Agricultural Lighting Market Size & Trends Analysis:

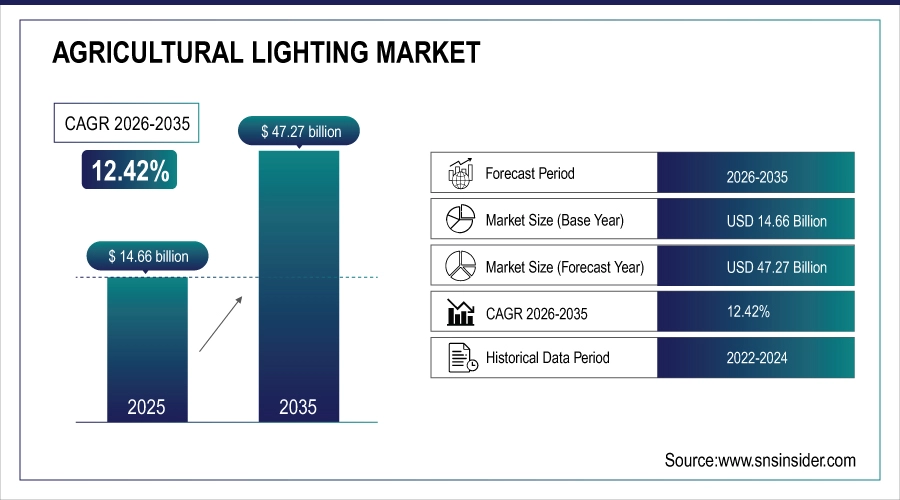

The Agricultural Lighting Market was valued at USD 14.66 billion in 2025 and is expected to reach USD 47.27 billion by 2035, growing at a CAGR of 12.42% over the forecast period 2026-2035.

The evolution of the Agricultural Lighting Market includes the high-tech adoption of artificial intelligence-incorporated lighting systems that automate spectrum changes and enhance energy efficiency capabilities. These developments improve efficiency and reduce power consumption by 40% compared to traditional lighting systems. Almost all LED components around the world depend on the Asia-Pacific region for their supply chain, which in turn influences the global supply shortage of LED components.

Agricultural Lighting Market Size and Growth Projection

-

Market Size in 2025: USD 14.66 Billion

-

Market Size by 2035: USD 47.27 Billion

-

CAGR: 12.42% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on Agricultural Lighting Market - Request Free Sample Report

Key Agricultural Lighting Market Trends:

-

Rising adoption of energy-efficient LED grow lights is driving market growth as farmers seek cost savings and sustainability.

-

Expansion of indoor farming and vertical agriculture is boosting demand for advanced lighting systems tailored to controlled environments.

-

Increasing global food security concerns are accelerating the use of horticultural lighting to maximize yields and crop quality.

-

Integration of smart farming technologies and IoT-enabled lighting systems is enhancing precision agriculture practices.

-

Growing legalization and commercialization of cannabis cultivation in various regions is fueling investments in high-performance grow lights.

-

Government incentives and subsidies promoting sustainable agricultural practices are supporting widespread adoption of advanced lighting solutions.

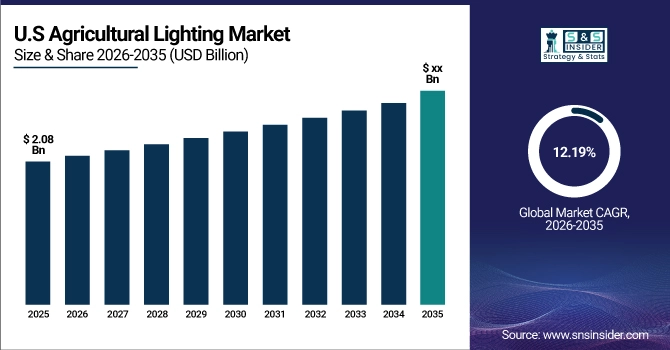

U.S. Agricultural Lighting Market Size Outlook

The U.S. Agricultural Lighting Market is estimated to be USD 2.08 Billion in 2025 and is projected to grow at a CAGR of 12.19%. The United States Agricultural Lighting Market is expanding on account of the adoption of LEDs & smart lighting in greenhouses, vertical farms, and livestock facilities government support for energy-efficient farming; surging demand for controlled environment agriculture; and embedding of advanced artificial intelligence in lighting for crop & livestock productivity purposes.

