Aerospace Battery Technology Market Report Scope & Overview:

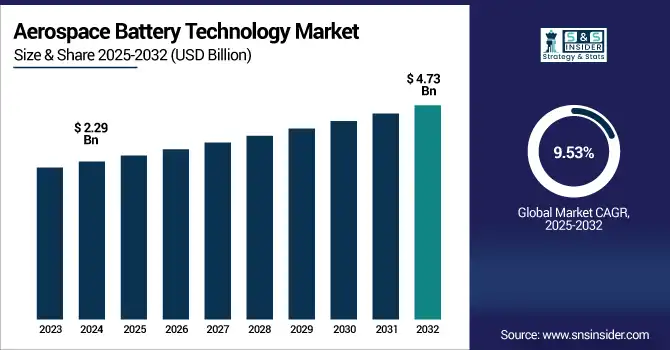

The Aerospace Battery Technology Market size was valued at USD 2.29 billion in 2024 and is expected to reach USD 4.73 billion by 2032, expanding at a CAGR of 9.53% over the forecast period of 2025-2032.

To Get more information on Aerospace Battery Technology Market - Request Free Sample Report

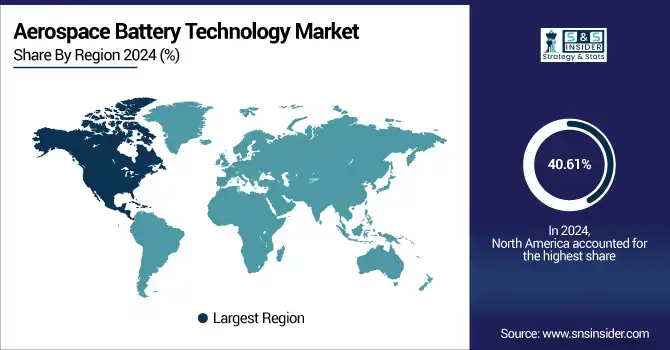

The Aerospace Battery Technology (ABT) Market is expanding fast, driven by increased electric & hybrid aviation, the proliferation of UAVs, and a growing need for lightweight, high-density energy storage. Lithium-ion batteries currently rule the market, but new technologies like solid-state batteries and wireless charging are starting to emerge. Among the application fields of interest are commercial aeroplanes, military airframes, UAVs and spacecraft. Infrastructures like BMS and thermal management play a critical role in safety and efficiency. North America accounts for the fastest growth in the market, due to the existence of the U.S. as a major contributor, and Asia Pacific is projected to grow at the highest CAGR, owing to growth in aerospace investment and increasing manufacturing capacity by end-user.

According to the research, next-generation batteries can reduce aircraft weight by up to 30%, enhancing fuel efficiency and range. Solid-state batteries offer 2–3x the energy density of lithium-ion, while over 75% of electric aircraft prototypes in 2024 use lithium-ion or hybrid systems.

The U.S Aerospace Battery Technology Market size reached USD 0.69 billion in 2024 and is expected to reach USD 1.34 billion in 2032 at a CAGR of 8.63% from 2025 to 2032.

The U.S. leads the market on account of the presence of a well-developed aerospace industry, the huge defense budget, and the early adoption of next-generation battery technologies in this region. With its large aerospace and defense companies, France is at the forefront of R&D investment in electric aviation and battery systems. The involvement of the likes of Raytheon Technologies, Teledyne, or EaglePicher only reinforces the position of the U.S. market position. Rising need for electric aircraft, drones (UAVs), and green aviation systems is anticipated to boost market growth. Furthermore, government policies that support clean energy and military upgrading programs are driving the market growth for battery technology.

Market Dynamics

Drivers:

-

Rising Demand for Electrification of Aircraft and UAV Systems to Enhance Efficiency and Sustainability.

Increasing focus on decreasing carbon footprints and developing better fuel economies has driven demand for electrification in both commercial and defense aviation. The move to electric and hybrid-electric aircraft demands high-performance battery systems offering more energy density, safety, and an extended lifecycle. Unmanned Aerial Vehicle (UAV) is popular for military and surveillance applications, with the advancement of the power batteries for long-range and stability. The emergence of programs such as NASA’s electric aircraft work and the private sector’s investment in eVTOL aircraft has pushed battery advancements and technology to function at an accelerated speed.

