Sensitive Data Discovery Market Report Scope & Overview:

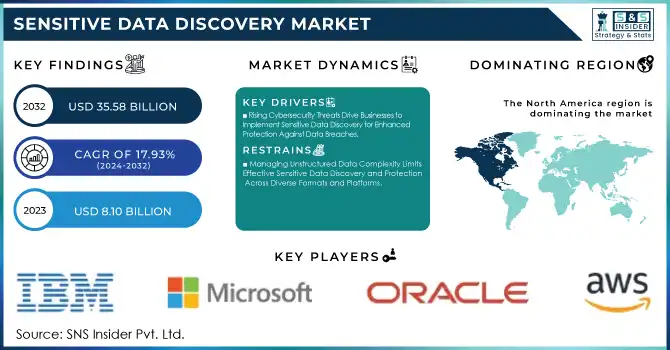

The Sensitive Data Discovery Market was valued at USD 8.10 billion in 2023 and is expected to reach USD 35.58 billion by 2032, growing at a CAGR of 17.93% from 2024-2032

To Get More Information on Sensitive Data Discovery Market - Request Sample Report

The Sensitive Data Discovery market is growing rapidly, as businesses are increasingly burdened by stringent data protection regulations. With organizations now holding more sensitive information, including personally identifiable information and financial records, the urgency to know what sensitive data exists and where it resides has never been more acute. According to the 2024 GDPR report, it indicates that 60% of the data protection authorities reported an increase in complaints with handling personal data especially concerning sensitive data processing. As regulatory requirements such as GDPR and CCPA are changing, companies are investing in tools that help them discover, classify, and protect sensitive information. 60% of respondents have already implemented or will implement data classification tools such as Microsoft Purview to augment their sensitive data discovery processes. Higher dependence on compliance with the increasing threat of data breaches has dramatically increased demand for sensitive data discovery solutions across industries.

The growing demand for sensitive data discovery tools is fueled by the need to minimize security risks and maintain compliance in an increasingly complex digital landscape. According to the study, with 55% of organizations identifying and classifying sensitive data across cloud environments as one of their top priorities to enhance their security posture, businesses are turning to advanced solutions powered by AI and machine learning to improve data identification. In 2024, AWS improved Amazon Macie to make automated sensitive data discovery and classification better, so organizations can deal with and secure their data across cloud environments for better compliance. These solutions would help businesses identify sensitive data in various systems and minimize risk of losing it through leakage or cyberattack. Since these sectors, which deal with high amounts of sensitive information, have an increased sense of urgency, more of such tools will push the growth of the market.

Looking forward, technological advancements hold high promise in Sensitive Data Discovery. Moving to multi-cloud and new data-driven technologies across various businesses shall push the AI-based data discovery solution market high in the upcoming future. In 2024, Google Cloud improved the vertex AI sensitive data discovery feature which would now work hand-in-glove with its security command center to enforce stronger compliance for data and ensure security on the AI-led horizon. Securing sensitive data across complex infrastructures will be critical and drive innovation, new product offerings. Increasing focus on data sovereignty, increasing privacy rights, and emerging technology, such as blockchain and IoT, will create an opportunity for companies to create solutions that satisfy the needs evolving in this market.

Sensitive Data Discovery Market Dynamics

Drivers

-

Rising Cybersecurity Threats Drive Businesses to Implement Sensitive Data Discovery for Enhanced Protection Against Data Breaches

As cyberattacks become more frequent and sophisticated, the protection of organizational data is becoming a challenge. In November 2024, Microsoft detected a drastic surge in cyberattacks, and it has reported more than 600 million attacks targeting customers daily. Hackers are targeting sensitive data more frequently and exploiting vulnerabilities in digital infrastructures. Thus, proactive data discovery is necessary to prevent unauthorized breaches. Businesses must first identify where sensitive data is stored and how it is accessed. advanced discovery tools have become necessary to prevent risks in traditional security measures.

According to the UK Government's Cyber Security Breaches Survey 2024, it has been established that 30% of businesses and charities have now specifically included board members to oversee the security aspect of data protection. Ransomware, phishing, and other forms of cyberattacks have become increasingly frequent, so organizations must make sensitive data discovery and protection in multiple environments - both on-premises and cloud-based infrastructures.

-

AI and Machine Learning Enhance Sensitive Data Discovery, Enabling Faster and More Accurate Identification at Scale

Advances in Artificial Intelligence and Machine Learning are revolutionizing data discovery because companies are now able to recognize, classify sensitive information at unheard-of scales. With growing volumes of data and increasingly large volumes of unstructured data, it is not possible to look for the new information manually today. AI and ML algorithms can quickly pass through large datasets and find patterns and potential risks much more accurately than human efforts alone.

These technologies learn continuously and adapt to changing data structures, improving on the efficiency of sensitive data discovery. AI-driven tools are of utmost importance for automation and streamlining the discovering process as organizations face the challenge of really large and complex data environments. With such improvement on the speed and precision of identification of data, businesses can safely protect their most vital information better, ensuring compliance with many regulations while minimizing risk exposure due to data breaches.

