Network Automation Market Size & Overview:

Get more information on Network Automation Market - Request Sample Report

Network Automation Market Size was valued at USD 4.7 Billion in 2023 and is expected to reach USD 32.1 Billion by 2032, growing at a CAGR of 23.8% over the forecast period 2024-2032.

Global Network Automation Market has seen the highest growth rate which is primarily driven by rising interest in automation technologies and a push towards digital transformation processes by many different industries. Governments across the world have taken note of the strategic and economic significance of advanced technologies such as network automation, and there are a few initiatives that are being initiated to provide for the integration of such systems. A significant incentive for the acceleration of automation within network infrastructures stems from the U.S. government's report on National Infrastructure Modernization (2023), citing that automation helps reduce operational expenses, enhance efficiency, and bolster cybersecurity management tactics. In this context, as part of its Digital Decade Initiative, the European Union has made major investments to also drive the digitalization of sectors such as network infrastructure through 2030.

One of the main contributors to the growth of network automation is the Information Technology (IT) sector, which led the overall market in 2023 by accounting for 24% of the total revenue. The rising adoption of automated networks for the management of growing data traffic and network performance optimization along with the reduction of human error are some key factors driving the automated network market. Network automation tools are being integrated by IT companies to provide ease of use, improve performance, and scale up as required. According to government-backed reports from India and Japan, the IT sector’s adoption of network automation is forecasted to increase by 10-15% annually. This pivot to network automation is also aided by strong government initiatives that offer a sound technological backbone.

With growing pressure on IT Service Providers, telecom operators, and enterprises to cope with increasing demands for seamless connectivity, deployment of network automation solutions has become a necessity. Due to fast-expanding cloud services, the presence of edge computing, and networking systems getting complicated, automation is supporting to manage it more efficiently. According to a report in 2023 by the U.S. Department of Commerce, federal agencies are adopting network automation in a further bid to pave the way for deep connectivity, efficiency gains, and a more distributed, future-looking approach to data security initiatives across the public sector.

Network Automation Market Dynamics

Drivers

-

The rapid adoption of cloud-based services drives demand for dynamic, adaptive network infrastructures. Network automation accelerates cloud resource management, allowing faster deployments and improved scalability.

-

Automated security processes can quickly patch vulnerabilities, reducing the risk of breaches and improving overall network security, making it a critical driver for businesses seeking stronger defenses.

Cloud Adoption and Agility needs are some of the main drivers in network automation market. With rising cloud adoptions, the network infrastructures have to be dynamic and flexible to align with the scalability and agility so important to cloud environments. For instance, network automation helps to automate the provisioning, configuration, and management of cloud resources, which helps reduce cloud resource deployment time drastically and increases efficiency as a whole. Automation simplifies the challenges associated with managing vast cloud infrastructure at scale, especially with regard to load balancing and resource allocation. This need for speed and flexibility is especially critical in industries like IT and telecommunications, where uptime and rapid adjustments to network capacity are essential.

For example, large cloud service providers like Amazon Web Services (AWS) and Microsoft Azure have been leveraging network automation to streamline the configuration of virtual networks. AWS’s EC2 instances automatically scale up or down based on demand, facilitated by automated network provisioning. This enables businesses to quickly respond to changing workloads, minimizing downtime and optimizing costs. Network automation is becoming more critical than ever as businesses continue down their digital transformation paths, depending on it to build an infrastructure that is agile, scalable, and secure in the cloud, and by doing so, fueling greater combativeness for organizations across sectors.

Restraints:

-

While network automation promises long-term cost savings, the upfront investment in licenses, hardware, and skilled personnel can be a deterrent, particularly for smaller organizations with limited budgets.

-

Integrating new automation tools with existing, often multi-vendor infrastructure can be complex and resource-intensive. This challenges organizations that are hesitant to overhaul their current systems.

A major constraint in the Network Automation market is integration challenges. While enterprises look to automate their networks, the issue is how to combine such new solutions into some existing infrastructure. A lot of organizations utilize networks comprising various types of devices and software from different vendors. This results in possible compatibility problems since each network component must be configured and tuned to work optimally with others. In addition, these integrations are often the most time-consuming to plan and resource, which leads to slow-down automation. If the integration process is expensive, time-intensive, or complicated, organizations may be reluctant to invest in network automation. These challenges are compounded by the fact that deploying the integration and keeping everything working together requires expertise. Hence, firms avoid or postpone switching to automation solutions, worried that it could disrupt or hamper their network operations.

