Reverse Osmosis Membranes Market Report Scope & Overview:

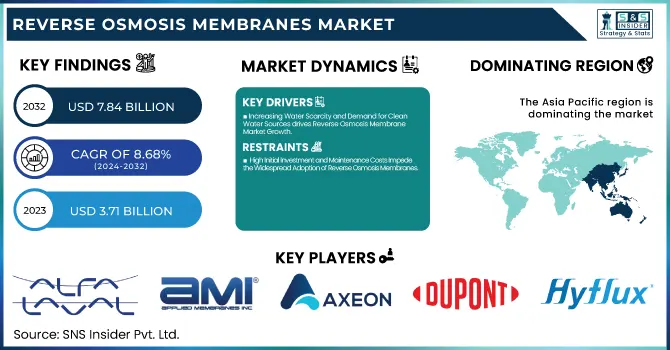

The Reverse Osmosis Membranes Market size was valued at USD 3.71 billion in 2023 and is expected to reach USD 7.84 billion by 2032, growing at a CAGR of 8.68% over the forecast period 2024-2032.

To Get more information on Reverse Osmosis Membranes Market - Request Free Sample Report

The Reverse Osmosis Membranes Market is characterized by rapid technological advancements and increasing demand for water purification solutions across various industries, including municipal, industrial, and agricultural sectors. Market dynamics are influenced by the growing awareness of water scarcity and the need for efficient water treatment solutions. Recent developments in membrane technology have focused on enhancing performance and durability while reducing operational costs. For instance, Toray Industries announced the launch of a new reverse osmosis membrane product in November 2024, designed to improve water treatment efficiency and reduce energy consumption. Additionally, ongoing research efforts aim to tackle biofouling, a significant challenge in membrane filtration. Researchers revealed a novel reverse osmosis membrane technology in January 2025, which is expected to significantly reduce biofouling while maintaining high water permeability, thus improving overall membrane longevity and performance.

Innovative recycling approaches are gaining traction as sustainability becomes a priority in the industry. In November 2024, reports indicated that membrane recycling could play a critical role in reducing waste and conserving resources within the reverse osmosis sector. Furthermore, significant investments in infrastructure are being made to upgrade existing facilities. For instance, Metrowater plans to start replacing a portion of the reverse osmosis membranes in its Nemmeli desalination plant in Chennai by December 2024 to enhance water quality and operational efficiency. Notable advancements include a May 2024 development where hydrophilic ZIF-8 was found to enhance the performance of reverse osmosis membranes, indicating a shift towards materials that improve filtration efficiency. DuPont's recognition with a bronze Edison Award in April 2024 for its membranes used in lithium brine purification exemplifies the company's commitment to innovation. Other notable initiatives include the unveiling of new membrane and resin technologies by LG Water Solutions at the 2024 IDRA World Congress in December, highlighting the ongoing pursuit of advanced filtration solutions. Furthermore, in December 2023, Samyang launched new reverse osmosis membrane and electrodeionizer solutions, demonstrating the continuous evolution of membrane technologies tailored to meet diverse water treatment needs. These developments collectively reflect the industry's focus on enhancing membrane performance, sustainability, and addressing water scarcity challenges.

Reverse Osmosis Membranes Market Dynamics

Drivers

-

Increasing Water Scarcity and Demand for Clean Water Sources drives Reverse Osmosis Membrane Market Growth

-

Increasing Industrial and Municipal Applications Drive the Adoption of Reverse Osmosis Membranes in Water Treatment

The increasing applications of reverse osmosis membranes in industries such as municipal water treatment, power generation, and pharmaceuticals are driving the demand for advanced filtration systems. In the municipal sector, reverse osmosis membranes are widely used in desalination plants to provide clean drinking water to growing populations, especially in water-scarce regions. In industrial applications, reverse osmosis is critical for the treatment of wastewater and the recovery of valuable by-products. The technology's ability to remove salts, minerals, and other contaminants from water makes it indispensable in industries like oil and gas, power, food and beverage, and pharmaceuticals. With the rising concerns about environmental sustainability, companies are also focusing on using reverse osmosis to reduce water wastage, improve efficiency, and meet stricter regulations on water quality and wastewater treatment. As the industrial and municipal demand for high-quality water rises, reverse osmosis membranes are seeing wider adoption, which will continue to drive market growth.

Restraints

-

High Initial Investment and Maintenance Costs Impede the Widespread Adoption of Reverse Osmosis Membranes

Despite their many advantages, one of the key restraints for the widespread adoption of reverse osmosis membranes is the high initial investment and maintenance costs associated with installing and operating RO systems. The cost of reverse osmosis systems, including the membranes, pumps, and other infrastructure, can be significant, especially for large-scale water treatment plants or desalination units. Furthermore, RO membranes require regular maintenance to ensure optimal performance, including cleaning, replacement, and monitoring of system components. This leads to ongoing operational costs that can be prohibitive for smaller municipalities or industrial users with limited budgets. As a result, the financial burden associated with reverse osmosis systems may deter some potential users from adopting this technology, especially in regions where alternative water treatment methods are more affordable or accessible. The high costs of installation and maintenance are therefore a considerable barrier to the widespread deployment of reverse osmosis membranes.

