Agentive AI In Healthcare Market Report Scope & Overview:

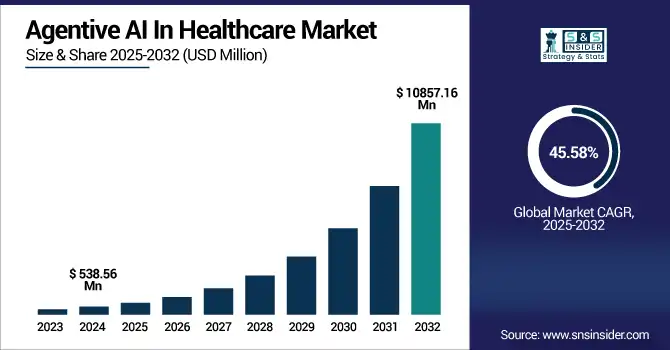

The agentive AI in healthcare market size was valued at USD 538.56 million in 2024 and is expected to reach USD 10857.16 million by 2032, growing at a CAGR of 45.58% over 2025-2032.

To Get more information on Agentive-AI-In-Healthcare-Market - Request Free Sample Report

The global agentic AI in healthcare market is poised for strong growth, driven by an increasing demand for intelligent automation, personalized healthcare delivery, and enhanced operational productivity. The growing demand for agentic AI in healthcare is driven by the need to increase the efficiency of clinical workflows, expedite revenue cycle management, and minimize administrative overhead. Recent agentive AI in healthcare market trends show that over 40% of providers are purchasing AI-supported tools to help desks manage productivity and patient care.

IQVIA unveiled its new AI agents for life sciences and healthcare in June 2025, further establishing its direction to be the leader in patient-centric AI implementation.

Primary drivers fuelling the agentive AI in healthcare market growth of digital 'agents' include a multi-billion-dollar shift to digital health solutions, increasing volumes of healthcare data, and expanding R&D spend for intelligent agents with decision-making in real-time, autonomy, and adaptability. Already, giants such as Microsoft, NVIDIA, and IQVIA are driving innovation, and combined, they have recently deployed more than USD 100 million in partnership and investment.

The U.S. agentic AI in healthcare market is at the forefront of this transformation, owing to favorable regulations and extensive adoption of tech-enabled care, whereas increasing penetration in developing countries suggests significant prospects. Moreover, projects such as Omega Healthcare’s collaboration with Microsoft and Nabla’s USD 70 million Series C funding make evident the commitment to scale agentic solutions. A rising number of regulatory approvals, such as AI-embedded RCM tools that are HIPAA-compliant and machine learning models that are FDA-accredited, are also contributing to the agentive AI in healthcare market growth. This is shaping the agentic AI in healthcare market analysis, giving direction for its expansion.

Autonomize AI also announced in June 2025 that it raised USD 28 million in a series A funding round to develop next-generation agentic AI platforms for healthcare and life sciences, which aim to enable proactive clinical choices and decrease diagnostic error.

Market Dynamics:

Drivers:

-

Expanding Automation & Precision-Centric Demand in Healthcare to Fuel the Market Expansion

The global agentic AI in healthcare market is driven by the increasing need for intelligent systems that independently guide clinical decision-making, mitigate provider burnout, and enhance diagnostic accuracy. Agentic AI agents are revolutionising medical workflows, such as triage, patient engagement, diagnostics, or treatment advice, by making them more efficient and lowering the costs. For instance, Insight Health has launched autonomous AI agents that can conduct patient intake and follow-up communication, eliminating the need for staff and freeing up administrative bottlenecks.

Increasing R&D investment is also driving agentive AI in healthcare market growth, with healthcare AI-related R&D spend increasing by over 30% year-on-year in 2024, according to GlobalData. Another factor is the growing integration of AI into electronic health records (EHRs), which is pushing more adoption as hospitals look for ways to utilize real-time insights.