Network Automation Market Segment Analysis

By Deployment

In 2023, the on-premises deployment segment led the Network Automation Market, with more than 58% of total revenue. For enterprises that deal with sensitive data and security concerns, on-premises network automation solutions provide additional control over their network environments. Earlier CISA (U.S. Cybersecurity and Infrastructure Security Agency) backed reports pointed at on-prem automation preference by business giants coming from regulated industries such as finance, healthcare, and government sectors, as they offer better security options.

On-premise solutions have one major advantage in that the network automation tools can be customized to work with the different specifics of a business. This is especially critical in the sectors where local regulations heavily lean toward data protection and compliance. Due to the rise of cyber threats globally, several governments have ramped up funding along with research programs focused on advancing security around on-premises network automation solutions. This has reinforced the on-premises deployment requirement in data privacy-focused sectors.

By Component

In terms of components, the solution segment dominated with a 69.2% revenue share in 2023 and is expected to grow at a significant compound annual growth rate over forecast period. SDWAN and network virtualization tools, intent based networking solutions platforms, configuration management tools, and other Network Automation Tools are included in the solution segment.

By Infrastructure

The hybrid infrastructure segment is expected to grow at a significant compound annual growth rate during the forecast period. The IT infrastructure environment consists of a hybrid infrastructure. It enables the monitoring and management of all infrastructure services through a combination of public and private clouds and data centers. It enables the management and evaluation of physical and cloud-based infrastructure, thus facilitating performance optimization.

By Enterprise Size

The large enterprises segment accounted for the largest revenue share of more than 64% in the Network Automation Market in 2023. This predominance is mostly governed by the major investments by bigger enterprises to upgrade their network infrastructures and digital transformation. Statistics from the government provide further evidence, with a report by the U.S. Small Business Administration stating that large enterprises lead the race to implement advanced network automation technologies because they have the resources to invest in infrastructure upgrades.

Large enterprises normally have large networks and complex data environments that need great and powerful automation solutions. Network automation helps these organizations to perform operations more efficiently, reduce downtime, and increase security. The U.S. government, through initiatives such as the Federal IT Modernization Act, has provided substantial support to large enterprises for upgrading their network systems. This has encouraged even more businesses to integrate network automation to handle their increasing network management needs. According to reports by the European Commission, large businesses in Europe have seen productivity gains of over 20% after implementing automation solutions. With the vast resources at their disposal, large enterprises are expected to continue dominating the network automation market, particularly as they adopt advanced AI and machine learning technologies to further enhance their network management capabilities.

By Vertical

The Network Automation Market was dominated by the IT segment in 2023, accounting for around 24% of overall revenue. This dominance is driven by fast-developing IT infrastructure and a multitude of large-scale and complex network environments that organizations require to manage. Government statistics highlight that the global IT sector is experiencing continuous growth in cloud computing, data storage, and the adoption of artificial intelligence (AI), all of which heavily depend on automated network solutions.

That demand for processing data quickly, scalability, and agility is directly related to the growing emphasis on automation within the IT sector. As per the report released by the U.S. Department of Commerce, almost 45% of the businesses operating in the IT vertical have reported about deployment of some manner of network automation to fulfill these requirements. Government assistance through technology grants and innovation initiatives has also helped to bring about this shift in enterprise network systems automation. With the emergence of the evolved digital-first business, the network infrastructure is becoming increasingly complicated, and the complexity has led to necessary automation and solutions such as software-defined networking (SDN) and network function virtualization (NFV) triggering the automation trend.

