Aerospace Cybersecurity Market Report Scope & Overview:

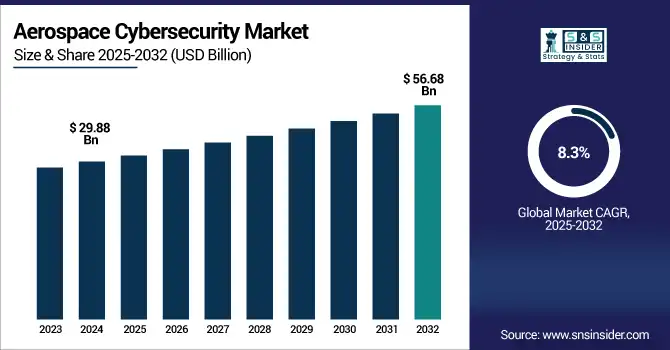

The Aerospace Cybersecurity Market Size was valued at USD 29.88 billion in 2024 and is expected to reach USD 56.68 billion by 2032 and grow at a CAGR of 8.3% over the forecast period 2025-2032.

To Get more information on Aerospace Cybersecurity Market - Request Free Sample Report

The Aerospace Cybersecurity Market has been driven by the growing digitalization of aerospace systems and the ramping up of cyberattacks on aviation infrastructure. As aircraft, drones, and even satellites become ever more interconnected, the integrity of onboard systems and the networks supporting their communications and ground support has become of critical importance. Government mandates, national defense modernization programs, and the growing adoption of cloud-based avionics continue to drive the demand for state-of-the-art cybersecurity solutions. Major players are investing in AI-enabled threat detection, encrypted communication protocols, and resilient architectures to minimize the risks. The market includes commercial and defense aerospace applications and deployments, including on-premise and cloud. The aerospace industry negotiates to ensure cybersecurity reflects a rising concern as cyber warfare and space-based threats to satellites mature and refine.

The U.S. Aerospace Cybersecurity Market size was USD 7.08 billion in 2024 and is expected to reach USD 11.41 billion by 2032, growing at a CAGR of 6.12% over the forecast period of 2025–2032.

The U.S. Aerospace Cybersecurity Market is a rising investment in defense modernization and the increasing frequency of cyberattacks targeting military and commercial aerospace systems. The U.S. dominates the North American market due to its advanced aerospace infrastructure, high defense spending, and presence of leading companies. In 2024, the U.S. defense budget exceeded USD 800 billion, significantly boosting demand for advanced cybersecurity across aircraft, drones, and satellite networks.

Market Dynamics:

Key Drivers:

-

Rising Defense-Oriented Cyber Threats Accelerate Investment in Aerospace Cybersecurity Systems Across Military and Commercial Sectors

The market is experiencing an increasing frequency and sophistication of cyber threats targeting defense and commercial aerospace platforms. With aircraft, drones, and satellites increasingly dependent on digital communication systems and cloud-based control networks, the possibility of cyberattacks targeting navigation, avionics, and command infrastructure has risen dramatically. As threat levels have risen, both government agencies and private aerospace companies have stepped up investments. As a result, air and space-based platforms' defense budgets have seen a dramatic increase in cyber infrastructure investments. The ever-growing threat landscape puts cybersecurity not only on the technical topic but also makes it an unquestionable strategic necessity for the domestic security and international competitiveness of aerospace. This, in turn, is leading to an increasing inclusion of cybersecurity functionalities at the design stage of aerospace systems instead of as an afterthought, thereby fortifying long-term market growth.

Restraints:

-

High Integration Costs and Technical Complexity Hinder Cybersecurity Adoption in Legacy Aerospace Systems

The cost and complexity of integrating advanced cybersecurity solutions into legacy aerospace systems are a challenge facing the market. Many of the aircraft, drones, and satellite systems are currently in use and were not designed with the modern cybersecurity threats in mind. Retrofitting these systems to meet the current threats requires a great deal of reengineering, both in cost and in time. Additionally, a lot of the impacted organizations are unable to support the infrastructure and training for staff and certification formalities required for having secure systems. Since the world is fighting a losing battle against cyber threats, maintaining security infrastructure further increases the operational costs as it needs to keep up with the threats. The impact of these constraints is that cybersecurity as an initiative gets delayed or deprioritized in favor of other budgetary needs.