Agricultural Lighting Market Drivers:

-

Revolutionizing Agriculture with Smart and Energy-Efficient Lighting for Sustainable Farming and Higher Yields

The agricultural lighting market is rapidly growing as a result of the rising adoption of controlled-environment farming, high demand for energy-efficient lighting solutions, and new technological advancements in LED. The rapidly increasing global population drove demand for augmented agricultural output and consequently larger dependence on greenhouses, vertical farming, and indoor farming. The market is being propelled by the energy-saving characteristic, high durability, and possibility of light spectrum optimization of LED lighting for plant growth. In addition to this, market growth is driven by government promotion of sustainable farming, as well as government compensation for energy-efficient agricultural lighting systems. Smart lighting systems to improve animal health, reproduction rates, and productivity are also finding increasing adoption in the livestock sector.

Agricultural Lighting Market Restraints:

-

Overcoming Knowledge Gaps and Adoption Barriers in Smart Agricultural Lighting for Enhanced Farm Productivity

The major challenge faced by the agricultural lighting market is the level of awareness and skills among farmers specifically in developing regions. The adoption of advanced lighting solutions such as LEDs and IoT-enabled smart lighting has been slower in traditional farming practices as many farmers are unaware of the benefits associated with the new advancements in lighting solutions. Mistakes to avoid: Incorrect spectrum choices from the available light spectra for each application, and inconsistent installation practices, which can decrease efficiency and impair plant growth or animal health. This requires specialized knowledge to implement both sides of the control interface into the computerized farming ecosystem which poses another barrier to the practical implementation of agricultural lighting.

Agricultural Lighting Market Opportunities:

-

Expanding Opportunities in Smart Farming with IoT AI and Advanced Lighting Technologies for Future Growth

Market opportunities are represented through technological improvement and a growing demand for investment in smart farming. IoT-enabled agricultural lighting systems, which provide remote monitoring and automated light adjustments, are growing at a fast pace. Furthermore, with the rise in the adoption of advanced farming techniques, the blooming economies in the Asia-Pacific and Latam regions are adding new growth opportunities. Additionally, the growing trend for urban farming and aquaponics is providing supplementary impetus to the rising adoption of new lighting systems. These companies which invest in Research and development for spectrum-optimized lighting and also in AI-powered precision farming technologies will be well placed for future growth.

Agricultural Lighting Market Challenges:

-

Addressing Regulatory Gaps Infrastructure Limitations and Durability Challenges in Agricultural Lighting for Efficient Farming

The biggest obstacle is the regulatory and standardization gap between ag-lighting systems. Crops and livestock have specific lighting needs but there are no universally accepted standards on the optimal light spectrum, time, and/or intensity, globally. Such problems usually cause farming operations to run inefficiently, and the consistency of products suffers. Besides, low infrastructure in rural places, such as unsustainable light provide and low technology aid, restricts the purported utilization of superior agricultural lighting. Additionally, with lighting systems often exposed to high humidity, dust, and temperature fluctuations in farming environments, product durability in extreme environmental conditions also poses challenges in the market, impacting the life of lighting systems.

