Agricultural Surfactants Market Report Scope & Overview:

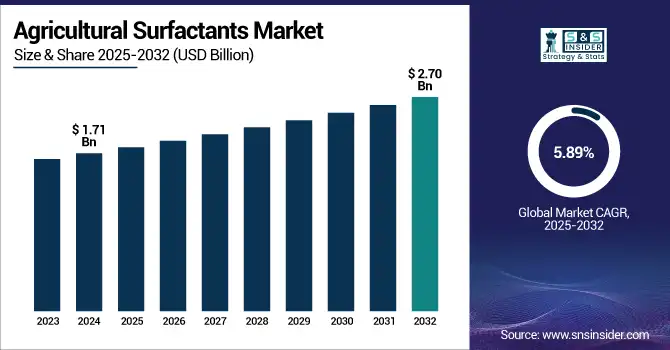

The Agricultural Surfactants Market size was valued at USD 1.71 billion in 2024 and is expected to reach USD 2.70 billion by 2032, growing at a CAGR of 5.89% over the forecast period of 2025-2032.

To Get more information on Agricultural Surfactants Market - Request Free Sample Report

Growth in the agricultural surfactants market is driven by sustainability efforts and the increasing necessity of agrochemical efficacy following the implementation of stringent regulations.

On February 15, 2024, the U.S. EPA announced a PFAS detection method for HDPE agrochemical containers to help strengthen safety. In December 2023, the agency took a step to restrict PFAS use in fluorinated HDPE packaging. The USDA also recognized the inaugural National Biobased Products Day on March 8, 2023, further signaling the value of its BioPreferred Program in driving the usage of biodegradable surfactants.

These are some of the factors driving the agricultural surfactants market trends, which also include the increasing acceptance of non-ionic and silicone surfactants in crop protection. Agricultural surfactant companies are moving toward bio-based agro surfactants to conform to regulatory norms. The agricultural surfactants market share is increasingly driven by environmentally friendly formulations and precision delivery technologies which are contributing to market sustainability and innovation. Progressive innovations in the surfactant technology for crop protection and sustainable agricultural practices will continue to stimulate the growth of agricultural surfactants industry.

Agricultural Surfactants Market Drivers:

-

Extensive Adoption of Precision Farming Technologies Necessitates Specialized Surfactant Integration

Rising adoption of precision agriculture technologies is considerably contributing to the growth of the agricultural surfactants market. More than half of medium-sized and nearly all large farms use precision guidance autosteering to enhance application efficiency. These applications need the use of surfactants that favor droplet spread and retention, especially non-ionic and silicone-based based to decrease chemical drift and increase efficacy. Agricultural surfactant companies are developing formulations that are compatible with VRT and sensor-based input applications to increase their share of agricultural and crop growth. This trend is consistent with the growing necessity for precision crop protection, which is strengthening changes in agrochemical surfactant market trends and focusing on the importance of personalized adjuvants and modern farming.

-

EPA’s 2024 PFAS Detection Method Elevates Surfactant Safety Compliance in Packaging Operations

New EPA techniques for measuring ultra-low PFAS amounts in plastic containers are having a large effect on agricultural surfactant companies. This has led to an increase in quality control for surfactant packaging as new standards arise, and new regulations have been passed, including label changes. Agrochemical manufacturers need to ensure their surfactant formulations are PFAS-free, and the cost of compliance is ramping up. This legislation is pushing up the demand for safer or PFAS-free surfactants and packaging materials, which impacts the agricultural surfactants industry analysis. Companies are investing in advanced testing equipment and supply chain auditing, stimulating support for the market by matching products to more stringent environmental regulations and by building consumer confidence in sustainable surfactants.

Agricultural Surfactants Market Restraints:

-

Stringent Pesticide Adjuvant Regulations Increase Compliance Costs for Surfactant Manufacturers

The agricultural surfactant industry is facing increased regulatory challenges, however, there is significant potential to be more regulatory complaints as well. Such demands consist of improved reporting and compatibility, along with escalating development and R&D, and operational costs. This adds to the compliance cost and restricts investment in innovation, which may hinder the growth of the agricultural surfactants market. Surfactant formulators are also being exposed to higher legal risks and are required to constantly review packaging labels, leading to a loss of production potential. Accordingly, regulations and their challenging nature stunt the potential growth of market share in the agricultural surfactants sector and create entry hurdles, particularly for smaller producers who cannot afford increasing compliance costs.

