Bike Sharing Market Report Scope & Overview

The Bike Sharing Market Size was valued at USD 7 billion in 2023 and is expected to reach USD 18.64 billion by 2032 and grow at a CAGR of 11.5% over the forecast period 2024-2032.

Get More Information on Bike Sharing Market - Request Sample Report

Bike sharing has emerged as a popular transportation solution in cities around the world. This service allows individuals to rent bicycles, both conventional and electric, for short-term use. Users can access these bikes from designated stations throughout the city.

Several key demand factors drive the growth in the bike-sharing market. First is the urbanization factor already, over 55% of the world's population resides in an urban setup, which is expected to increase to about 68% by 2050. This rapid shift toward urbanization has increased congestion and pollution, resulting in cities around the globe being forced to adapt to bike-sharing schemes as a sustainable option for transportation. Moreover, ecological consciousness plays an important role: over 70% of city residents already prefer ecologically clean modes of transportation, which raises the demand for bike-sharing services. The convenience and affordability of bike-sharing predisposes it for popularity: close to 60% of users use this service instead of car ownership because it's cheaper and more convenient.

Specifically, technological developments, which include the integration of GPS and mobile applications, improved user experience, boosting subscriptions up to 35% in cities with advanced technological infrastructures. Moreover, governmental promotions of cycling as one of the healthy and eco-friendly means of travel spur the growth of this market. While cities providing subsidies or tax incentives for bike-sharing programs see a 40% increase in adoption rates over cities without such policies, the rise of multi-modal transportation systems-where bike sharing is integrated along with public transit networks-further indicates an increasing demand. Indeed, in cities with a well-interconnected system, the number of public transit users who also use bike-sharing may reach up to 25%, depicting great interlinking of integrated transport solutions and bike-sharing adaption. The afore-mentioned facts together drive the bike-sharing market and are expected to show huge growth in the upcoming years.

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising urbanization fuels demand for convenient and eco-friendly transportation solutions like bike sharing.

As cities around the world grow denser, the need for efficient and environmentally friendly transportation solutions becomes increasingly critical. This is where bike sharing comes in. This system offers a convenient and eco-friendly way to navigate urban environments. With growing populations, cities are seeing a rise in traffic congestion and air pollution. Bike sharing provides an alternative that reduces reliance on cars, contributing to cleaner air and less crowded streets. This makes it an attractive option for both cities and residents seeking sustainable transportation solutions.

-

Technological advancements like mobile apps and GPS tracking make bike sharing user-friendly and efficient.

RESTRAINTS:

-

High initial investment costs for setting up bike sharing infrastructure can limit program adoption.

Though bike sharing offers a multitude of benefits, its widespread adoption can be hampered by the significant upfront investment required. Setting up a bike sharing program necessitates the creation of a network of docking stations or designated parking zones, along with the purchase and maintenance of a fleet of bicycles. These initial costs can be a major hurdle for cities, particularly those with limited budgets.

-

Unfavourable weather conditions, like extreme heat or cold, might deter potential users.

OPPORTUNITIES:

-

Wider availability of electric bikes can attract those seeking a faster and easier riding experience.

-

Offering monthly or yearly subscriptions can attract frequent riders and generate recurring revenue.

CHALLENGES:

-

High upfront costs can make initiating bike sharing programs financially difficult for cities.

-

Vandalism and theft of bikes can be a significant financial burden and discourage ridership.

KEY MARKET SEGMENTS:

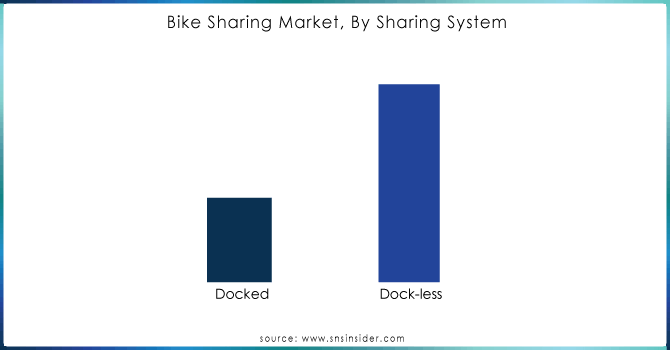

By Sharing System

-

Docked

-

Dock-less

Dockless is the dominating sub-segment in the Bike Sharing Market by sharing system holding around 60-65% of market share. Dockless systems offer unmatched convenience and flexibility. Users can locate and abandon bikes anywhere within the designated service area, eliminating the need to find a docking station. This is particularly appealing in densely populated cities or areas with limited docking infrastructure. Additionally, dockless systems often require less operational expenditure due to the absence of physical docking stations.

