Advanced Analytics Market Report Scope & Overview:

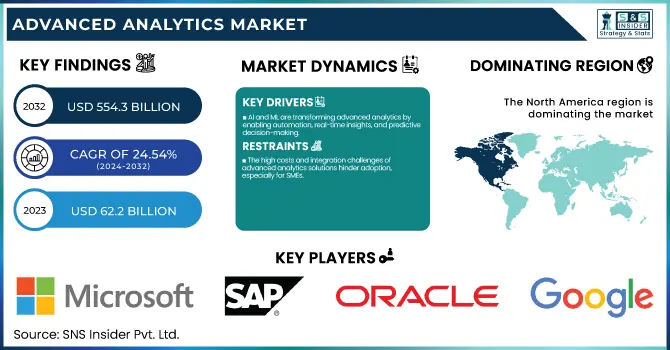

The Advanced Analytics Market was valued at USD 62.2 Billion in 2023 and is expected to reach USD 554.3 Billion by 2032, growing at a CAGR of 24.54% from 2024-2032.

To Get more information on Advanced Analytics Market - Request Free Sample Report

The Advanced Analytics Market is experiencing rapid growth, driven by the increasing adoption of AI-powered analytics solutions that enhance decision-making and operational efficiency through machine learning and automation. The utilization of big data varies by industry and region, with finance, healthcare, and retail at the forefront of data-driven strategies. From 2020 to 2023, predictive analytics has seen significant adoption, fueled by the demand for real-time insights and risk assessment. Additionally, organizations are increasingly favoring cloud-based analytics over on-premise solutions due to their scalability, cost benefits, and seamless integration. The report also explores emerging trends in real-time analytics, AI-driven data processing, and industry-specific applications of advanced analytics.

Advanced Analytics Market Dynamics

Drivers

-

AI and ML are transforming advanced analytics by enabling automation, real-time insights, and predictive decision-making.

AI and ML are being increasingly used with advanced analytics and transforming the way industries make data-driven decisions. Businesses are using AI-enabled analytics to identify outliers, automate data processing, and derive actionable insights in real-time. Industries such as finance, healthcare, and retail are at the forefront of this change, leveraging predictive and prescriptive analytics to identify fraud, deliver personalized customer experiences, and drive operational efficiencies. Generative AI is the next disruptive force in analytics, creating opportunities for functionality like natural language processing and automated forecasting. With the growing sophistication of analytics tools powered by AI, businesses are increasingly adopting such tools for competitive advantage and to enhance data-driven decision making.

Restraints

-

The high costs and integration challenges of advanced analytics solutions hinder adoption, especially for SMEs.

One of the main challenges faced by businesses, especially small and medium enterprises, is the high cost of implementing advanced analytics solutions, even though it is popular and effective. Costs of getting AI-based analytics tools, to upgrade infrastructure, and the cost of skilled individuals are all too much to handle. Furthermore, adapting state-of-the-art analytics with the pre-existing legacy systems is similarly challenging and more time-consuming, needing a lot of engineering skills. When deploying analytics solutions, many organizations face the challenge of data silos and compatibility issues. If businesses do not implement it effectively, time may lead to the expected ROI. Accordingly, cost and integration challenges are still major inhibitors of advanced analytics adoption.

Opportunity

-

Cloud-based analytics offers scalability, cost efficiency, and flexibility, driving its widespread adoption.

The transition to cloud-based advanced analytics is an important long-term growth opportunity for the industry driven by demand for scale, cost efficiency, and flexibility. With cloud-based analytics platforms, there is no need for an expensive on-premise infrastructure , while at the same time bringing the data access to your fingertips anytime and anywhere. As an example, large AI-driven analytics offerings from Google Cloud, AWS & Microsoft are accommodating organizations with big data for business without heavy IT associated outlays. Analytics-as-a-Service is a huge factor in the growth of adoption as well, allowing organizations to use some seriously powerful analytics tools for their organizations on a subscription basis. The flexibility, instant data processing, and seamless integration of cloud-based analytics have led organizations to migrate to the cloud.

Challenges

-

Increasing data volumes and regulatory requirements raise concerns about privacy, security, and compliance in analytics.

The increasing dependency on big data analytics, the issue of data privacy and security still constitutes a major trouble. Data storage poses risks to large organizations, particularly those with high levels of sensitive data in sectors like banking, healthcare, and government, where data breaches, regulatory compliance, and unauthorized access qualify as a crisis. Data protection regulations like GDPR and CCPA in the EU, and also HIPAA in North America, require stringent data protection measures, which creates complexity in deploying analytics pipelines. Furthermore, the surge in the use of cloud-based analytics stirs fears of data sovereignty and third-party exposures. For this reason, businesses need to channel their efforts into strong encryption and access controls with a compliance framework to enforce trusted analytics practices with a secure and responsible use of your data.

Advanced Analytics Market Segmentation Analysis

By Type

In 2024, the big data analytics segment dominated the market and accounted for significant revenue share in 2023, as big data analytics enables a large and unprecedented amount of structured and unstructured data to be processed and analyzed from multiple sources. Big data has become a magnetic touchpoint that brings the attributes of volume, velocity, and variety to the data table where organizations with datasets so large that traditional data processing applications are inadequate come together.