Regulatory nudging in the form of the FDA’s digital health software precertification program and the EU’s AI Act has forged safer pathways for adoption. On the supply side, upstart and established tech companies are investing heavily in building adaptive agents that learn to act without human tending. The agentic AI in healthcare market growth is also supported by the scalable cloud infrastructure that reduces infrastructure running costs and facilitates widespread adoption. With the growth of value-based care models, vendor-neutral AI will be a necessity to meet outcomes-based reimbursement models.

Restraints:

-

Ethical Concerns, Regulatory Gaps, and Data Privacy Risks Propel the Market Growth

The global agentic AI in healthcare market is confronted by major obstacles such as ethical and regulatory-based limitations and infrastructural obstructions. One of the key challenges is the absence of a transparent accountability process for decisions made by autonomous agents, particularly when high-stakes decisions like clinical diagnosis or patient triage are involved. This is associated with high medicolegal risks and prevents wide-scale use. For instance, in 2024, the U.S. Government Accountability Office (GAO) published that 60% of health care providers who were surveyed were not willing to trust AI agents because they are not interpretable or auditable. Second, the issue with data privacy is still obvious; since the HIPAA and GDPR compliance framework do not completely align with the emergent AI model, many organizations find it challenging to implement an agentic system without offending the privacy of a patient.

On the investment side, although venture capital-backed funding remains strong, institutional health systems overall continue to demonstrate a relatively conservative planned budget allocation to AI, in an attempt to mitigate the risk of unspecified RoI and operational impact. A second bottleneck is the agentic platforms’ lack of easy interoperability with legacy IT systems, which leads to slower integration and higher switching costs. Lastly, the absence of globally recognized validation protocols for agentic agents (contrary to the standards associated with traditional medical software) hinders market entries and time-to-market. Together, these barriers are inhibiting the widespread commercial growth of agentic AI in healthcare companies and products.

Segmentation Analysis:

By Agent System Type

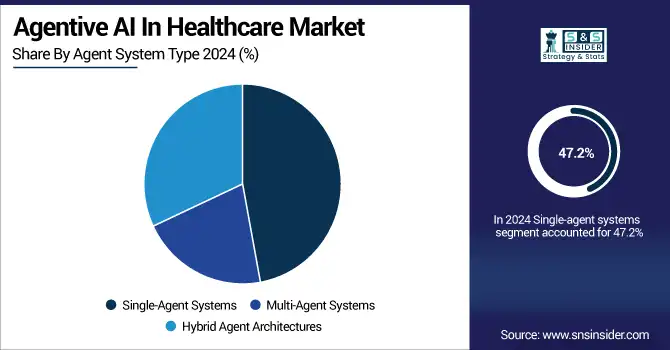

Single-agent systems accounted for the largest share of the agentic AI in healthcare market in 2024 at 47.2%. Such systems gain popularity because of their quick installations, lower development and support costs, as well as their capability of doing specific tasks such as clinical note taking, medical billing, and appointment scheduling. Institutions increasingly depend on such agents for fixed, rule-based tasks that do not entail either complete autonomy or inter-agent collaboration.

Hybrid agent architectures are agents that are composed of various agent types, diagnostic, administrative, and support, spread across systems, but they also form the fastest-growing class. About their growth, they are growing so rapidly because there is more and more demand for scalable, context-aware, and interoperable AI ecosystems that can coordinate across different healthcare touchpoints. Hybrid agents have particular applicability in complex tasks like coordinated care and hospital workflow automation.

By Product Type

Pre-built agentic AI solutions were the leading segment in the product market during 2024, and they occupied the largest share with 52.5%. These solutions are preferred by clinicians due to their immediate availability, accelerated time to value, and pre-built functionality in billing automation, clinical decision support, and patient engagement. Hospitals and clinics demand a turnkey AI system that can be easily deployed alongside the existing infrastructure and that requires no development of specific solutions in-house.

Customizable/build-your-own agents are the fastest growing segment, fueled by big health systems, payers, and drugmakers competing on AI that need customized AI solutions based on their clinical protocols, data models, and compliance needs. These agents allow organizations to build purpose-specific capabilities such as agentic workflows for drug discovery, claims adjudication, or population health management, thus fostering increased flexibility and long-term scalability.

