AI Companion App Market Report Scope & Overview:

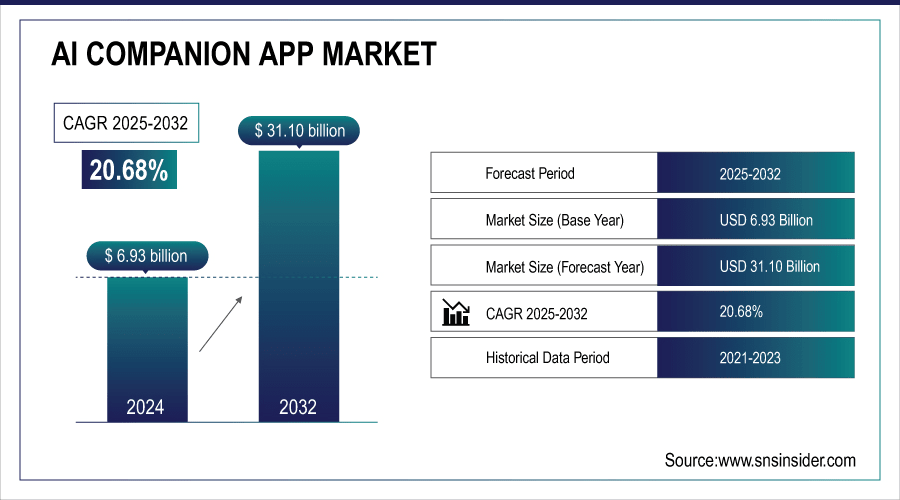

The AI Companion App Market Size was valued at USD 6.93 Billion in 2024 and is expected to reach USD 31.10 billion by 2032 and grow at a CAGR of 20.68% over the forecast period 2025-2032.

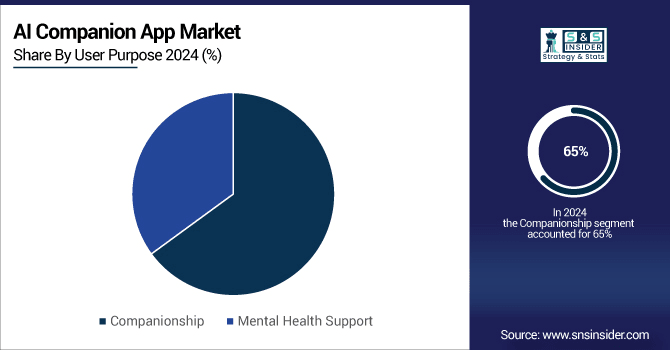

The growth of the AI Companion App Market is primarily driven by rising demand for personalized digital interactions and emotional support solutions. Younger demographics, particularly teenagers and young adults, are increasingly turning to AI companions for entertainment, roleplay, and social connection, fueling market adoption. At the same time, the integration of advanced technologies such as natural language processing (NLP), behavioral learning, and custom avatar design has made these applications more realistic, engaging, and emotionally responsive, encouraging daily engagement. According to study, AI companions for mental health support accounted for ~35% of usage in 2024.

To Get More Information On AI Companion App Market - Request Free Sample Report

AI Companion App Market Trends

-

Rising demand for personalized and interactive digital companions is driving market adoption.

-

Teenagers and young adults increasingly engage with AI companions for social interaction, entertainment, and roleplay.

-

High daily engagement rates encourage continuous interaction and strengthen user retention.

-

Integration of custom avatars, behavioral learning, and NLP enhances realism and emotional responsiveness

-

Widespread smartphone adoption, particularly Android devices in emerging markets, expands accessibility and user base.

-

Growing focus on mental health supports adoption for stress, anxiety, depression, and loneliness management.

-

Inclusion of CBT tools, mood tracking, and personalized coping strategies enhances user experience across all age groups.

-

Rising awareness and destigmatization of mental health issues boost acceptance of AI wellness applications.