-

Exponential Data Growth Drives Demand for Effective Sensitive Data Discovery Solutions to Manage Unstructured Information

-

Stricter Data Privacy Regulations Increase Need for Sensitive Data Discovery to Ensure Compliance with Laws like GDPR and CCPA

Restraints

-

Managing Unstructured Data Complexity Limits Effective Sensitive Data Discovery and Protection Across Diverse Formats and Platforms

Unstructured data, such as Emails, documents, and multimedia files pose a significant challenge to organizations while trying to identify and protect sensitive information. Since unstructured data does not have a predefined format, it cannot be classified or secured as effectively as structured data. The process of processing and discovering sensitive information becomes increasingly complex as businesses generate massive amounts of unstructured data.

Proper classification of valuable data may miss out or receive insufficient protection to breach. Automated discovery tools further become complicated to apply due to the sheer volume and variety of unstructured data, requiring extra time, resources, and expertise. Organizations often face challenges fully implementing sensitive data discovery strategies as they deal with massive volumes of unstructured content spread across diverse platforms and environments.

Sensitive Data Discovery Market Segment Analysis

By Component

In 2023, the Solutions segment dominated the Sensitive Data Discovery Market and accounted for nearly 69% of the overall revenue share. This is largely due to increasing reliance on sophisticated technologies that allow for automatic detection and classification of sensitive data in various environments. Organizations are moving toward robust data discovery solutions in order to provide better security, ensure compliance, and reduce risks of data breaches. In scalable, efficient, and reliable solutions that manage a volume of massive data, business organizations are pushing further growth to be able to proactively protect sensitive information better.

The services segment is expected to grow at the fastest 19.61% CAGR between 2024 and 2032 due to a managed and professional service trend. As data discovery solutions continue to become complex and more in use by companies, the support for deployment, integration, and continued management would be required with expertise. Data discovery services provide organizations with much-needed support for maximizing the leverage of data discovery tools, particularly customized and compliance-driven requirements. The growing need for expertise and tailored service offerings is accelerating the expansion of the Services segment and complements the ongoing evolution of the broader market.

By Organization Size

In 2023, the Large Enterprises segment led the Sensitive Data Discovery Market, capturing the highest revenue share of about 63%. This dominance is largely due to the significant resources available to large organizations, enabling them to invest in comprehensive data discovery solutions that cover vast, complex data environments. These enterprises face stringent compliance requirements and higher cybersecurity risks, driving them to prioritize advanced technologies that can securely manage sensitive data across multiple platforms. Additionally, the scale and diversity of their operations necessitate the adoption of robust, scalable solutions to ensure data protection.

The SMEs segment is expected to grow at the fastest growth with a projected CAGR of 19.26% from 2024 to 2032. With SMEs realizing the need to protect sensitive data, they are shifting to more affordable and user-friendly solutions. Cloud-based services and subscription models have made it easier to deploy effective data discovery tools for these businesses, without the significant capital expenditures undertaken by large enterprises. Moreover, increased pressure from data privacy regulations makes SMEs implement data discovery solutions to remain compliant as well as protect their operations.

By Application

The Security and Risk Management segment dominated the Sensitive Data Discovery Market in 2023, with largest share of around 47%. This has been fueled by the increasing incidents and sophistication of cyberattacks and the need to secure data more than ever for organizations. Businesses are investing increasingly in solutions that can proactively discover and secure vulnerable data. The growing need for risk mitigation and the rising complexity of data environments make security and risk management solutions essential for enterprises that aim to protect their critical information assets.

The Compliance Management segment is expected to grow at the fastest CAGR of 19.36% from 2024 to 2032, driven by the tightening of global data privacy regulations. As governments and regulatory bodies impose stricter laws such as GDPR and CCPA, organizations must ensure compliance to avoid significant fines and reputational damage. Rising complexity in maintaining compliance across multiple jurisdictions motivates businesses to implement advanced data discovery tools that reduce the complexity of identifying, classifying, and protecting sensitive information. This growing need for streamlined compliance management is driving the sharp growth of this segment.

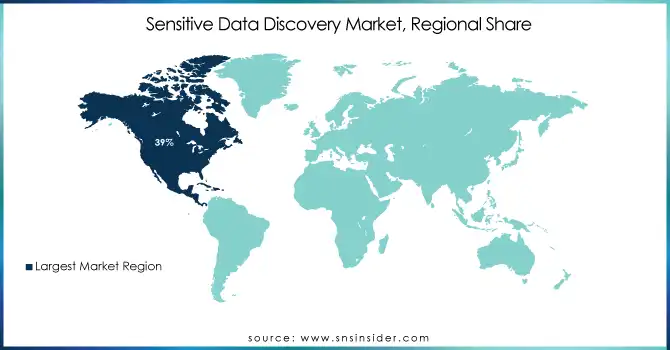

Regional Analysis

North America dominated the Sensitive Data Discovery Market in 2023, with around 39% of total revenue. That is because, due to increasing demand for reliable data protection and strict regulatory rules like GDPR and CCPA within the region, North America would continue to sustain its top-most position. As North America possesses most of the giant technology houses and has extremely high cybersecurity consciousness, the product would be found highly adopted there in all domains. The well-established infrastructure of the region and ongoing investment in digital transformation support the more extensive use of sensitive data discovery solutions.

