AI Assistant Market Report Scope & Overview:

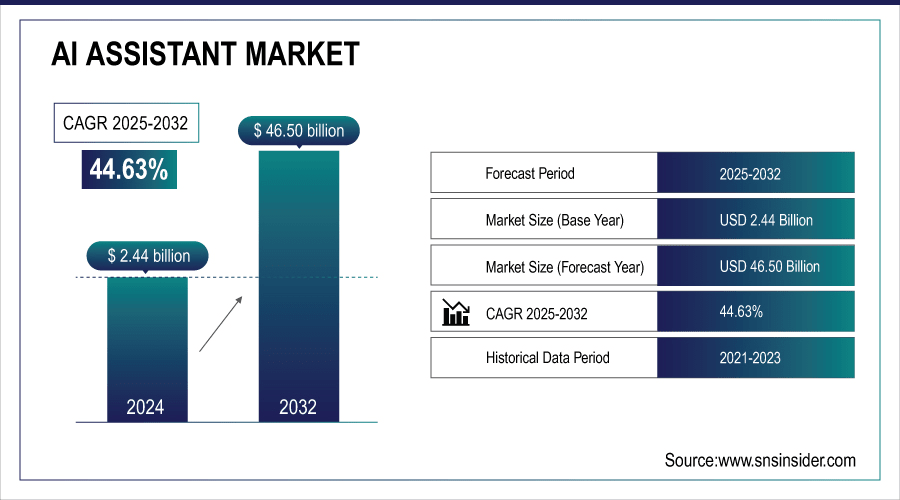

AI Assistant Market was valued at USD 2.44 billion in 2024 and is expected to reach USD 46.50 billion by 2032, growing at a CAGR of 44.63% from 2025-2032.

The AI Assistant Market is witnessing rapid growth due to rising enterprise adoption for productivity enhancement, advancements in natural language processing, and integration with business workflows. Increasing demand for personalized customer experiences, automation in diverse sectors, and expanding SaaS-based deployment models further accelerate adoption, driving sustained market expansion globally.

According to Microsoft, 75% of global knowledge workers are now using AI at work, with 46% having started in the past six months.

Moreover, IBM states that two-thirds of AI leaders report AI has already driven a greater than 25% improvement in revenue growth rate.

To Get More Information On AI Assistant Market - Request Free Sample Report

AI Assistant Market Trends

-

Growing adoption of AI assistants for customer support, marketing, and sales to improve engagement and efficiency.

-

Rising integration with voice, chat, and multimodal platforms is enhancing user experiences.

-

Cloud-based deployment and SaaS models are driving scalability and flexibility.

-

Increasing use of AI assistants in HR, recruitment, and workflow automation is streamlining operations.

-

Advancements in natural language processing (NLP) and generative AI are enabling more contextual and human-like interactions.

-

Expansion across sectors like healthcare, BFSI, IT, and retail is fueling market growth.

-

Focus on data privacy, compliance, and ethical AI is shaping adoption strategies.

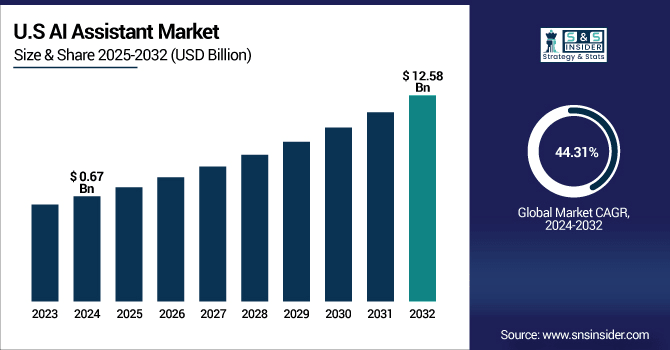

U.S. AI Assistant Market was valued at USD 0.67 billion in 2024 and is expected to reach USD 12.58 billion by 2032, growing at a CAGR of 44.31% from 2025-2032.

The U.S. AI Assistant Market is growing rapidly due to strong adoption across enterprises for customer engagement, workforce productivity, and automation. Advancements in AI, speech recognition, and machine learning enhance performance, while the presence of leading tech players, robust digital infrastructure, and high investment in AI-driven innovations further fuel market expansion.