-

Restraints:

High Costs and Safety Concerns Associated with Advanced Battery Technologies Limit Broader Adoption.

Even with the advancements in technology, the cost of manufacturing and integrating advanced lithium-ion and solid-state batteries for EVs still remains a sizable deterrent for widespread use. Furthermore, concerns about battery safety, including thermal runaway, fire safety issues, and performance in harsh environments, remain significant concerns for both manufacturers. Satisfying rigorous aerospace certification standards adds more time and costs to its development. These economic and safety considerations limit the implementation of batteries, particularly in price-constrained aerospace applications, and limit the candidate flight vehicles upon which next-generation power systems can be sized.

Opportunities:

-

Rising Government Investments in Sustainable Aviation and Defense Electrification Programs Create Lucrative Growth Prospects.

Governments around the world continue to pour money into clean energy offerings such as sustainable aviation and defense-electric fleets. Research in lightweight, high-energy density, and recyclable aviation batteries is being driven by programs such as the U.S. Department of Energy's funding of ARPA-E and the European Clean Aviation initiative. These investments are opening doors for manufacturers to innovate and deliver next-gen power systems that span aircraft platforms. The increasing emphasis on decreasing reliance on fossil fuels and achieving net-zero emissions by 2050 is also driving demand for superior battery technology. These developments offer significant prospects for the well-entrenched as well as the newcomers in the aerospace battery market, over the long term.

Challenges:

-

Limited Infrastructure for Battery Manufacturing and Recycling in the Aerospace Sector Challenges Supply Chain Development.

There is a significant challenge for the aerospace industry because the infrastructure for battery production, testing, and recycling is not yet well developed for aviation-grade needs. Aerospace requires far more specific methods and techniques for battery manufacturing, and they’re still pretty immature. In addition, battery recycling plants that can process aerospace-grade materials are few, leading to questions of environmental regulations and the sustainability of the supply chain. This lack of economy of scale inhibits scalable, cost-effective battery deployment for aerospace, and therefore is a major barrier to market growth and expansion of the electrification of aerospace.

Segment Analysis

By Battery Type

The lithium-ion battery segment dominates the Aerospace Battery Technology Market with a 57.27% share in 2024, due to its high energy and power densities, low weight, and cycle life, all important benefits for aerospace applications. They are part of batteries that power everything from emergency systems to navigation equipment and avionics. Certainly, recent developments such as Saft’s lithium-ion battery solutions for Airbus and Boeing indicate that commercial fleets will increasingly follow suit. In addition, GS Yuasa unveiled high-capacity lithium-ion modules for aerospace for greater efficiency and safety. Electric aircraft and the drive for sustainability are accelerating this segment, this is a significant piece of today’s aviation battery solutions.

Nickel-Cadmium (Ni-Cd) batteries are witnessing the fastest CAGR of 10.70% during the forecast period, because of their ability to operate in hot and cold temperature extremes and their long heritage of running in military and space aviation. They are perfect for mission-critical applications. Technology manufacturer Concorde Battery Corp. has added Ni-Cd to its battery solutions, with an emphasis on rotorcraft and business jets. In addition, EnerSys launched upgraded Ni-Cd battery families to address growing needs in existing aircraft. With the preference of reliability in extreme environments in defense and military applications, Ni-Cd batteries are again becoming to a more growth-oriented choice in the aerospace power systems.

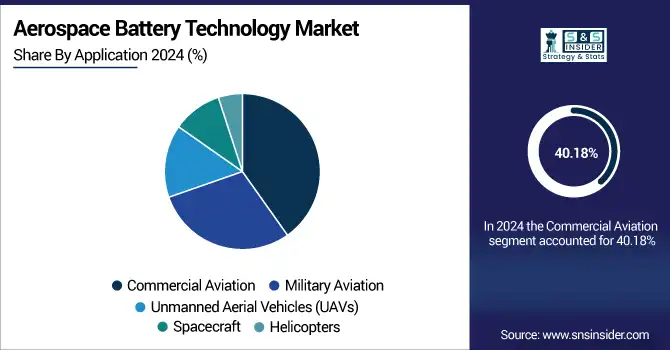

By Application

The commercial aviation sector is expected to dominate with a revenue share of 40.18% in 2024, owing to increasing demand for an adequate onboard power supply solution and increasing demand for air travel across the globe. Airlines are purchasing lighter-weight battery systems for auxiliary power and emergency use to minimize fuel consumption. aerospace battery technology market companies such as EaglePicher and Saft have designed lithium-ion battery packs for commercial airplanes. Boeing’s ongoing electrification efforts and Airbus’s hybrid-electric aircraft programs are also helping to stoke demand for batteries. Commercial aviation represents one major application segment where significant battery deployment and innovation are happening, so long as fleet expansion and sustainability targets grow.