Opportunities

-

Growing Focus on Sustainable Water Management Opens New Avenues for Reverse Osmosis Membranes

With increasing global awareness about environmental sustainability and water conservation, there are growing opportunities for reverse osmosis membranes in industries and regions that are focusing on sustainable water management practices. As organizations and governments aim to meet sustainability goals, reverse osmosis technology presents a solution for improving water usage efficiency, reducing water waste, and ensuring that industries can meet stringent water quality standards. The potential for reverse osmosis membranes in wastewater reuse and brine treatment offers significant opportunities in sectors like mining, food processing, and agriculture. As the demand for environmentally friendly and resource-efficient technologies continues to rise, reverse osmosis membranes will play a key role in shaping sustainable water treatment practices and wastewater management, creating opportunities for market expansion.

Challenge

-

Challenges in Overcoming Biofouling and Membrane Degradation Affect Reverse Osmosis Efficiency

A major challenge in the reverse osmosis membranes market is the issue of biofouling and membrane degradation, which can significantly impact the efficiency and longevity of the membranes. Biofouling occurs when microorganisms such as bacteria, algae, and fungi accumulate on the surface of the membranes, forming a layer that impedes water flow and reduces filtration performance. This not only affects the quality of water treated but also results in frequent cleaning and membrane replacement, increasing operational costs. While significant research is underway to develop anti-fouling membranes and more durable materials, biofouling remains a persistent issue that continues to challenge the effectiveness and cost-efficiency of reverse osmosis systems, limiting the growth potential of the market.

Reverse Osmosis Membranes Market Segments

By Type

In 2023, the Thin Film Composite Membrane segment dominated the Reverse Osmosis Membranes Market, capturing a market share of 70%. This dominance is attributed to the exceptional performance characteristics of thin film composite membranes, which include higher salt rejection rates, superior permeate flow, and enhanced durability compared to cellulose-based membranes. The manufacturing process of thin film composite membranes involves layering materials that create a thin barrier for water while allowing the passage of smaller molecules, which significantly improves efficiency. These membranes are versatile and can be utilized in various applications, such as seawater desalination, industrial water treatment, and municipal water purification. Furthermore, advancements in membrane technology have led to continuous improvements in fouling resistance and operational lifespan, making these membranes increasingly appealing for large-scale water treatment facilities. The rising global demand for high-quality freshwater, coupled with the need for efficient wastewater management, drives the adoption of thin film composite membranes. Their effectiveness in producing potable water from saline sources, especially in regions facing water scarcity, further solidifies their position as the preferred choice in the reverse osmosis membranes market.

By Filter Module

In 2023, the Spiral Wound segment dominated the Reverse Osmosis Membranes Market, with a market share of 60%. Spiral wound modules are highly regarded for their efficient design and space-saving characteristics, making them suitable for a wide array of water treatment applications. The spiral configuration allows for a large membrane surface area within a compact structure, resulting in improved filtration performance and lower operating costs. These modules are widely utilized in both industrial and municipal sectors, particularly in desalination plants, commercial water treatment systems, and large-scale wastewater facilities. The design enables the effective handling of high volumes of water while minimizing energy consumption, which is crucial for operational efficiency. Moreover, advancements in membrane technology have enhanced the performance of spiral wound modules, allowing for higher salt rejection rates and longer service life. The increasing demand for freshwater in various industries and the necessity of effective wastewater management are driving the adoption of spiral wound filter modules, solidifying their position as the preferred choice in the reverse osmosis membranes market.

By Application

In 2023, the Desalination segment dominated the Reverse Osmosis Membranes Market, accounting for approximately 50% of the market share. This segment's dominance stems from the critical role of reverse osmosis in converting seawater into potable water, particularly in regions with limited freshwater resources. The global water scarcity crisis has heightened the importance of desalination as a viable solution to meet the increasing demand for clean drinking water. Reverse osmosis technology is recognized for its efficiency in removing salts and impurities from seawater, making it the preferred choice for large-scale desalination projects. As more countries invest in infrastructure to harness seawater resources, the demand for advanced reverse osmosis membranes continues to rise. Additionally, ongoing innovations in membrane materials and designs are improving the performance and sustainability of desalination processes, making them more economically viable. The growing trend toward sustainable water management practices and investments in desalination technologies, especially in arid regions and developing countries, further contribute to the significant growth of this application segment within the reverse osmosis membranes market.