The U.S. Bureau of Labor Statistics reports that call center agents using AI chat assistants experienced a 14% increase in successfully resolved customer issues, while newer agents saw a 34% boost in productivity.

AI Assistant Market Growth Drivers:

-

Growing adoption of conversational AI for customer engagement and personalized assistance across industries to improve efficiency and reduce costs

The rapid adoption of conversational AI is transforming how businesses engage with customers and streamline operations. AI assistants are increasingly deployed in sectors such as e-commerce, healthcare, banking, and retail to handle customer queries, automate support, and deliver personalized recommendations. Organizations leverage AI assistants to reduce call center workloads, cut operational costs, and enhance user satisfaction. The growing demand for instant, round-the-clock responses fuels widespread integration of these technologies into customer service ecosystems, making AI assistants a critical driver for digital transformation and operational excellence across industries.

-

Microsoft's internal data shows that Copilot users engage significantly more with ads driving 73% higher click-through rates and 16% stronger conversion rates.

-

IBM reports that 97% of customer service providers say conversational AI has a positive impact on customer satisfaction.

-

Microsoft's Work Trend Index indicates that 82% of leaders expect to expand their use of digital labor to boost workforce capacity in the next 12 to 18 months.

AI Assistant Market Restraints:

-

Rising concerns over data privacy and security risks due to continuous AI assistant interactions and sensitive information processing

Concerns around data privacy remain a major barrier for AI assistant adoption. These systems continuously process sensitive personal and business information, creating risks of misuse or breaches. Fear of surveillance, identity theft, and unauthorized access limits user confidence and slows down enterprise deployment. Additionally, strict data protection regulations such as GDPR and evolving global compliance frameworks increase challenges for companies implementing AI assistants. Businesses must invest heavily in cybersecurity infrastructure and transparent data practices to address these concerns. Without robust safeguards, privacy issues may significantly hinder large-scale adoption of AI assistants across industries and consumer markets.

-

IBM highlights several AI privacy risks, including the collection of sensitive data without consent, unchecked surveillance, and data leakage. These concerns are particularly pertinent as AI systems often require large volumes of data, increasing the potential for privacy violations.

-

The U.S. National Institute of Standards and Technology (NIST) has launched a Cybersecurity, Privacy, and AI Program to address AI-related cybersecurity and privacy risks. The program aims to understand how advancements in AI may affect cybersecurity and privacy risks, identify needed adaptations for existing frameworks and guidance, and fill gaps in existing resources.

AI Assistant Market Opportunities:

-

Rising demand for multilingual and localized AI assistants to enhance inclusivity and expand adoption across emerging global markets

The increasing demand for AI assistants that support multilingual and localized interactions creates strong opportunities for global adoption. Emerging markets with diverse linguistic populations require AI systems tailored to local languages and cultural nuances. This opens avenues for companies to expand services into regions such as Asia-Pacific, Latin America, and Africa. Enhanced inclusivity also strengthens customer engagement and accessibility in underserved areas. As organizations prioritize cross-border operations and global customer bases, AI assistants with multilingual capabilities become essential. Developing localized, culturally adapted assistants allows firms to tap into untapped markets, driving growth and international expansion.

-

Oracle Digital Assistant offers native multilingual support, enabling organizations to add training data in multiple languages without relying on external translation services. This capability enhances engagement and expands use beyond English-speaking populations.

-

Salesforce Einstein Generative AI supports over three dozen languages, including Polish and Vietnamese, across all regions. This extensive language support facilitates broader customer engagement and service delivery.

AI Assistant Market Segment Highlights

-

By Offering, Analytical & Spreadsheet Assistants dominated with ~16% share in 2024; Writing & Content Assistants fastest growing (CAGR 46.91%).

-

By Function, Customer Support & Chatbot Assistants dominated with ~28% share in 2024; Personal Productivity Assistants fastest growing (CAGR 47.82%).

-

By Integration Type, SaaS-Native Assistants dominated with ~34% share in 2024; API-Based Assistants fastest growing (CAGR 48.23%).