-

Smallholder Farmers’ Limited Access to Advanced Technologies Restricts Eco-friendly Surfactant Uptake

Although bio-based agricultural surfactants continue to become more available worldwide, smallholder farmers, particularly in developing countries, may not have access to precision-farming technology to utilize them to their fullest extent. Limited availability of capital for training and immobile prevents them from being adopted on a large-scale, preventing a penetration into the market. This technology and knowledge gap impedes the expansion of sustainable surfactants and retards the transition to environmentally benign solutions in crop protection. Thus, the growth of agricultural surfactants market is uneven across regions and has relatively low uptake in key emerging markets, which are restraining the overall agricultural surfactants market size and there by the potential environmental benefits.

Agricultural Surfactants Market Segmentation Analysis:

By Type

Anionic surfactant product type dominated the agricultural surfactants market in 2024, owing to the demonstrated compatibility of these products with all major herbicide chemistries and their ability to provide excellent performance under different field conditions. In 2017, over 60 % of new adjuvant registrations in the U.S. were anionic products, and these products have become a major part of crop-protection programs. Surfactant suppliers have innovated their portfolios around these proven chemistries, building market share on strong spray performance and wide application flexibility.

However, non-ionic surfactants projected the fastest growth at 6.28% CAGR during 2025-2032, driven by the requirement for drift-reduction and advanced spray-coverage technologies. The USDA BioPreferred rewards approved more than 120 new non-ionic adjuvants in 2023 and reinforces the government's commitment to sustainable, high-performance formulations. Growing environmental standards and precision-agriculture requirements are favoring the usage of non-ionic solutions, prompting the agro surfactants in the crop protection sector.

By Substrate Type

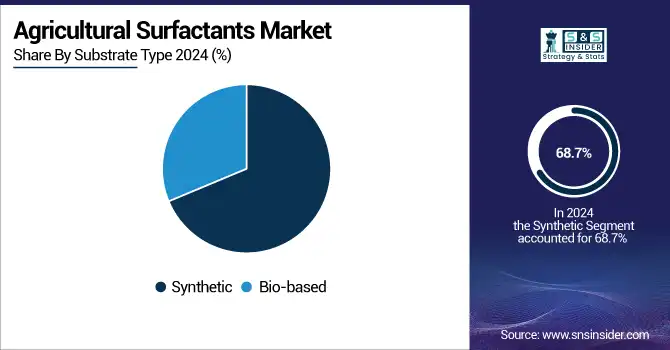

Synthetic surfactants dominated and accounted for 68.7% of the agricultural surfactants market in 2024, showing how mature the petrochemical supply chains are and their price advantage for large-scale crop protection. Large players in the industrial manufacturing segments capitalized on existing resin and surfactant infrastructures to supply high volume demand, winning industry pricing power. The USDA data indicate that the previous trend of synthetic adjuvants remaining the most common surfactants for agricultural use among prevalent commodity crops holds as their results-driven nature, along with higher supply availability, keeps augmenting their share in the agricultural surfactants market.

The Bio-based surfactants segment is anticipated to be the fastest-growing segment with the highest CAGR of 6.22% during the forecast period of 2025-2032. Growth is driven by the USDA BioPreferred procurement mandates and increasing end-user demand for environmentally friendly adjuvants. The expanded catalog of the program includes more than 8,000 biobased products certified through this program, fuelling the growth of the agricultural surfactants market toward sustainable chemistries. To match federal sustainability goals and changing consumer preferences, leading agricultural surfactant companies are upscaling bio-based production and improving adoption in precision-application systems.

By Crop Type

Cereals & grains dominated and accounted for 43.6% of agricultural surfactants use in 2024 due to the widespread use of such crops in key growing areas. In 2023, the USDA figures indicate more than 412 million acres planted with cereals & grains requiring high loads of surfactants to facilitate effective herbicide and fungicide applications. Market leaders have built supply chains and service programs around these high-acre crops, with dedicated crop-protection partnerships and technical support.

During the forecast period of 2025-2032, fruits & vegetables applications are projected to be the fastest growing crop type with the highest growth rate of 6.96%, owing to the trend of low-residue & food-safety adjuvants in the sector. Increased pressure from FDA and USDA standards on post-harvest treatments compared to previously marketed surfactants released to maximize pesticide performance while minimizing residues. To meet this need, manufacturers of agricultural surfactants have responded with more specialized formulations, increasing market growth for this high-value crop segment.

By Application

Herbicides dominated and accounted for about 49.6% of the agricultural surfactants market in 2024, with growers preferring to use effective weed-control products across large expanses of acreage. For instance, EPA reports that nearly 50% of all adjuvants registered are used in combination with glyphosate and paraquat products, which highlights the importance of surfactants for herbicide efficacy. All surfactant companies have developed products for drift control and rain fastness and captured market share by delivering established herbicide enhancement services.