By Technology

Machine learning captured 38.1% of the agentive AI in healthcare market share in 2024. Agents that are based on ML underpin a wide variety of applications, such as patient risk stratification, diagnostic support, fraud detection, and clinical forecasting. Its central role in delivering predictive power for health care AI is what makes it so critical to both clinical applications and administrative functions.

The high-growth category within technology is smart virtual assistants (SVAs). These AI agents are being quickly deployed across telehealth, primary care, and patient engagement platforms and come with features including voice assistance, automated charting, medication reminders, and symptom questionnaires. They are gaining momentum due to the increased need for always-on, human-like interactions in patient-facing and provider-facing applications that drive operational efficiency and provide greater care experiences.

By Application

Medical imaging & diagnostics continued to be the leading application segment in 2024 and accounted for 29.4% of the total market. In radiology, pathology, and ophthalmology, agentic AI tools are widely used to automate scan interpretations, identify anomalies, and prioritize urgent cases. These systems can reduce turnaround time and increase diagnostic accuracy, particularly in high-volume hospitals.

On the contrary, the fastest-growing application is remote patient monitoring & virtual care. This increase is brought on as a result of the worldwide transition to value-based care and post-pandemic demand for ongoing and decentralized healthcare services. Agentic AI solutions here aid in monitoring key signs (chronic) of the disease, warning systems for patient vital signs, triage of patients, all typically enabled by sensors and worn devices, and home systems that enable real-time understanding and provide direction for clinicians to intervene proactively and optimize patient outcomes remotely.

By End-Use

Healthcare providers were the largest end-use segment in 2024 and accounted for 63.8% of the market revenue. This is supported by the industry requirement for automation when it comes to clinical documentation, diagnostics, patient engagement, and resource utilization. Agentic AI tools also improve efficiencies, reduce strain on workers so they can focus on patient care, and enhance the level of care provided.

On the other hand, health IT & AI startups were the fastest-growing end-use segment, on account of their innovative business approach and nimbleness. These startups are rapidly iterating on next-gen agentic systems in verticals like ambient clinical intelligence, personalized health coaching, and AI-assisted trial matching. Their emphasis on state-of-the-art R&D, cloud-native architectures, and plug-and-play capabilities is making them a key disruptor in the changing AI healthcare landscape.

Regional Analysis:

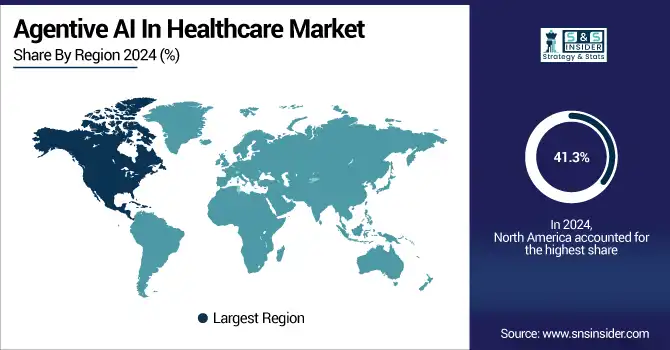

The agentic AI in healthcare market in North America is dominant, contributing more than 41.3% of the global revenue. The U.S. agentive AI in healthcare market size was valued at USD 200.22 million in 2024 and is expected to reach USD 3957.44 million by 2032, growing at a CAGR of 45.16% over 2025-2032. The U.S. is ahead of the rest, given strong digital back-office infrastructure, early uptake of AI, and a conducive healthcare reimbursement environment for AI-enabled solutions. Strong foothold of key players such as Microsoft, NVIDIA, and Notable, implementation across EHR systems, diagnostics, and patient triage, eases its dominance. The US has also had substantial VC investment, and 170+ hospital systems deployed agent-based solutions for decision support and administrative automation. Canada is closely behind, especially in public health AI pilots and telemedicine agent-based uses. Canada is moving quickly, with countrywide AI ethics and healthcare digitisation investment. It’s even deploying AI agents in rural healthcare and long-term disease management programs.