-

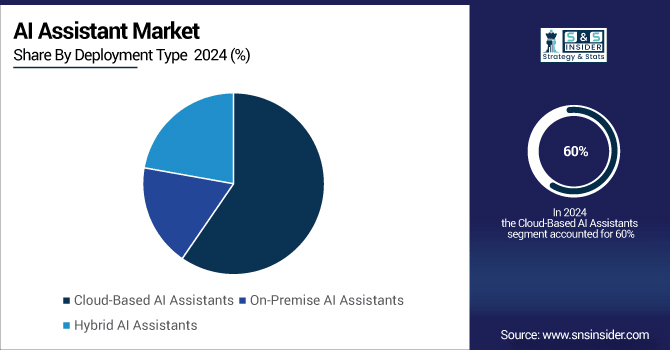

By Deployment, Cloud-Based AI Assistants dominated with ~60% share in 2024; Hybrid AI Assistants fastest growing (CAGR 47.32%).

AI Assistant Market Segment Analysis

By Deployment Type, Cloud-Based AI Assistants led while Hybrid AI Assistants are projected to grow fastest

Cloud-Based AI Assistants segment dominated the AI Assistant Market in 2024 due to their ability to provide scalable infrastructure, faster deployment, and cost-efficient access to advanced AI capabilities. Organizations choose cloud deployment to support global accessibility, real-time data synchronization, and flexible integration, aligning with the growing reliance on cloud computing across industries worldwide.

Hybrid AI Assistants segment is expected to grow at the fastest CAGR from 2025 to 2032 as enterprises seek solutions combining on-premise security with cloud scalability. These assistants address data privacy concerns while delivering flexible performance, making them suitable for industries handling sensitive information such as healthcare, finance, and government operations.

By Offering, Analytical and Spreadsheet Assistants dominated while Writing and Content Assistants are expected to grow fastest

Analytical & Spreadsheet Assistants segment dominated the AI Assistant Market in 2024 due to their critical role in simplifying complex data analysis, streamlining reporting, and enhancing decision-making efficiency. Enterprises across finance, operations, and business intelligence rely heavily on these solutions to save time, reduce human error, and improve productivity in managing large datasets.

Writing & Content Assistants segment is expected to grow at the fastest CAGR from 2025 to 2032 driven by increasing demand for automated content creation, personalized marketing, and digital storytelling. Businesses, educators, and media platforms are adopting these tools to accelerate content production, improve creativity, and maintain consistency across multiple formats and languages.

By Function, Customer Support and Chatbot Assistants led while Personal Productivity Assistants are projected to expand fastest

Customer Support & Chatbot Assistants segment dominated the AI Assistant Market in 2024 owing to their ability to provide round-the-clock customer service, automate query resolution, and reduce operational costs. Companies in retail, banking, telecom, and healthcare integrate chatbots to enhance customer satisfaction, streamline service delivery, and support high volumes of real-time interactions efficiently.

Personal Productivity Assistants segment is expected to grow at the fastest CAGR from 2025 to 2032 as individuals increasingly adopt digital tools to manage schedules, emails, reminders, and tasks. Integration with smart devices and workplace platforms enhances efficiency and convenience, making these assistants central to daily routines and professional productivity enhancement.

By Integration Type, SaaS-Native Assistants dominated while API-Based Assistants are expected to grow fastest

SaaS-Native Assistants segment dominated the AI Assistant Market in 2024 due to their seamless integration within cloud applications, enabling real-time collaboration, workflow automation, and cross-platform accessibility. Enterprises prefer these solutions for scalability, cost efficiency, and flexibility, as they align with the global shift toward cloud-first business strategies and digital transformation initiatives.

API-Based Assistants segment is expected to grow at the fastest CAGR from 2025 to 2032 fueled by demand for customizable, developer-friendly solutions that integrate with enterprise systems. Businesses adopt these assistants to build tailored workflows, enhance interoperability, and extend AI capabilities, enabling greater adaptability and innovation across diverse industries and organizational processes.