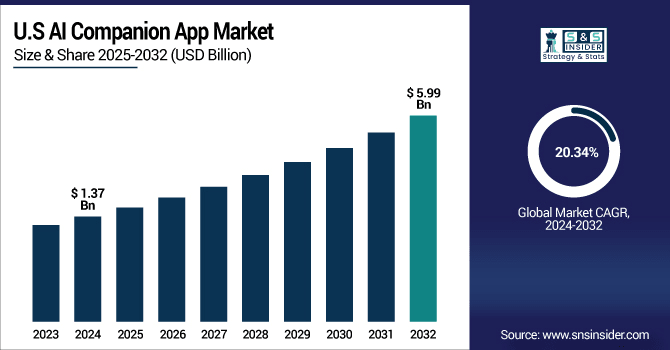

The U.S. AI Companion App Market size was USD 1.37 billion in 2024 and is expected to reach USD 5.99 billion by 2032, growing at a CAGR of 20.34% over the forecast period of 2025-2032. driven by high smartphone penetration, advanced digital literacy, and widespread internet access. Consumers, especially teenagers and young adults, are increasingly adopting AI companions for social interaction, entertainment, and emotional support.

AI Companion App Market Growth Drivers:

-

Rising Demand for Personalized and Interactive Digital Companions

Rising interest in customized and engaging digital companions is a major factor driving growth in the AI Companion App Market. The users and the young adults (teenagers in particular) are looking for productive experiences that give them social interaction, emotional support, entertainment, etc. Custom avatars, behavioral learning, and natural language processing (NLP) enhance the human-like and emotional reactivity of the AI companions. People check in every day and stay for hours, chatting and role playing with AI companions and generating personalized content. Moreover, with the relevance of smartphones, especially android based devices in emerging markets increases the applicability of the apps to be distributed to a larger population in the world.

Teenagers represent around 20% of active users, highlighting early adoption trends.

AI Companion App Market Restraints:

-

Data Privacy Concerns and Ethical Challenges Limiting Adoption

Inspite of increasing market, privacy and ethical issues act as a major restraint. Many AI companion apps analyze intimate personal data conversations, emotional states, behavioral patterns, to ‘better cater’ to the user. If this data is mismanaged or falls into the wrong hands, it can result in users losing trust in the crypto sector or regulators taking close notice of the sector. In addition, fear of over-reliance on artificial intelligence for emotional support, possible psychological consequences, and the moral use of these AI-led interactions can dissuade potential users from using these apps. To avoid these risks, developers do need to invest in strong data protection measures, as well as transparent AI ethics policies.

AI Companion App Market Opportunities:

-

Expansion into Mental Health and Wellness Applications

AI companion apps can take advantage of a global opportunity, as mental health is increasingly in the spotlight. Besides entertainment, these set of apps can be real, affordable, easy to access, and scalable digital therapists for the management of stress, anxiety, depression, and loneliness. Combining CBT tools, mood tracking, and personalized coping strategies would ensure cross-age adoption. Given the increase in awareness and de-stigmatization around mental health issues, AI companions can appeal to not only younger demographics targeting also adults and seniors allowing for high-growth potential in the mental wellness portion of the market.

Users engaging daily with mental wellness features account for ~64% of total mental health app interactions.

AI Companion App Market Segment Analysis

-

By User Demographics: Young Adults led the market with approximately 40.10% share, while Seniors are the fastest-growing segment with a CAGR of 27.84%.

-

By User Purpose: Companionship dominated the market in 2024 with around 65% share, whereas Mental Health Support design is growing the fastest at a CAGR of 21.03%.

-

By Technology Platforms: Android held the leading position in 2024 with roughly 59.96% share, with fastest-growing technology segment at a CAGR of 20.75%.

-

By Functionality Features: Custom AV Character Design led the market in 2024 with approximately 55.10% share, while Behavioral Leaing is the fastest-growing application at a CAGR of 15.91%.

-

By User Engagement Level: Daily Engagement is dominated in 2024 with around 65.04% share, and fastest-growing strategy with a CAGR of 20.81%.

AI Companion App Market Segmentation Analysis:

-

By User Purpose, Companionship Leads Market While Mental Health Support Fastest Growth

Companionship AI currently heads the App Market for AI Companion apps, that expanded due to the demand for social interaction, entertainment & role play experiences in 2024. The rise of users using AI companion to create virtual friends, be a part of detailed storytelling and enjoy tailored digital experience. Because AI apps need to take care of teenagers and young adults more than any other segment by offering emotional connection as well as daily engagement, demand in this segment is the biggest. However, the fastest growing segment Mental Health Support is having fastest growth, due to increasing popularity & intake of emotional wellness and stress management. Mental health remains a top priority during the pandemic and tapping into this high-growth opportunity, AI companions provide CBT tools, mood tracking, and personalization to adults and seniors.