Asia Pacific is expected to grow at the fastest CAGR of 19.61% from 2024 to 2032 with rapid economic development and increased digital technology adoption in the region. As the business in the region adopts cloud computing, IoT, and big data, advanced data discovery solutions that secure sensitive information become even more critical. More stringent regulatory requirements and the growing incidence of data breaches are making Asian Pacific organizations increase their investment in data security, thus increasing the sensitive data discovery market rapidly in this region.

Do You Need any Customization Research on Sensitive Data Discovery Market - Enquire Now

Key Players

-

IBM (IBM Security QRadar, IBM Cloud Pak for Security)

-

Microsoft (Microsoft Information Protection, Microsoft Purview)

-

Oracle (Oracle Data Safe, Oracle Cloud Infrastructure)

-

AWS (Amazon Macie, AWS Secrets Manager)

-

Proofpoint (Proofpoint Information Protection, Proofpoint Data Loss Prevention)

-

Google (Google Cloud Data Loss Prevention, Google Cloud Security Command Center)

-

Micro Focus (Micro Focus Secure Content Management, Micro Focus Data Security)

-

SolarWinds (SolarWinds Data Security, SolarWinds Access Rights Manager)

-

PKWARE (PKWARE Smart Encryption, PKWARE Data Encryption Solutions)

-

Thales (Thales CipherTrust, Thales Cloud Protection)

-

Spirion (Spirion Data Loss Prevention, Spirion Data Discovery)

-

Egnyte (Egnyte Data Governance, Egnyte Data Loss Prevention)

-

Netwrix (Netwrix Data Classification, Netwrix Auditor)

-

Varonis (Varonis Data Security Platform, Varonis Data Classification)

-

Digital Guardian (Digital Guardian Data Loss Prevention, Digital Guardian Endpoint Protection)

-

Solix (Solix Cloud Data Management, Solix Data Masking)

-

Immuta (Immuta Data Privacy, Immuta Data Governance)

-

MENTIS (MENTIS Data Masking, MENTIS Data Discovery)

-

Ground Labs (Ground Labs Data Discovery, Ground Labs Compliance Solutions)

-

Hitachi (Hitachi Data Discovery, Hitachi ID Data Protection)

-

Nightfall (Nightfall Data Loss Prevention, Nightfall Cloud Security)

-

Securiti (Securiti Data Privacy, Securiti Data Governance)

-

DataGrail (DataGrail Data Privacy, DataGrail Compliance Suite)

-

Dathena (Dathena Data Discovery, Dathena Data Privacy)

-

BigID (BigID Data Discovery, BigID Data Privacy)

-

1touch.io (1touch.io Data Classification, 1touch.io Data Discovery)

-

DataSunrise (DataSunrise Data Protection, DataSunrise Database Security)

Recent Developments

-

In November 2024, IBM announced the integration of Guardium with IBM Security Discovery & Classify, enhancing data protection by automating sensitive data discovery, policy synchronization, and continuous monitoring across hybrid cloud and on-premises environments.

-

In November 2024, Microsoft introduced Sensitive Data Threat Detection in Microsoft Defender for Storage, utilizing an agentless engine to identify sensitive data and integrating with Microsoft Purview's classification labels for improved data security.

-

In September 2024, Oracle Data Safe introduced enhanced data discovery features, allowing users to select common sensitive types more easily and compare masking policies based on changes to the sensitive data model, improving data protection.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.10 Billion |

| Market Size by 2032 | USD 35.58 Billion |

| CAGR | CAGR of 17.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)) • By Deployment Mode (On-premises, Cloud) • By Application (Security and Risk Management, Compliance Management, Asset Management, Other Applications) • By Vertical (BFSI, Government, Healthcare and Life Sciences, Retail, Manufacturing, IT and Telecommunications, Other Verticals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Microsoft, Oracle, AWS, Proofpoint, Google, Micro Focus, SolarWinds, PKWARE, Thales, Spirion, Egnyte, Netwrix, Varonis, Digital Guardian, Solix, Immuta, MENTIS, Ground Labs, Hitachi, Nightfall, Securiti, DataGrail, Dathena, BigID, 1touch.io, DataSunrise |

| Key Drivers | • Rising Cybersecurity Threats Drive Businesses to Implement Sensitive Data Discovery for Enhanced Protection Against Data Breaches • AI and Machine Learning Enhance Sensitive Data Discovery, Enabling Faster and More Accurate Identification at Scale |

| RESTRAINTS | • Managing Unstructured Data Complexity Limits Effective Sensitive Data Discovery and Protection Across Diverse Formats and Platforms |