By End-use

In 2023, the Industrial segment dominated the Reverse Osmosis Membranes Market, holding a market share of 45%. Industrial applications, including sectors such as food and beverage production, pharmaceuticals, and power generation, heavily rely on reverse osmosis technology for water purification and wastewater treatment. The necessity for high-quality water in manufacturing processes, along with the increasing focus on water recycling and reuse, drives the demand for reverse osmosis systems in industrial settings. Industries face strict regulations regarding water quality and discharge, necessitating the implementation of effective water treatment solutions to comply with environmental standards. Additionally, the growing awareness of sustainability and resource conservation within the industrial sector has led to the widespread adoption of advanced reverse osmosis technologies. These systems not only improve water quality but also enhance operational efficiency and reduce costs associated with water treatment. As industries strive to minimize their environmental footprint and optimize resource utilization, the role of reverse osmosis membranes in ensuring clean water supply and effective wastewater management continues to grow, solidifying the industrial segment's position in the market.

Reverse Osmosis Membranes Market Regional Analysis

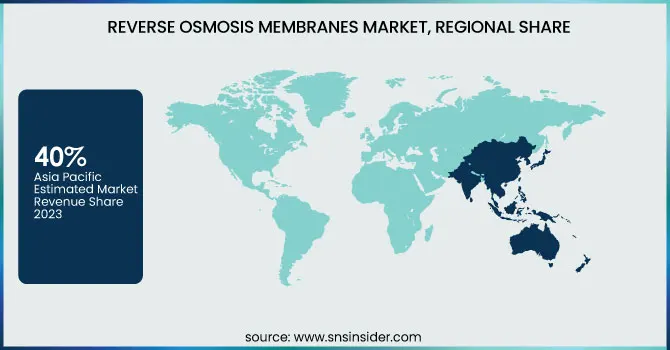

In 2023, the Asia Pacific region dominated the Reverse Osmosis Membranes Market with a market share of 40%. The dominance of this region is primarily driven by the increasing demand for water treatment technologies due to rapid industrialization, population growth, and urbanization, particularly in countries like China, India, and Japan. Asia Pacific faces significant water scarcity issues, especially in countries like India and China, where large-scale desalination projects are essential to meet growing water demands. For example, China has been investing heavily in reverse osmosis systems for desalination plants to tackle its water scarcity, with the country being one of the largest consumers of reverse osmosis membranes. India is also focusing on improving its water infrastructure, with numerous industrial and municipal water treatment projects relying on reverse osmosis technologies. Japan, known for its advanced water treatment systems, is another major player in the region, adopting reverse osmosis for both desalination and wastewater reuse. Additionally, the Middle East, particularly countries like Saudi Arabia and the UAE, also contribute significantly to the market, where reverse osmosis is the preferred method for seawater desalination. This region's large-scale investments in water infrastructure and desalination plants solidify its dominant position in the global reverse osmosis membranes market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Alfa Laval (Lund, Sweden)

-

Applied Membranes Inc. (Vista, California, USA)

-

Axeon Water Technologies (Temecula, California, USA)

-

Best Water Technology Group (Langen, Germany)

-

BNKO Environmental Technology (Shanghai) Co. Ltd. (Shanghai, China)

-

DuPont (Wilmington, Delaware, USA)

-

Hydranautics (Oceanside, California, USA)

-

Hyflux Ltd. (Singapore)

-

Kovalus Separation Solutions (Saskatoon, Canada)

-

Koch Separation Solutions (Wichita, Kansas, USA)

-

Keensen Technology Co. Ltd. (Taipei, Taiwan)

-

Lanxess (Cologne, Germany)

-

LG Chem (Seongnam, Gyeonggi-do, South Korea)

-

Mann+Hummel Water & Fluid Solutions (Ludwigsburg, Germany)

-

Membranium (Moscow, Russia)

-

Pall Corporation (Port Washington, New York, USA)

-

Pentair (London, UK)

-

Suez Water Technologies & Solutions (Paris, France)

-

Thermo Fisher Scientific (Waltham, Massachusetts, USA)

-

Toray Industries Inc. (Tokyo, Japan)

-

Toyobo Co. Ltd. (Osaka, Japan)

-

Vontron Technology Co. Ltd. (Shenzhen, China)

Recent Development:

-

November 2024: Toray Industries introduced an innovative reverse osmosis membrane designed to enhance water treatment efficiency while reducing energy consumption. This development aims to meet the rising global demand for sustainable water solutions in large-scale desalination and wastewater treatment.

-

December 2024: LG Water Solutions showcased new membrane and resin technologies at the 2024 IDRA World Congress in December 2024. These advancements focus on enhancing membrane performance and durability, crucial for meeting the increasing demand for efficient water treatment solutions.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

US$ 3.71 Billion |

|

Market Size by 2032 |

US$ 7.84 Billion |

|

CAGR |

CAGR of 8.68% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Cellulose-Based Membrane, Thin Film Composite Membrane, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

DuPont, Toray Industries Inc., LG Chem, Hydranautics, Veolia, Alfa Laval, Mann+Hummel Water & Fluid Solutions, Pentair, Suez Water Technologies & Solutions, Pall Corporation and other key players |

|

Key Drivers |

•Increasing Water Scarcity and Demand for Clean Water Sources drives Reverse Osmosis Membrane Market Growth |

|

RESTRAINTS |

•High Initial Investment and Maintenance Costs Impede the Widespread Adoption of Reverse Osmosis Membranes |