-

By User Demographics, Young Adults Lead Market While Seniors Fastest Growth

Young Adults are the highest users of AI companion apps in 2024, driving market growth with their widespread use of AI companions for socialization, entertainment, and personalized digital experiences. To engage in roleplay, emotional support, and daily conversations, this segment leans heavily on custom avatars, behavior-based learning and natural language processing (NLP) features. Seniors, on the other hand, are the growing segment that is utilizing AI companions for mental health needs, emotional well-being, and to combat loneliness. The tailwind comes in the shape of ease-of-use, customization on-boarding, and making sure there is elder-friendly capability. With the growing mental health awareness and psychological stress among Seniors will continue this trend with Digital solutions for emotional wellness, which is, a key emerging segment for continued market growth.

-

By Technology Platforms, Android Leads Market with Fastest Growth

Android currently dominates the AI Companion App Market in 2024, it formerly being the more widely adopted smartphone OS, especially in emerging markets with lower-cost smartphone availability. With its adaptability, wide device compatibility, and massive user base, it is the ideal platform for both developers and consumers. Because it allows for wide accessibility, easy application, and integration of AI features such as behavioral based learning, custom avatars, and natural language processing, Android has a firm hold on market share. In fact, Android is the rapidly growing platform segment rising due to increased smartphone penetration, expanded Internet connectivity and the increase number of people turning to AI companion applications for entertainment, socialization and exercise through mental health.

-

By Functionality Features, Custom AV Character Design Leads Market While Behavioral Learning Fastest Growth

Custom AV Character Design currently dominates the AI Companion App Market in 2024 due to its support in delivering hyper personalized and visually rich experiences. AI companions allow users the ability to build avatars, with distinct features, moods, and personality traits. This feature leads in demand, due to its ability to increase user engagement, prompt daily use, and reinforce the psychological bond between users and their AI companions. In contrast, Behavioral Learning which helps an AI companion learn and understand individual user behavior, preferences and emotional cues over time is the highest growing functionality segment. This awareness of adaptive and intelligent features is adding to its growth, especially within users looking to support their mental health, receive more personalized support within the utility, and provide more realistic interactions.

-

By User Engagement Level, Daily Engagement Leads Market with Fastest Growth

Daily Engagement now arises as the leading factor shaping the AI Companion App Market in 2024, as users prefer slow, steady and sober interaction with AI Companion. For daily users, personalized avatars, behavioral learning, and conversational AI keep them glued to their screens for hours on end, providing interaction, entertainment, and emotional support. Frequent interactions are crucial for user retention, app usage time and emotional bonding between AI companions and their users, which translates directly to leadership in market share in this segment. In addition, Daily Engagement is another fastest growing segment as developers attempt to insert the best focus on real-time interaction, push notifications and gamification features. Market growth is sustained due to increasing habitual use across all age groups including young adults and seniors.

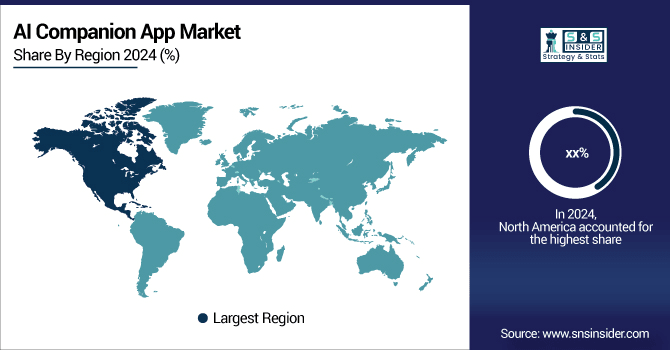

North America AI Companion App Market Insights:

In 2024, North America dominates the AI Companion App Market due to deployment of maturing technology ecosystem, high smartphone penetration and consumer digital literacy. It is home to a large demographic of young adults and teens who are early adopters of AI companion apps for entertainment, socialization, and companionship. Such competitive advantage in turn is augmented by the widespread availability of advanced capabilities, such as natural language processing, behavioral learning and customizable avatars. In addition, North America is the largest and the most dominant market worldwide, which is supported by the presence of top app developers, repeating investments in innovations backed by Artificial Intelligence (AI).

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Leads AI Companion App Market with Technological Adoption

The United States and Canada dominate the AI Companion App Market, supported by widespread smartphone penetration, advanced digital literacy, and early adoption of AI technologies for social interaction, entertainment, and mental health applications, driving strong user engagement and market demand.