Get a Customized Report as per your Business Requirement - Request For Customized Report

By Bike Type

-

Traditional/Convectional Bikes

-

E-Bikes

E-Bikes is the dominating sub-segment in the Bike Sharing Market by bike type holding around 50-55% of market share. E-bikes are gaining ground due to their functionality. The pedal assistance they offer makes them perfect for longer commutes, conquering hilly terrains, or simply providing a less strenuous riding experience. As battery technology improves and concerns about range anxiety diminish, e-bikes are poised to become even more popular.

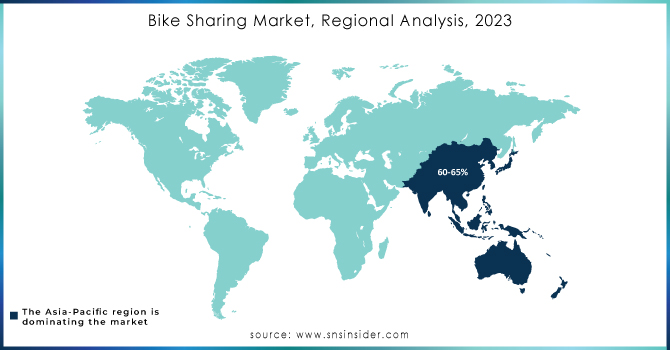

REGIONAL ANALYSES

The Asia-Pacific is the dominating region in the bike sharing market holding 60-65%of market share. This dominance stems from the rapid urbanization creating a demand for efficient transportation, government support through subsidies and infrastructure, and a tech-savvy population readily embracing dockless systems.

Europe is the second highest region in this market fueled by a strong existing cycling culture, a growing focus on sustainability, and investments in dedicated bike lanes.

North America is the fastest growing region with rising traffic congestion, air pollution concerns, and advancements in both battery technology and bike-sharing apps are driving this rapid expansion, along with a shift towards more bike-friendly urban design in some cities.

KEY PLAYERS

The major key players are Bluegogo (China), Neutron Holding, Inc (US), Dropbike (Canada), JCDecaux (France), Motivate (US), Jump Bikes (US), OFO (China), Anywheel Pte. Ltd, Uber Technologies Inc, Bird Rides, Inc, BIXI Montreal, Beijing Xiaoju Technology Co, Ltd., Bond Mobility (Europe) AG, Lime, LYft, Inc., Mobike, Mobycy, Nextbike GmbH, SG Bike Pte Ltd, Spin, Tembici., Youon Technology Co., Ltd and other key players.

RECENT DEVELOPMENTS

- In March 2023: MYBYK introduces two electric bike models: MYBYK Electric for citizens and tourists seeking convenient travel, and MYBYK Electric Cargo designed to assist gig-workers with last-mile deliveries.

- In Dec. 2023: The U.S. government's development agency (DFC) and an inter-American investment bank (IDB Invest) are jointly contributing $23 million to Tembici, a company that rents bikes in Latin American cities. This investment aims to expand bike-sharing options in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7 Billion |

| Market Size by 2032 | US$ 18.64 Billion |

| CAGR | CAGR of 11.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Bike Type (E-Bike, Traditional Bike) • by Sharing System (Docked, Dock-less) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Bluegogo (China), Neutron Holding, Inc (US), Dropbike (Canada), JCDecaux (France), Motivate (US), Jump Bikes (US), OFO (China), Anywheel Pte. Ltd, Uber Technologies Inc, Bird Rides, Inc, BIXI Montreal, Beijing Xiaoju Technology Co, Ltd., Bond Mobility (Europe) AG, Lime, LYft, Inc., Mobike, Mobycy, Nextbike GmbH, SG Bike Pte Ltd, Spin, Tembici. and Youon Technology Co., Ltd. |

| Key Drivers | • Rising traffic congestion as a result of increased car use. • Advancements in ride-sharing navigation technology. |

| RESTRAINTS | • Early investment expenses are substantial. • Frequent maintenance is required. |