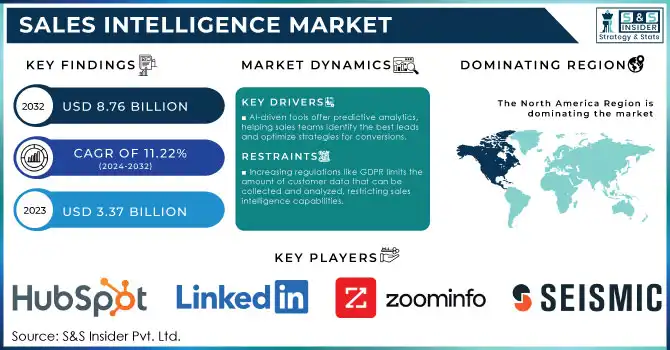

Sales Intelligence Market Size & Overview:

The Sales Intelligence Market was valued at USD 3.37 billion in 2023 and is expected to reach USD 8.76 billion by 2032, growing at a CAGR of 11.22% over 2024-2032.

The sales intelligence market is experiencing steady growth, supported by an ever-increasing demand for data-driven intelligence to optimize sales strategies. Since sales intelligence is critical to the process of lead generation, customer acquisition, and customer retention, organizations can leverage sales intelligence tools to better target potential customers with enriched data and more advanced analytics. One of the most notable factors fuelling the development of this market is the incorporation of artificial intelligence (AI) and machine learning technologies. With these innovations, businesses can also use predictive analytics which helps sales teams understand what customers want and how they will behave and thus could provide a better conversion rate and sales cycle. In other words, those sales intelligence tools that run on AI can seamlessly automate lead searching and offer suggestions on how to connect with high-quality leads, improving the overall efficiency of the sales process. Growing cloud technology is also an important driving force for market expansion. Cloud-based sales intelligence solutions are often scalable, flexible, and easily accessible, and because of this, they are suitable for businesses of all sizes. Hence, a growing number of small and medium enterprises (SMEs) are rolling out these solutions into their process. Data analytics has changed the game, allowing these companies to fully leverage the same set of advanced tools only accessible by these larger enterprises for their advantage in the marketplace.

Sales Intelligence Market Size and Forecast

-

Market Size in 2023: USD 3.37 Billion

-

Market Size by 2032: USD 8.76 Billion

-

CAGR: 11.22% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2023

Get More Information on Sales Intelligence Market - Request Sample Report

Sales Intelligence Market Trends:

-

Widespread adoption of AI-driven lead scoring and prospecting is improving conversion rates by 25–35% across B2B sales teams.

-

Integration with CRM and marketing automation platforms is accelerating, with over 65% of enterprises connecting sales intelligence tools to unified customer data systems.

-

Growing demand for real-time intent data and buyer signals is increasing platform usage, boosting pipeline accuracy by 30%.

-

Rising focus on account-based selling (ABS/ABM) is driving adoption, with more than 55% of B2B organizations using sales intelligence for targeted outreach.

-

Expansion of predictive analytics and data enrichment capabilities is reducing research time for sales reps by 40–50%, improving productivity and engagement rates.

Furthermore, the increased adoption of customer relationship management (CRM) systems has propelled the sales intelligence industry. Through the integration of sales intelligence solutions with CRM systems, businesses can track customer interactions and gather insights that will enable them to create targeted sales strategies. It helps companies convert leads into sales faster by making customer data management easy for them and thus enhancing the overall customer experience they deliver.

Companies working in this space continue to improve the functionality of sales intelligence tools through features such as lead scoring, data management, and sales forecasting. All these enhancements allow organizations to obtain better answers regarding customer behavior and market trends that help them gain a competitive edge through more informed decisions. To conclude, the sales intelligence market is going through rapid growth due to AI, cloud solutions, and the need for data analytics to provide better sales processes. The ever-evolving and competitive landscape urges enterprises to make better decisions, based on the data available, and thus they will continue to raise the demand for advanced sales intelligence solutions.

Sales Intelligence Market Dynamics

Drivers

-

AI-driven tools offer predictive analytics, helping sales teams identify the best leads and optimize strategies for conversions.

-

The shift to cloud-based sales intelligence solutions offers scalability and ease of access, benefiting businesses of all sizes.

-

Companies increasingly rely on data insights to make informed decisions, leading to higher adoption of sales intelligence solutions.

As businesses operate in an increasingly fast-paced environment, the reliance on big data for informed decision-making has led to the rise of sales intelligence solutions. Sales intelligence is defined as tools and technologies that help businesses obtain and provide the info in customer behavior analytics to optimize their sales and generate revenue. By leveraging a vast array of data—from customer preferences and purchasing patterns to competitor analysis—sales teams can make informed decisions, amend their strategies, and anticipate customer demands successfully. A major reason for this accelerated dependence on data insights is the power to access real-time analytics. Sales intelligence platforms empower businesses to track customer interactions and behaviors, in real-time, allowing them to take a faster approach to shifting situations. The ability to get this real-time feedback enables sales teams to adapt their approaches, react to early signs of trouble, and uncover new opportunities. Also, with even more companies understanding customer centricity, sales intelligence helps them provide more tailored experiences. Data-driven insights into specific customer profiles allow sales teams to understand which products, offers, or services to recommend, leading to a more enjoyable customer experience and improved conversion rates.