Asia-Pacific AI Companion App Market Insights

The largest regional market is Asia Pacific which is growing at the fastest pace due to rising adoption of smartphones, increasing internet penetration and rising awareness about AI based emotional wellbeing solutions. The accelerated market growth across countries like China, India, and Japan can be attributed to rapid urbanization, increasing disposable incomes, and government encouragement for digital plans. New users are acquiring AI companion apps for social engagement, therapy and personalized digital utilities. Asia Pacific, with its vast population base and rapidly growing digital engagement, offers heretofore unrealized potential, emerging as the main engine of growth for the global AI Companion App Market.

China and India Drive Rapid Growth in AI Companion App Market

China, India, and Japan are driving rapid growth in the AI Companion App Market, fueled by increasing smartphone adoption, better internet connectivity, and rising awareness of AI-powered emotional wellness and social interaction solutions, creating significant opportunities for developers and expanding user engagement across diverse demographics.

Europe AI Companion App Market Insights

Europe contributes majorly to the AI Companion App Market in 2024 and nations such as the United Kingdom, Germany and France lead the adoption. Digital literacy in India is high, a growing number of peoples uses smartphone and internet then high awareness in peoples about AI-driven social and mental wellness solutions, which is a major factor driving market growth. For all age groups but specifically for the younger adults, users are interacting with A.I., meant for entertainment, companionship, and mental health support.

Germany Leads Europe in AI Companion App Market Growth

The UK and Germany lead European adoption of AI companion apps, driven by high smartphone penetration, advanced digital literacy, and growing demand for entertainment, social interaction, and mental health support across young adults and adult users.

Latin America (LATAM) and Middle East & Africa (MEA) AI Companion App Market Insights

The global market for AI companion apps has evolved In Latin America and Middle East, the market is expected to boom due to the increasing use of smartphone, developing the internet usage, and recognition of digital emotional wellness tools. As these regions see increased user engagement for social, entertainment, and mental health purposes, this opens major avenues for growth for developers.

AI Companion App Market Competitive Landscape

RoomGPT is a platform that provides AI-powered room redesign solutions, enabling users to transform their spaces in various styles quickly and easily. The company focuses on making interior design accessible and interactive for homeowners and DIY enthusiasts.

-

In June 2025, RoomGPT introduced an enhanced AI-powered room redesign tool that allows users to upload a photo of their space and receive instant design transformations in various styles, making interior design more accessible to homeowners.

Coohom is a provider of AI-driven interior design solutions, offering tools for 3D visualization, furniture placement, and virtual room planning. The company aims to streamline the design process for professionals and DIY users alike.

-

In June 2025, Coohom released a new AI Image Generator feature that enables users to create photorealistic 3D renderings of their interior designs, streamlining the design process for professionals and DIY enthusiasts alike.

Planner 5D is a global interior design platform that integrates AI tools to assist designers and homeowners in creating customized 2D and 3D layouts. The company focuses on providing accessible, user-friendly solutions for home and commercial projects.

-

In August 2025, Planner 5D released insights from a global user survey, revealing that kitchens, living rooms, bathrooms, and bedrooms remain the most frequently designed spaces worldwide, highlighting the platform's widespread usage among interior designers.

AI Companion App Market Key Players

Some of the AI Companion App Market Companies are:

-

InteriorAI

-

Coohom

-

Spacejoy

-

Planner 5D

-

RoomSketcher

-

Foyr

-

ZMO.AI

-

Spayci

-

Superside

-

Spacely AI

-

Box Clever Interiors

-

REImagine Home

-

Autodesk

-

IBM Corporation

-

Microsoft

-

IKEA

-

Houzz Inc.

-

Cylindo

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.93 Billion |

| Market Size by 2032 | USD 31.10 Billion |

| CAGR | CAGR of 20.68% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By User Demographics (Teenagers, Young Adults, Adults, and Seniors) •By User Purpose (Companionship and Mental Health Support) •By Technology Platforms (iOS and Android) •By Functionality Features (Custom AV Character Design and Behavioral Learning) •By User Engagement Level (Daily Engagement and Weekly Engagement) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Replika, Character.AI, Chai, PolyBuzz, Kajiwoto, Woebot Health, Wysa, Youper, Kuki (Mitsuku), Poe (Quora), Anima, AI Dungeon, Friend, Hugging Face, Chatterbox, AnonyMate, Candy AI, OurDream AI, Kindroid, Talkie, and Others. |