The UAV segment is estimated to grow at the fastest CAGR during the forecast period at a CAGR of 11.36% owing to a rise in defense applications, commercial drone implementation, and demand for surveillance. High-performance lightweight batteries are important for expanding the service life and missions of UAVs. In 2024, firms such as Sion Power and A123 Systems announced high energy density lithium-metal and advanced lithium-ion offerings specifically designed for UAS. These advancements improve both the endurance and the payload-carrying capacities. With governments and companies ramping up UAV operations for defence, logistics, and agriculture, demand for specialist, long-duration battery systems is driving exponential growth in this area.

By Component

BMS accounted for the largest aerospace battery market share, with a share of 35.27% in 2024, as it plays a vital role in maintaining the safety, longevity, and performance of aerospace batteries. As the usage of lithium-type batteries increases, it has become necessary to monitor them in real-time and to control them. Intelligent BMS systems have also been developed by companies like Teledyne and Ultralife to improve system safety and lower the risk of failure. Rapid penetration of cyber-physical systems and AI for battery health monitoring is providing an added impetus to the growth forecast. With the rapid progress of aerospace electrification, the need for advanced BMS is becoming necessary for power management and compliance.

Battery Packs are witnessing rapid growth at a CAGR of 10.18% due to electrification over demanding multiple platforms of the aerospace such as Unmanned Aerial Vehicles (UAVs), helicopters, large aircraft, and small aircraft. Battery pack makers are zeroing in on modular and ultralight pack-and-harness designs to help meet aviation’s unique demands. In 2023, GS Yuasa introduced modular lithium-ion battery packs for easier integration on various aircraft. Raytheon Technologies is also going to upgrade the battery packs in military drones. Increasing demand for customised solutions in commercial and military aviation is encouraging innovation and increasing the use of lightweight, flexible, and high-performance battery packs.

By End User

The aerospace manufacturers will account for the largest share in 2024, 50.26%, due to the incorporation of large batteries for electric aircraft, hybrid propulsion systems, and onboard power units. Meanwhile, companies like Airbus and Lockheed Martin are also integrating lithium-ion and solid-state batteries into aircraft designs to improve the sustainability and fuel efficiency of their planes. Battery tech companies and manufacturers collaborate more often to co-develop application-specific energy solutions. These partnerships, combined with internal R&D spending, place aerospace OEMs at the centre of demand for and innovation in battery technology.

Aerospace component suppliers are the fastest-growing end-user segment at a CAGR of 12.37%, fueled by the growing outsourcing of advanced battery modules, controllers, and schedules integrated power systems. These vendors work on establishing civil and military programs, offering scalable, certified, and versatile parts. Ultralife Corporation widened its supply deals for UAV and defense-grade battery plans in 2024. Sion Power also collaborated with Tier 2 suppliers on the manufacture of high-energy cells. With it comes increasing demand for higher-level deliverable components, which are now driving the electronic and mechanical development of battery systems, and the vendor base has become strategic for battery system deployment and innovation.

By Technology

Traditional battery technologies have a 39.26% market share as they have been used extensively on legacy aircraft and military systems. Their heritage of reliability, affordability, and maintainability offers peace of mind and a sense of security for existing aerospace fleets. EnerSys and Concorde have developed new generations of traditional batteries to comply with OEMs. Approvals and certifications are also in favor of established methods when it comes to continued use. Traditional battery chemistries retain their leadership, while the ITC tech is playing catch-up, even with aging fleets and ongoing replacement cycles.

