Internet Of Things Fleet Management Market Report Scope & Overview:

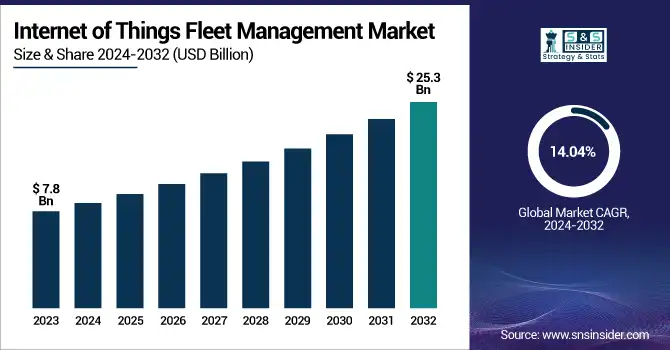

The Internet of Things Fleet Management Market was valued at USD 7.8 billion in 2023 and is expected to reach USD 25.3 billion by 2032, growing at a CAGR of 14.04% from 2024-2032.

To Get more information on Internet of Things Fleet Management Market - Request Free Sample Report

The Internet of Things Fleet Management Market has seen a steady rise in the adoption of connected fleet solutions across industries, with logistics and transportation leading in 2023. Telematics and connectivity infrastructure expanded rapidly, particularly in North America and Europe, improving real-time vehicle tracking and operational efficiency. At the same time, the market faced a noticeable increase in fleet-related cybersecurity incidents from 2020 to 2023, emphasizing the need for stronger security frameworks. Cloud-based fleet management solutions gained widespread traction in 2023, with the Asia Pacific emerging as the fastest-growing region. The report also highlights emerging trends like AI-driven predictive analytics, EV fleet integration, and advanced driver behavior monitoring systems enhancing overall fleet operations.

The U.S. IoT Fleet Management Market was valued at USD 2.2 billion in 2023 and is projected to reach USD 7.7 billion by 2032, growing at a CAGR of 13.80% from 2024 to 2032. Growth is driven by rising demand for real-time fleet tracking, predictive maintenance, and compliance automation. Increasing adoption of EV fleet management and AI-based telematics solutions will further accelerate market expansion in the coming years.

Internet Of Things Fleet Management Market Dynamics

Driver

-

Rising demand for real-time fleet tracking and predictive maintenance is driving widespread adoption of IoT-based fleet management solutions.

The growing requirement for real-time monitoring of fleet operations, vehicle health, and driver performance is a key driving factor of this market. More and more companies are using IoT-enabled telematics systems to monitor vehicle routes, fuel consumption, and maintenance schedules, which help reduce downtime and costs. IoT sensors provide predictive maintenance capabilities that allow fleet operators to rectify issues before a breakdown occurs, growing the lifetime of a vehicle and improving the serviceability of a fleet. Moreover, increasing compliance regulations for the fleet safety, emissions control, driver behavior monitoring, etc. in various geographies like the U.S. and Europe are leading fleet owners to invest in smart, connected solutions that can help in staying compliant and competitive.

Restraint

-

High initial deployment, hardware, and integration costs are limiting adoption, especially among small and mid-sized fleet operators.

Despite the operational benefits, the high initial investment required for IoT fleet management systems remains a key restraint for market growth, especially among small and medium-sized enterprises. The cost includes hardware such as sensors, GPS modules, and telematics control units, as well as cloud-based analytics platforms and cybersecurity solutions. Additionally, integrating IoT-based systems into legacy fleet infrastructures often demands technical upgrades and skilled personnel, adding to the financial burden. In regions with limited digital infrastructure or lower fleet digitization rates, these costs can deter adoption. As a result, smaller operators may delay implementation, potentially missing out on long-term operational savings and efficiency gains.

Opportunity

-

The growing shift toward electric vehicle (EV) fleets is creating strong demand for specialized, IoT-driven EV fleet management solutions.

The accelerating shift towards electric vehicles (EVs) in commercial fleets presents a major growth opportunity for IoT fleet management providers. EV fleets require specialized management solutions to monitor battery health, optimize charging schedules, and plan routes based on available charging infrastructure. IoT-enabled platforms can deliver real-time insights into EV performance, energy consumption patterns, and predictive maintenance needs, enhancing operational efficiency. With governments worldwide promoting zero-emission commercial transportation and offering incentives for fleet electrification, the demand for connected EV fleet management systems is rapidly growing. Companies investing in integrated IoT platforms tailored for EVs are well-positioned to capture this emerging market segment.

