Business Software And Services Market Report Scope & Overview:

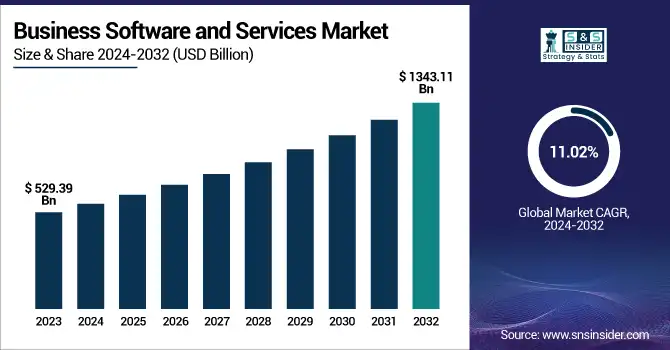

The Business Software and Services Market Size was valued at USD 529.39 Billion in 2023 and is expected to reach USD 1343.11 Billion by 2032 and grow at a CAGR of 11.02% over the forecast period 2024-2032.

To Get more information on Business Software and Services Market - Request Free Sample Report

The Business Software and Services Market is propelled by the growing demand for digital transformation, automation, and data-driven decision-making across various sectors. Organizations are migrating to cloud-based and AI-driven solutions to improve operating efficiency and eliminate workarounds. The market includes finance, human resources, supply chain, and sales software applications as well as consulting and support services. The growth of remote work, cybersecurity issues, and regulatory requirements further drive the industry's growth. With major players investing in technological advancements, the market is experiencing robust growth among SMEs and large businesses. The report offers detailed analysis, trends, and forecasts defining the industry.

The U.S. Business Software and Services Market was valued at USD 106.32 Billion in 2023 and is projected to reach USD 246.14 Billion by 2032, growing at a CAGR of 9.90% from 2024 to 2032.

The U.S. Business Software and Services Market is growing fast, powered by digitalization, cloud usage, and automation with AI. Companies in every industry, ranging from finance to healthcare, are adopting sophisticated software solutions to drive productivity and data-based decision-making. The shift towards remote working, cybersecurity requirements, and compliance needs also increase demand. Supported by the dominance of tech players and startups, the market continues to be intensely competitive. Small and medium businesses (SMEs) are increasingly using cloud-based services for cost-effectiveness. With businesses focusing on innovation and efficiency, the American market continues to dominate technological progress and software service deployment.

Business Software And Services Market Dynamics

Key Drivers:

-

Increasing Adoption of Cloud-Based and AI-Powered Solutions Enhances Business Software and Services Market Growth

The swift transition to cloud computing and AI-based automation is contributing heavily to the Business Software and Services Market. Companies from various sectors are using cloud-based services for scalability, affordability, and remote access. AI-based analytics and automation solutions improve decision-making, streamline processes, and enhance customer experiences. Enterprises, particularly SMEs, are investing more in software-as-a-service (SaaS) models to simplify operations and lower IT infrastructure expenses. Also, the evolution of cybersecurity and data privacy laws is motivating companies to enhance their software solutions. This increasing need for advanced and effective technologies is driving market growth in different industries in the U.S. and worldwide.

Restraint:

-

High Implementation and Maintenance Costs Hinder Business Software and Services Market Expansion

Even with the growing use of business software, high implementation, customization, and maintenance costs pose a major impediment. Most small and medium businesses (SMEs) cannot afford the upfront cost of sophisticated software solutions, particularly those demanding specialized infrastructure or integration with legacy systems. Periodic subscription fees for cloud computing and constant updates to software add to the total cost of ownership. Companies also need to invest in employee training and cybersecurity, further increasing costs. These cost factors can restrict market growth, especially in cost-sensitive markets and emerging business environments.

Opportunity:

-

Rising Demand for Industry-Specific and Customizable Software Solutions Creates Growth Potential for the Business Software and Services Market

As businesses look to optimize their operational efficiency, sector-specific sector and sector-dedicated software solutions that address distinct business requirements are poised in. demand. Healthcare, finance, retail, and manufacturing companies are embracing specialized software to meet regulatory compliance, workflow automation, and data protection issues. The expanding demand for flexible and scalable software-as-a-service (SaaS) platforms enables organizations to incorporate customized features and functionality. Moreover, AI-based analytics and automation are facilitating tailored software experiences. This need provides a profitable prospect for software companies to create niche offerings, catalyzing innovation and growth in the Business Software and Services Market.

Challenge:

-

Rising Cybersecurity Threats and Data Privacy Concerns Pose Risks to Business Software and Services Market Growth

With growing dependence on cloud and AI-driven business software, cybersecurity attacks and data breaches are significant issues. Companies dealing with personal customer and financial information are susceptible to cyberattacks, phishing, and ransomware, resulting in financial loss and reputational harm. Strict data privacy laws like GDPR and CCPA mandate companies to maintain compliance, increasing the complexity and expense of software implementation. As cyber-attacks become more sophisticated, organizations are required to regularly invest in new security technologies such as encryption, multi-factor authentication, and threat detection systems. Resolving these cybersecurity issues is important for sustaining trust and ongoing market growth.