Europe has a strong market since there is increasing focus towards digital health policies, public-private AI partnerships, and cross-border data sharing for companies that are GDPR compliant. The region represented 25.7% of the global market in 2024. Germany is leading the way in the region with large-scale hospital digitization and agentic AI embedded in image diagnostics as well as in billing automation, amongst others, under the DiGA framework. France and the UK come next with government-funded initiatives and a health AI sandbox with testing of agent-based systems. The outpatient backlog and administrative burden in the UK have been mitigated via NHS-backed smart assistants. France is growing fastest in Europe, propelled by national AI-health investments and incentives to digitalize medical workflow in public hospitals.

Asia Pacific is the fastest growing region in the global, expected to grow strongly on the back of increasing investments, substantial patient population, and aggressive AI policy enforcement. The region took 20.6% of the agentive AI in healthcare market share in 2024. China is leading with a national approach to AI, a high level of healthcare digitization, and widespread use of agentic AI in clinical imaging, hospital workflow management, and virtual triage. Hospitals in cities such as Beijing and Shanghai have widely deployed smart assistant systems and AI-based diagnostics. Telehealth and remote care in India are also seeing traction from AI agents as healthcare access remains a challenge, and the government continues to support innovation hubs. The second fastest growing market is India, because of a large tech talent pool, government push for digital health, and more virtual health agents getting deployed in tier-2 and tier-3 cities.

Key Players:

Leading Agentic AI in Healthcare companies driving the market include NVIDIA, Oracle, Microsoft, Thoughtful Automation, Hippocratic AI, Cognigy, Amelia US, Beam AI, Momentum, Notable, Springs, Google Health, IBM Watson Health, AWS Health AI, Infermedica, Tempus, PathAI, Viz.ai, Aidoc, and Corti.

Recent Developments:

-

In June 2025, Microsoft introduced MAI‑DxO, an advanced multi-agent AI system that achieved 85.5% accuracy in diagnosing complex cases using New England Journal of Medicine datasets, over four times more accurate than human physicians (20%) while reducing diagnostic costs by around 20%.

-

In June 2025, IQVIA rolled out agentic AI solutions built on NVIDIA tech to streamline clinical trial workflows, literature reviews, patient recruitment, and data review, marking a significant step toward orchestrated agent systems in life sciences and enhancing trial efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 538.56 million |

| Market Size by 2032 | USD 10857.16 million |

| CAGR | CAGR of 45.58% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Agent System Type (Single-Agent Systems, Multi-Agent Systems, Hybrid Agent Architectures) • By Product Type (Pre-Built Agentic AI Solutions, Customizable/Build-Your-Own Agents, Open-Source Agentic Frameworks) • By Technology (Machine Learning (Supervised, Unsupervised, Reinforcement, Semi-supervised), Deep Learning, Natural Language Processing (Text Analytics, Speech Recognition & Analytics, Auto-Coding & Medical Transcription, Clinical Document Classification), Context-Aware Computing, Computer Vision, Smart Virtual Assistants (SVAs), Optical Character Recognition (OCR)) • By Application (Medical Imaging & Diagnostics, Personalized Medicine & Drug Discovery, Electronic Health Record Optimization, Remote Patient Monitoring & Virtual Care, Clinical Decision Support Systems, Predictive Analytics & Pandemic Preparedness, Genomic Data Interpretation, Chronic Disease Monitoring & Management, Hospital Workflow & Resource Optimization, Healthcare Research & Clinical Trials Analytics, Administrative Automation, Others) • By End-Use (Healthcare Providers, Healthcare Payers, Pharmaceutical & Biotech Companies, Academic & Research Institutions, Government & Public Health Agencies, Health IT & AI Startups, Others) |

| Regional Analysis/Coverage | North America (U.S., Canada), Europe (Germany, France, UK, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

| Company Profiles | NVIDIA, Oracle, Microsoft, Thoughtful Automation, Hippocratic AI, Cognigy, Amelia US, Beam AI, Momentum, Notable, Springs, Google Health, IBM Watson Health, AWS Health AI, Infermedica, Tempus, PathAI, Viz.ai, Aidoc, and Corti. |