Challenge

-

Increasing cybersecurity risks and data privacy concerns are posing significant challenges to the safe operation of connected fleet systems.

The increasing interconnectivity of fleet vehicles and cloud-based management systems brings significant cybersecurity and data privacy challenges. IoT fleet management platforms continuously collect and transmit sensitive information, including vehicle locations, routes, driver behaviors, and operational data. This makes them vulnerable to data breaches, ransomware attacks, and unauthorized access. A single cybersecurity incident can disrupt operations, compromise customer data, and damage brand reputation. Additionally, differing data protection regulations across countries complicate compliance for global fleet operators. Ensuring secure communication protocols, encryption standards, and regular system updates is critical. Overcoming these risks remains a top challenge for service providers and fleet operators alike.

Internet Of Things Fleet Management Market Segmentation Analysis

By Solution

In 2023, the vehicle tracking & monitoring segment dominated the IoT fleet management market and held a significant revenue share. This comprises global positioning system technology, portable connected devices, and sensors. The growth of this segment is attributed to the increasing adoption of vehicle tracking & monitoring by companies to reduce the effects of commute risks, provide real-time assistance during emergencies or spillage, and build and maintain an integrated network of vehicles.

The predictive maintenance segment is expected to be the fastest-growing segment during the forecast period. The management teams are using IoT sensors to help identify the critical aspects of vehicle maintenance and predict the potential problems that may be more likely to become problems during the commute. This eliminates operational deviations, providing timely repairs.

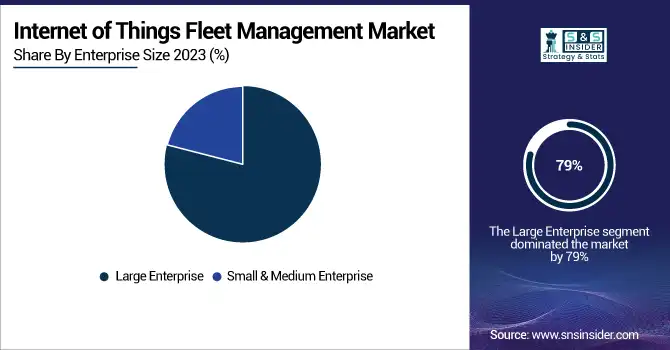

By Enterprise Size

In 2023, the large enterprise segment dominated the market and accounted for 79% of the revenue share. This segment is generating growth owing to good financial resource availability, large fleet operations, and a necessity for advanced and sophisticated platforms for fleet management solutions. The massive growth of global trade, increasing reaction of e-commerce sites, and continuous export and import of various products, including consumer goods, food, equipment, materials, automotive parts, electronics, etc., to and from all the corners of the globe, is anticipated to drive demand for IoT fleet management solutions in large enterprises.

The small and medium enterprises segment is expected to grow with the fastest CAGR in the forecast period. This part, in particular, is defined by the surging figures of small and medium-scale entrepreneurs providing solutions and accounts to a broad clients around the world.

By Platform

In 2023, the device management segment held the largest share of the global market. IoT fleet management has been associated with application enablement and network management, among other platforms. Centralized oversight and control over a vast range of IoT devices is one of the leading advantages of device management, which has established its stronghold among other key features. Automotive sensors, for example, can deliver real-time data elements for fuel consumption, engine health, and route optimization within a logistics fleet. These data are collected and stored through device management platforms, which help fleet managers make informed decisions promptly by getting vehicles rerouted around traffic or scheduling maintenance to prevent a breakdown.

The application enablement segment is expected to register the fastest growth rate in the IoT platform market from 2024 to 2032. The escalating adoption of the IoT application enablement platform and its scalability is powering the growth of this segment. AEP IoT scales to support thousands of connected devices cost-effectively.

By Deployment

The private deployment segment dominated the market and accounted for the largest share of revenue of the global market in 2023. Compared to a public cloud solution, private cloud environments offer more flexibility and customization options. Fleet management operations typically need custom applications designed to integrate with their existing IT infrastructure, ERPs, software, and databases. With private clouds, organizations can tailor their IoT rolling out to their use case and even integrate their systems while keeping total control over fleet management without the need to rely on other providers. In addition, private cloud environments allow organizations to adjust resources based on demand and business expansion.