Business Software And Services Market Segment Analysis

By Software

The finance sector led the Business Software and Services Market in 2023, with a share of 24.58% of overall revenue. The increasing use of financial management software, AI-based analytics, and automation tools is fueling market growth. SAP, Oracle, and Intuit are some of the companies that have launched sophisticated financial software solutions to improve accounting, risk management, and regulatory compliance. Oracle released Fusion Cloud ERP updates in 2023, including AI-based financial planning software, and Intuit widened QuickBooks AI automation for SMEs.

The sales & marketing segment will grow at the highest CAGR of 12.80% due to rising investments in customer relationship management (CRM), AI-based analytics, and automation platforms. Salesforce, HubSpot, and Adobe are among the key companies driving innovation in this space. In 2023, Salesforce strengthened its Einstein AI for predictive sales analytics, and Adobe launched AI-based personalization in its Experience Cloud. Companies are focusing on data-driven decision-making and segmentation-based marketing, which is leading to increased demand for sophisticated software.

By Services

The Support & Maintenance segment had the highest market share in 2023, with 41.59% of the total revenue, fueled by the growing need for hassle-free software functionality, security patches, and technical support. Businesses depend on strong support services to provide minimal downtime and maximum software performance. Large players like IBM, Microsoft, and Oracle have increased their support services, incorporating AI-based predictive maintenance and automated diagnostics.

For example, Microsoft upgraded its Azure Support Plans with sophisticated analytics, and Oracle launched AI-driven self-healing cloud support.

The Managed Services segment is expanding at the highest CAGR of 13.79% owing to rising demand for cost-saving IT outsourcing and proactive infrastructure management. Organizations are using managed services to streamline IT operations, bolster cybersecurity, and enhance cloud efficiency. Accenture, IBM, and Cisco are some of the companies that have introduced AI-powered managed service offerings, offering automated monitoring and predictive analytics for enterprise software. IBM added more AI-based IT automation in 2023, bolstering cloud management capabilities.

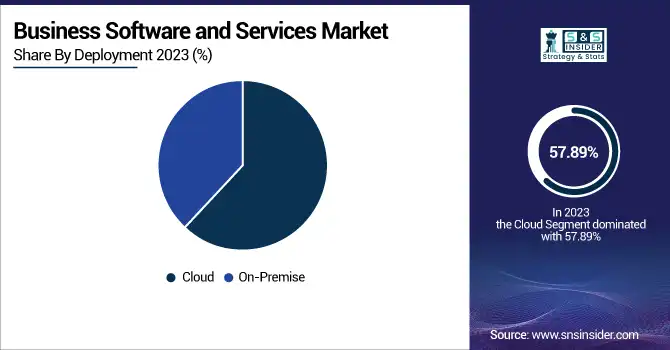

By Deployment

The cloud segment topped the Business Software and Services Market in 2023 with a 57.89% share of revenue due to the accelerating use of Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS) offerings. Industry players like Microsoft, with its AI and automation offerings based on Azure, and Salesforce, with its cloud-based CRM offerings, have played important roles in increasing market size. Google Cloud's AI-based data analytics and Amazon Web Services (AWS) cloud scaling have further catalyzed uptake. Remote working, digital business transformation, and affordable cloud subscription plans continue to drive demand, making cloud deployment a leading factor in enterprise software and service take-up.

The on-premise segment is observing the highest CAGR of 11.71% during the forecast period due to industries focusing on data security, compliance, and tailored software control. Large organizations and BFSI, healthcare, and government sectors continue investing in on-premise solutions to have complete control over sensitive data. Corporates such as Oracle and IBM have introduced sophisticated on-premise enterprise solutions, such as AI-powered analytics and cybersecurity features. SAP's S/4HANA on-premise solution also addresses businesses that need high-performance computing. With growing cybersecurity threats and data privacy regulations, companies are striking a balance between cloud adoption and on-premise solutions to address operational and security requirements.

By End Use

The IT & Telecom segment led the Business Software and Services Market with 17.58% revenue in 2023 due to the growing need for cloud computing, cybersecurity services, and AI-based automation. Industry leaders such as Microsoft developed AI-enhanced updates for Microsoft Azure to further improve cloud efficiency, while IBM extended its hybrid cloud and AI capacities. Oracle also released new telecom-oriented cloud offerings to automate 5G network operations. As telecom operators make investments in automation, data analysis, and digitalization, demand for sophisticated business software is increasing at a faster pace.

The Healthcare segment is growing at the highest CAGR of 16.07% with the increasing use of electronic health records (EHR), AI-based diagnostics, and telemedicine platforms. Epic Systems improved its AI-enabled EHR solutions, whereas Oracle introduced its cloud-based healthcare applications to streamline patient data management. Salesforce also introduced Health Cloud innovations to facilitate patient engagement and care coordination. The growing emphasis on interoperability, data protection, and regulatory compliance is compelling healthcare organizations to invest in sophisticated business software.