Opportunities:

-

Integration of Cybersecurity in Defense Modernization Programs Creates Strong Market Opportunities for Aerospace Solution Providers

The Aerospace Cybersecurity Market growth is driven by an integration of cybersecurity technologies into national defense modernization programs. But as defense agencies across the globe move toward an era of multi-domain interoperability, cyber-ready frameworks are being baked into aerospace systems including aircraft, drones, and satellites. This directly translates into a high demand for aerospace cybersecurity vendors who can offer a secure platform with inbuilt threat detection, encryption communication, and resilient architecture. As smart defense systems, cloud command networks, and data-centric warfare models expand, dependence on secure aerospace platforms grows. Furthermore, cybersecurity is now considered a design requirement for new aerospace programs, becoming a primary driver in both a project's bidding and the selection of its vendor.

Challenges:

-

Fragmented Global Standards and Lack of Unified Frameworks Complicate Cybersecurity Implementation Across Aerospace Platforms

A key challenge in the Aerospace Cybersecurity Market is the lack of harmonized global standards and regulatory frameworks governing cybersecurity in the aerospace sector. Different countries and regions maintain their cybersecurity requirements for aviation, defense, and satellite operations, creating inconsistencies that complicate product development and deployment. For instance, a cybersecurity solution approved for use in one country may require substantial modification to meet compliance standards elsewhere. Without a unified regulatory baseline, aerospace companies face higher risk exposure, as gaps in policy enforcement or interpretation can be exploited by cyber adversaries. This lack of alignment also poses significant obstacles to building integrated, interoperable, and scalable cyber defense systems across various aerospace domains. Until global cooperation improves, cybersecurity implementation in aerospace will remain a complex, fragmented, and challenging task.

Segmentation Analysis:

By Deployment

The on-premise deployment segment dominates the U.S. Aerospace Cybersecurity Market with a 64% revenue share in 2024, driven by defense contractors and airlines prioritizing data sovereignty and low-latency threat detection. Leading firms including Airbus and Atos continue to launch hardened on-premise cybersecurity suites tailored for aerospace ground stations and aircraft hangar networks. These solutions emphasize encrypted data storage, secure enclave computing, and integrated AI-powered intrusion detection, meeting rigorous regulatory standards and aligning with aerospace operators’ preference for complete control over mission-critical systems.

The cloud deployment segment is growing at a robust 11.24% CAGR, propelled by aerospace players embracing cloud-native cybersecurity for global scalability and real-time data analytics. Industry leaders, such as Netskope are scaling secure access service edge (SASE) platforms, while aerospace contractors are integrating cloud-based encryption and zero-trust frameworks. The flexibility of on-demand threat intelligence and AI-driven monitoring aligns with aerospace digitization trends including connected aircraft and satellite fleets, accelerating the adoption of cloud-centric cybersecurity architectures.

By Application

Aircraft applications dominate the aerospace cybersecurity market with a revenue share of 53% in 2024, reflecting the increasing investments in securing onboard avionics, communication links, and maintenance systems. Major cybersecurity vendors are rolling out aircraft-specific solutions, such as embedded encrypted communication modules and real-time anomaly detection systems. These launches coincide with aerospace manufacturers updating fleet cybersecurity certifications, reinforcing the strategic importance of securing commercial and military aircraft networks against evolving cyber threats.

The drone application segment leads in growth, with a 9.56% CAGR over the forecast period. This surge is driven by innovations, such as SEALSQ’s post-quantum encryption suite for mission-critical drone operations and AUVSI’s new cybersecurity certifications for commercial UAVs. As defense and enterprise sectors deploy intelligent drone fleets for ISR, logistics, and infrastructure inspection, robust cybersecurity solutions integrated into communication links and flight control systems are gaining momentum.

By Type

Network security is the top revenue-generating type segment at 42% in 2024, as aerospace platforms increasingly depend on secure and multi-layered communication. Leading cybersecurity firms are deploying AI-enabled network intrusion detection and encrypted mesh networking across aircraft, satellites, and ground control. These solutions address high-volume telemetry exchange and defense-grade connectivity requirements. The dominance of network security reflects continuous investment in protecting critical aerospace infrastructure from man-in-the-middle attacks, intrusion attempts, and supply chain vulnerabilities.

Cloud security leads the fastest growth, with a 10.9% CAGR during the forecast period. Aerospace organizations are rapidly adopting cloud-native security frameworks, including serverless encryption, identity-based access, and AI-based cloud threat detection. Providers are launching cloud-first secure access platforms customized for aerospace workloads, including real-time security for satellite command-and-control, and aircraft maintenance data. The growth in cloud security aligns with industry-wide digital transformation toward analytics-driven operations and distributed aerospace network environments.