Key AI Assistant Market Regional Analysis

-

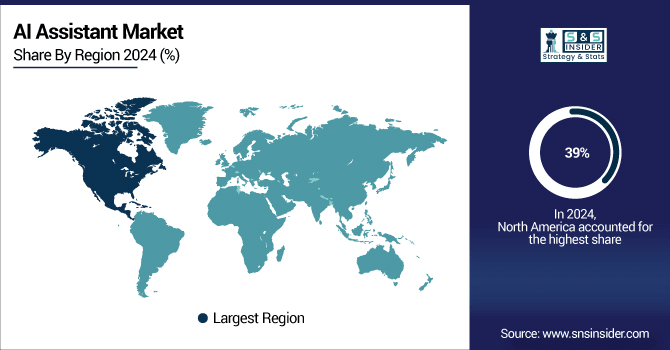

By Region, North America dominated with ~39% share in 2024; Asia Pacific fastest growing (CAGR 47.04%).

North America AI Assistant Market Insights

North America dominated the AI Assistant Market in 2024 with the highest revenue share due to early adoption of advanced technologies, strong presence of leading AI companies, and high investment in research and development. Enterprises across industries such as healthcare, finance, and retail deploy AI assistants to enhance customer service, productivity, and decision-making, while robust digital infrastructure and supportive regulatory frameworks further strengthen the region’s leadership in market growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

The U.S. Department of Commerce's Bureau of Industry and Security (BIS) requires companies developing dual-use AI models to report activities, ensuring safety, reliability, and cybersecurity for AI in defense and critical applications.

-

The U.S. government emphasizes AI as a strategic priority, with the 2023 National AI R&D Strategic Plan focusing on sustained foundational research and innovation to maintain global leadership and competitiveness.

-

The U.S. House of Representatives formed a Bipartisan AI Task Force to guide AI adoption, governance, and innovation, emphasizing responsible deployment, regulatory oversight, and mitigation of potential ethical and technological risks.

-

The General Services Administration (GSA) maintains an AI Use Case Inventory, documenting federal AI applications to promote transparency, knowledge sharing, best practices, and efficient adoption of AI technologies across public-sector agencies.

Asia Pacific AI Assistant Market Insights

Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2032 driven by rapid digital transformation, rising smartphone and internet penetration, and expanding use of AI assistants in e-commerce, banking, and education. Governments and enterprises in countries like China, India, and Japan are investing heavily in AI adoption, while growing multilingual demand and rising consumer tech usage accelerate market expansion across the region.

-

In 2024, the Singaporean government announced a USD 554 million investment over five years to enhance national AI capabilities and implement the National AI Strategy 2.0, focusing on cultivating a trustworthy AI ecosystem and secure implementation.

Europe AI Assistant Market Insights

Europe in the AI Assistant Market is experiencing steady growth, supported by strong government initiatives, digital transformation strategies, and increasing enterprise adoption across industries such as finance, healthcare, and retail. The region emphasizes data privacy, ethical AI, and regulatory compliance, driving trust in AI technologies. Expanding multilingual capabilities and rising demand for personalized solutions further strengthen adoption and market development across European countries.

-

The European AI Act, which entered into force in August 2024, aims to foster responsible AI development and deployment in the EU, addressing potential risks to citizens’ health, safety, and fundamental rights.

Middle East & Africa and Latin America AI Assistant Market Insights

Middle East & Africa in the AI Assistant Market is growing steadily due to rising smart device adoption, digital government initiatives, and increasing demand for automated customer engagement. Latin America is witnessing expansion driven by rapid e-commerce growth, mobile-first users, and cost-efficient AI adoption. Both regions face infrastructure and investment challenges but offer significant opportunities for scalable, localized AI assistant solutions.

AI Assistant Market Competitive Landscape:

Microsoft

Microsoft is a key player in the AI Assistant Market, leveraging its Azure AI platform, Cortana, and Microsoft 365 integrations. The company focuses on enhancing workplace productivity, collaboration, and enterprise automation through advanced natural language processing, cloud-based AI services, and continuous innovation, driving widespread adoption across global businesses and sectors.

-

February 2025: Microsoft released a standalone Copilot app for macOS on February 27, enhancing Mac user productivity with AI-driven support for web search, writing, and navigation bringing advanced Copilot features beyond Windows.

-

October 2024: Microsoft launched autonomous AI agents at Ignite 2024, enabling enterprises to streamline sales, finance, and supply chain workflows. These agents automate tasks intelligently, advancing Copilot’s integration into business-critical operations.

