Automotive Aluminum Market Size & Overview:

Get More Information on Automotive Aluminum Market - Request Sample Report

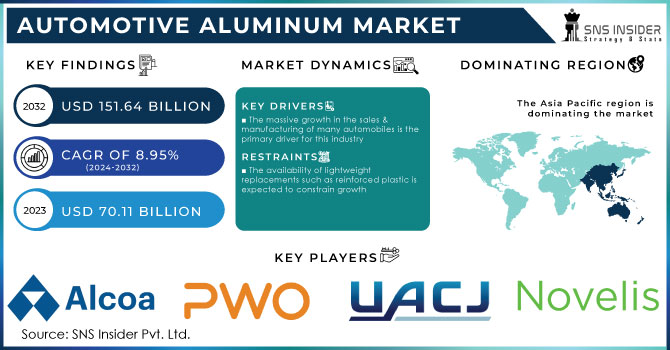

The Automotive Aluminum Market Size was valued at USD 70.11 billion in 2023 and is expected to reach USD 151.64 billion by 2032 and grow at a CAGR of 8.95% over the forecast period 2024-2032.

- What are the factors which will be improving the revenue pool for the players operating in this market during the forecasted period?

In the dynamic landscape of the Automotive Aluminum Market, several key factors are poised to enhance the revenue pool for its players in the foreseeable future. Firstly, technological advancements in aluminum manufacturing processes are expected to streamline production, reducing costs and enhancing product quality, thereby attracting more consumers. Additionally, the growing emphasis on sustainability and environmental consciousness is driving the demand for lightweight materials like aluminum, as automakers seek to improve fuel efficiency and reduce emissions in their vehicles.

Moreover, the increasing adoption of electric vehicles (EVs) presents a significant opportunity for aluminum suppliers, as EVs require more aluminum components due to their lightweight properties and conductivity. Furthermore, strategic partnerships and collaborations within the automotive industry can facilitate innovation and market expansion, enabling players to tap into new segments and geographical regions. By leveraging these factors effectively, companies operating in the Automotive Aluminum Market can anticipate a substantial growth in their revenue streams, driving sustainable success in the future.

MARKET DYNAMICS:

KEY DRIVERS:

-

The massive growth in the sales & manufacturing of many automobiles is the primary driver for this industry

-

Because of its environmental benefits & robustness, aluminum is becoming more popular in automotive applications

-

The demand for aluminum has increased as the demand for passenger cars has increased

-

Aluminum is becoming more popular as a versatile material for body construction in luxury car

-

Aluminum's demand in automotive applications is predicted to rise as more people use it as a steel substitute.

The automotive sector is undergoing a notable transition towards prioritizing aluminum over the historically prevalent steel. This shift is spurred by a combination of factors, with stringent fuel efficiency standards and consumer demand for lighter vehicles leading the charge. Aluminum's natural lightweight properties, with a density roughly one-third that of steel, result in significant reductions in car body weight, aligning perfectly with the industry's objectives.

RESTRAINTS:

-

The availability of lightweight replacements such as reinforced plastic is expected to constrain growth

-

The market's expansion has been hampered by price fluctuations related to aluminum, as well as an increase in operational costs

OPPORTUNITIES:

-

Government rules support the increased use of environmentally friendly and lightweight materials

-

Increase in demand for transporting commodities.

The automotive aluminum market is significantly propelled by the transportation sector. With the global rise in demand for transporting goods, spurred by e-commerce and a heightened emphasis on international trade, there is a growing necessity for lightweight and fuel-efficient vehicles. Aluminum emerges as an ideal solution due to its innate lightness compared to conventional steel. This characteristic results in substantial weight reduction in vehicles, ultimately enhancing fuel economy and minimizing emissions.

CHALLENGES:

-

Supply chain disruptions & demand share variations are the major challenges

-

The long-term and immediate impact of the COVID-19 pandemic had a detrimental impact on the industry

IMPACT OF RUSSIA-UKRAINE WAR:

The conflict in Ukraine reverberated across the automotive aluminum sector, causing disruptions in supply chains and driving prices upwards. With Russia being a major aluminum producer, responsible for approximately 6% of global output in 2021 according to statistics from the aluminium industry association, sanctions and logistical challenges severely impeded exports. This exacerbated existing supply chain issues, leading to a tightening of the market. The London Metal Exchange (LME) witnessed aluminum prices reaching an all-time high of $4,000 per ton in March 2022, marking a 24% surge compared to the previous month's average, as reported by metal.com. This surge in prices squeezed the margins of automakers, who heavily rely on aluminum for lightweighting vehicles to comply with increasingly stringent fuel efficiency standards.