Regional Analysis:

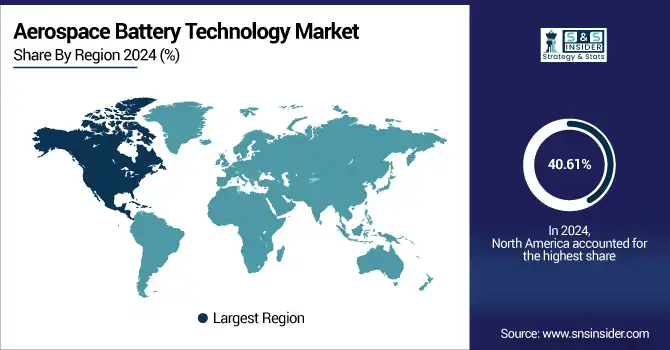

North America dominated the region in 2024 with a market share of 39%. High defense spending, advanced aerospace infrastructure, and ongoing cyber modernization programs significantly drive North America's dominance in aerospace cybersecurity. The U.S. is the dominant country in North America, owing to its extensive military and commercial aerospace ecosystem, rapid adoption of cybersecurity protocols, and leading presence of major defense contractors, along with strong government mandates, federal investments in cybersecurity R&D, and large-scale integration of AI-based security in UAVs and satellites further reinforce U.S. leadership in aerospace cybersecurity across the region.

Asia Pacific was the fastest-growing region in 2024 with an estimated CAGR of 12.69%. Rapid aerospace expansion, increasing cyber threats, and growing defense modernization budgets drive cybersecurity investments in the Asia Pacific aerospace sector. China dominates the Asia Pacific aerospace cybersecurity market due to aggressive investments in military aerospace, satellite communications, and indigenous drone programs. China is also heavily investing in AI-based threat detection, encrypted satellite links, and quantum-resistant communications, making it a regional leader in both the scale and sophistication of aerospace cybersecurity deployment.

Europe Market Growth Supported by Defense Alliances and Satellite Programs in 2024. Cybersecurity regulations, space defense programs, and pan-European digital cooperation drive aerospace cybersecurity growth across EU member states. Europe is a key player in the aerospace cybersecurity market, driven by strong defense integration under NATO and EU cybersecurity strategies. France leads the regional market, supported by firms like Airbus and Thales, which are advancing military satellite cybersecurity and encrypted aircraft systems. Government investments in joint cyber defense platforms and European space programs, such as Galileo and IRIS², further bolster demand.

In 2024, the Middle East & Africa and Latin America regions have witnessed growing adoption of aerospace cybersecurity solutions. In the Middle East & Africa, rising investments in drone fleets, air defense systems, and satellite surveillance led by the UAE and Israel are driving secure, AI-enabled aerospace platforms. Meanwhile, Latin America, particularly Brazil, is advancing through aviation digitization and public-sector cybersecurity initiatives. Despite limited space infrastructure, increasing cyber threat awareness is fueling steady growth in both commercial and defense aerospace cybersecurity sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The aerospace cybersecurity market companies are Thales, Leonardo S.p.A., Lockheed Martin Corporation, General Dynamics Corporation, Booz Allen Hamilton Inc., BAE Systems, IBM, AIRBUS, Honeywell International Inc., Northrop Grumman, and others.

Recent Developments:

-

March 2025 – Thales led the European Interactive Sensor-Based Dynamic Defence Network (EISNET) consortium, co-funded by the European Defence Fund. The initiative involves 23 partners across 12 countries to bolster integrated air and missile defence systems, enhancing cyber resilience, interoperability, and dynamic communication across Europe’s defence networks.

-

February 2025 – Lockheed Martin signed a new contract with Guardtime Federal to enhance aircraft cybersecurity across its supply chain, employing blockchain-based data integrity technologies to protect software and hardware against manipulation.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 29.88 Billion |

| Market Size by 2032 | USD 56.68 Billion |

| CAGR | CAGR of 8.3% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Security Type (Network Security, Wireless Security, Cloud Security, Content Security) • By Deployment Mode (On-Premise, Cloud) • By Application (Aircraft, Drones, Satellite) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thales, Leonardo S.p.A., Lockheed Martin Corporation, General Dynamics Corporation, Booz Allen Hamilton Inc., BAE Systems, IBM, AIRBUS, Honeywell International Inc., Northrop Grumman, etc. |