The hybrid deployment is expected to register the fastest growth rate during the forecast period because of scalability, flexibility, and better performance for fleet management operations. A hybrid cloud refers to companies within their private cloud, but the public cloud, such as AWS, Intel cloud service, is used for other business towards some data and applications.

By Service

The professional services segment dominated the market and held the largest market share of more than 75% in 2023. The growth drivers of this segment are increasing innovation in IoT technology, increasing operational efficiency, and strong security. The generation of vast prospects for this segment is delivered by quick launches of advanced IoT-enabled products & networks, including 5G & 6G. Another factor contributing to the growth of the market is the increasing adoption of end-to-end IoT fleet solutions by professional service providers in the logistics industry. These involve expert knowledge and customized consulting services necessary for the adoption and configuration of IoT fleet management solutions as well as helping businesses develop operational workflows and realize organizational objectives. The managed services segment is anticipated to grow at the fastest CAGR during the forecast period. For cloud-based services, this stems from rising infrastructure complexity.

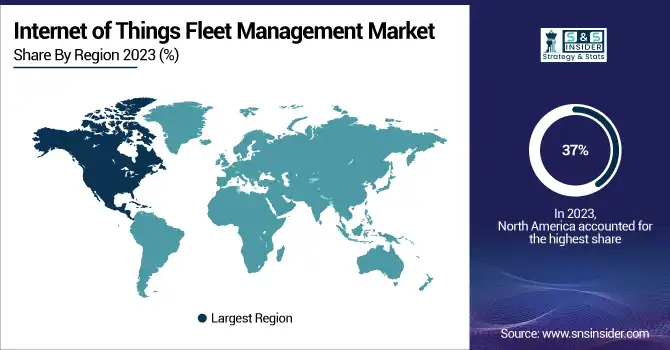

Regional Analysis

North America dominated the market and accounted for 37% of the revenue share. Factors such strong technology ecosystem and the growing size of fleets in the region have brought growth to this segment. Most of the emerging trends around the region, particularly in technology applications, are likely to create substantial demand for the IoT fleet management market.

The Asia Pacific IoT fleet management market is expected to register the fastest CAGR during the forecast period. The growth of this market is driven partly by rise in import and export through multiple countries in the region like China, India and Japan, by increasing demand of various products that are only available or manufactured in the region globally, the presence of various industries that deal with the global fuels or merchandise on regular basis and by increasing demand for effective solution from fleet management.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

-

Geotab Inc. — MyGeotab

-

Verizon Connect — Reveal

-

Samsara Inc. — Samsara Fleet Management Platform

-

Trimble Inc. — Trimble Fleet Manager

-

Teletrac Navman — Director

-

Fleet Complete — Fleet Complete Platform

-

Zonar Systems, Inc. — Zonar Coach

-

MiX Telematics — MiX Fleet Manager

-

ORBCOMM Inc. — FleetEdge

-

Azuga, Inc. — Azuga Fleet

-

KeepTruckin, Inc. (now Motive) — Motive Fleet Dashboard

-

Gurtam — Wialon

-

Webfleet Solutions (A Bridgestone Company) — WEBFLEET

-

Fleetio — Fleetio Manage

-

Inseego Corp. — Ctrack Fleet Management

Recent Developments

-

June 2024: Samsara Inc. Introduced the Asset Tag, a Bluetooth-enabled tracking device designed to monitor high-value items, enhancing inventory management for industries like transportation and construction.

-

March 2024: Gurtam Published insights on the top fleet management trends for 2024, emphasizing the integration of AI, electric vehicles, and sustainability in telematics solutions.

-

November 2024: Cavli Wireless Recognized as a Nasscom Emerge 50 Innovator for 2024, championing 'Made in India' deep tech solutions to drive global IoT and wireless connectivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.8 Billion |

| Market Size by 2032 | US$ 14.5 Billion |

| CAGR | CAGR of 20.19 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Deployment (Cloud, On-Premises) • By Enterprise Size (SMEs, Large Enterprises) • By Application (Disk Encryption, File and Folder Encryption, Database Encryption, Communication Encryption, Cloud Encryption) • By End-Use (Telecom & IT, Manufacturing, BFSI, Healthcare, Retail, Government, Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Thales Group, Microsoft Corporation, Amazon Web Services (AWS), Google LLC, Oracle Corporation, Dell Technologies Inc., Hewlett Packard Enterprise (HPE), Broadcom Inc., Fortanix Inc., HashiCorp, Entrust Corporation, Micro Focus, Unbound Security, Venafi, Inc. |