The advanced battery technologies market is expanding at 10.36% CAGR, with higher energy density, quick recharge, and lightweight requirements for new-generation aircraft. This category is non-quelcom and covers lithium-sulfur, lithium-metal, and solid-state batteries. Saft Groupe S.A. started with the production prototype of a solid-state battery in 2024 and A123 Systems targeted the use of lithium-metal for long-range UAVs. The use of digital twins for performance simulations and AI-driven safety monitoring helps to further drive innovation. With goals for electrification increasing, the aerospace industry is quickly transitioning to advanced chemistries that can deliver on both performance and environmental targets.

Regional Analysis

North America is the dominating region in the market, accounting for 40.61%. The segment’s leadership is due to robust pulls and varying investments in aerospace electrification, the growing use of electric aircraft, and a well-established ecology of aerospace OEMs and battery technology suppliers. Development State support of R&D further bolsters technological progress in aerospace batteries, particularly in the United States.

The United States leads the North America region, which has a vast aerospace manufacturing base, defense spending, and NASA and Department of Defense initiatives for electric propulsion and battery advancement.

Europe is experiencing steady growth can be attributed to the increasing efforts by the EU towards green aviation projects, implementation of sustainable power applications in aerospace, and the presence of leading aircraft OEMs such as Airbus driving the adoption of lithium-ion and advanced batteries.

Germany is the front-runner in Europe due to its aerospace research and R&D strength, battery manufacturing capacity, and favorable hybrid-electric aviation policy.

APAC is the fastest-growing region, which is likely to grow at a CAGR of 10.82% over the projected period, due to the growing aircraft production, rising use of drones, and better technologies in China, India, and Japan. The high defense spending, the local development of aerospace, and the huge lithium-ion investments [6] by China mean that it is the driver in the APAC region within batteries specifically for aerospace, both lithium-ion and solid-state.

The Middle East & Africa and Latin America regions are experiencing a steady growth in the Aerospace Battery Technology Market due to increasing UAV placements, modernisation of defence, and regional aerospace programmes. In the Middle East, the UAE is the top country bringing space and UAV development forward, and in Latin America, Brazil leads with Embraer and solid government backing for innovation in aerospace.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the aerospace battery technology market are GS Yuasa Corporation, Saft Groupe S.A., EaglePicher Technologies, LLC, Concorde Battery Corporation, EnerSys, Teledyne Technologies Incorporated, A123 Systems LLC, Ultralife Corporation, Sion Power Corporation, Raytheon Technologies Corporation, and others.

Key Developments

-

In April 2024, GS Yuasa lithium-ion batteries dominated Mitsubishi Heavy Industries' Third H3 Launch Vehicle, emphasizing their aerospace credentials. The firm also won an award at the 2024 New Energy Awards for its innovative battery storage system.

-

In October 2024, Saft Groupe S.A. unveiled a new 28V lithium-ion battery, specifically tailored for aviation applications, offering better performance for business aircraft and helicopters, further solidifying its focus on developing aerospace energy solutions.

-

In November 2024, EaglePicher Technologies announced a USD20.9 million expansion in Joplin, Missouri, to increase aerospace battery manufacturing capabilities. The company also won an award under the IARPA RESILIENCE Program to develop advanced battery technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.29 Billion |

| Market Size by 2032 | USD 4.73 Billion |

| CAGR | CAGR of 9.53% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Battery Type (Lithium-ion Batteries, Nickel-Cadmium Batteries, Nickel-Metal Hydride Batteries, Solid-State Batteries, Lead-Acid Batteries) •By Application (Commercial Aviation, Military Aviation, Unmanned Aerial Vehicles, Spacecraft, Helicopters) •By Component (Battery Management Systems, Charge Controllers, Battery Packs, Ultra Capacitors, Thermal Management Systems) •By End User (Aerospace Manufacturers, Aviation Service Providers, Government and Military Agencies, Research Institutions, Aerospace Component Suppliers) •By Technology (Conventional Battery Technology, Advanced Battery Technology, Environmental-Friendly Battery Solutions, Wireless Charging Technologies, Battery Recycling Technologies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | GS Yuasa Corporation, Saft Groupe S.A., EaglePicher Technologies, LLC, Concorde Battery Corporation, EnerSys, Teledyne Technologies Incorporated, A123 Systems LLC, Ultralife Corporation, Sion Power Corporation, Raytheon Technologies Corporation |