Engineered Stone Market Report Scope & Overview:

Get More Information on Engineered Stone Market - Request Sample Report

The Engineered Stone Market Size was valued at USD 23.3 Billion in 2023. It is expected to grow to USD 39.2 Billion by 2032 and grow at a CAGR of 5.9% over the forecast period of 2024-2032.

The general expansion of the construction industry, especially in developing countries, is one of the factors that boost the demand for engineered stone. Due to rapid urbanization and the growing disposable income of the citizens of the Asia-Pacific, for instance, a plethora of residential and commercial construction projects are currently being launched throughout the region. Correspondingly, more people are in need of stylish and reliable materials to use at their homes and or their workplaces. As a result, greater demand for engineered stone is observed and companies focused on launching new products

In 2023, Caesarstone began introducing a distinctive type of surface with Quartz and Antimicrobial Technology, which incorporates means of preventing bacterial contamination and, hence, is perfect for use in kitchens and bathrooms. Along with the general trend of producing smart home materials, i.e. finding smart solutions to facilitate and automate working processes, which resulted in a 40% increase in demand for smart materials, as suggested in a 2022 report by the U.S. Department of Housing and Urban Development, the identified pattern shapes the growth of the market.

By introducing smart technologies into the process of manufacturing engineered stones, one creates a product that, in addition to aesthetic qualities, serves the needs of modern consumers and the demands to be met by the market. Such factors are likely to fuel the market on a global scale concomitant with the expansion in construction activities across residential, commercial & infrastructure sectors and quartz-based engineered stone gaining popularity. Furthermore, the rising demand for artificial alternatives that are not only attractive but durable as well in comparison with natural stone coupled with the increasing use of green building materials is expected to have a positive impact on the market.

The trend of using engineered stone for sustainable architecture has gained momentum, as the social movement for greener and more sustainable building practices in line with achieving LEED certification is growing worldwide. Thus, in 2021, Cosentino Group introduced the Silestone Eco line, which consists of engineered stone with regulator admixtures. Being manufactured with the use of recycled materials, including post-consumer glass, Silestone Eco reduces waste and complies with sustainability requirements.

As a result, the product has become a favorite among architects and builders aiming at green building initiatives and LEED certification. In 2022, Diresco introduced Bio-UV as another example of engineered stone that emphasizes green marketing, as it is made with bio-resins and complies with the general tendency of green marketing regulation. Thus, the presented products reflect the increasing number of efforts of the key players aimed to satisfy customer demand and meet the rapidly developing regulatory requirements in this sphere of construction.

Engineered Stone Market Dynamics

Drivers

-

High durability and low maintenance drives market growth.

The major trend is the increased use of engineered stone in construction. Its popularity is based on the high value of such stone which is appreciated by homebuilders, especially those choosing low-maintenance and durable materials. It is said to be highly resistant to different issues, such as stains, scratches, and heat, making it ideal for countertops and flooring in homes and other buildings. In this regard, a relevant trend related to new development is Cosentino Group’s launch of the Silestone HybriQ+ technology in 2022. It shows that new developments serve, and this development is no exception as it increases the stone’s strength and introduces certain aspects of sustainability.

It implements new high-recycled materials in the engineered stone that makes the technology less detrimental to the environment and increases the material’s resistance to wear and tear. Here, one should note that the new development is likely to have a higher cost that will place it into a different product class. While the demand for engineered stone is bound to increase, such a product can be viewed as premium, and the eco-friendly characteristics are going to be especially valuable in terms of modern-day construction. A U.S. government construction report claims that there is a noticeable trend toward the use of engineered materials, such as stone, that are less demanding in terms of maintenance and can be used for longer periods reducing long-term costs for construction and homebuilding.

Restraint

Competition from natural stone and alternatives hampers market growth.

Natural stones have always been the distinct choice for anyone who seeks to maintain an organic, raw, and often exclusive look. The premium construction and interior design segments have naturally embraced the product, turning it into a powerful opponent for all possible alternatives. As a result, the market is now supplied with more affordable types of ceramic tiles, laminates, and other engineered surfaces, and concrete surfaces containing stone particles and other materials combined to resemble natural and engineered stone in appearance and, to some extent, in the durability features alike. Such products attract customer and builder attention in terms of budgets, and that is even more so on residential projects, where it is crucial to save costs. Lastly, natural stones present a historical value and are therefore seen as a timeless and never-fake solution for those who are excited about traditional aesthetics.

Engineered Stone Market Segmentation Overview

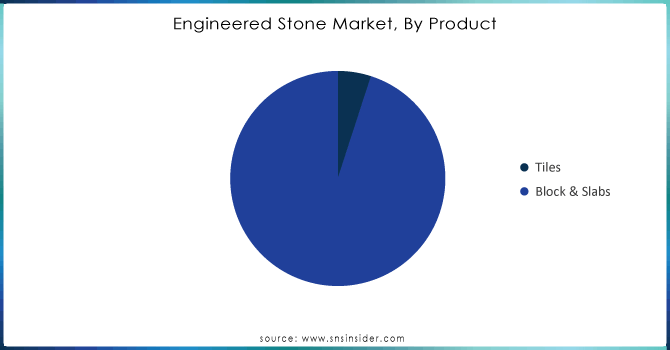

By Product

The blocks & slabs segment held the largest market share around 95% in 2023. This is due to the ease of installation and care. Unlike natural stones, they are almost not subject to stains from most of foods, including oil, wine, and other beverages usually used without coatings, which makes them ideal for kitchens. Engineered blocks and slabs can be made very large, and they are suitable for wet areas, such as bathrooms, swimming pools, showers, and bathtubs, as they are non-porous. The desire to outwardly improve the interior of the premises with the help of beautiful countertops will also contribute to the growth of demand over the reporting period.