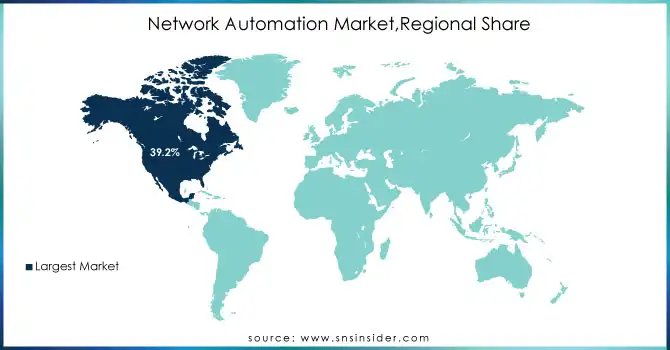

Regional Insights

In 2023, North America had a market share of 39.2%. The rapid adoption of network automation Market has contributed to this growth. This dominance is largely driven by the extensive technological infrastructure and high adoption rates of network automation solutions in the U.S. and Canada. According to data from the U.S. Department of Commerce, network automation adoption in North America is bolstered by both public and private sector investments in next-generation technologies, particularly in industries such as telecommunications, IT, and manufacturing. The U.S. government's push for 5G infrastructure and smart city projects has further fueled the demand for network automation in the region. The presence of several major players, like Cisco Systems Inc. and IBM Corporation in particular, which have fuelled market growth are the main factors driving this region's progress. The research and development of data centers is a major investment by large enterprises, while the network infrastructure has an important role to play in growing automation.

Over the forecast period, growth in Asia Pacific is expected to be substantial at a compound annual growth rate. The increase is due to the growing adoption of the network automation market in the region, as well as the emergence of startups that are adopting this solution. The demand is driven by a large and diverse customer base in India and China, which creates new opportunities for the region. Government-backed programs, such as China’s “Made in China 2025” initiative, which emphasizes the development of intelligent manufacturing and advanced infrastructure, have played a significant role in this growth. Similarly, India’s Digital India campaign is expected to boost the adoption of automated network solutions in the coming years.

Need any customization on Network Automation Market - Enquiry Now

Key Players

Service Providers / Manufacturers

-

Cisco Systems (Cisco DNA Center, Cisco Network Services Orchestrator)

-

Juniper Networks (Contrail Networking, Junos OS)

-

IBM (IBM Cloud Pak for Network Automation, IBM SDN)

-

Arista Networks (Arista EOS, Arista CloudVision)

-

Huawei Technologies (Huawei Agile Network, Huawei CloudEngine)

-

Nokia (Nuage Networks, Nokia CloudBand)

-

VMware (VMware SD-WAN, VMware NSX)

-

Ericsson (Ericsson Network Manager, Ericsson Cloud Core)

-

Extreme Networks (ExtremeCloud IQ, ExtremeSwitching)

-

Ciena (Blue Planet, Ciena Manage)

Key Users of Network Automation

-

AT&T

-

Verizon Communications

-

T-Mobile

-

Deutsche Telekom

-

Vodafone

-

Orange

-

BT Group

-

Telstra

-

China Mobile

-

Nippon Telegraph and Telephone Corporation (NTT)

Recent News and Developments

-

In January 2024 Cisco Systems announced a next-generation network performance automation platform for large-scale enterprises seeking real-time insights and streamlined operations. Using AI and ML, the platform automates network configs to enhance productivity and security.

-

In June 2023 Network to Code, a provider of network automation services and solutions, announced the release of Nautobot Cloud, a SaaS-based automated solution that greatly reduces the costs associated with deploying and managing data-driven network automation.

-

In August 2023, Juniper Networks, one of the global leaders in secure, AI-driven networks, announced that Savant Systems, one of the global leaders in smart home and energy solutions, has selected Juniper’s AI-driven enterprise solutions, including wireless access, to assist in revolutionizing the home automation experience by bringing intelligent controls to millions of homes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.7 Billion |

| Market Size by 2032 | USD 32.1 Billion |

| CAGR | CAGR of 23.8% from 2024-2032. |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Deployment (On-Premises, Cloud) • By Infrastructure (Physical, Virtual, Hybrid) • By Enterprise Size (Large Enterprises, SMEs) • By Vertical (BFSI, Retail, IT & Telecommunications, Manufacturing, Media & Entertainment, Education, Healthcare, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Cisco Systems, Juniper Networks, IBM, Arista Networks, Huawei Technologies, Nokia, VMware, Ericsson, Extreme Networks, Ciena |

| Key Drivers | •The rapid adoption of cloud-based services drives demand for dynamic, adaptive network infrastructures. Network automation accelerates cloud resource management, allowing faster deployments and improved scalability •Automated security processes can quickly patch vulnerabilities, reducing the risk of breaches and improving overall network security, making it a critical driver for businesses seeking stronger defenses |

| Market Restraints | •While network automation promises long-term cost savings, the upfront investment in licenses, hardware, and skilled personnel can be a deterrent, particularly for smaller organizations with limited budgets •Integrating new automation tools with existing, often multi-vendor infrastructure can be complex and resource-intensive. This challenges organizations that are hesitant to overhaul their current systems |