By Enterprise Size

The large businesses sector led the Business Software and Services Market in 2023, with 60.59% of overall revenue, due to the high IT spending and large-scale digital transformation programs. Large businesses are investing in enterprise software driven by AI, cloud computing, and cybersecurity solutions to increase operational effectiveness. Corporations such as Microsoft introduced AI-driven Copilot for enterprise usage, whereas Oracle strengthened cloud-based ERP offerings. Salesforce has added sophisticated automation capabilities to its CRM offerings for large-scale organizations.

The Small & Medium Enterprises (SMEs) category is growing at the highest rate of 11.72% during the forecast period due to the adoption of cloud and budget-friendly SaaS offerings. SMEs are more and more adopting digital solutions to increase productivity and competitiveness. Google introduced AI-based Workspace innovations designed for small businesses, and Zoho launched low-cost CRM and accounting applications. Intuit added automation capabilities to QuickBooks to provide hassle-free financial management for SMEs. The growth of easy-to-use, scalable software solutions enables SMEs to streamline operations, driving market expansion. This is an indicator of the increasing role of customized business software in driving SME digitalization.

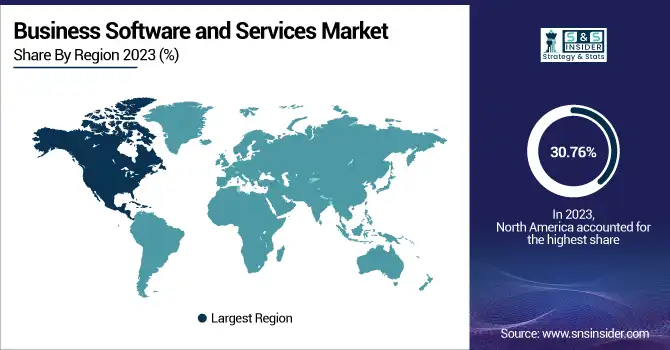

Regional Analysis

North America leads the Business Software and Services Market with a 30.76% revenue share in 2023, led by high enterprise digitalization and cloud usage. Key players Microsoft, Oracle, and Salesforce keep introducing new solutions, including Microsoft's AI-enabled Copilot for business applications and Salesforce's AI-based customer relationship management (CRM) enhancements. The region's focus on cybersecurity and compliance propels software demand in finance, healthcare, and retail industries. The increased uptake of SaaS and AI analytics by SMEs also drives growth. The innovation-fueled environment of North America guarantees continued growth in the business software market.

Europe is expected to register the highest CAGR of 12.42% over the forecast period, led by growing adoption of the cloud, AI, and digital transformation across sectors. Major players like SAP and Siemens are introducing cutting-edge enterprise offerings, with SAP expanding its cloud ERP suite and Siemens making strategic investments in AI-based industrial software. The strict data privacy policies of the European Union, such as GDPR, further propel companies to embrace secure software solutions. Furthermore, government policies promoting manufacturing and financial sectors' digitalization stimulate demand.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

IBM Corporation – (IBM Cloud Pak, IBM Watson Analytics)

-

Infor – (Infor CloudSuite, Infor M3)

-

SAP SE – (SAP S/4HANA, SAP Business One)

-

Microsoft – (Microsoft Dynamics 365, Microsoft Power BI)

-

NetSuite Inc. – (NetSuite ERP, NetSuite CRM+)

-

Epicor Software Corporation – (Epicor Kinetic, Epicor Prophet 21)

-

Unit4 – (Unit4 ERP, Unit4 Financial Planning & Analysis)

-

MicroStrategy Incorporated – (MicroStrategy HyperIntelligence, MicroStrategy Analytics)

-

SYSPRO – (SYSPRO ERP, SYSPRO CRM)

-

Deltek, Inc. – (Deltek Costpoint, Deltek Vantagepoint)

-

Acumatica, Inc. – (Acumatica Cloud ERP, Acumatica Financial Management)

-

Oracle – (Oracle Fusion Cloud ERP, Oracle NetSuite SuiteCommerce)

Recent Trends

-

February 2024 – Infor Released Infor CloudSuite Automotive, designed to enhance digital transformation in the automotive supply chain.

-

January 2024 – Microsoft Introduced Copilot for Microsoft Dynamics 365, an AI-powered assistant to enhance CRM and ERP automation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 529.39 Billion |

| Market Size by 2032 | US$ 1343.11 Billion |

| CAGR | CAGR of 11.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Software - (Finance, Sales & Marketing, Human Resource, Supply Chain, Others) • By Services - (Consulting, Managed Services, Support & Maintenance) • By Deployment - (Cloud, On-premise) • By Enterprise Size - (Large Enterprises, Small & Medium Enterprises) • By End Use - (Aerospace & Defense, BFSI, Government, Healthcare, IT & Telecom, Manufacturing, Retail, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acumatica, Inc., Deltek, Inc., Epicor Software Corporation, IBM Corporation, Infor, Microsoft, MicroStrategy Incorporated, NetSuite Inc., Oracle, SAP SE, SYSPRO, Unit4 |