-

November 2023: Microsoft rebranded and expanded Copilot across Windows, Edge, Bing, and Microsoft 365, introducing Pro and Voice-enabled versions in late 2023, unifying its AI assistant ecosystem for consumer and enterprise productivity.

Google is a leading contributor to the AI Assistant Market through its Google Assistant and AI-driven services integrated across Android, Google Workspace, and smart devices. By leveraging advanced machine learning, natural language understanding, and cloud infrastructure, Google enhances productivity, personalization, and automation. Continuous innovation and ecosystem expansion strengthen its market presence and drive widespread adoption globally.

-

March 2025: Google launched an experimental AI Mode in Search with Gemini 2.0, offering advanced query handling and AI-generated answers. Available in Search Labs, it is exclusive to Google One AI Premium subscribers.

-

May 2025: Google introduced Project Mariner, a browsing agent integrated with Gemini API and AI Mode. It automates tasks like shopping and form-filling while retaining user oversight, expanding Gemini’s assistant-like functionalities.

Salesforce

Salesforce plays a significant role in the AI Assistant Market with its Einstein AI platform, integrated across Salesforce CRM and business applications. It enables intelligent automation, predictive analytics, and personalized customer engagement. By enhancing sales, marketing, and service workflows, Salesforce empowers enterprises to improve efficiency and decision-making, driving adoption of AI assistants across diverse industries globally.

-

February 2025: Salesforce launched Agentforce 2.0, introducing AI agent integration into Slack with workflow building, natural-language agent creation, and a Tableau semantic layer available to customers beginning February 2025.

-

May 2024: Salesforce expanded its Einstein Copilot portfolio deploying AI assistants tailored for merchants, marketers, and personalization, powered by Data Cloud to enhance ecommerce content and promotions.

Zoom

Zoom is a prominent player in the AI Assistant Market, integrating AI-powered features within its video conferencing and collaboration platform. Its AI assistants facilitate meeting transcription, real-time language translation, scheduling automation, and productivity analytics. By enhancing remote communication and team collaboration, Zoom strengthens user engagement and workflow efficiency, driving widespread adoption of AI assistant solutions across enterprises globally.

-

June 2025: Zoom Unveiled Virtual Agent 2.0, a 24/7 AI receptionist for Zoom Phone that handles caller intents like bookings or inquiries in multiple languages and integrates with Zoom Contact Center and CRM platforms.

-

March 2024: Zoom Launched Zoom Workplace, an AI-powered collaboration platform featuring Ask AI Companion summarizes content, schedules prep, and supports multi-channel workflows across Meetings, Team Chat, and more.

Key Players

Some of the AI Assistant Market Companies

-

Microsoft

-

Google

-

Salesforce

-

Oracle

-

Monday

-

ClickUp

-

DocuSign

-

Lucid Software

-

Gamma

-

Glean

-

Otter.ai

-

x.ai

-

Fathom

-

Scribe AI

-

Tome

-

Jasper

-

Copy.ai

-

Supernormal

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.44 Billion |

| Market Size by 2032 | USD 46.50 Billion |

| CAGR | CAGR of 44.63% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Function (Customer Support & Chatbot Assistants, Voice & Speech Assistants, Personal Productivity Assistants, Marketing & Campaign Assistants, HR & Recruitment Assistants) • By Offering (Writing & Content Assistants, Meeting & Collaboration Assistants, Knowledge & Research Assistants, Scheduling & Calendar Optimization Assistants, Sales & Prospecting Assistants, Developer Productivity Assistants, Presentation & Design Assistants, Analytical & Spreadsheet Assistants) • By Integration Type (Standalone Assistants, SaaS-Native Assistants, Browser Extensions/Plug-ins, API-Based Assistants, Workspace Add-Ons) • By Deployment Type (Cloud-Based AI Assistants, On-Premise AI Assistants, Hybrid AI Assistants) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microsoft, Google, Zoom, Salesforce, Oracle, Monday, ClickUp, DocuSign, Lucid Software, Gamma, Canva, Glean, Otter.ai, x.ai, Fathom, Scribe AI, Tome, Jasper, Copy.ai, Supernormal |