Agricultural Lighting Industry Segmentation Analysis

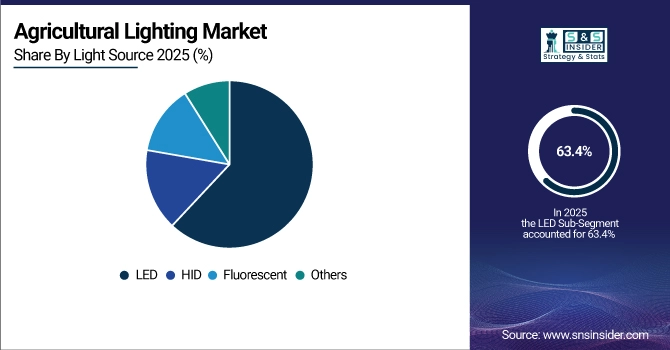

By Light Source, LEDs Dominate Agricultural Lighting Market with 63.4% Share in 2025, While Fluorescents Poised for Fastest Growth

In 2025, LED held the largest share of the agricultural lighting market (63.4%). The rising demand for technologically advanced solutions for minimizing energy resource loss has positively impacted the growth of the LED segment, as the LED possesses superior characteristics in terms of energy efficiency, average lifespan, and the ability to provide adjustable light spectra as per the requirement of various crops & livestock. The rise in vertical farming, greenhouses, and indoor farming, which offer greater potential yield and lower energy consumption than traditional lighting technologies, has expedited the transition to LED lighting.

Fluorescent lighting is projected to experience the highest CAGR from 2025-2035, due to its low-cost options and readiness availability in developing countries. Although the LEDs remain the heavy guns of high-tech farming, even small-scale farming and conventional greenhouse setups rely on fluorescent light systems due to their relatively lower capital cost. The increased rate of improvement in fluorescent lamp efficiency and lifespan through technological advancement is expected to increase the rate of fluorescence adoption in cost-sensitive agriculture application segments.

By Installation, New Installations Lead Agricultural Lighting Market in 2025, Retrofit Segment Set for Strongest Future Growth

The agricultural lighting market was led by new installations in 2025, accounting for 56.2% of the global market share, due to the rapid growth of greenhouse, vertical farming (VF), and smart farming infrastructure. This was in part due to the growing global interest in controlled environments agriculture (CEA) and the implementation of LED lighting in newly constructed agricultural facilities. Modern initiatives undertaken in farming systems are receiving support from governments and investors to increase the demand for new lighting systems for efficiency in crop and livestock production.

Retrofit installations segment is expected to grow at the highest rate between 2025 and 2035, considering the renovations of older systems among existing farms and conventional agricultural practices to convert the existing light systems to energy-efficient light systems, such as LEDs.

By Application, Horticulture Holds 62% Market Share in 2025, While Livestock Lighting Emerges as Fastest-Growing Segment

The horticulture sector led the agricultural lighting market, with a 62% share in 2025, owing to the increasing prevalence of greenhouses, and vertical, and hydroponic farming systems. The rising need for high-yield crop cultivation, year-round agriculture, and maximized plant growth, is driving the horticultural sector towards LED and smart lighting technologies. This helps to reinforce the lead horticulture has on the market with constant improvements in spectrum-tuned lighting that directly benefits photosynthesis and plant well-being. Increasing adoption of these advanced lighting solutions is driven not only by private investment but also by governments that are supporting sustainable farming practices.

The livestock segment is projected to be the fastest-growing segment over the 2025-2035 timeline, as farmers are now adopting various specialized lighting systems to stimulate animal health, reproduction, and productivity. Lighting can even improve how fast poultry grows, how much milk cows produce, and how quickly livestock breed, studies show. The increasing adoption of smart livestock farming initiatives, paired with automated special lights with IoT-based controls, is expected to witness significant market expansion in this market segment.