European manufacturers bore the brunt of these challenges, facing both sanctions and surging natural gas prices, which compelled them to scale back production. Consequently, there emerged a temporary price disparity of $300 per ton between European and Chinese aluminum, prompting traders to seek out cheaper Asian metal, as noted by Infomineo. Although aluminum prices have somewhat receded from their peak, they still remain significantly elevated compared to pre-war levels, intensifying the strain on automotive production budgets already stretched thin. The enduring impact on the market depends on the duration of the conflict and the ability to establish alternative supply chains.

IMPACT OF ECONOMIC SLOWDOWN:

The automotive aluminum market faces challenges amid an economic slowdown. With consumer spending decreasing, global car sales are projected to decline by 3-5% in 2024, directly impacting the demand for aluminum, a crucial component in lightweight vehicles. Given that each car can use up to 400 pounds of aluminum, a significant drop in sales will result in a notable reduction in aluminum consumption by the automotive sector. Moreover, economic uncertainty prompts automakers to prioritize affordability, potentially favoring steel over aluminum despite the latter's weight-saving advantages. This shift may cause a 10-15% decrease in demand for automotive-grade aluminum compared to pre-slowdown levels, affecting aluminum producers and possibly causing price fluctuations in the market.

Market, By Product Form:

Based on the product form segment, the global market has been divided into Cast Aluminum, Rolled Aluminum, and Extruded Aluminum. In comparison to other types of aluminum, cast aluminum contributes the most to the worldwide automotive aluminum industry. It is utilized in the automobile industry to create a wide range of vehicle designs and types. Rolled aluminum has more flexibility and can be used in a wider range of applications in modern industries. Roof rails and sunroofs for automobiles are made of extruded aluminum.

Market, By Application:

The global market has been divided into Electric Powertrains, Car bodies, and Chassis & Suspension based on the application type segment. The powertrain is the part of the vehicle that transmits power to the wheels. The category is predicted to account for a sizable portion of the worldwide aluminum market for automobiles. The chassis of a car is regarded as one of the most important components. It houses the vehicle's body as well as its powertrain. All other components are joined to the car body, which is the major supporting structure.

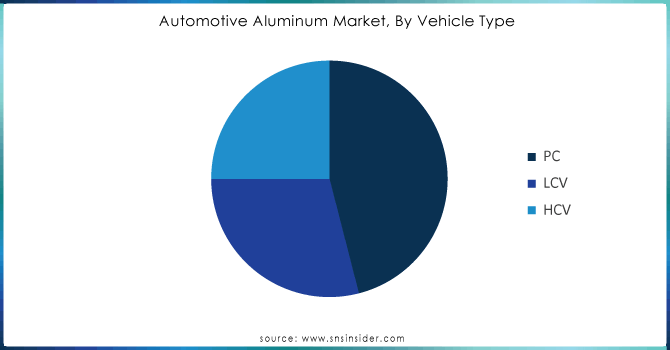

Market, By Vehicle Type:

Get Customized Report as per Your Business Requirement - Request For Customized Report

Based on the vehicle type segment, the global market has been divided into Passenger cars, LCV, and HCV. A passenger car with a maximum capacity of 9 seats and a maximum weight of 3.5 tones is considered a passenger car. A light commercial vehicle (LCV) is a vehicle that includes minivans, three-wheel vehicles, and pickup trucks. Heavy commercial vehicles are referred to as HCVs. Vehicles with a gross weight of more than 3500 kg are included.