These trends of moving sales towards data-driven decision-making correlate with the larger trends of digital transformation. Gone are the days of cold calling and manually sending out an email; instead, data-driven and modern sales techniques are taking over. This transformation is driven by the combined power of sales intelligence platforms, which automate most lead generation, scoring, and follow-up processes. Focus on productivity and cost management: By automating these tasks, organizations can better utilize their resources and become more efficient and cost-effective than they ever thought possible.

Thus, the growing dependence of businesses on data insights is one of the major growth factors of the sales intelligence market since organizations in every industry are trying to tap their data in order to stay competitive and attain sustained growth.

Restraints

-

Increasing regulations like GDPR limits the amount of customer data that can be collected and analyzed, restricting sales intelligence capabilities.

-

The initial cost of setting up sales intelligence systems, including software, hardware, and training, can be a barrier for smaller companies.

-

Sales intelligence is only effective when the data is accurate, and poor data quality can undermine decision-making, causing companies to hesitate in adopting such solutions.

In the Sales Intelligence Market, the effectiveness of sales intelligence tools is highly dependent on the quality of the data they process. These tools gather and analyze large amounts of data to generate insights that guide business decisions, uncover sales opportunities, and strengthen customer relationships. However, if the data feeding into these systems is inaccurate, incomplete, or outdated, the value of these tools diminishes substantially.

Inaccurate data can lead businesses to make misguided decisions. For example, a sales team working with incorrect customer details might chase outdated or irrelevant leads, neglecting high-value prospects. This issue becomes more significant in dynamic industries where customer preferences, buying patterns, and market conditions are continuously evolving, meaning that bad data can have far-reaching consequences. Furthermore, poor-quality data affects the predictive capabilities of sales intelligence systems. These systems use data analytics, machine learning, and AI to forecast future sales trends and suggest strategies. However, if the data is flawed, these predictive models become unreliable, causing companies to lose confidence in the tools. Studies have shown that about 40% of organizations struggle with inaccurate data, which impedes the successful deployment of sales intelligence tools.

The situation worsens as businesses accumulate increasing volumes of data through customer interactions, sales transactions, and market analytics. Ensuring that all of this information remains accurate and current is a growing challenge. To overcome this, organizations must implement robust data governance strategies to preserve the integrity and usefulness of their sales intelligence systems. As companies contemplate adopting sales intelligence technologies, the concern about making decisions based on unreliable data can hinder their willingness to invest. Ensuring that the data is clean, accurate, and integrated properly into these systems is therefore crucial for maximizing the benefits of sales intelligence solutions. Data quality thus stands as a pivotal factor in both operational success and the strategic decision to adopt these tools.

Sales Intelligence Market Segmentation Analysis

By Application

The lead management segment held the largest revenue share of 36.7% in 2023 and is expected to grow at the fastest CAGR throughout the forecast period. Due to this significant share, the use of AI platforms has gained immense popularity to generate leads and grow businesses. Several large enterprises and SMEs use LinkedIn Sales Navigator — a cloud-based sales intelligence platform developed by LinkedIn Corporation for lead management, for example.

Over the forecast period, the data management segment is expected to record the second-highest CAGR of 10.9% with the increase in the touchpoints and use cases in business functions, and thus an exponential increase in the complexity and number of data that an enterprise generates, robust data management solutions are required.

By Offerings

The software segment held the largest revenue share of 86.7% in 2023. The reason for such a high share is that most sales intelligence software can be integrated and seamlessly deployed within existing systems, like marketing platforms and Customer Relation Management (CRM) systems. It is usually favorable to enable the availability of multiple deployment options and good-quality data enrichment. In addition to that, the prevalence of lead-generation software tools among organizations reinforces the uptake of these solutions in the market.

There are multiple companies that provide sales intelligence software for different purposes like lead management, data management, risk management, data analytics, etc. For example, DueDil Ltd, a U.K.-based research company that-source database service, offers an AI platform, called DueDil for BFSI, Fin-Tech, and B2B technology industry horizontals. This tool is mainly used for lead management, risk management, and business growth features.

The service segment is anticipated to exhibit the highest CAGR rate over the forecast period. Sales intelligence services are cloud-based, always updating data, and could be used by organizations of any size. This makes it a great asset for businesses that want to stay ahead of the competition. Besides, the service offerings segment is anticipated to grow significantly owing to the high AI adoption. With the help of artificial intelligence, sales intelligence services can simply automate tasks like lead generation and qualification. This allows sales professionals to engage in more high-level tasks such as closing deals.

By Deployment

The cloud segment held the largest revenue share of 64.4% in 2023 and is expected to grow at the highest CAGR during the forecast period. The reason for this high share is that the cloud solutions omit the firewall limitations that can restrict the access of users for an on-premise solution. In addition, storage capacity that rarely runs out is also offered in cloud object storage service, which improves scalability and limits the volume of locally-placed hardware.

