial vehicles across the globe, particularly in emerging economies such as China and India have led to an increased requirement for carbon black, which in turn has increased the demand for slurry oil in the production of carbon black. Even the growing customer base for electric vehicles (EVs) quenched demand since tires are still a basic need of all cars. In addition, slurry oil feedstock is economical for the automotive industry, so large tire producers prefer it. Driven by urbanization and increasing disposable incomes, growth in vehicle production is expected to remain robust, which in turn is expected to fuel the demand for the automotive sector, thereby contributing to the steady growth of the slurry oil market.

Food & Beverage is the fastest-growing segment. In the food and beverage industry, it is used to produce carbon black which is required in food packaging materials. Carbon black is commonly used in food-grade plastic packaging, containers, and films, as it improves durability high-temperature resistance, and thermal durability, all derived from slurry oil. Rising consumption of high-quality and long-lasting processed and packaged foods has catalyzed demand for packaging solutions resulting in increased usage of the flavor and aroma hexes derived from slurry oil. Wide use of food-grade making them safe and thus FDA-approved and food-contact safe carbon black is another factor towards the market growth in this industry due to stringent food safety acts. Global urbanization, e-commerce, and convenience food trends continue to drive global food industry growth leading to continued strong demand for slurry oil in the food packaging end market.

Slurry Oil Market Regional Outlook

Asia Pacific held the largest market share around 48% in 2023. This is owing to some of the largest oil refineries in the world are located in countries such as China, India, and South Korea, and they yield a large volume of slurry oil. In addition, the rapid growth of the automotive industry in this region, specifically China and India, has led to high demand for carbon black, which is primarily used for tire production. Moreover, Asia Pacific is the fastest-developing region for the marine and shipping industry where major ports like Singapore and Shanghai use slurry oil in marine fuel blending. Strong infrastructure development in the region also results in increased slurry oil demand in asphalt production. Besides these, cheap manpower and an outsourcing-friendly government policy promoting industrial growth also create demand for slurry oil, establishing Asia Pacific as the largest consumer of the product. This will keep the region at the top of its game in slurry oil.

North America held a significant market share in 2023. It's owing to its well-developed refining industry, a large amount of carbon black demand, and marine fuel consumption. Slurry oil is produced by Fluid Catalytic Cracking (FCC) units, and the United States, which possesses some of the largest and most sophisticated refineries in the world, produces large quantities of slurry oil. Such supply sustains the region's booming carbon black industry, which is key to the automotive tire and industrial rubber value chain. Moreover, major shipping hubs on the Gulf Coast and East Coast have contributed to the need for blending with marine fuels, using slurry oil as a cheap solution. The increasing consumption of the drug in asphalt and road construction in North America is also supported by the development of infrastructure. Further, technological innovations in refining and residue upgrading make it possible to utilize slurry oil more efficiently which will further strengthen North America's market position.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Metso (Slurry Pumps, Process Valves)

-

Weir Group (Centrifugal Slurry Pumps, Knife Gate Valves)

-

ITT Goulds Pumps (Model 5500 Severe Duty Slurry Pumps, XHD Extra Heavy Duty Lined Slurry Pumps)

-

Grundfos (Hydro MPC BoosterpaQ, SE/SL Wastewater Pumps)

-

Flowserve (Warman Slurry Pumps, Durco Process Pumps)

-

KSB (GIW Minerals LCC Heavy Slurry Pumps, MegaCPK Standardized Chemical Pumps)

-

Tsurumi Pump (GPN Series Sand Pumps, KRS Series High-Head Dewatering Pumps)

-

EBARA Pumps (Model DLFU Submersible Pumps, Model FSA End Suction Pumps)

-

Excellence Pump Industry (EHM Series Slurry Pumps, EGM Series Gravel Pumps)

-

Schurco Slurry (S Series Lined Slurry Pumps, Z Series Gravel Pumps)

-

SNF Floerger (FLOPAM Flocculants, FLOQUAT Coagulants)

-

Afton Chemical (HiTEC 11100 Viscosity Modifier, HiTEC 6460 Detergent)

-

Lubrizol (LZ 9150A Viscosity Modifier, LZ 1110A Pour Point Depressant)

-

Schaeffer Oil (Supreme 9000 Engine Oil, Moly EP Synthetic Plus Grease)

-

Castrol India (CRB Turbomax Diesel Engine Oil, VECTON Long Drain Engine Oil)

-

Vopak (Tank Storage Services, Chemical Logistics Solutions)

-

Marine Biologics (SuperCrude Food Emulsifiers, Seaweed-Based Biomaterials)

-

Adnoc (Murban Crude Oil, Polyolefins)

-

Covestro (Makrolon Polycarbonate, Desmodur Polyurethane)

-

Polartech (Metalworking Fluid Additives, Corrosion Inhibitors)

Recent Development:

-

In December 2024, ADNOC Drilling collaborated with SLB and Patterson-UTI to establish Turnwell Industries, focusing on the development of unconventional energy resources in Abu Dhabi through advanced extraction technologies.

-

In April 2024, Chevron and Woodside Energy finalized an asset swap to strengthen their LNG operations in Western Australia. As part of the agreement, Chevron expanded its ownership in the Wheatstone project, while Woodside gained Chevron’s stakes in the North West Shelf LNG and oil ventures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.51 Billion |

| Market Size by 2032 | USD 5.23 Billion |

| CAGR | CAGR of 4.53 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End Use (Air Purification, Automotive, Food & Beverage Processing, Pharmaceutical & Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Evonik Industries AG, Infineum International Limited, The Lubrizol Corporation, Clariant AG, Afton Chemical Corporation, Baker Hughes, Bell Performance, Inc., Chevron Oronite Company LLC, Dorf Ketal, Innospec Inc., TotalEnergies SE, HollyFrontier Corporation, Nalco Water (an Ecolab company), Tianhe Chemicals, Cestoil Chemical Inc., Exxon Mobil Corporation, Ecolab Inc., Croda International Plc, Schlumberger Limited |