The customer analytics segment is expected to register the fastest CAGR during the forecast period. Rising need to provide personalized experience and improving customer satisfaction is the main driver for the adoption of customer analytics. More sophisticated consumer analytics are being utilised by businesses, which allows them to profile consumers behaviour, tastes and purchasing patterns in order to tailor marketing, product and customer service.

By Deployment

The cloud segment dominated the market and accounted for 64% of revenue share in 2023 because of its high scalability, flexibility, and cost-efficacy. For companies that want to implement analytics quickly, and in a way that can easily scale, cloud solutions provide a way for organizations to access state-of-the-art analytics capabilities without large capital outlays for hardware or infrastructure. The cloud supports real-time data processing, integrating easily with existing systems, and enabling collaboration with team members around the world.

The on-premise is anticipated to register the fastest CAGR during the forecast period. However, on-premise advanced analytics solutions are generally adopted by organizations that require more control, security, and customization. Organisations in highly regulated sectors like finance, healthcare, and government tend to focus to a greater degree on data security and are often subject to stricter regulatory frameworks than others, and – as such – are more likely to opt for on-premise deployment.

By Enterprise size

In 2023, the large enterprise segment dominated the market and accounted for a significant revenue share. As these customers possess large amounts of data due to the complexity of operations, they allocate bigger resources towards analytics to get insights on their business and external factors. Such organizations have massive and complex operations with massive amounts of both structured and unstructured data that need to be analyzed to extract actionable insights that are not possible with traditional analytics solutions.

The SME segment is expected to register the fastest CAGR during the forecast period. The increasing availability of analytics tools, and the need among SMEs to stay competitive in a data-driven business environment have driven the adoption of advanced analytics. The rise of cloud-based analytics platforms and software-as-a-service models now enables SMEs to implement advanced analytics solutions with lower entry barriers by eliminating the need for large upfront investment in infrastructure.

By End-Use

The BFSI segment dominated the market and held the largest market share in 2023, as it is a data industry that requires assistance in risk management, fraud detection, and customer insights. Background: Financial institutions create and use colossal transactional, behavioral, and market data, necessary to drive the decisions to buy and sell, manage the risk of the buy and sell, and meet regulatory compliance to the buy and sell.

The healthcare segment is anticipated to record the fastest CAGR during the forecast period. The healthcare sector has been driven to adopt advanced analytics due to the growing demand for data-driven insights to help improve patient outcomes, optimize clinical operations, and reduce costs. The explosion of data in healthcare creates a fertile ground for predictive analytics, where healthcare providers and organizations mine large datasets, e.g., patient records, clinical trial data, population health statistics for patterns and trends that can help with diagnostics, treatment plans, and preventive care.

Regional Landscape

North America dominated the market and accounted a significant revenue share in 2023. driven by the high adoption of artificial intelligence and machine learning technologies in various industries. Demand for advanced analytics is being propelled by a focus on digital transformation throughout the region, along with a well-established IT infrastructure and the availability of leading technology providers in the region.

The Asia Pacific advanced analytics market is expanding rapidly, especially between 2024 and 2032. Many growth factors exist in the Asia Pacific advanced analytics market because of the increasing digitalization among different industries and the fintech and e-commerce booming market. The situation in countries like China, India or Japan suggests that — due to increased competition in the global market — most companies are now turning to advanced analytical methods, which help them boost their operational efficiency, customer interaction and innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Microsoft – Power BI

-

IBM – IBM Watson Analytics

-

SAP – SAP Analytics Cloud

-

Oracle – Oracle Analytics Cloud

-

Google – Google Cloud BigQuery

-

SAS Institute – SAS Viya

-

AWS (Amazon Web Services) – Amazon QuickSight

-

Tableau (Salesforce) – Tableau Desktop

-

Qlik – Qlik Sense

-

TIBCO Software – TIBCO Spotfire

-

Alteryx – Alteryx Designer

-

Databricks – Databricks Lakehouse Platform

-

Cloudera – Cloudera Data Platform (CDP)

-

Domo – Domo Business Cloud

-

Zoho – Zoho Analytics

Recent Developments

-

February 2024: PwC implemented advanced data visualization tools, enabling clients to gain real-time insights into financial performance, thereby enhancing strategic decision-making and profitability.

-

March 2024: Databricks reported a 60% year-over-year revenue increase, attributed to its effective leveraging of artificial intelligence to meet growing business demands.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 62.2 Billion |

|

Market Size by 2032 |

USD 554.3 Billion |

|

CAGR |

CAGR of 24.54% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Big Data Analytics, Business Analytics, Customer Analytics, Risk Analytics, Statistical Analysis, Others), |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Microsoft, IBM, SAP, Oracle, Google, SAS Institute, AWS (Amazon Web Services), Tableau (Salesforce), Qlik, TIBCO Software, Alteryx, Databricks, Cloudera, Domo, Zoho |