The insecticide application segment is projected to be the fastest-growing, with a 6.89% CAGR in the forecast period over 2025-2032, owing to the increase in pest-resistance issues combined with integrated pest management. Regulation pressures for lower chemical loads mean increasing demand for surfactants to enhance the delivery of active ingredients for low-dose insecticide programs. Agricultural surfactant manufacturers are developing formulations to improve bio-efficacy and to make it compatible with natural biopesticides, and this is expected to fuel the growth of the segment.

Agricultural Surfactants Market Regional Outlook:

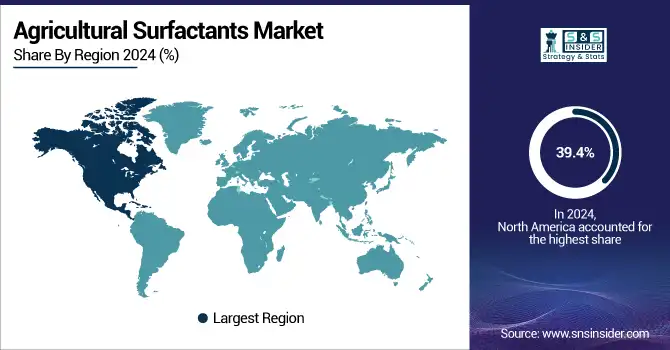

North America dominated and held 39.4% of the global agricultural surfactants market in 2024, benefiting from the U.S. and Canada driving the innovation, and with Mexican approvals being simplified.

The U.S is dominating the North American agricultural surfactants market with the largest market share of approximately 60% and market value of USD 402.66 million. In the U.S., over USD 25 million in Conservation Innovation Grants were awarded by the USDA in 2023 for surfactant R&D and facilitated advanced adjuvants on more than 85 million acres. At the same time, EPA approvals of drift-control products encouraged the adoption of precision sprays. The Agri Innovate program in Canada allocated CAD 75 million to scale up bio-based agricultural surfactants, increasing the output by 18 %. The 2023 SAGARPA reform in Mexico resulted in a 40% reduction in registration times, leading to the introduction of new formulations over 30 million hectares of cropland in just a few years.

The Asia Pacific is the fastest-growing region, with the highest CAGR of 7.31% of the market in 2024, on account of large government support and growing agricultural modernization. The “Agro-Modernization 2030” project in China, using advanced surfactant programs on over 120 million ha, led to a 16% increase in spray efficiency. As per India’s 2023 National Agrochemical Policy, 60 bio-based surfactant formulations have been fast-tracked for approval, with way of 35% cut in evaluation time. Australia’s National Smart Farming Program committed AUD 90 million to precision-spray studies for improved adjuvants’ use. The Japanese Ministry of Agriculture, Forestry and Fisheries financed 45 pilot experiments on drift-resistance agents, pushing the agricultural surfactants market growth and development in the entire region.

Europe secured a 25.7 % share of the agricultural surfactants market in 2024, on account of regulatory support and sustainable agricultural practices. A €120-million water-efficiency fund initiated by Germany’s Federal Ministry of Food and Agriculture demanded experimental use of eco-adjuvants on 10 % of arable land, while France’s Eco-Phyto scheme assigned €200 million for 2023 to incentivize low-drift surfactant technologies, nudging biodegradable adjuvant consumption to 22 %. In Italy, the €15 million investment offered by Emilia-Romagna accelerated the application of sustainable adjuvants to 65% of the vineyard. Spain’s adoption EU water-use directives led to an increase of 25% year over year in environmentally friendly surfactant use by the nation’s horticultural industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Agricultural Surfactants Market Companies are:

The major agricultural surfactants market competitors include BASF SE, Dow Inc., Evonik Industries AG, Clariant AG, Solvay S.A., Croda International Plc, Stepan Company, Huntsman Corporation, Helena Agri-Enterprises, LLC, and Nufarm.

Recent Developments:

-

In October 2024, AmphiStar launched two upcycled biosurfactants, AmphiCare and AmphiClean, derived from local organic waste through biological conversion, becoming the first commercial microbial surfactants of their kind.

-

In January 2024, Bionema introduced a biodegradable surfactant for agricultural biologicals and agrochemicals, enhancing water and nutrient uptake, reducing soil repellence, and improving the delivery of crop-protection agents in varied soils.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.71 billion |

| Market Size by 2032 | USD 2.70 billion |

| CAGR | CAGR of 5.89% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Non-ionic, Anionic, Cationic, Amphoteric) •By Substrate Type (Synthetic, Bio-based) •By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others) •By Application (Herbicides, Insecticides, Fungicides, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BASF SE, Dow Inc., Evonik Industries AG, Clariant AG, Solvay S.A., Croda International Plc, Stepan Company, Huntsman Corporation, Helena Agri-Enterprises, LLC, and Nufarm |