MARKET SEGMENTATION:

By Product Form:

-

Cast Aluminum

-

Rolled Aluminum

-

Extruded Aluminum

By Application:

-

Power train

-

Car body

-

Chassis & Suspension

By Vehicle Type:

-

Passenger cars

-

LCV

-

HCV

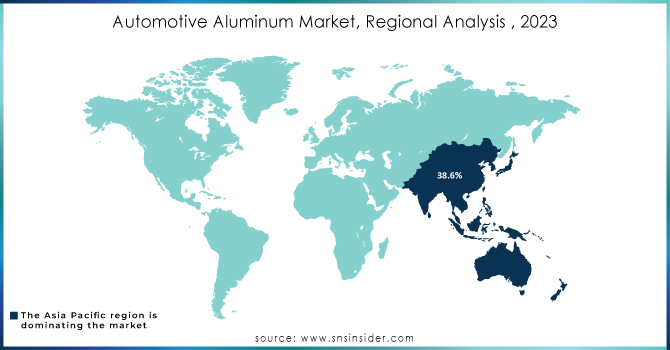

REGIONAL ANALYSIS:

Over the projection period, Asia Pacific is expected to be the largest regional market in terms of revenue. In 2023, the area contributed 38.6% of total income. The Asia-Pacific automotive aluminum market has been steadily growing as a result of the rising demand for luxury vehicles due to the region's abundance of disposable cash. The primary growth causes are rising demand for automobiles in nations like China and India, as well as rising investments in the regional automotive sector. North America is expected to grow at the highest CAGR of 11.2% throughout the projection period in terms of revenue. The creation of new facilities, legislation, and innovations are expected to move the European automobile sector forward. As a result, the creation of new production plants is expected to boost aluminum demand in the European automobile sector.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Alcoa Corporation (US), Novelis Inc. (US), Progress-Werk Oberkirch AG (Germany), UACJ Corporation (Japan), Norsk Hydro ASA (Norway), AMG Advanced Metallurgical Group (Netherlands), Constellium (US), Rio Tinto Group (UK), Aluminum Corporation of China Limited (CHALCO) (China), Aleris Corporation (US), Autoneum Holding AG (Switzerland), Dana Limited (US), Lorin Industries (US), ElringKlinger AG (Germany), JINDAL ALUMINIUM LTD. (India), Kaiser Aluminum (US) are some of the affluent competitors with significant market share in the Automotive Aluminum Market.

Recent Development:

-

Novelis Inc. (U.S.):

Expanded its capacity for lightweight aluminum sheet production to meet the rising demand driven by electric vehicles.

Pioneered innovative alloys engineered to enhance both strength and formability, specifically tailored for car body applications.

-

Alcoa Inc./Arconic Inc. (U.S.):

Devoted significant resources to advancing aluminum alloy research, particularly focusing on battery enclosures for electric vehicles.

Implemented streamlined production processes, aimed at reducing costs and enhancing sustainability within the aluminum manufacturing sector.

-

Constellium N.V. (Netherlands):

Teamed up with automotive manufacturers to co-create aluminum solutions geared towards lightweight structures within the truck industry.

Introduced new product lines featuring enhanced recyclability, catering to the preferences of environmentally conscious consumers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 70.11 Billion |

| Market Size by 2032 | US$ 151.64 Billion |

| CAGR | CAGR of 8.95% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Form (Cast Aluminum, Rolled Aluminum, Extruded Aluminum) • by Application (Power train, Car body, Chassis & Suspension), by Vehicle Type (Passenger cars, LCV, HCV), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alcoa Corporation (US), Novelis Inc. (US), Progress-Werk Oberkirch AG (Germany), UACJ Corporation (Japan), Norsk Hydro ASA (Norway), AMG Advanced Metallurgical Group (Netherlands), Constellium (US), Rio Tinto Group (UK), Aluminum Corporation of China Limited (CHALCO) (China), Aleris Corporation (US), Autoneum Holding AG (Switzerland), Dana Limited (US), Lorin Industries (US), ElringKlinger AG (Germany), JINDAL ALUMINIUM LTD. (India), Kaiser Aluminum (US) |

| Key Drivers | •The massive growth in the sales & manufacturing of many automobiles is the primary driver for this industry. •Because of its environmental benefits & robustness, aluminum is becoming more popular in automotive applications. |

| RESTRAINTS | •The availability of lightweight replacements such as reinforced plastic is expected to constrain growth. •The market's expansion has been hampered by price fluctuations related to aluminum, as well as an increase in operational costs. |