Need any customization research on Engineered Stone Market- Enquiry Now

By Application

The countertops segment held the largest market share around 65% in 2023. This demand can be accredited to the product’s stain-resistant properties. Engineered stone slabs are relatively cheaper than natural stones and provide a greater choice regarding shape, design, color, and texture. Engineered stones contain polymeric resins that are not UV stable, leading to the stone becoming off-color and the degradation of the resin binder. In addition, continuous exposure to UV rays will cause the binding materials to harden over time which results in a reduced flexural strength. Engineered stones are thus, not fit for outdoor uses.

The flooring application is anticipated to grow at a CAGR of 4.7% over the forecast period. Engineered stone flooring is gaining popularity in home kitchens, bathrooms, and below-grade basements, owing to its water resistance and non-porous nature. In addition to this, it is used in heavily used flooring areas for its higher wear resistance. The other segment includes wall & exterior coverings, and furnishing items, such as chairs and tabletops. The products are used because of their superior aesthetics, durability, and water & stain resistance properties in the furnishing accessories market.

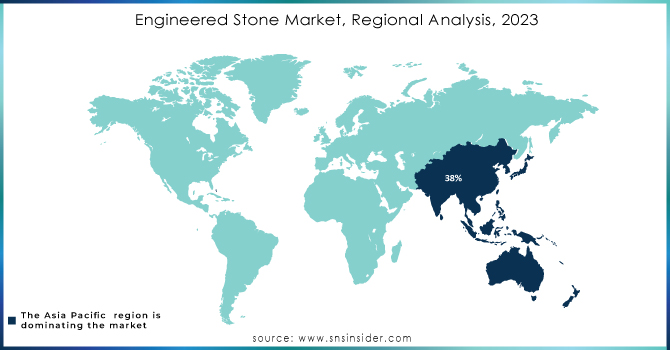

Regional Analysis

Asia Pacific held the largest market share around 38% in 2023. Rapid urbanization and increasing infrastructure investments have been observed in countries such as China, India, and Southeast Asian nations. The construction of buildings has been increasing in both residential and commercial contexts. Engineered stone has been preferred due to its high performance, durability, and aesthetic appeal due to the rising disposal incomes and evolving preferences among consumers. Moreover, the change in preferences from traditional to modern designs with luxurious interiors has been leading to the adoption of engineered stone for various applications such as kitchen countertops, wall cladding, and flooring. Secondly, manufacturing shifted to the region because of the easy availability of raw materials, and production costs are low in the region, and there is further scope for expanding production capacity. Hence Asia-Pacific can be considered a key player in large-scale manufactured production of engineered stone. Several governments and related bodies have announced large funding projects for urban housing and infrastructure, which has further been fueling the growth of the market in Asia-Pacific.

Key Players in Engineered Stone Market

-

Caesarstone Ltd. (Caesarstone Quartz)

-

Cosentino S.A. (Silestone)

-

Dupont (Corian Quartz)

-

LG Hausys Ltd. (HI-MACS)

-

Compac (Compac Quartz)

-

Hanwha L&C (HanStone Quartz)

-

Vicostone (Vicostone Quartz)

-

Cambria (Cambria Quartz)

-

Technistone (Technistone Quartz)

-

Quartzforms (Quartzforms)

-

Stone Italiana S.p.A. (Stone Italiana Quartz)

-

Samsung Radianz (Radianz Quartz)

-

Pental Surfaces (PentalQuartz)

-

Diresco (Diresco Quartz)

-

Santa Margherita (Santa Margherita Quartz)

-

MSI Surfaces (Q Quartz)

-

Belenco Quartz Surfaces (Belenco Quartz)

-

Quarella (Quarella Quartz)

-

Levantina (Levantina Quartz)

-

Lotte Chemical Corporation (Staron Quartz)

Recent Development:

-

In 2023, Cosentino introduced a new series of sustainable engineered stone under its Silestone Sunlit Days collection. This collection is the first of its kind to be carbon-neutral, addressing the growing environmental concerns in the market. The company emphasized its focus on sustainability by using recycled materials in production.

-

In 2023, Diresco, known for its bio-UV engineered stone, introduced a new series of engineered surfaces using biopolymer resins, positioning itself as a leader in eco-friendly engineered stone production. The development highlighted the increasing market shift towards bio-based materials in the construction industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 23.3 Billion |

| Market Size by 2032 | US$ 39.2 Billion |

| CAGR | CAGR of 5.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Tiles, Block & Slabs) • By Application (Countertops, Flooring, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Caesarstone Ltd., Cosentino S.A., Dupont, LG Hausys Ltd., Compac, Hanwha L&C, Vicostone, Cambria, Technistone, Quartzforms, Stone Italiana S.p.A., Samsung Radianz, Pental Surfaces, Diresco, Santa Margherita, MSI Surfaces, Belenco Quartz Surfaces, Quarella, Levantina, Lotte Chemical Corporation. and Others |

| Key Drivers | • High durability and low maintenance drives market growth. |

| RESTRAINTS | • Competition from natural stone and alternatives hampers market growth. |