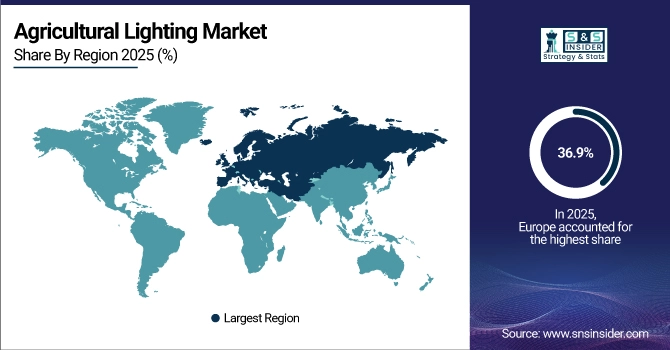

Agricultural Lighting Market Regional Analysis

Europe Dominates Agricultural Lighting Market in 2025

Europe is the dominant region in the Agricultural Lighting Market, holding an estimated 36.9% market share in 2025. This is being propelled by the stringent energy efficiency directives of the EU, as well as strong policies in agriculture for sustainability and the rapid adoption of greenhouse farming. More farmers in Europe are now investing in spectrum-optimized LEDs and intelligent lighting as a means to ensure maximum year-round yield at minimum cost. Indeed, with established infrastructure and advanced CEA practices, Europe still represents the hub of innovation and large-scale adoption for agricultural lighting.

Get Customized Report as per Your Business Requirement - Enquiry Now

Netherlands Dominates Europe’s Agricultural Lighting Market

The Netherlands accounts for the biggest market in Europe due to its reputation for the best greenhouse technology in the world, along with its pioneering efforts in vertical and hydroponic farming methods. The Dutch farmers are heavily dependent on LED technology to make the best use of energy while increasing crop quality. Sustainability incentives from the government, along with substantial investment from private parties, have ensured that the Netherlands tops the charts for agriculture with efficient use of technology. The country’s greenhouses guarantee a strong position for the Netherlands at the top of Europe’s agricultural lighting technology.

Asia Pacific is the Fastest-Growing Region in Agricultural Lighting Market in 2025

Asia Pacific is the fastest-growing region in the Agricultural Lighting Market, with an estimated CAGR of 14.1% from 2025 to 2035. This rapid growth is primarily driven by higher demand for food, urbanization, and government support for vertical and hydroponic farming. The growing adoption of LED-based technologies, along with private investments in sustainable agriculture, is fueling the adoption of high-tech agriculture at a faster pace. The changing demographics of the Asia Pacific region, along with their focus on the food agenda, render this region the growth catalyst of the agricultural Lighting industry.

China Leads Agricultural Lighting Market Growth in Asia Pacific

Furthermore, it is important to note that the growth pattern of the Asia Pacific market is dominated by China, as it has invested heavily in controlled environment agriculture to address serious food security issues. China's growing interest in urban cultivation, such as vertical farming, with greenhouse installations, is boosting product adoption, considering it is also a domestic manufacturer of LEDs. Moreover, private sector participation in the country, in combination with the government's focus on green agriculture, ranks it as a pioneer in green lighting. In addition, it is worth noting that the urban population in China is also boosting product demand.

North America Agricultural Lighting Market Insights

In 2025, North America holds a significant share of the Agricultural Lighting Market, accounting for 29.7% of the global market. Driving Factor: Expansion of cannabis cultivation drives strong demand for spectrum-optimized LEDs, because growers seek high yields, lower costs, and consistent crop quality. The United States dominates the region, driven by advanced vertical farming adoption, government incentives for energy-efficient agriculture, and strong private investments in horticulture lighting. The presence of leading manufacturers and rapid cannabis industry expansion further strengthen the U.S. position in the market.

Middle East & Africa and Latin America Agricultural Lighting Market Insights

In 2025, the Agricultural Lighting Market in Latin America and MEA is emerging with steady adoption across urban farming projects and greenhouse setups. In Latin America, Brazil leads with strong greenhouse agriculture growth and increasing awareness of energy-efficient LED systems. In the Middle East, the UAE and Saudi Arabia are driving adoption through large-scale vertical farming investments aimed at overcoming arid climates and food security challenges. While both regions remain in the early growth phase, rising investments and modernization initiatives point to substantial future potential.