The CAGR of the on-premise segment is projected to be considerably higher over the forecast period due to the high levels of security and privacy afforded by the on-premises solutions. Similarly, on-premise solutions leverage edge analytics that minimize bandwidth demand. The integration of these solutions with on-premise deployment adds more speed and provides more reliable results.

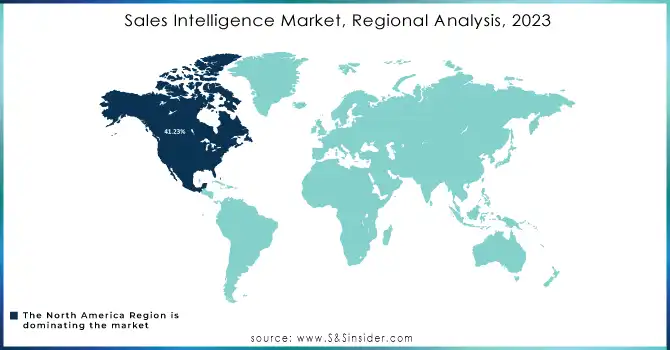

Sales Intelligence Market Regional Analysis

North America led the sales intelligence market and held the largest revenue share of 41.23% in 2023. This wide share is due to a large number of sales intelligence vendors. Numerous companies, from niche tech giants to sales intelligence platform start-ups, are building tailored solutions for specific verticals. For example, LinkedIn Corporation (U.S.) is one of the most preferred and trusted lead management applications. It provides the Sales Navigator platform to help you target the appropriate companies and clients and reach out to them in a tailored manner. In the retail segment, data is fuelling the advancements towards understating and anticipating customer needs in a whole new fashion. Sales intelligence deployment in this segment across different regions, facilitates the sales team to receive information from beacons, wearables, PoS terminals, and CRMs among other databases in larger volumes. The concept of sales and trade intelligence is helping retailers solidify their position . It also supports transformation to a vibrant intelligent and agile retail enterprise.

The Asia Pacific is anticipated to register the highest CAGR throughout the forecast period. The increase is due to the rapid rise of FinTech investment in sales intelligence. In addition, a rising number of AI start-ups in the region are boosting the adoption of sales intelligence solutions and services to automate order processing and improve sales productivity.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

The major key players along with their products are

-

Salesforce – Sales Cloud

-

HubSpot – Sales Hub

-

LinkedIn – LinkedIn Sales Navigator

-

InsideSales – Predictive Sales

-

ZoomInfo – Engage

-

Seismic – Sales Enablement Platform

-

Chorus.ai – Conversation Analytics

-

Outreach – Outreach Sales Engagement Platform

-

LeadSquared – Lead Management Software

-

PandaDoc – Document Automation

-

Domo – Domo for Sales Intelligence

-

DataFox (Oracle) – Data Enrichment Tool

-

Clearbit – Data Enrichment Tools

-

Clari – Revenue Operations Platform

-

Reply.io – Sales Automation Platform

-

SleekFlow – Omnichannel Sales Intelligence

-

Apollo.io – Sales Engagement Software

-

VanillaSoft – Lead Management Solution

-

People.ai – Revenue Intelligence Platform

-

Kissflow – Sales Process Automation

Recent Developments in the Sales Intelligence Market

-

In December 2023, Dux-Soup introduced a cloud-based option to enhance its LinkedIn automation tools, enabling improved scalability and lead generation. This advancement integrates smoothly with existing sales intelligence platforms, boosting efficiency.

-

Intellimize launched AI-driven Account-Based Marketing (ABM) experiences in November 2023. This solution empowers B2B SaaS firms to boost revenue by tailoring marketing efforts for specific accounts, utilizing AI to personalize the customer experience.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.37 Bn |

| Market Size by 2032 | US$ 8.76 Bn |

| CAGR | CAGR of 11.22% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Software, Service) • By Application (Analytics and Reporting, Data Management, Lead Management, Others) • By Deployment (Cloud, On-Premises) • By Organization Size (SMEs, Large Enterprises) • By Vertical (BFSI, IT & Telecom, Retail & E-Commerce, Healthcare, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Salesforce, HubSpot, LinkedIn, InsideSales, ZoomInfo, Seismic, Chorus.ai, Outreach, LeadSquared, PandaDoc, Domo, DataFox (Oracle), Clearbit, Clari, Reply.io, SleekFlow, Apollo.io, VanillaSoft, People.ai, Kissflow |

| Key Drivers | • AI-driven tools offer predictive analytics, helping sales teams identify the best leads and optimize strategies for conversions. • The shift to cloud-based sales intelligence solutions offers scalability and ease of access, benefiting businesses of all sizes. • Companies increasingly rely on data insights to make informed decisions, leading to higher adoption of sales intelligence solutions. |

| Market Restraints | • Increasing regulations like GDPR limits the amount of customer data that can be collected and analyzed, restricting sales intelligence capabilities. • The initial cost of setting up sales intelligence systems, including software, hardware, and training, can be a barrier for smaller companies. • Sales intelligence is only effective when the data is accurate, and poor data quality can undermine decision-making, causing companies to hesitate in adopting such solutions. |