Competitive Landscape of the Agricultural Lighting Market:

HATO

HATO Agricultural Lighting is a company based in Europe and is a leader when it comes to agricultural lighting, especially for livestock and poultry farming. With decades of experience, HATO agricultural lighting develops products that are meant for improving the health, development, and utilization of electricity within the arena of agriculture. Its main product line, RUDAX, is adopted for harsh environments, which is common within the world of agriculture. HATO is a vital contributor to the world of agricultural lighting, especially when it comes to scientific testing for improved efficiency, which is healthy for the nature of sustainable farming.

-

In 2025, HATO expanded its RUDAX portfolio with new dimmable LED systems optimized for poultry and swine barns, offering longer lifespans and enhanced light uniformity.

Sennlite Agricultural Lighting Technology Co. LTD

Sennlite Agricultural Lighting Technology Co. LTD specializes in the development of horticulture lighting solutions and greenhouse lighting systems, mostly focusing on the Nova 645 series. The company is known for the design and production of high-efficiency grow lights with the primary objective of achieving the best results from photosynthesis efficiency. Sennlite’s products are used in vertically planted farms and hydro systems, and one of the roles observed in the agricultural lighting industry is its cost-effectiveness and capacity to meet the needs of both small-scale and large-scale growers.

-

In 2025, Sennlite launched upgraded Nova 645 LED systems featuring enhanced heat dissipation and spectrum control, aimed at boosting efficiency in commercial greenhouses.

Orion Energy Systems

Orion Energy Systems, based in the United States, is a world leader in LED lighting solutions, with a variety of certified agricultural lighting systems that are specially engineered for greenhouses, livestock areas, and vertical farming applications. Orion, utilizing efficient technologies, combines smart controls, long life expectancy, and high durability into its products. The firm's agricultural solutions have been designed aiming at reducing costs of operations while yielding consistency and improving productivity. Orion Energy Systems plays a vital part in the market, matching the latest engineering with a customer-oriented approach to providing retrofitted and new installation solutions for contemporary agriculture.

-

In 2025, Orion Energy Systems introduced a new line of certified LED grow lights featuring integrated smart control platforms for precision agriculture and automated lighting management.

Hontech-Wins

Hontech-Wins is a leading Asia-based provider of revolutionary livestock lighting solutions, focusing on the provision of waterproof and dimmable LED lights, especially for animal farming. Hontech-Wins' IP67-rated LED lights, known as T16 LED cow farm lights, are known globally for their flicker-free, harsh-environment-resistant, and animal-welfare-enhancing capabilities. This company is a central player within the global animal farm lighting sphere, particularly for its provision of innovative, durable, and animal-welfare-focused animal lights for farmers.

-

In 2025, Hontech-Wins launched an advanced dimmable T16 lighting series with enhanced waterproofing and IoT-based control options, further strengthening its global livestock lighting portfolio.

Agricultural Lighting Companies are:

-

HATO Agricultural Lighting (RUDAX)

-

Sennlite Agricultural Lighting Technology Co., LTD

-

Orion Energy Systems

-

Hontech-Wins

-

G&G Industrial Lighting

-

J.W. Speaker Corporation

-

Growlight Agricultural Lighting Solutions

-

Everlight Electronics

-

Signify (formerly Philips Lighting)

-

OSRAM

-

Valoya

-

Heliospectra

-

Illumitex

-

Current, powered by GE

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 14.66 Billion |

| Market Size by 2035 | USD 47.27 Billion |

| CAGR | CAGR of 12.42% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Light Source Fluorescent, HID, LED, Others) • By Installation (New, Retrofit) • By Application (Aquaculture, Livestock, Horticulture) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | HATO Agricultural Lighting, Sennlite Agricultural Lighting Technology Co. LTD, Orion Energy Systems, Hontech-Wins, Legion Lighting Co. Inc., G&G Industrial Lighting, J.W. Speaker Corporation, Growlight Agricultural Lighting Solutions, Everlight Electronics, Signify (formerly Philips Lighting), OSRAM, Valoya, Heliospectra, Illumitex, Current (powered by GE). |